Introduction

Globalisation refers to process of relations and integrations among organisations, people and governments across the globe. In business world, this concept represents the free flow of data, technology, capital, goods and services between nations. In the past, Western nations viewed globalisation as an essential phenomenon, since it promoted economic growth. Today, there exists scepticism among people, particularly Americans who believe that developing nations have exploited globalisation at their expense (Cavusgil, Knight and Riesenberger, 2019).

The majority of the prosperous Western countries insist that the idea of free trade brought about by globalisation, benefits only the emerging economies. It underscores the reason why President Trump imposed tariffs on foreign goods as a measure to protect local companies. Economic analysis shows that globalisation has both positive and negative effects on domestic businesses. This essay will discuss the effects of globalisation on local firms, absolute and comparative advantage theories and the factors that contributed to President Trump introducing tax on imports.

Impacts of Globalisation

One of the benefits of globalisation to domestic firms is transfer of technology. As per Surugiu and Surugiu (2015), it has not only facilitated rapid technological growth but also promoted easy sharing of knowledge between nations and companies. Presently, consumer expectations influence market operations. Surugiu and Surugiu (2015) argue that technology has been of significant value, especially to domestic companies that operate in capital-intensive industries.

These firms require adjusting their operations according to constantly changing market and consumer demands. Globalisation allows organisations to access modern technology, which is helpful in research and development. Indeed, many local firms have not only managed to improve the quality of their products and services but also developed novel goods, thereby boosting competitiveness.

Globalisation has opened international borders, making it possible for local businesses to access foreign markets. Studies show that international trade has grown significantly over the last three decades. Economists use the phrase “scale advantage of globalisation” to describe how globalisation benefits local firms. Today, companies like Ericson can manufacture electronics in large quantities because they are guaranteed of ready market across the globe.

Apart from promoting international trade, globalisation has enabled domestic firms to specialise in the production of specific goods or services, thus enhancing quality. Collier (2018) maintains that contemporary companies no longer manufacture varieties of products under the safety of trade barriers. Three decades ago, Nokia Company invested in electricity, rubber boots, household goods and television sets; a strategy that hindered its capacity to improve on quality. Today, specialisation has enabled this firm to become one of the best phone-manufacturing businesses.

Globalisation is blamed for the current degree of competition in world market. Opening of international boundaries has made it easy for multinational firms to sell their products and services in foreign countries. Therefore, it has become difficult for local businesses to grow their market base due to competition. Collier (2018) posits that multinational companies benefit from economies of scale; hence, their cost of production is low.

In return, they sell products at cheap prices, making it hard for domestic businesses, especially those that are at the start-up stage, to compete. One of the factors that have contributed to the poor performance of local companies in developing economies is stiff competition from established multinationals. For instance, in Africa, it has been difficult for local firms that produce soft drinks to compete with global giants like Coca Cola.

Globalisation contributes to significant changes in local consumer outlooks, cost of production and business-supplier relations. These adjustments trigger worldwide market chain reactions that have devastating repercussions on domestic companies (Collier, 2018). For instance, the decision by Britain to leave the European Union has affected the operations of many local businesses that source raw materials from foreign countries. One may argue that this decision will only affect multinational companies, which have establishments in different European nations. However, an assessment of the potential impacts of Brexit reveals that it has resulted in noteworthy uncertainty amid business operators in Ireland and Scotland.

Absolute and Comparative Advantage Theories

It is imperative to note that absolute advantage theory and comparative advantage theory are completely different. The former refers to situation where a nation or company is capable of constantly manufacturing quality and affordable goods compared to rivals (Seretis and Tsaliki, 2015). A nation may exploit absolute advantage because of its environmental conditions or availability of resources. For example, the production of coffee in Columbia and Guatemala is cheap due to favourable climatic conditions. According to Laursen (2015), comparative advantage theory refers to a situation where a state or company has to consider opportunity costs when deciding to produce a particular commodity. The majority of the nations are not endowed with resources for manufacturing anything they want.

Consequently, they must leverage comparative advantage to make sure that they distribute the available resources in an efficient manner. The comparative advantage theory is more practical than the absolute advantage theory. The former is significant because it enables countries to make sound economic decisions. No country is self-sufficient in terms of natural resources and climatic conditions. Therefore, every state has to source certain products or services from other countries.

Numerical Explanation of Comparative Advantage

Comparative advantage theory promotes trade between nations, as they specialise on manufacturing what they can produce at low costs. For instance, the United States and Saudi Arabia produce corn and oil respectively, which are in high demand in both nations. The only resource that is accessible to the two nations is labour hours. Let us assume that the United States requires two hours and one hour to produce oil and corn respectively.

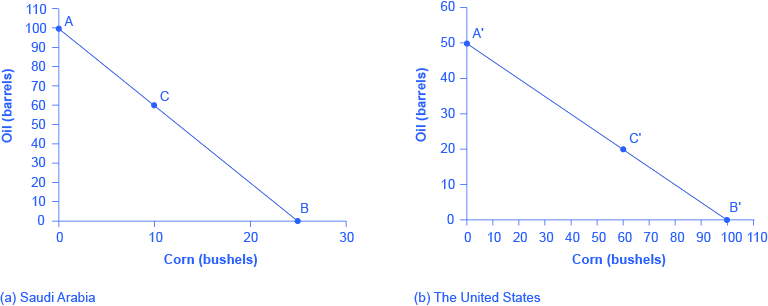

On the other hand, Saudi Arabia needs one hour and four hours to manufacture oil and corn in that order. Additionally, if we consider each country to have 100 working hours, then the United States would only produce 50 barrels of oil or 100 bushels of corn. Conversely, Saudi Arabia would yield 100 drums of oil or 25 bushels of corn. The graphs below represent the production possibilities of each country.

From these diagrams, it is clear that for the two countries to produce both corn and oil, they require dividing their working hours. At the points marked C, Saudi Arabia may opt to allocate 60 hours to extraction of oil (60 drums) and 40 hours to the production of corn (10 bushels). Conversely, the United States might decide to assign 40 hours to oil production (20 barrels) and 60 hours to corn manufacture (60 bushels). In this case, these countries require evaluating the opportunity cost of producing each commodity. Engaging in trade would allow these nations to specialise in what they are capable of producing at low cost. In return, the move would boost the production level of each country and facilitate efficient utilisation of the available resources.

Import Tariffs

Heightened trade war between the United States and China has led to the two nations imposing tariffs on imports. Numerous factors may have prompted President Trump to enforce tax on Chinese products, among them the need to protect local industries, promote domestic employment and curb hostile trade practices. Pierce and Schott (2016) contend that taxation helps nations to cushion infant industries against stiff competition from foreign companies.

President Trump may have opted to tax Chinese goods as a measure to allow local businesses to cultivate, promote and build their organisations into competitive units. One of the promises that Trump made during his presidential campaign was job creation. Influx of Chinese products in American market resulted in stiff competition, as some consumers preferred buying foreign goods to locally manufactured commodities. Therefore, Trump introduced tariffs to encourage people to spend on domestic goods, thereby facilitating job creation, particularly in the manufacturing division.

Free trade, which is attributed to globalisation, encourages unhealthy business behaviour. For instance, some multinationals flood their products in international markets as a strategy to increase their sales volume and lock out local companies (Pierce and Schott, 2016). Today, there are many Chinese products in American market. Besides, these goods are cheap compared to locally produced commodities, hence denying domestic companies an opportunity to grow their market coverage. President Trump imposed tariff as a way to discourage Chinese firms from engaging in aggressive trade practices that could harm American businesses.

For many years, the United States has imported more products from China than it exports. Therefore, the move to introduce tax was meant to reduce trade deficit between the two nations. President Trump took this protectionist measure to control the amount of money that the United States remits to China.

Introduction of tax on foreign products may have numerous effects on local consumers. As per Amiti, Redding and Weinstein (2019), one of the impacts of tariffs is increase in prices of commodities. Trump’s decision contributed to Chinese companies raising the cost of their goods and services as a strategy to protect profit. Additionally, American companies that source raw materials from China increased the charges of their products to compensate for the high cost of importing these essential resources. It became difficult for most American consumers to purchase these products.

Apart from the increased cost of commodities, imposing tariffs on foreign goods deprives local consumers of the opportunity to choose from a variety of merchandises. Amiti, Redding and Weinstein (2019) argue that many Chinese firms have shied away from the United States’ market. Consequently, local customers are forced to purchase American goods because there are no alternative products.

Conclusion

Globalisation has positive and negative impacts on domestic businesses. It facilitates sharing of technology, which enhances the quality of locally manufactured goods. Furthermore, it opens international borders, enabling domestic companies to sell their products and services in overseas markets. On the other hand, it causes uncertainty among local businesses and increases competition due to influx of foreign products in a country.

No country is self-reliant; hence, there is a need to leverage comparative advantage to guarantee efficient utilisation of the available resources. Allowing unregulated entry of foreign goods into a country may have adverse impacts on domestic firms. The decision by Trump to impose tariffs on Chinese products was aimed at promoting job creation, protecting local companies and curbing unhealthy business practices. On the other hand, the move resulted in the increase in prices of most commodities. Additionally, it denied domestic consumers an opportunity to choose commodities from a variety of products, as many Chinese businesses avoided American market.

Reference List

Amiti, M., Redding, S.J. and Weinstein, D.E. (2019) ‘The impact of the 2018 tariffs on prices and welfare’, Journal of Economic Perspectives, 33(4), pp. 187-210.

Cavusgil, S.T., Knight, G. and Riesenberger, J.R. (2019) International business: the new realities, global edition. 5th edn. New York: Pearson Higher Ed.

Collier, P. (2018) ‘The downside of globalisation: why it matters and what can be done about it’, The World Economy, 41(4), pp. 967-974.

Laursen, K. (2015) ‘Revealed comparative advantage and the alternatives as measures of international specialization’, Eurasian Business Review, 5(1), pp. 99-115.

Pierce, J.R. and Schott, P.K. (2016) ‘The surprising swift decline of US manufacturing employment’, American Economic Review, 106(7), pp. 1632-1662.

Seretis, S.A. and Tsaliki, P.V. (2015) ‘Absolute advantage and international trade: evidence from four Euro-zone economies’, Review of Radical Political Economics, 48(3), pp. 438-451.

Surugiu, M. and Surugiu, C. (2015) ‘International trade, globalization and economic interdependence between European countries: implications for businesses and marketing framework’, Procedia Economics and Finance, 32(2015), pp. 131-138.

Taylor, T. et al. (n.d) Principles of economics. Houston: Rice University.