Impact of Foreign Exchange Rates

When a corporation decides to conduct business internationally, it will be exposed to two significant accounting risks associated with export sales and import purchases. These risks are related to fluctuations in foreign currency exchange rates. When speaking about export sales and import purchases that are paid for immediately, there are no evident accounting issues or financial risks. The company only needs to translate the functional currency to the presentation currency at the current exchange rate and show the information with one journal entry (Hoyle et al., 2016). However, complications will occur if a company allows delayed payment for the products or services.

To understand the nature of such risks, it is beneficial to discuss the matter using an example. For instance, Company U operating in the US sells products to Company E operating in Europe for €100,000. On the date of sale, the exchange rate was $1.2 for €1. Company U allowed its customer to pay within 30 days after the transaction, and the exchange rate on the day of the transaction was $1.1 for €1. Therefore, instead of receiving $120,000, the company received only $110,000 in cash, which resulted in a $10,000 loss in expected revenue. This situation describes the most common risk of losing money associated with international trade. The level of risk associated with uncertainty around foreign exchange rates can be exceptionally high when dealing with unstable financial markets of developing countries, such as members of BRICS (Prasad & Suprabha, 2017). However, apart from financial risks, accounting complications may occur, as it is unclear how Company U should account for the loss of $10,000.

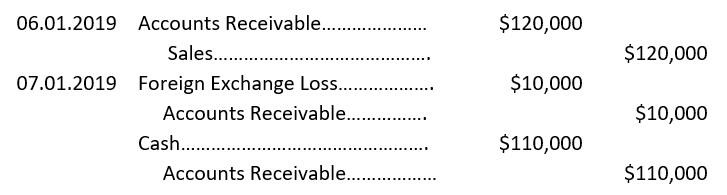

FASB ASC 830-20 Foreign Currency Matters–Foreign Currency Transactions require companies to utilize a two-transaction approach (Hoyle et al., 2016). This implies that Company U should make two entries into the book that accounts for the decision and for the transaction. The example is demonstrated in Table 1. The approach requires treating the difference in exchange rates as foreign exchange rate gain or loss. However, this approach is associated with considerable difficulties, especially if the payment is collected after the date of reporting and/or borrowings in foreign currencies are needed (Hoyle et al., 2016). Therefore, when a company decides to enter into international trade, it should consider such risks and hire a highly-qualified professional.

There are two ways of addressing the risks associated with international trading, which are forward contracts and options (Hoyle et al., 2016). Currently, forward contracts are the most preferred method of hedging, as it ensures that a certain amount of foreign currency will be purchased at a set date with the most favorable price (Prasad & Suprabha, 2017). Both of these methods allow predictable future purchases of foreign currency and have their benefits and flaws and should be used under the guidance of a qualified accountant.

Translating Financial Statements

There are two methods of translating financial statements, which are temporal (historical) and current rate methods. The current rate method of converting foreign currency is an approach that translates most of the items of financial statements at the current exchange rate (Hayes, 2020). On the balance sheet, only stockholders’ equity is reported using historical or composite exchange rates (Hoyle et al., 2016). In the income statement, the method uses a weighted average exchange rate (Hoyle et al., 2016). This method is used when the subsidiary country is not well integrated with the parent country, and the local currency is the functional currency of the subsidiary (Hayes, 2020). If a company has a sizeable entity in which all operations occur in a different currency, the whole operation is exposed to currency risk. Therefore, an accountant would want to translate all the numbers at the current rate to determine what can happen if that business was to go down.

The temporal method is used when the functional currency of the subsidiary is the same as the parent company. In other words, if the subsidiary is well-integrated with the parent company, the temporal method is preferred (Kenton, 2020). If a subsidiary company is only a temporary extension, the management may not be concerned with all the asset exposure. Therefore, the current foreign exchange rates are used only for monetary matters (Kenton, 2020). These items include cash and receivables, marketable securities, inventory, current liabilities, and long-term debt (Hoyle et al., 2016). In the income statement, only revenues and expenses use a weighted average of the current exchange rates (Hoyle et al., 2016). In summary, when a corporation decides to create a subsidiary in a foreign country, the choice of method of translating financial statements should be based on the level of integration with a parent company and the functional currency of the subsidiary.

References

Hayes, A. (2020). Current rate method. Investopedia.

Hoyle, J.B., Shaefer, T.F., & Doupnik, T.S. (2016). Advanced accounting (13th ed.). McGraw-Hill Education.

Kenton, W. (2020). Temporal method. Investopedia.

Prasad, K., & Suprabha, K. (2017). Exchange rate exposure and usage of foreign currency derivatives by Indian nonfinancial firms. The Impact of Globalization on International Finance and Accounting, 71-80.