Introduction

Lala Coffee Shop imports both coffee Arabica and Robusta beans to specialty roasters in the U.S. The company’s main office is located in San Francisco, California, while other warehouses are in Colombia and several other states in America. Lala Coffee Shop’s products are differentiated from those provided by the competitors, as it explicitly constitutes the top five percent highest quality of beans grown in Antioquia and Caldas regions in Colombia. Moreover, the two coffee bean varieties are 100% organic. These two competitive advantages, combined with the fact that the country is the United States’ biggest coffee trading partner, substantially reduce the risk to market entry.

For the starting year, Lala Coffee Shop intends to attract specialty roasters by showcasing its products in several CoffeeFest events that are usually held in various states across the U.S. The event is known to attract different stakeholders in the coffee industry right from baristas to specialty roasters. Lala Coffee Shop projects sales to be approximately $890,000 by the end of its first year of operation, $1.1 million in the second year, and $1.5 million at the end of the third year. Therefore, sustaining an average gross margin of 30 to 35% is practical.

Type of Business

Our start-up company’s name is Lala Coffee Shop. The company used the name “Lala” as it is a Hawaiian name meaning “famous”. The name thus aligns with the company’s mission and objectives, which primarily revolve around providing quality products at affordable prices. This will propel it to emerge as a famous coffee importer in the U.S.

Lala Coffee Shop is an independent developer and importer of mild washed green Arabica and Robusta coffee beans from farmers in Colombia. Its headquarters is in San Francisco, California, with other warehouses in New York and Illinois. Therefore, with an established presence in several states in the U.S., Lala Coffee Shop will be able to sell and ship green coffee all over the country. Its clients solely comprise specialty coffee roasters. Moreover, the company’s coffee is distinct from that of the competition in that it prepares the top 5% with regards to the quality standards of all Arabica and Robusta beans in the market at an affordable price. The American clients will thus seek this product as it will give them an edge of differentiation.

The mission of Lala Coffee Shop is to become a recognized importer of coffee beans in the U.S. the firm guarantees high-quality products at an affordable price. Commitment to clients will be mirrored through honesty and increased customer satisfaction.

Legal Structure

Lala coffee Shop is a Limited Liability Corporation (LLC). The legal issues and written agreements are managed by the Lala Coffee Shop’s consultant lawyer.

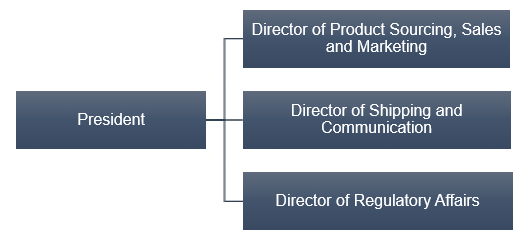

Organization Chart

The company will consist of four primary functional departments, which include product sourcing, sales and marketing, shipping, finance and administration, and communication.

Kirk Davis: President and founder. He will be in charge of finance and administration. Kirk Davis, originally from Colombia, has worked in the coffee export industry for 18 years.

Stella Lawson: On board of directors. Will be responsible for sourcing coffee beans, sales, and marketing. She was previously the procurement officer for ten years at an agricultural brokerage and supply company. MBA in Procurement and Supplies Management from the University of North Carolina.

Ivan Carrasquilla: On board of directors. Will be responsible for shipping and communication. She previously worked as a Shipping and Receiving supervisor at the MSC Mediterranean Shipping Company.

William McKinsey: Onboard directors. Will be responsible for regulation and compliance. He obtained his degree in law from the University of California.

Product

Lala Coffee Shop will deal with green Arabica and Robusta coffee, grown by small-scale farmers in various regions in Colombia. The coffee beans will be directly purchased from the farmers, dehusked, and then packed into 60kg sacks in the Lala Coffee Shop’s plant in Colombia. The final product is appropriate for sale and exportation. The two coffee varieties differ in price, in that the Robusta species has a market value that is almost twice that of Arabica. However, one problem with the Robusta is that it is still new in the region; hence, it is grown by relatively few farmers.

Competitive Comparison

Lala Coffee Shop products consist of the features below that differentiate them from that offered by the competition:

- They comprise beans, which are the top 5% with regards to the quality standards of all Arabica and Robusta beans grown in Colombia. This will be accentuated in all marketing efforts.

- All the beans are guaranteed to be fresh upon delivery and are shipped three days after preparation.

- Lala Coffee Shop only trades in the Colombian Supremo, which is regarded as the highest grade and comprises of large beans that are sorted at 95% screen 18.

- Lala Coffee Shop only trades in organic coffee that comprises coffee grown in adherence to environmentally friendly farming methods without the use of farming chemicals, such as herbicides, fungicides, and fertilizers.

Sales Literature

Sales literature will comprise personal selling, direct mailing to specialty roasters, a website, and print advertising.

Technology

Lala Coffee Shop products will fall under the protection of patents even though a majority of the products are independent of patentable interventions. Moreover, partially operated machinery will be used as they are associated with a heightened production capacity with a lesser operator-to-machine ratio. Technology will also be inculcated into several other aspects of the business process, such as communication with customers in import countries, shipment tracking, and inventory control.

Future Products

Due to the demand for Robusta probably exceeding supply, Lala Coffee Shop will start farming Robusta coffee to help reduce the disparity. Although the Arabica and Robusta coffee varieties share some similar characteristics, they differ relative to their growing conditions and resistance to disease. Moreover, Robusta has an advantage over Arabica in that it has relatively higher caffeine content. Therefore, with having a relatively higher supply of Robusta, the company has the potential to attract more customers.

Marketing Strategy

The mission of Lala Coffee Shop is to provide the freshest and finest quality of Arabica and Robusta beans available. The company has positioned itself as a differentiated provider of high-end coffee imports in the U.S. As a result, the primary aim of the marketing efforts will be to communicate the company’s competitive edges to both the current and potential clients. The following marketing strategy will be used:

- Lala Coffee Shop is focused on green coffee beans and targets specialty roasters in the U.S.

- Lala Coffee Shop plans to exhibit its products at CoffeeFest. CoffeeFest is a B2B specialty coffee event held in several states across the U.S. multiple times a year. The event allows for coffee professionals to gather and showcase their products. As a start-up, this will be an excellent opportunity for the company to exhibit its products, therefore, attracting specialty roasters. This will be a realistic goal in events such as the CoffeeFest as it is renowned for drawing the largest population of independent specialty beverage operators and decision-makers in America (CoffeeFest).

Promotion Strategy

The promotion strategy will seek to communicate the company’s competitive edges to potential clients, develop a customer base, and works towards establishing customer loyalty. The strategy will be mainly centralized in conveying how Lala Coffee Shop imports Supremo Arabica and Robusta beans at affordable prices. This information will be communicated through a variety of channels. For instance, in the beginning, sales will be primarily managed via personal selling; however, later on, other additional literature will be utilized. They will comprise print advertisements in trade publications such as the Coffee Times.

The Coffee Times is a monthly journal targeting individuals in the U.S. dealing in the coffee industry. In addition to appearances in related catalogs, direct-mail advertisements in personal letters to potential customers will be utilized. The fourth promotion strategy used will be the website. Through the website, interested parties will be able to comprehensively view information regarding Lala Coffee Shop, for instance, its products, sourcing regions, and other information. Lastly, additional strategies will consist of in-store promotions and publicity events.

Pricing Strategy

The end market price for green specialty coffee in the U.S. depends on the quality of the beans and the growing regions. Coffee grown in Colombia is ranked fourth in terms of price. Typically, the export prices of green coffee constitute approximately 5-25% of the end-market prices (Transparent Trade Coffee). According to Transparent Trade Coffee, the end-market price of exported Colombian coffee Arabica and Robusta is categorized into three levels:

- Upper-end: USD 4.95 per pound.

- Middle range: USD 2.85 per pound.

- Lower-end: USD 1.55 per pound.

Since Lala Coffee Shop deals explicitly in high-quality Arabica and Robusta beans, the price of its coffee will be slightly higher (five percent) than the Colombian coffee market average. As a result, high-quality beans will be sold at USD 5.20 per pound. Furthermore, the import market substantially determines the price of imported coffee in the U.S., and Lala Coffee Shop targets the roasting industries in the high-end niche. In case some beans do not meet Lala Coffee Shop’s quality standards, they will still be exported into the U.S. but will be priced at USD 2.85 and USD 1.55 per pound for average and lower quality beans, respectively.

This pricing strategy is equal to that of the Colombian coffee market average for beans falling within those criteria. This pricing strategy is deemed as favorable since Lala Coffee Shop is offering high-quality products; hence, roasting industries are readily capable of compromising the price for the quality. Furthermore, since green beans will be priced at an attractive margin relative to that of competitors, and at the same time offering value to targeted industries, the pricing strategy is deemed as favorable.

Place

The warehouse in Colombia will be located in Antioquia, the central coffee belt. Antioquia is renowned for being the region where the bulk production of high-quality coffee lies (Colombian Coffee Growers Federation). In the U.S., the central warehouse will be in San Francisco, which can accommodate approximately 3000 60kg bags of coffee beans. Other warehouses will be located in New York and Illinois, each having a storage capacity of 1500 bags.

These three strategic locations were selected because they contain some of the largest specialty roasting companies in the U.S. Therefore, this will help the company minimize the cost of transportation and distribution. Whole coffee beans are regarded as duty-free, nevertheless, they are subjected to a merchandise processing fee and harbor maintenance fee (Flexport). Otherwise, apart from the quotas imposed by the U.S. Customs Office, no significant obstacles are affecting the import process.

The distribution process is relatively simple. Lala Coffee Shop will source its coffee from small-scale farmers within Antioquia and other farming cooperatives. Contracts will be made with cooperatives six months before harvest, while the farmers will be paid on delivery. The products will then be shipped directly to the warehouses, as they await delivery to the various specialty roasters.

Financial Strategy

Lala Coffee Shop intends to finance its growth by combining cash flow and long-term debt. Purchasing a farm in Caldas, Colombia, will require about forty percent debt financing. The loan will be obtained by seeking angel investors. Furthermore, the process of the company introducing more Robusta will be mainly financed by cash flow.

Pro Forma Financial Statements

Projected Income Statement

Projected Cash Flow

Lala Coffee Shop’s cash balance is expected to increase every year, therefore, this will provide the capital required to facilitate the expansion into other states and distribution channels.

Projected Balance Sheet

The balance sheet below illustrates the growing and ever-increasing net worth for Lala Coffee Shop.

Conclusion

Lala Coffee Shop’s managerial committee is certain that the company attains its aggressive sales forecast, by generating $890,000, $1.1 million, and $1.5 million sequentially in three years from its beginning of operations. Furthermore, the management has keenly taken into consideration its targeted customer base and its capability to increase sales by including the Arabica variety, which almost twice the price of Robusta in the market.

Therefore, Lala Coffee Shop can grow and become highly regarded in the state and national markets. Moreover, with regards to the firm’s aggressive marketing strategy, the establishment of Lala Coffee Shop as a “distinct” entity in the coffee sector, and the firm’s profitable revenue model, Lala Coffee Shop has the prospective of providing rewarding returns to its stakeholders.

Works Cited

CoffeeFest. Exhibitor FAQ. 2019.

Colombian Coffee Growers Federation. Our Coffee. 2019. Web.

Transparent Trade Coffee. 2018 Specialty Coffee Transaction Guide (Revised). 2018. Web.

Flexport. Importing Coffee into the United States. 2019.