Introduction

No business operates with infinite amount of resources. All production eventually faces the issue of scarcity related to employees, equipment, materials, and other related costs. Determining optimal operations capacity in regards to costs is paramount to minimize expenditures associated with production and maximize profits in short and long-term perspectives. Costs of production, also known as overhead costs, include marginal costs, total fixed costs, total variable costs, average fixed costs, average variable costs, average total costs, and total costs (“Costs of Production”).

Average fixed costs remain constant throughout the entire output. Total variable costs are included into the equation to represent the law of diminishing marginal returns. Total costs are calculated using the formula TC=TFC+TVC (Rittenberg 431). Average variable costs are calculated by dividing total variable costs by the output. It follows a U-shape, in order to reflect three stages of the process, namely increasing returns, constant returns, and diminishing returns.

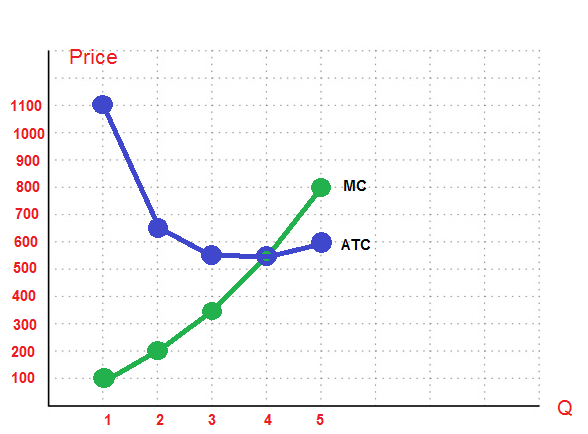

Average total costs (ATC) are also known as unit costs. They reflect on the efficiency of resources used. The lower ATC is – the better. Marginal costs (MC) are costs of producing one extra unit of output. They are used for determining total and average costs (“Production cost”). At the same time, marginal costs are used to calculate lowest possible prices for products.

Illustration

The purpose of this assignment is calculating all major variables necessary for estimating production costs. They are displayed in the graph and tables below. The following calculations are for Marginal Costs, Average Fixed Costs, Average Variable Costs, and Average Total Costs. Marginal Costs (MC) and Average Total Costs (ATC) are represented in Fig. 4. The task was to develop these graphs and determine the output at which ATC is minimized. As it is possible to see on the graph, ATC is at its minimum (550) during the output of 4. It is also the place where ATC and MC intersect.

The table below reflects all the production costs involved in calculations:

Discussion

Fixed costs for this case study were determined at 1000$, which enabled calculation of all other parameters. Marginal costs were calculated using the formula of TCn+1 – TCn. For the rate of output of 1 it was 100, for two – 200, and so on. Average fixed costs were calculated by dividing fixed costs by the output. AFC = FC/Output. Average variable cost is calculated by subtracting fixed costs from total costs and dividing them by the rate of output. TC-FC= VC (variable cost), AVC = VC/Output. Finally, Average total cost is calculated by dividing total cost by rate of output. ATC=TC/Output (Rittenberg 442).

Conclusion

Production costs, also known as overhead costs, play a significant role in determining the profitability of a production process. They take into account many factors, ranging from construction of required facilities to purchasing materials and tools necessary for facilitation of the process. Without calculating production costs, real time planning of operations would become impossible due to scarcity of resources. As illustrated by the correlation of the MC and ATC graphs constructed in the scope of this case study, maximum production output is not necessary the most cost-efficient due to added costs per additional unit and excessive resource consumption.

Works Cited

“Costs of Production.” Economics Online, 2018.

“Production Cost.” Investopedia.

Rittenberg, Libby. Principles of Microeconomics. Flat World Knowledge, 2009.