Introduction

Economic disparity has always been a hot-debated topic and relevant problem in the United States. The vast difference in wealth between the rich and poor people constantly promotes social inequality, decreases economic growth, and increases political tension (Stiglitz 4). Additionally, the relationship between economic disparity and the said complications is bidirectional, and there is a large number of factors accounting for these problems. One of the constituents is the current tax system, which allows billionaires from the top 400 earners to pay less in percentage terms than people from the bottom 10%. A large number of experts consider the existing tax system unfair and detrimental to the development of the United States both in economic and social aspects (Stiglitz 1). Ultimately, it is essential to propose effective tax reforms as countermeasures to minimize the economic disparity in the United States.

Economic Disparity and Social Inequality

As mentioned briefly before, economic disparity is not only detrimental to the financial development of the country but also accounts for social tension, political risks, and overall inequality. The issue is particularly relevant for the United States due to the vast prominence of economic injustice among various ethnic and racial groups. The studies demonstrate that the net worth difference between white and black households was more than 500% in 2017 (Kapadia 23). Concerning immigrants, the statistics are saddening, as well, due to economic disparity and difficulties in assimilation (Hardin 7). As a result, ethnic minorities experience larger amounts of economic and social inequality in the United States compared to the majority of the developed countries (Kapadia 23). Many experts consider that the current state of unequal wealth distribution is not only the byproduct of capitalism and an unjust tax system but also the consequence of the structural racism in the country (Kapadia 23). Hence, it is necessary to combat the inequalities both in the economic and social aspects of society.

Wealth Distribution

Another cause of the drastic economic disparity in the country is wealth distribution. The United States are notoriously known for the vast difference between the rich and poor people, with the top 0.1% of wealth share equal to the bottom 90% of wealth share (Saez and Zucman 449). While there might be some inaccuracy in the statistics, essentially, it implies that hundreds of oligarchs possess the same amount of money as approximately 300 million people in the bottom 90% of wealth share. In general, it is not necessarily ‘bad’ or ‘unfair’ due to the nature of capitalism and the wide acceptance of its principles in the United States. However, such a drastic difference in income could only benefit the country in case of a just and productive tax system, which is, unfortunately, not the case for America. The studies demonstrate that the current tax system promotes economic disparity, decreases financial growth, and increases social inequality (Stiglitz 3). While the majority of the Western developed countries have seen an increase in economic inequality in the last century, the situation is particularly complicated with the United States.

Furthermore, not only the current system has a low top income-based tax rate, but it also allows for various schemes to avoid paying taxes for the wealthy 1% of the country. For instance, among the owners of Amazon, Microsoft, Berkshire, and Facebook, only Bill Gates pays the correct taxes (Saez and Zucman 464). On the other hand, Bezos, Buffett, and Zuckerberg only pay taxes for their individual income, which is approximately equal to 0.1% of their total wealth (Saez and Zucman 464). As a result, such schemes allow the billionaires to minimize the obligatory income taxes and pay sums equal to 0.1% of what they should have paid according to the just tax system. Naturally, these tendencies demonstrate the flaws of the current policies and promote economic disparity. Overall, the possibility of tax evasion is one of the most critical problems in the system and should be resolved in the future to minimize economic disparity.

Lastly, it is essential to address the current tendencies of wages and savings among American citizens. As mentioned before, there is a significant wealth gap between the richest and the poor people, further complicated by the racial aspect and social inequality. However, the problem has become even more relevant due to the coronavirus pandemic, which has left thousands of people without a job. Evidently, most people who have lost their occupations belong to the middle or lower class in terms of economic wealth (Kapadia 23). These sectors of society have experienced wage stagnation since 1970, as opposed to continual growth in income of the wealthy people (Kapadia 24). Correspondingly, the households of the bottom 90% income have experienced a decline in net savings (Kapadia 24). Hence, it is necessary to level the wages of the working classes since they constitute the largest part of consumers and are the driving force of the economy (Reich 303). Ultimately, the difference in wealth between the top 10% and the middle/lower classes has reached the critical point and should be moderated for the stable economic and social development of the country.

Solution

Having discussed the relevant problems of contemporary America, such as economic disparity, stagnant wages, social inequality, and unjustified tax system, it is essential to propose a comprehensive plan of how to combat the issue. Naturally, the problem of economic disparity is highly complicated and global; therefore, many experts argue that the easy fix does not merely exist. Nevertheless, one of the most efficient methods to overcome financial injustices is considered to be via tax reforms (Kapadia 25). The proper tax distribution among the wealthy and poor people might initiate the course of action toward economic stability. At present, the top income-based tax rate in the United States is considerably lower than in a large variety of developed Western countries, such as Denmark or Germany (Stiglitz 2). Furthermore, the tax system allows for various machinations and schemes in regard to tax evasion. There is also a large variety of multinational companies, which headquarters are located in the United States, that pay fewer taxes due to the business policies (Stiglitz 2). In other words, many experts transparently claim that the American tax system is unfair and should be changed.

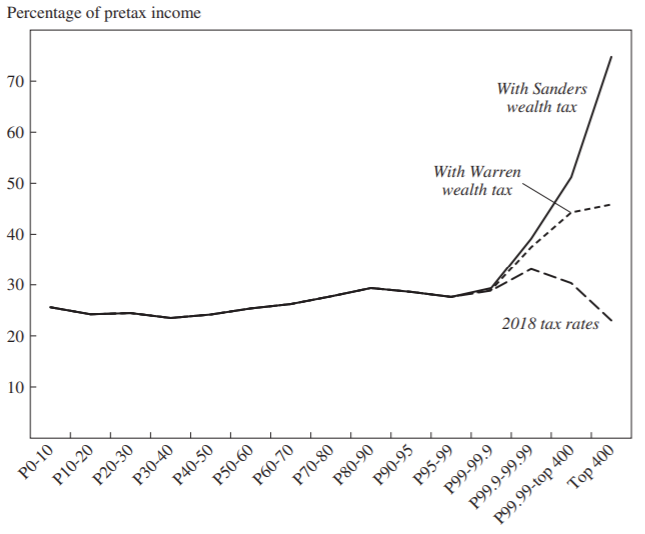

One of the potential solutions to tax reforms, specifically, would be to utilize wealth taxation on the tax progressivity system. In general, it implies the increased interest of taxes for the top 1% of the population and decreasing the possibilities of tax evasion (Saez and Zucman 467). Some of the proposals are reflected in the chart below (see fig.1):

The figure reflects the tax reforms proposed by Elizabeth Warren and Bernie Sanders concerning the overall tax progressivity. In theory, the implementation of these proposals would return the tax rate to the levels observed in 1980 (Saez and Zucman 468). Additionally, the alternatives or complementary elements to wealth taxation include taxing realized capital, taxing capital gains on accrual, merging wealth and capital gains taxation (Saez and Zucman 470). All these methods might be efficient in decreasing the economic disparity in the country.

Nevertheless, it is also crucial to reinforce the existing laws concerning tax avoidance and evasion. At present, the majority of billionaires do not pay the taxes according to their wealth by utilizing loopholes in the laws. This is a global problem that many governments struggle with; nevertheless, the situation in America is considerably worse compared to the majority of the Western developed countries. Therefore, the innovative tax reforms should approach the problems of asset exemptions, storing assets abroad, and expatriation (Saez and Zucman 473). Overall, tax evasion is a critical problem of the present system and should be addressed.

Conclusion

Summing up, the current paper has examined the present state of economic disparity in the United States, analyzed the tax system, and proposed several recommendations concerning the potential tax reforms. At present, American society is afflicted by social inequality, unequal wealth distribution, political and racial tension, and other problems. The proper tax reform will not solve the said issues immediately, but it is a necessary step to minimize the economic disparity in the country. Increasing the wealth taxation will promote the just tax system and reduce the possibilities of tax evasion and tax moderation, that many billionaires utilize to pay only 0.1% of what they should pay. Ultimately, the implementation of innovative tax reforms is necessary to maintain the integrity of society.

Works Cited

Hardin, Garreth. “Lifeboat Ethics: The Case Against Helping the Poor.” Psychology Today, 1974, pp. 1-8.

Kapadia, Reshma. “The High Cost of Inequality.” Barron’s, 2020, pp. 21-26.

Reich, Robert. “Why the Rich are Getting Richer and the Poor, Poorer.” Saez, Emmanuel, and Gabriel Zucman. “Progressive Wealth Taxation.” Brookings Papers on Economic Activity, vol. 2, 2019, pp. 437-533.

Stiglitz, Joseph. “A Tax System Stacked Against the 99 Percent.” The New York Times, 2013, pp. 1-5.