Introduction

Globally, the aviation sector has been significantly impacted by the COVID-19 pandemic. Social isolation protocols have been implemented because the virus is spread by respiratory droplets, harming economies and industries, including the aviation sector. The world’s most outstanding aviation market, the U.S., saw a 79% decrease in total aircraft operations in April 2020 (Federal Aviation Administration, 2019).

The epidemic revealed industry flaws and possible avenues for development. This paper describes the effects of COVID-19 on every part of the U.S. aviation sector, including economics, passenger flights, freight transport, production, and its ecological impact. It also suggests further research to solve these effects.

Pre-Pandemic Growth of the U.S. Aviation Industry

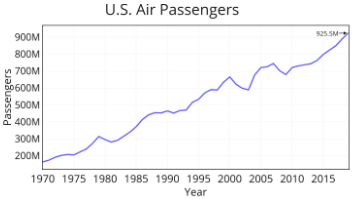

The U.S. aviation industry was thriving before the COVID-19 pandemic. The number of air passengers has been increasing consistently since the 1970s and reached a record high of 925.5 million in 2019, as shown in Figure 1 (Jain et al., 2020). Along with passenger flights, the air cargo industry was also an essential part of global trade, with the number of goods transported increasing steadily.

The aviation manufacturing industry was also expanding due to the growing demand for aircraft, and the industry’s economic growth contributed significantly to that of the nation. The aviation industry was the seventh leading contributor to the U.S. economic growth out of the 63 industries that comprise the U.S. economy (Jain et al., 2020). However, the industry’s rapid growth also increased emissions, attracting public attention. Despite this, the U.S. aviation industry was doing well, with high profits and growth.

Before COVID-19, the passenger air travel industry in the United States was busy and profitable, generating almost $500 billion annually and carrying almost 1 billion passengers (Jain et al., 2020). Despite the complexity of air traffic, travelers could travel anywhere in the U.S. in hours with a generally safe and reliable experience. However, the industry could have been better, with crowded planes, overbooking, and poor airport efficiency causing passenger issues. Before COVID-19, global air cargo was growing, with a 9.7% growth in demand for air cargo in 2017 and a 3.4% growth in 2018 (Jain et al., 2020). The growth was due to modernization and safety standards that made air cargo more reliable, increased businesses and e-commerce, and the U.S. air cargo industry’s influence on global growth.

The manufacturing industry is an essential part of aviation, involving the production and shipment of aircraft, drones, and other air vehicles. The industry has experienced growth in recent years, with a value of $26.8 billion in aircraft deliveries in 2019, up from $24.3 billion in 2018 (Jain et al., 2020). This growth is driven by a demand for more aircraft globally, and the industry had a market size of $712 billion in 2019, with over 20,000 businesses and 4 million workers (Publications, n.d.). With new aircraft vehicles such as drones and 4-person passenger aircraft, the industry is expected to grow from 2020 through 2025.

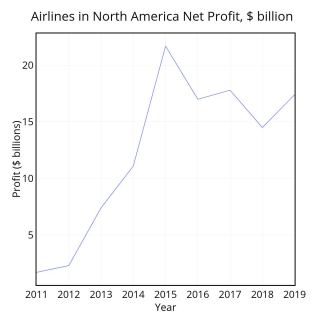

According to Figure 2, the U.S. aviation industry significantly contributed to the nation’s economy before COVID-19. It generated $1.6 trillion in annual economic activity, supporting over 10 million jobs, which accounts for 7.3% of all U.S. jobs. The industry also showed an upward trend in passenger revenue miles since 2010. Moreover, according to (Jain et al., 2020), the aviation industry in North America had an overall increase in net profit from 2011 to 2019, going from $4.2 billion to $17.4 billion, with no net loss recorded.

Impact of COVID-19 on Aviation and Manufacturing

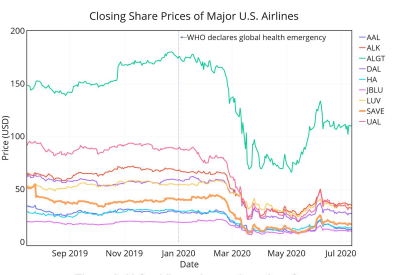

The COVID-19 pandemic has had a significant impact on the aviation industry. All major U.S. carriers reported net losses in the first quarter of 2020. The air cargo industry has also been affected with a 28% drop in capacity, and significant cargo companies in the U.S. are reporting losses (Jain et al., 2020).

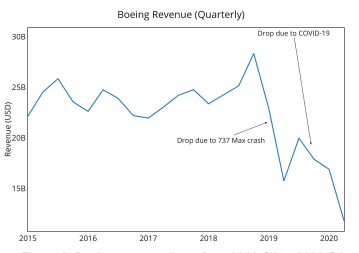

Aviation manufacturing companies have also lost revenue as demand for aircraft has decreased.

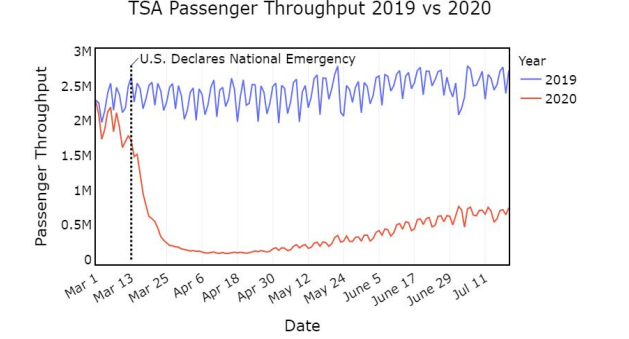

However, the pandemic has positively impacted the environment, with reduced air traffic resulting in decreased emissions. The graph in Figure 3 shows a significant drop in passenger throughput in the United States since the COVID-19 pandemic began. In March 2020, passenger throughput fell by more than 50% compared to March 2019 (Jain et al., 2020).

The numbers continued to decrease in the following months, with April 2020 showing a decrease of 96% compared to the previous year. The numbers slowly recovered in the summer months but remained significantly lower than in 2019. According to Publications. (n.d.), In December 2020, the number of passengers was still down by almost 60% compared to the previous year.

The aviation industry as a whole is facing a significant decrease in demand due to COVID-19, which has led to a reduction in the demand for new airplanes. This has not only affected Boeing but also other major aviation manufacturers. Airbus, one of Boeing’s major competitors, has reported a 55% decrease in commercial aircraft orders in the first half of 2020 compared to the same period in 2019 (Boeing Reports First-Quarter Results – April 29, 2020, n.d.). The company has also reduced its production rates in response to the decrease in demand.

In addition to commercial airplane manufacturers, drone manufacturers have also been affected by COVID-19; one of the leading drone manufacturers in the world has faced supply chain disruptions due to factory closures in China. This has led to a shortage of components, delaying the release of new products. Overall, the aviation manufacturing industry has experienced severe losses due to COVID-19, with reduced demand for airplanes and disruptions in the global supply chain. The industry is expected to recover, but the timing and extent of the recovery will depend on the duration and severity of the pandemic.

Recovery Efforts and Future Innovations in Air Travel

The CARES Act has included provisions to ensure that airlines receiving federal aid maintain a minimum level of service to ensure connectivity to remote and underserved areas. The act requires airlines to maintain at least 90% of their domestic flight capacity and to refrain from reducing service to any location that had scheduled flights before March 1, 2020, unless an exemption is offered by the Department of Transportation (COVID-19 Stimulus Funding for Transportation in the CARES Act and Other Supplemental Bills, n.d).

The airline industry’s recovery largely depends on how quickly people feel comfortable traveling again and how effectively vaccines and other measures can prevent the spread of COVID-19. International Air Transport Association experts predict that air travel demand will return to pre-pandemic levels by 2024, while others believe it may take longer. However, the industry may look different after the pandemic, with changes such as increased sanitation measures, digital technologies, and a focus on sustainability and reducing carbon emissions.

Urban Air Mobility (UAM) is an air transportation system for short-distance travel within cities. Due to COVID-19 and social distancing measures, small aircraft seating six or fewer passengers may become popular with people concerned about contracting the virus. Research on electric vertical take-off and landing vehicles (eVTOLs) should continue, and public opinion regarding UAM should be researched. Private chartered flights have increased due to the pandemic, which may lead to more air traffic, and air traffic controllers are prepared for this possibility.

Projects such as Next Generation Air Transportation System, ATD-2, and Air Traffic Control Simulator testing can support this development. Unmanned Aircraft System Traffic Management (UTM) could also be helpful during the pandemic to increase shipping efficiency and limit contact between workers and customers. NASA could also research how aircraft circulate air to prevent the transmission of airborne viruses or viruses transmitted via airborne respiratory droplets.

One possible solution would be to circulate air from the top of the cabin and release it at the bottom, minimizing the number of people the air reaches. A breathable aerosol-type chemical could be mixed with cabin air to kill bacteria and viruses during flight. A modular divider could be designed to separate passengers to prevent the spread of airborne or waterborne viruses and bacteria between them. NASA would work with aircraft manufacturers to design the divider according to specific aircraft specifications.

Conclusion

In conclusion, it is essential to monitor the aviation industry’s recovery by tracking the number of operations, passengers, and commercial private flights. Airlines that effectively manage the crisis can guide the future. Research should be conducted on how auxiliary air transport services are adapted, and other countries’ aviation industries should be studied for insights. Data on the global aviation industry can be compared to determine which airlines went bankrupt and which recovered quickly. This information can be valuable in planning for future crises.

References

Boeing Reports First-Quarter Results – Apr 29, 2020. (n.d.). MediaRoom. Web.

COVID-19 Stimulus Funding for Transportation in the CARES Act and other Supplemental Bills. (n.d.). Data.bts.gov. Web.

Federal Aviation Administration. (2019). Federal Aviation Administration. Faa.gov. Web.

Jain, T., Menon, V., Nease, D., Robins, C., & Sattary, K. (2020). An Analysis of COVID-19’s Impact on U.S. Aviation. Web.

Publications. (n.d.). Www.iata.org. Web.