Over the last 30 years in the US, the real price of a college education has increased by almost 70 percent. Over the same period, an increasing number of high school graduates have sought a college education. While faculty salaries have barely kept pace with inflation, administrative staffing (and expenditures) and capital costs have increased significantly. Besides, government support for universities (particularly research funding) has been cut.

College enrollments increased at the same time that average tuition rose dramatically. Does this contradict the law of downward-sloping demand?

The law of downward sloping demand states that when the price of a good or service is increased while other factors remain the same, buyers are highly likely to purchase fewer products. However, the quantity of demand goes up when the price of a product is lowered especially if other factors remain unchanged. Although college enrolment increased amidst a dramatic rise in tuition fees, it does not imply that the law of downward sloping demand has been contradicted (Samuelson & Marks, 2012). According to this law of demand, we expect that any increase in the price of a commodity should result in lower purchasing tendencies. In the case of college enrollment, it is crucial to understand that quite a large number of students may have been locked out owing to high tuition fees. Since there are so many students seeking college enrollment, the number of admissions was still high. This implies that if tuition fees can be brought down slightly, college enrollment will go up.

Use supply and demand curves (or shifts therein) to explain the dramatic rise in the price of a college education.

Millions of students enrolled

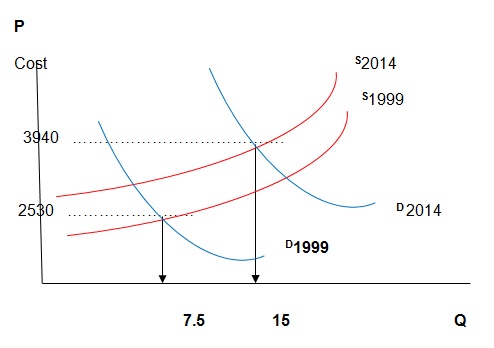

From the above supply and demand curves, it is evident that the college education supply curve shifted upwards. This implies that the number of students being enrolled in colleges is continually increasing. The upward shift in the supply curve is largely attributed to the ever-increasing demand for education notwithstanding the cost. Besides, demographic factors also contribute to the upward shift in supply. For example, the population has been rising over the years. As a result, more students seek admission in colleges even if the cost of education is high. Needless to say, it is expected that costs related to staffing, maintenance, and equipment have been rising over the years. Therefore, tuition fees have to be hiked accordingly (Samuelson & Marks, 2012).

The right shift of the demand curve shows the rising number of students who seek a college education. This explains why there has been a sharp rise in both enrolment and the price of a college education.

In 1989, the Detroit Free Press and Detroit Daily News (the only daily newspapers in the city) obtained permission to merge under a special exemption from the antitrust laws. The merged firm continued to publish the two newspapers but was operated as a single entity.

Before the merger, each of the separate newspapers was losing about $10 million per year. What forecast would you make for the merged firm’s profits?

The merger between the two companies will lower operating expenses owing to large-scale production. The profitability of the merged firms is indeed expected to improve because of an expanded market share of the new firm. Consequently, the merger will reduce market competition that used to exist between the two firms. Hence, budgetary allocation to advertising and other promotional activities will reduce almost by 50%. The latter is foreseeable because all the promotional and marketing operations will be carried out for a single firm (Samuelson & Marks, 2012). Reduced competition is one of the strategies that firms can employ to improve profit margin. Also, lower average costs will be generated by the new firm bearing in mind that both companies rely on fixed costs. Discounts obtained from bulk buying, streamlined operations, and access to financial services are among the factors that will improve the profitability of the new firm.

Before the merger, each newspaper cut advertising rates substantially. What explanation might there be for such a strategy? After the merger, what prediction would you make about advertising rates?

Reducing advertising rates is one of the marketing strategies that most firms use to promote their brands or products. The two newspaper companies already knew that they were going to merge after a short while. Since advertising is the main source of income for newspaper firms, reducing the rate for advertisers is highly likely to boost demand. A price reduction strategy always leads to a high volume of sales. The new firm under the merger may also opt for new product lines. The latter could be the reason for lowering the advertising rates. In terms of profitability, an initial surge in sales is expected (Samuelson & Marks, 2012). However, the new firm cannot continue with low rates due to sustainability issues. Hence, the rates will be gradually raised after the merger to guarantee the profitability of the new company.

Reference

Samuelson, W.F. & Marks, S.G. (2012). Managerial Economics. Boston: John Wiley & Sons, Inc.