Economic

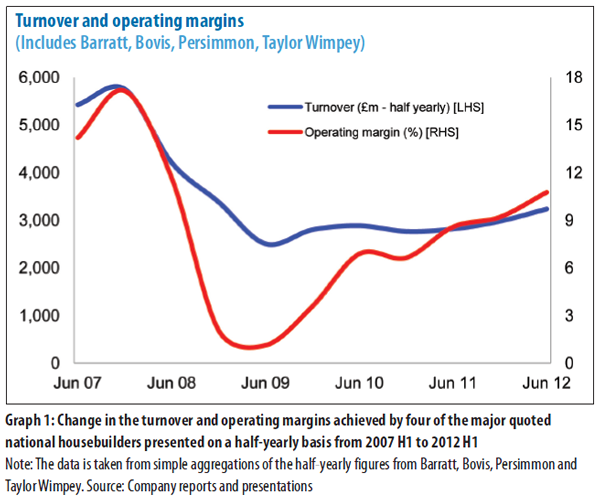

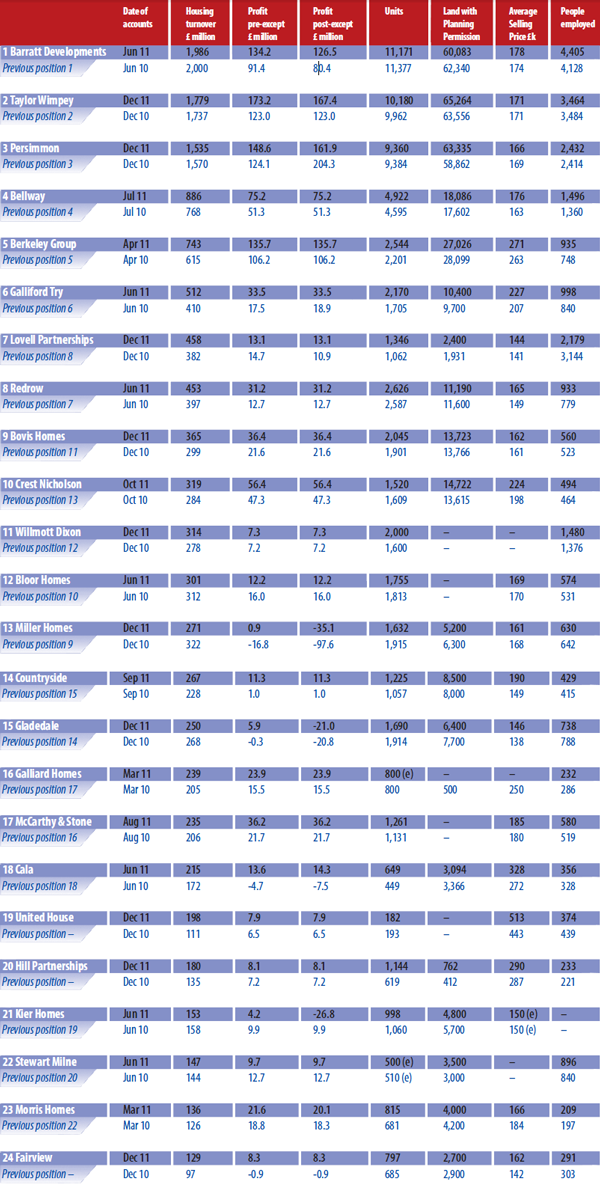

The 2008 financial crisis had had greater effect on the housing industry. However, in 2010, the industry has regained its normalcy of recording positive revenues. Following the re-structuring that characterised the industry in 2009 and 2010, the available data indicate that the turnovers of the top firms rose by an average of about 6%. The rise in the profitability indicates a huge come back following the decreased levels in which the firms operated between 2008 and 2009. According to the major firms in the industry, the initiatives by the government and their strategic focus on the profit growth led to the general increase in the profit margins by 45% in 2010 and 2011 financial year.

In the first half of 2012, the operating margins of the major firms in the industry rose by over 11%. The rise was about 3% higher compared with the last half of the previous year. Among the top 25 listed firms in the industry, the average operating margins in 2012 was 8% compared with the 6% recorded in the previous year.

According to the Housing Market Intelligence (HMI) report, large firms are doing better and recovering faster compared with the smaller firms. In 2012, the bottom fifty firms among the top 75 listed firms recorded an average of 7% operating profit margin compared with 5% average operating profit margin recorded in 2011. While recession had a greater influence on the operations of the firms, the overall growth of 8% among the top 75 firms in the industry is commendable. The overall growth in the operating margins of the top firms in the industry between 2007 and 2012 is indicated in the graph below

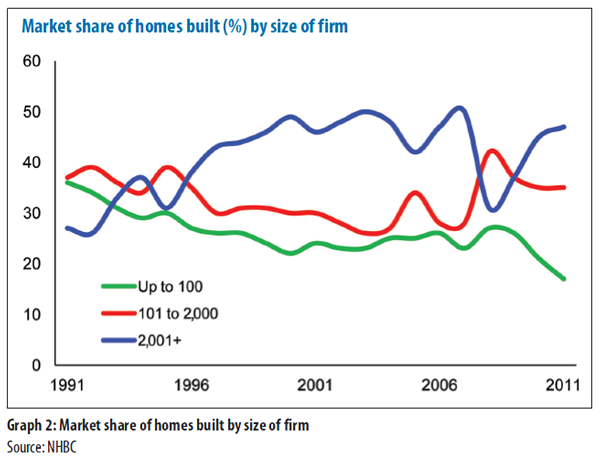

The recession also caused a shift in terms of market share. In fact, the recession caused a huge decrease in terms of market share among the top firms in the industry. However, the firms are increasingly gaining their previous share of the market. The industry reports indicate that smaller firms are reducing their productions or are falling out of the market. The DCLG data indicated about 3.4% growth in the number of homes built in 2011. Besides, in 2011 the top 75 listed firms indicated a growth of over 4% in the number of homes completed. The market share in terms of number of homes built is indicated in the graph below.

The economic restructuring after the 2008 financial crisis had an impact on the production process. Firms had to restrict new site openings, reduce the number of existing new houses and re-examine their product mix (Johnson & Whittington, 2012). However, the level of distrust on mortgage loans and the high interest rates that have been charged on those loans reduced the number of mortgagees, which in turn decreased the demand for houses.

In UK and European Union in general, majority of people tend to own personal houses instead of rental accommodation. In order to own a house, majority places a small deposit and borrow the remaining bulk amount on the basis of competitive interest rates repaid over long-term from the mortgage firms (Johnson & Whittington, 2012). The interest rates are reviewed occasionally to take into account the general inflation.

In 2012, the interest rates were adjusted from 4% to 6% by the central bank in order to control the rising inflation. The adjustments caused 50% increase in the monthly installments that mortgage holders are required to repay. Besides, the increase in the interest rates also made the mortgage loans expensive that majority could not afford. Such increases reduced the housing demand and major players are predicting that the demand will continue to decline with expected increase in the interest rates by over 0.2% in the next twelve months (Johnson & Whittington, 2012). The response to the decline in the mortgage market was to shift to the high end buyers who could afford the houses. Major firms also shifted their market to the more affluent south.

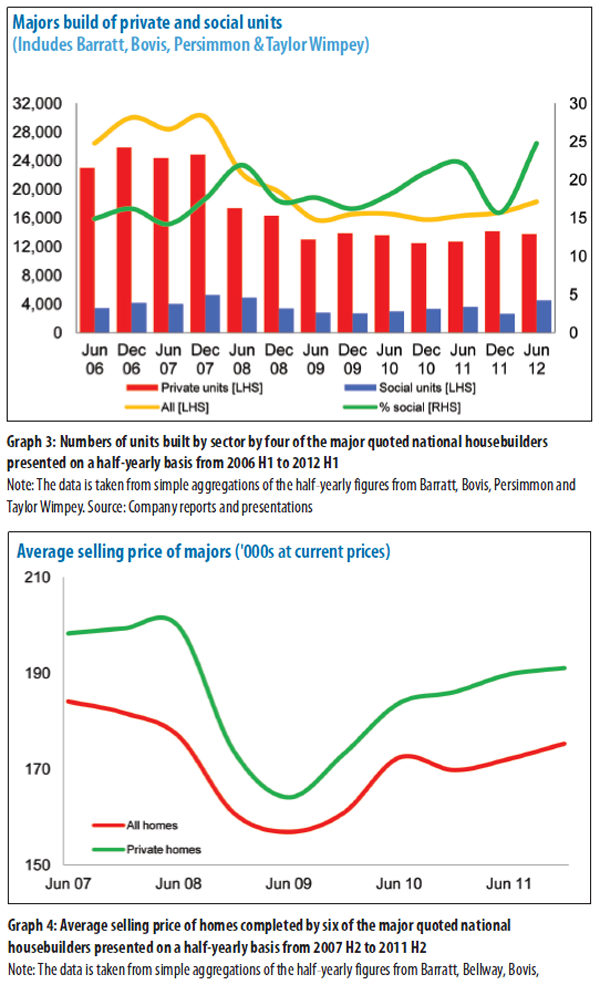

However, smaller firms had no opportunity to shift given the limitations in their capital base. Such firms were forced to utilise the available land while others targeted the lower-end market. The top firms in the industry increased their production due to the inclusion of social sector homes in their product mix. The following graph indicates how the social housing has increased from 15% before the crunch to 20% in 2012. Increased volatility was experienced after recession due to the government funding.

However, the stability was restored by the inclusion of social sector in the product mix. The NHBC data indicates that the three bed roomed apartments rose by 20%. The effects of the product mix are observable in the increased prices. The following graph also indicates the average selling prices of the top firms in the industry from 2009 to 2012. The available data indicate that the average low prices range between £164, 000 to £175,000 and the highest prices range from £181,000 to £190,000.

Political

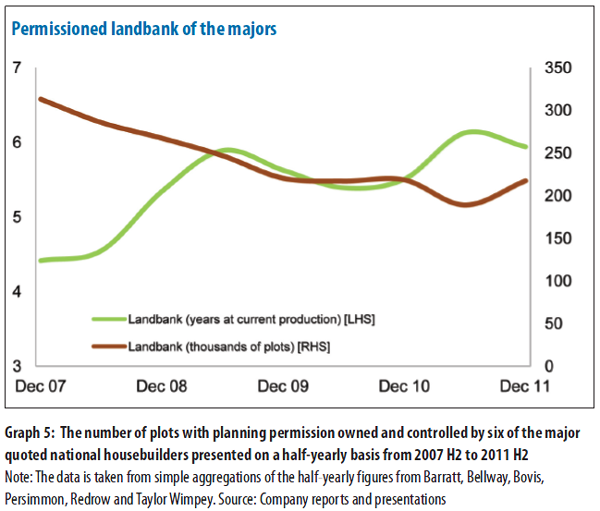

One of the major factors that influence the growth and development of the housing sector is the planning system, which affects the manner in which land is utilised for building purposes. Land is a major factor of production in the industry and the way the government influences its use remains significant. However, statistics indicate a sharp rise in the use of land as major firms continue to readjust their businesses following a revamp after the financial crisis. The available data indicate an increased usage of land and a sharp rise in the land prices. According to the Housing Market Intelligence (HMI), the land banks of top firms in the industry have remained stable in terms of available land permitted to be applied.

In the 2010 and 2011 financial year, the top national stock market-listed traditional firms in the industry have increased the use of plots with planning permission. The indication is that after full utilisation the available land following the restructuring after the crisis, large firms are willing to increase their stock of land in a controlled way to be able to fit in the new business order within the housing market.

Besides, the needs for low-cost accommodation have driven the government to come up with new legislations that allowed the development of building properties. According to the industry statistics, it is projected that the new regulations will stimulate the construction and development of the new houses by over 40%. The ease of housing planning restrictions will also cause an increase on the development of new high rise buildings by over 20%. However, the demand for affordable houses is still high despite the government efforts to increase the quantity of houses.

Socio-cultural

Following the planning system that has controlled the use of land in the recent years, housing developments have focused on the depressed areas. In the last two years, the UK government has provided incentives to stimulate these developments. Major firms in the industry argue that such developments would not bring immediate returns on investments given the state of the economy and have shifted to more affluent south (Haynes & Nunnington, 2010).

However, such development has been found to be central to the regeneration prospects. Majority of UK residents are campaigning for the construction of sustainable community residential buildings. The argument is that such community residential areas offer social amenities besides the much needed housing. The aim of constructing such kind of community residential houses is to avoid future social issues. The social aspects of the housing developments have led to the smaller firms getting an opportunity to construct houses for the lower end of the market.

In 2010, majority of UK residents opt for such community residential areas instead of moving to more expensive properties, which are equipped with in-house leisure equipments instead of outdoor leisure facilities. According to the 2010 survey, about 45% of the UK citizens prefer community residential areas compared with luxurious and expensive residential houses (Haynes & Nunnington, 2010). The long belief in the outdoor leisure remains a central consideration for most firms that are building houses.

The falling living standard due to depressed economy also influences the housing sector. According to the survey conducted in 2012, the living standard of UK residents has decreased by 12%. The decreased living standards have also caused a decrease in the housing demand by similar margin. The indication is that the living standard and the demand for housing are directly correlated. Similar reductions have also been observed in the high employment rates observed in the economy.

In 2013, the unemployment rate among the youth has risen by 9%, which was reflected in the low-cost housing demand. Generally, the firms in the industry responded strategically by building luxurious houses targeting the older generations that can afford the increased mortgage premiums (Haynes & Nunnington, 2010). However, the demands for low-cost green houses are still strong even though such houses require new technologies that would reduce the cost of construction.

Technological

The zero-carbon requirements have driven the industry to come up with new innovations including the development of MMC. The new technological advances have enabled the firms in the industry to build more environmentally friendly houses as demanded by the consumers and the government (Gorgenlnder, 2011). Besides, the constant changes in technology will ensure sustainability of the industry in particular, through the construction of the prototype carbon-zero homes that are cheaper to the majority of home buyers (Gorgenlnder, 2011). The trends in the industry since 2008 peak indicate that majority of home buyers are seeking for ‘green houses’ that are affordable. The combination of economic and legal drivers has changed the housing demand landscape where majority of consumers are seeking cheaper green housing.

Legal

Various legal constraints ranging from limiting mortgage loans to environmental regulations have greater impact on the industry. The government regulations on the amount of mortgage loans through increased interest rates have relatively shifted the demand for housing from the young graduate employees seeking to enter into the property ladder to older affluent buyers who can afford to pay the higher mortgage premiums (Gorgenlnder, 2011). Besides, with new mortgage limitations, the housing builders are indebted to change their product mix that would allow them to construct houses for the affluent old buyers.

However, from 2012, the government has been pursuing the deregulations policy in the sector. The deregulations aim at reforming the planning system in the sector to favour the housing developments and land release to support the sustainable development of the sector. Recently the government is harnessing the zero-carbon policy and other reforms in the sector in order to stimulate the construction of new houses (Gorgenlnder, 2011).

Environmental

Expansion of housing developments particularly in the country side has remained controversial between the environmental groups and the major players in the housing sector. Environmentalists argue that building new houses in the countryside would have a devastating effect to the environment (Henry, 2011). On the other hand, major firms in the industry argue that the desirable city areas have been fully exploited and the majority of the citisens prefer staying in the community residential areas constructed on the countryside.

It is estimated that the environmental issues have cost the industry over 20% in total revenue, which has translated into reduced growth (Henry, 2011). The need to protect the environment and the building industry prompted the government to approve the development of housing in brown-field sites (Williams, 2013). The brown-field sites are often run-down and less desirable city areas. Even though the government provides incentives for such construction, lack of appropriate places such as open countryside is costing the industry over 20% in revenue annually.

Besides the environmental concerns over the construction land, the government’s zero-carbon targets are also another important consideration. Under the zero-carbon targets policy, firms are required to adopt greener technologies that result in the reduction of carbon emissions into the atmosphere (Williams, 2013). Firms in the building industry had to re-strategise in order to accommodate this change in the environmental policy.

The future of the housing industry

The data indicates that the major firms in the industry have set a platform for expansion. Even though the growth is high regulated by the governments set of planning systems and environmental concerns, the future growth is inevitable. The growth is indicated by continuous increase in the operating margins and increased market share. However, the expansion will depend on the demand for housing not only in UK but also around the globe. Large firms have started to look for international markets.

Besides, the weak global economy will also have a indirect effect in the sector. The international markets for the housing industry are performing below the expectations due to depressed global economy (Haynes & Nunnington, 2010). According to the sector statistics, the demand for both residential and commercial houses within the European Union and USA that forms the larger percentage of the international markets has decreased by over 30%. The indication is that the depressed global economy has caused the low demand. However, the projection is that the demand for houses will start to increase as the US and other European economies continue to recover. The graph below indicate the general performance of top firms in the industry

Is the house building industry attractive? From the perspective of the large national house builders such as Barratt, Taylor Wimpey and Persimmon, apply Porter’s Five Forces framework to support your discussion.

The available data indicate that the large firms in the industry have seen a tremendous growth. According to the large firms, the industry remains attractive and has potential for future growth. However, the competitive rivalry has led to the decline of small firms in the industry.

Five-force analysis

Threat of new entrants

The UK housing industry is highly consolidated with few firms holding the majority share. Such consolidation reduces the chances of newly formed firms to enter into the industry (Powell, 2013). Besides, large firms are continuously consolidating the market. In addition, in order to operate effectively within the industry, huge capital investments are required. In other words, the building industry requires huge capital investments compared with other industries. As such few firms and individuals are capable of entering in the industry (Powell, 2013). Generally, the threats of new entrants are low due to increased consolidation and high capital intensity.

The buyers bargaining power

Like in most of the European and American building industry markets, majority of the buyers are single households. In UK, single households account for over 76% making the industry to have greater control over its buyers. In fact, alternatives available for single home buyers are limited. As such, the buyer bargaining power is greatly reduced given the fact that the buyers tend to behave in similar manner (Powell, 2013).

Threat of substitutes

The substitutes for the houses are very limited. In fact, in UK, homes can only be alternated with temporary accommodations, which remain to be very expensive. Besides, the rental houses are also considered as part of the homes build by similar firms in the industry. Moreover, majority of residents prefer having personal homes instead of temporary rental homes. As such, the threat of new substitutes is relatively low given the fact that the various temporary homes do not provide the better option (Golland & Blake, 2014).

Bargaining power of suppliers

The bargaining power of suppliers is relatively low due to large number of small firms supplying the building materials to the industry. The estimation is that large firms supplying the industry with building materials only account for 40%. In other words, combining large firms such those found in the cement and steel industries, it is estimated that they account for only 40.23% of the total suppliers (Pettinger, 2002). However, the volume of their supplies is approximately 75%. The retail supply firms are numerous supplying all the building materials required.

Competitive rivalry

The industry is highly competitive. Large firms are competing for the few home buyers available in the market. The fierce competition is exhibited by the continued rash to built affordable houses (Boddy, 2011). The survivability of the firm in the industry depend on the capability to generate enough capital to invest in new building technologies such as MMC, which enable such firms to construct green homes that are affordable to most buyers.

The capability of the firm to generate enough capital would enable it to survive during economic tantrums. Since 2009, large construction firms with huge capital bases have been acquiring smaller competition firms, particularly the firms that could not survive the financial crisis that hit the mortgage market. As the competition becoming intense, the housing prices continue to fall, which in effect increases the demand (Powell, 2013).

References

Boddy, D 2011, Introduction to management, Pearson, Upper Saddle River, NJ.

Golland, A & Blake, R 2014, Housing development: theory, process and practice, Psychology Press, Abingdon, Oxford.

Gorgenlnder, V 2011, A strategic analysis of the construction industry in the uk: opportunities and threats in the construction business, Diplomica Verlag, Hamburg

Haynes, B & Nunnington, 2010, Corporate real estate asset management, Taylor & Francis, Abingdon, Oxford.

Henry, A 2011, Understanding strategic management, Oxford University Press, Oxford.

Johnson, S. & Whittington, J 2012, Fundamentals of strategy, FT/Prentice Hall, London.

Mennen, M 2011, Global corporate strategy – a critical analysis and evaluation, GRIN Verlag, Munich.

Pettinger, R 2002, Introduction to mangement, Palgrave, UK.

Powell, C 2013, The British building industry since 1800: an economic history, Routledge, London.

Williams, J 2013, Zero-carbon homes: a road map, Routledge, London.