Introduction

Due to the increase in population all over the world, there is high demand for shelter and the housing industry is one of the most significant and growing sectors nearly in all the economies of the world. However, changes in the different economies have impacted both positively and negatively the growth of this sector over the past few years. Such factors like inequalities in the wage distribution, tax burdens, shortage of land, and increase in the cost of building materials due to high inflation among others in different nations have played a major role in the growth of this sector. Governments have also played the responsibility of ensuring that the industry has had a favorable environment for its growth and at the same time devoid of exploitation (Mankiw, 2004).

Due to economic hardships in some countries, many residents live in abject poverty and cannot afford to raise their rental payments, a situation that has led to the development of slums in those nations. The housing industry mainly deals with residential real estate markets whereby their main participants in this market include; the owner who rent out the houses to other people and is commonly referred to as the landlord, user/owner who is both an owner and tenant, a renter who is a pure consumer, developers who are responsible for preparing raw land for construction that will be a new product, renovators who will provide refurbished buildings to the market and facilitators who have a role of facilitating the buying and selling of commercial houses or real estates. Generally in economics, developers and renovators fall in the category of the supply side of the market while the owner/user, owner, and the renter falls in the category of the demand side of the market.

Shifts and Price Elasticity of Supply And Demand in the Housing Industry

Price elasticity about demand and supply can be defined as the measure of their sensitivity to changes in price, that is, when price elasticity is low, a big price change will result in a small change in supply. Demand and supply analysis can only be applied to the housing industry if changes to standard microeconomic assumptions and related procedures are effected (Chris, 2007). The following features relating to the housing industry that causes shifts in demand and supply should be considered.

Firstly durability features, whereby because of the durability of real estate, the market for these products are said to be of stock/flow market. Research indicates that 97% of supply comprises of stock of already existing houses while 3% represents new development. The supply of housing at any particular time is caused by the already existing stock and the flow of new development. Secondly, there is a heterogeneous characteristic which means that every estate is unique about where it is situated, the design of how it is built, and how it is financed. This aspect coupled with depreciation makes pricing of real estate to be cumbersome thus causing shifts in the demand and supply of housing. Thirdly there is an issue of high transaction costs that may comprise real estate fees, legal fees, land transfer taxes, and title deed registration fees among others. Fourthly there are constant delays that come up because of the time required to finance, design, the building of fresh supply, and the sluggish rate of change of demand (Mandel, 1962).

The fifth feature which must be taken into consideration is that real estates are not movable goods which means that consumers must look for houses because a physical marketplace does not exist. The demand for housing is affected by various factors including, the income of the consumers, demographics, the prices of the houses, cost and how one can access credit, customers preferences, and what the investors prefer. We all know that the higher the size of the population the higher the demand for housing in a country thus supply might be low (Blau, 1992).

There is also income elasticity of demand which should be considered. Under this, we find that the permanent income elasticity should be measured using permanent income and not annual income due to the ever-increasing cost of buying real estate. This is the reason why many cannot afford to buy houses and consider them as the most expensive asset to acquire thus opting to rent from those who own the real estate. Since pricing is an important determinant, the concept of price elasticity should be considered. The supply of housing is mainly done through the use of land, labor, and other several inputs.e.g. building materials. The measure of housing supply is always affected by the costs of building materials and the prices of existing houses. According to several economists, the price elasticity of supply is always high in the long run while it tends to be price inelastic in the short-run model of supply. Because increased costs of labor, it has led to the utilization of new materials and capital-intensive techniques in construction to reduce the use of costly labor (Mankiw, 2004).

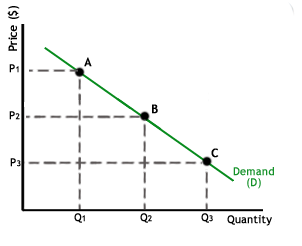

This change may include an increase or a decrease in the housing price. In this case, we find that these shifts in supply are meant to measure the effects of these product changes. This introduces the law of supply and demand which states that, as the price of a product increases its demand decreases, also when the price reduces the product’s demand increases. This is best explained in the figure below where it is evident that when the prices are high the supply is low and vice versa.

Positive and Negative Externalities

In economics an externality can be referred to as a cost or advantage that comes up from a business transaction among the parties, this cost is always applied in two forms. The negative externality, which is defined as a slump in a particular business transaction in which a person is affected refers to it as a reduced benefit to his business. The housing industry slump has occurred as a result of, building, high building prices, and lack of credit availability. The housing industry has also contributed to the depletion of natural resources through the use of building materials. Another form is a positive externality which means the benefits accrued from any business investments (Dillon, 2005).

Under the housing industry, there have been benefits such as the auto sector that is also related to the housing industry whereby the purchases of motor vehicles has considerably increased, as it is said that there is an increase in the sales of various trucks that are widely purchased by real estate contractors that are normally used in the transportation of the building materials. This housing industry has also caused positive effects in the employment sector, whereby there has been above 40% employment growth in various markets that is directed to the housing industry thus creating employment opportunities through jobs that are in the construction sector. Also, the other beneficiaries are the estate brokers, sales agents, the building material companies gaining the markets for their real estate, and also the mortgage finance industry who benefit from interest received from their customers who borrow to purchases the houses. There is also an increased purchase of home furniture and appliances due to more new homes that are built and through more old homes that are refurbished and expanded to be purchased thus creating a positive impact on the housing industry (Fallis, 1985).

Wage Inequality

A wage is referred to as the monetary returns received from doing any work or business transaction that may include, salaries, net self-employment income, interest, and other income generating resources. This money income comes in separate forms including the Household income which is usually defined as the money received by various family members inclusive of those who are not related to the family. This means that this income is not restricted to those who have families only but also those who are living alone always earn. This money can be earned as a wage or a salary among other sources (Blau, 1992).

In many cases, it’s said that the more wage one gets the more he is attracted to purchase real estates that always match with their income. In this case, we find that there are differences that usually occur when it comes to purchasing houses, those who earn low wages tend to purchase cheap houses and of low quality. On the opposite side, those who earn considerable wages tend to purchase expensive and best-designed houses such variations in wages have caused significant impacts on the economy and this has resulted in the widening of the gap between the rich and the poor (Mankiw, 2004).

Monetary and Fiscal Policies

The housing industry is also subjected to the present operating policies which are; monetary policies, these are outlined programs that are used in the regulation of circulation of money in the economy and fiscal policies are the regulations imposed by the governments to control tax collection and their spending to attain economic goals.

Under monetary policies that relate to the housing sector, the government through the central banks provides funds to financial intermediaries, for example, banks so that they can offer loans to their customers that they can use for the purchase of houses. The governments have also regulated inflation in their respective economies which have acted as an incentive in purchasing houses because the prices are not exaggerated. (Fallis, 1985).

Under fiscal policies, there have been significant improvements in the collection of taxes. The federals have practiced this by, setting up efficient tax systems which ensure that there are no tax defaulters. With such a move, there have been payment payments of average wages to individuals which in turn, has led to an increase in purchase and building of the real estate.

Conclusion

There have been records that the housing industry has had a negative impact in the balancing of business growth in various countries thus causing the housing industry to slump which occurs as a result of, overbuilding, high building prices, and less credit availability that is present in many owners of new homes. This housing industry slump is said to have harmed wealth in many countries due to the rise in prices of the homes which makes the consumers restrain from their spending believing that they are not well off and unable to withdraw their money through the home equity loans. (Olsen, 1969).

Many economists are putting into consideration whether this housing slump will bring the economy to the point of failure. The changing market conditions make it difficult for the consumers to rely on the present comparison between the prices of the houses thus giving the slump the potential to mess with property appraisals. The falling market of the houses has led to the upsetting of the consumers’ expectations and attitudes towards the purchasing of the houses which leads to the worry of the future increase in house prices.

Reference

Blau, J. (1992): The Visible Poor: Homelessness in the United States. New York: Oxford University Press.

Chris, A. (2007): Economists Brace for Worsening Subprime Crisis. National Public Radio. Web.

Dillon. C (2005): How Does Interest Rates Affect New Home Sales and Where’s The Best Place to Build.

Fallis G. 1985: Housing Economics: The demand for housing,. Review of Economics & Statistics Vol. 53- Butterworth, Toronto.

Joseph T. (1999): The Place of Mises’s Human Action in the Development of Modern Economic Thought. Quarterly Journal of Economic Thought V 2.

Mandel E (1962); Marxist Economic Theory:-The Marginalist Theory of Value and Neo-Classical Political Economy.

Mankiw, N. (2004) Principles of economics third edition Chicago, IL: Thomson South-Western.

Olsen, E. 1969-A competitive theory of the housing market: American Economic Rev Vol. 59.