Introduction

Innovation economics is a relatively young and expanding area of practical and theoretical economics that places a strong emphasis on innovative thinking and entrepreneurial activity. It includes putting any innovation, particularly one of a technological nature, to use for commercial purposes (Uzunidis, Kasmi, and Adatto, 2021). In the U.S. and the U.K., the greatest banks that follow this particular branch of economics are J. P. Morgan Chase & Co. (JPMC) and HSBC, respectively (HSBC, 2023; J. P. Morgan Chase & Co. [JPMC], 2023). Consequently, this report provides a market overview for the chosen banks in the years 2018–2023.

Background

JPMC is proud of its innovation orientation. In particular, the bank labels it one of the five fundamental values it has promoted since its inception: curiosity (JPMC, 2023). Among its recent innovations is the ongoing customer transition to the cloud platform, resulting in a twofold reduction in the servers’ runtime costs and over $500 million in financial value in 2022 (JPMC, 2023). In turn, HSBC also promotes technological innovation, which it informs of in its annual reports (Johannes, Dedy, and Muksin, 2018). For comparison, HSBC notes that it has invested approximately $5 billion each year into HSBC’s technological capabilities since 2018, whereas JPMC generally devotes $3–4 billion (HSBC, 2023; JPMC, 2023). In this context, both banks focus their innovation efforts on cost reduction rather than raw revenue growth.

Findings

JPMC

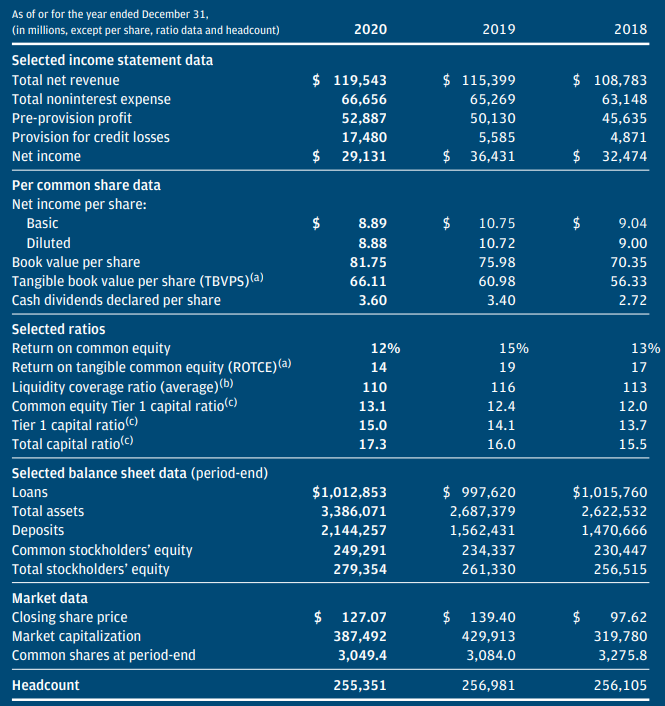

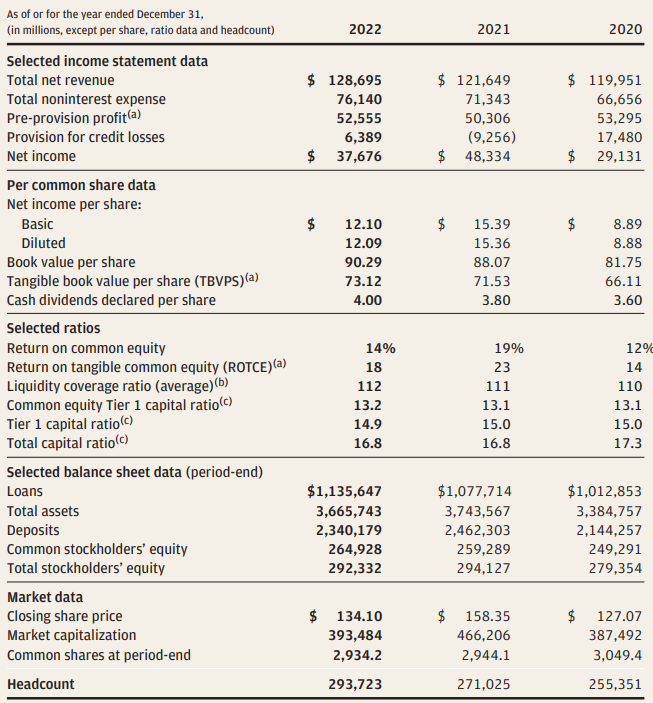

In a span of five recent years, JPMC can be considered in a state of steady growth. For example, its total net revenue has increased from $108,783 in 2018 to $128,695 in 2022 (JPMC, 2023). Moreover, based on the second-quarter reports from the company, it already managed to gain over $80,000 in net revenue, which implies a great potential for upholding the yearly growth tendency (JPMC, 2023). Although the 2018–2022 fluctuating net income of a parabolic form does illustrate the demand for improvement in the time of the COVID-19 crisis and the bank’s ability to fulfill it. The detailed findings of JPMC’s financial activities can be found in figures 1 and 2.

HSBC

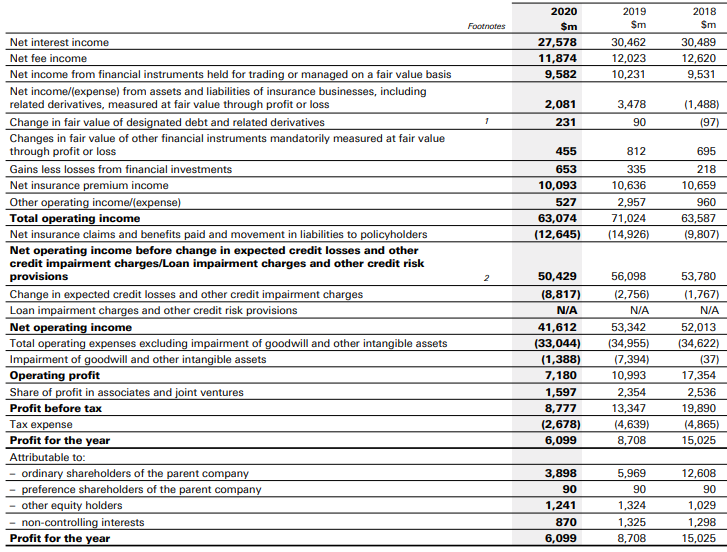

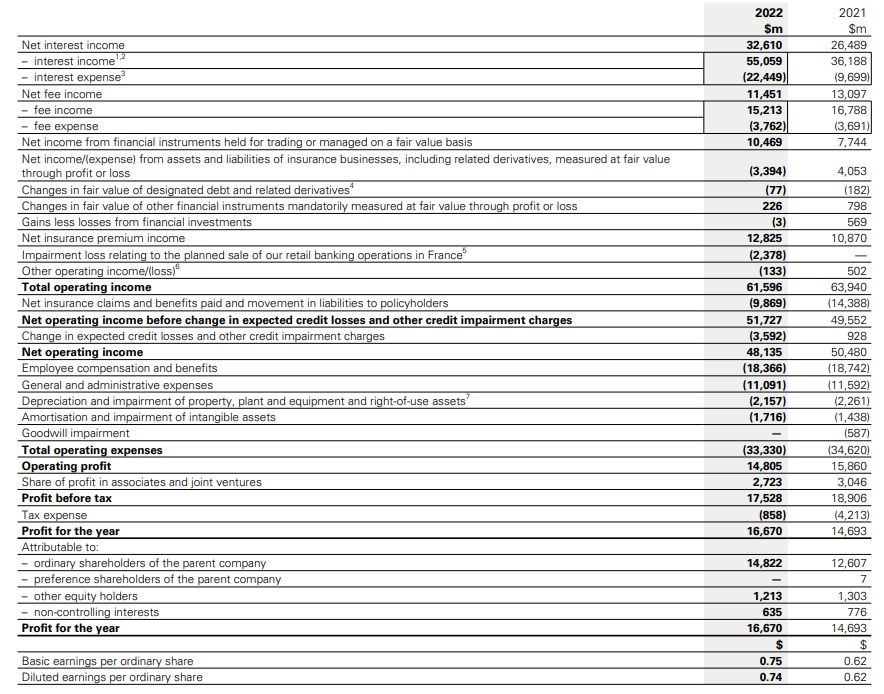

Compared to JPMC, HSBC showcases unstable growth tendencies in parabolic form. In particular, the company’s net profit has declined three-fold from 2018 to 2020 due to the COVID-19 crisis, only to proportionally grow back again during 2020–2022 (HSBC, 2023). It is worth mentioning that a significant increase in profitability occurred after 2020 due to a substantial improvement in operating profit, from $7,180 million to $14,805 million (HSBC, 2023). The more detailed information regarding HSBC’s performance can be found in figures 3 and 4.

Discussion

Based on the pieces of evidence presented above, one can derive the true short-term value behind technology innovation investment. In short, both banks, regardless of their affiliation with different banking systems, displayed parabolic development tendencies that were addressed by short-term innovation investments (Hearit and Hearit, 2023; HSBC, 2023). In short, these investments tend to influence supply capacity by increasing product demand and quantity while lowering production costs. However, Uzunidis, Kasmi, and Adatto (2021) warn against overfocusing on a short-term profit since it results in overlooking serious long-term concerns, such as “climate change, population aging, and pandemics” (p. 4). Nevertheless, both showcased financial institutions can be considered stable enough to be worthy of investment due to their ability to maintain growth despite arising challenges.

Conclusion

JPMC and HSBC are banks that represent different financial systems and similar parabolic development tendencies. Apart from that, both banks rely on innovation economics to guide their financial decisions. This way, they are able to flexibly gauge the market and adjust their decision-making accordingly. As a result, one can see from their financial statements that even the worldwide pandemic cannot substantially damage neither JPMC nor HSBC.

Reference List

Hearit, K.M. and Hearit, L.B. (2023), ‘Commentary—a Dimon in the rough: apologetic crisis management at JPMorgan Chase’, International Journal of Business Communication, 60(1), pp. 351-362. Web.

HSBC. (2023) All reporting. Web.

Johannes, R., Dedy, D. and Muksin, A. (2018) ‘The preparation of banking industry in implementing IFRS 9 financial instruments (a case study of HSBC Holdings Plc listed on London stock exchange of year 2015–2017)’, International Journal of Economics and Financial Issues, 8(6), pp.124-136. Web.

J. P. Morgan Chase & Co. (2023) Annual report & proxy. Web.

Uzunidis, D., Kasmi, F. and Adatto, L. (eds.) (2021) Innovation economics, engineering and management handbook 1: main themes. New Jersey: John Wiley & Sons.