Demographic Environment

Personal and social factors play a crucial role in the purchasing behavior of female consumers of beauty products in the United Arab Emirates (UAE) (Chaturvedi & Purohit, 2020). It is a threat to the local color cosmetics industry. It complicates customer behavioral analysis and the development of strategies for products promoting. It may lead to higher marketing costs, reduced advertising effectiveness, and lower overall sales and buyer growth.

Positive effect of color cosmetics on the Quality of Life (QoL) is limited on people in the UAE (Mohammed et al., 2022). Color cosmetics boost attractiveness, self-confidence but do not influence other spheres of QoL. The impact of these is reduced if the user has a dark skin tone and dry skin, which is a threat to the industry. It can result in a halt in the growth of new consumers in the market.

Economic Environment

The UAE is a country where the halal cosmetics industry has a very high global competitiveness (Ernawati, 2019). It can be interpreted as an opportunity as it protects local market and the industry from the aggression of multinational companies. Moreover, the UAE economy has been growing steadily and intensively for decades (Staff Writer, 2022). Every year, the opportunity for businesses to increase their operational efficiency becomes more accessible as the number of positive processes constantly increases.

Cultural Environment

In Muslim countries, such a cultural beauty trend as using cosmetics containing prophetic foods is gaining popularity (Rahim, 2019). It diversifies the industry and poses an opportunity for cosmetics firms operating in Muslim countries to develop a new personal care product line. Moreover, UAE female citizens are the leading consumers of personal care goods and services (Maceda, 2020). This wealthy customer base provides an opportunity for commercial organizations to launch frequent new luxury product lines and makes the development of the industry fast and constant.

Political Environment

Over the past half a decade, the UAE authorities have entered into many new trade agreements with developed nations and emerging states (Zineldin et al., 2023). It gives an opportunity for vast multinational cooperation and reduces supply chain expenses for the entire industry. However, regulations for personnel care products for importers are still strict (Parker, 2018). These laws are of protective nature, and they create a safe window of opportunities for the development of domestic firms.

Technological Environment

Among various digital applications, virtual makeup try-ons are gaining incredible popularity among cosmetics users (Euronews, 2023). This technological trend is an opportunity for all industry participants to increase their target customer base, as these apps are effective advertising platforms. The UAE is also experiencing the emergence of many sustainable technology start-ups in the beauty business (RetailME Bureau, 2021). It is a threat and an opportunity; they can grow into severe competitors for current actors or profitable acquisitions and heat the market.

Natural Environment

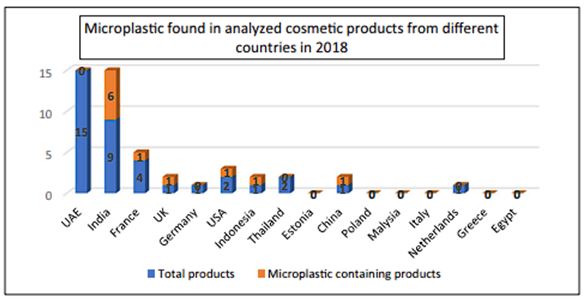

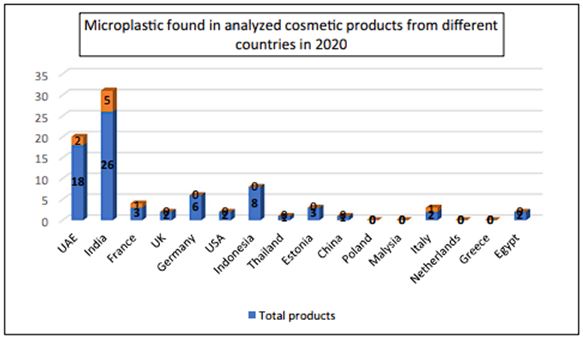

The public in the UAE, especially consumers of color cosmetics, is becoming more aware of the use of micro-plastics in these (Fig. 1-2) (Habib et al., 2022). It could lead to environmental protection laws, a ban on importing many categories of personal care products, and the withdrawal of foreign companies, making this trend a THREAT. This hypothetical sequence of events could strengthen the beauty industry’s home sector due to the departure of larger competitors, which is an opportunity. In both cases, the UAE beauty market actors would have to spend extra money on changing suppliers and production methods.

Manufacturers of skin care products in the UAE have poor quality and safety control of those goods that contain cannabinoids in their composition (Jairoun et al., 2021). It is an opportunity for the beauty industry to step up and propose adequate quality control methods and procedures. By doing this, companies would avoid future fines and improve institutional relationships with legislatures and regulators in the UAE.

References

Chaturvedi, N., & Purohit, H. (2020). Exploring the factors affecting buying behavior of women in UAE. International Journal of Scientific Research and Engineering Development, 3, 1210-1221. Web.

Ernawati, E. (2019). The global competitiveness study of halal pharmaceuticals and cosmetics industry. Mega Aktiva: Jurnal Ekonomi dan Manajemen, 8(1), 51-61. Web.

Euronews. (2023). Art, technology and innovation behind beauty in the UAE. Euronews. Web.

Habib, R. Z., Aldhanhani, J. A., Ali, A. H., Ghebremedhin, F., Elkashlan, M., Mesfun, M., Kittaneh, W., Al Kindi, R., & Thiemann, T. (2022). Trends of microplastic abundance in personal care products in the United Arab Emirates over the period of 3 years (2018–2020). Environmental Science and Pollution Research, 29(59), 89614-89624. Web.

Jairoun, A. A., Al-Hemyari, S. S., Shahwan, M., Ibrahim, B., Hassali, M. A., & Zyoud, S. E. H. (2021). Risk assessment of over-the-counter cannabinoid-based cosmetics: Legal and regulatory issues governing the safety of cannabinoid-based cosmetics in the UAE. Cosmetics, 8(57), 1–10. Web.

Maceda, C. (2020). UAE, Saudi women are world’s biggest spenders on beauty products – report. Zawya. Web.

Mohammed, A. H., Hassan, B. A. R., Wayyes, A. M., Al‐Tukmagi, H. F., Blebil, A., Dujaili, J., Nasr, M. H., El Hajj, M. G., Malaeb, D., Alhija, S. A., Kateeb, E., Amro, A., Al-Taweel, D., A., Al Juma, M. A., Al-Ani, O. A., Farhan, S. S., Darwish, R. M., & Al‐Zaabi, A. T. (2023). Exploring the quality of life of cosmetic users: A cross‐sectional analysis from eight Arab countries in the Middle East. Journal of Cosmetic Dermatology, 22(1), 296–305. Web.

Parker, J. (2018). Distributing cosmetics and perfumery products in the UAE. Gowling WLG. Web.

Rahim, N. (2019). Prophetic food-based cosmetics: A segment of halal beauty market. Ulum Islamiyyah.

RetailME Bureau. (2021). Beauty tech boom: A look inside the future of the $32 billion Middle East beauty industry. Images RetailME. Web.

Staff Writer. (2022). UAE’s strong economy to pull in ‘more foreign investments.’ Zawya. Web.

Zineldin, S., D’silva, H., & Hasan, F. (2023). Importing into the United Arab Emirates: Overview. Thomson Reuters Practical Law. Web.