Cargill Brief History, Development, Growth, And Effect of Bird Flu

Cargill company was founded by William Wallace Cargill and is the largest organization in the United States that is privately owned. The corporation deals in the supply of agricultural products such as fertilizers, feed, and seeds. Cargill Incorporate remains true to its vision of aiding farmers to thrive in their activities, also connecting consumers with farm products that they are seeking. Furthermore, livestock nutrition is a sector that Cargill operates to nourish the world sustainably and safely. The business has been in operation since 1865, and this has been possible due to the advancement in technology that helps understand how food and agriculture work. These advancements brought breakthroughs within the Company allowing the management to pursue new opportunities to do business responsibly.

Cargill company works side by side with the government, manufacturers, and retailers to help achieve its objective of nourishing the world. In realizing an organization’s goal, it can grow rapidly and remain relevant. Both large-scale and small-scale farmers receive inputs, technology, and expert services that help them increase productivity. In addition, Cargill provides markets to farmers worldwide, which makes the farmers remain loyal to the services Cargill provides. Securing customer loyalty makes Cargill Corporation grow and develop more rapidly as profits are high. Cargill organization owns several other companies, such as Cargill Cotton, Cargill cocoa and Chocolate, Cargill Ocean Transportation, and Diamond crystal salt are top four of the companies owned by Cargill. Over one hundred and sixty thousand people are employed by Cargill in seventy countries worldwide.

The spread of the bird flu virus in Minnesota affected Cargill Incorporate, the biggest turkey and chicken producer. One of the farms was operating under a contract with Cargill, thus impacting heavily on the production (Hughlett, 2015). In addition, over fifteen thousand turkeys were wiped out at a breeding farm in Minnesota, raising concerns about turkey importations in a few dozen countries that banned turkey imports from Minnesota, affecting Cargill’s supply chain.

Cargill Corporation SWOT Analysis

Various forces define the competitive edge of every industry and help determine strengths and weaknesses. Corporate strategies entail understanding the competition the Company faces, which helps establish long-term profit margins in the market. In addition, well-defined Porter forces help sustain businesses at different levels of profitability. Cargill offers various diverse products, ranging from agricultural products animal foods, proteins, and human dietary foods. With recent changes in market trends, Cargill opts to transform some of its companies, for example, by transforming Krefeld corn into a wheat processing plant (“Cargill to diversify its starches,” 2019). Transformation gives Cargill Company an edge to address the high demand for specific foods in the changing market. Furthermore, Cargill provides financial solutions and advises its customers.

Cargill has diversified from starches to vegetables rich in proteins and other specialized starches, putting it at the forefront of ensuring customer satisfaction. Quality service is achieved through an effective system that ensures well-run supply chain management. The climate is a major concern that affects the supply of agricultural-based products such as beverages. Cargill counters unfavorable climate conditions by acquiring companies in favorable climatic regions, for example, the Joe White Maltings Australia and Turkish fat (“The effects of climate change on Cargill supply chain,” 2017). Considering climate factors has proved to help Cargill capitalize on profits and reduce risks by providing wise investment strategies. Cargill is a strong brand that achieves a high market share in several regions it operates in due to the timely delivery. Furthermore, outsourcing delivery services has been achieved through partnerships with external stakeholders (“Sustainability and corporate responsibility,” 2021). The external stakeholders aid the organization in the delivery of products to clients.

Despite the success of Cargill Company, there have been setbacks that derailed the achievement of its objectives. The impact of unfavorable weather conditions such as long dry spells, affects Cargill’s food and beverage industry. In the poultry business, Cargill experienced low profits during the slowdown of the poultry market in Thailand, where several farmers have contracts with the organization. Illegal deforestation plays a significant role in the weakening of Cargill Inc. since it depletes the environment, which the Company strives hard to protect.

Another opportunity that has been set forth for Cargill is discovering agricultural markets in the far East in China and Japan. Cargill points out the significance of collaborating with the far Eastern countries, their regional clients, and suppliers seen as a niche where the Company can improve its customer’s experience through research. Cargill currently operates research centers in Beijing and Shanghai. These research centers aim to develop new flavors and food products to satisfy China’s customers’ needs (“Nourishing growth in China,” 2018). Identifying new markets in the far East will enable Cargill to post high profits and create and expand its market share.

On the flip side, there have been various threats to the growth of the Cargill company. Internal threats such as local market disruption majorly caused by political instability and the civil war threaten Cargill operations. In addition, brand switching is both an internal and external threat. Brand switching is where competitors bring to market a similar product but with a different brand. Different brands producing the same products but at different prices will tempt the buyer to go for the lower-priced product bringing unhealthy competition. As a result, the Company’s profitability is affected, and in the case where the production costs are higher than the selling price, the Company incurs losses.

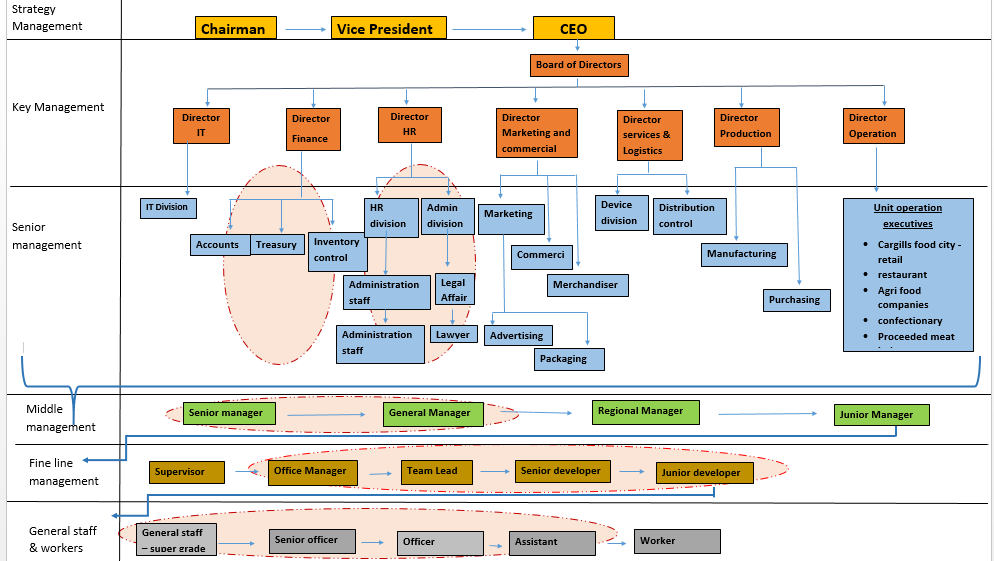

Nature, Structure, And Marketing Strategies of Cargill Company

Cargill Company majors its business operations on purchasing, trading, and distributing grains and other agricultural products. The agricultural commodities include palm oil and food ingredients for industrial use and application in processed foods. In addition, the organization operates in trading energy, marketing of steel and transportation of livestock feed, and production of feed. In addition, Cargill has a large arm that deals in financial service management for the Company in case of any financial risks in the product markets.

Cargill’s target audience is farmers that help strengthen food security around the globe and better nutrition. The acquisition of a food company in Poland and merging with several companies increase Cargill’s production capacity and expanded livestock and poultry products.

Competition in the business environment is unavoidable, and all businesses face it intending to come on top of the other organizations in the same field. At the center of Cargill’s principles is the reliance on the significance of having market sovereignty and leadership in all sectors where the Company is involved. Cargill’s management establishes policies with commitments to consumer triumph via innovation and collaboration and shares their global consciousness and experience to worldwide meet socioeconomic and environmental challenges. In implementing these policies, Cargill stays on top of the food chain, giving the organization a competitive advantage as its competitors take some of these assumptions for granted.

According to a global survey released by Cargill, the protein chicken demand is growing remarkably (Vorwerk, 2019). Furthermore, the survey showed that consumption of animal protein is expected to increase in the future; therefore, the Company will increase the supply to nourish the customers. In addition, Cargill Company incurs costs in connection to the acquirement of equipment and materials, distribution of infrastructure, the payment of salaries, and welfare to its staff (“Cargill Inc,” 2021). Also, the running of its production facilities, management of its partnerships, and the operation of the Company’s international crisscross of agencies and offices, which include payment of utility and rental fees, form part of Cargill’s cost structure.

The External Environment of Cargill Company

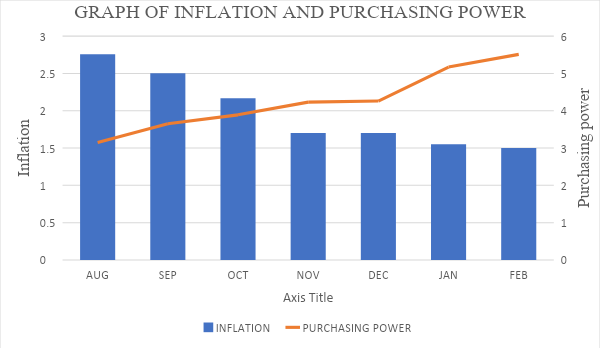

Analyzing the external environment helps understand how a company responds to macroeconomic factors. Macroeconomic factors are those external to the control of the Company. Cargill Company cannot influence the external factors in its favor despite these factors directly impacting the Company’s operations. In this context, the various but a few external factors affecting Cargill Company include inflation, recession, exchange rates, and government policy. These are factors beyond the Company’s control; however, implementation of specific measures can cushion such threats.

The rise in inflation reduces the purchasing power of buyers, considering that their income remains the same. With the rise in inflation, the cost of production rises, which means that products have to be marked up higher to cover the cost (Hudson, 2017). The cost of production rises due to rising prices of raw materials and inputs pumped in by the Cargill Company. A rise in prices will mean that consumers won’t purchase the products, and in the long run, Cargill company will be forced to lower its prices, resulting in a loss.

GDP is the major economic component used to gauge the overall appeal of profitability of Cargill Company, referring to an economic decline or when the trade activities are highly reduced, resulting from a decrease in GDP per capita. The higher the GDP, the higher the purchasing power, thus an advantage to Cargill Company in higher sales.

Cargill Company is a multinational company that is highly affected by the exchange rates of various currencies. Where there are higher exchange rates, it means that interest rates will also be high. Interest rate fluctuations translate to lower or higher purchases of products. High-interest rates lead to increased prices, thus affecting the number of products purchased, affecting Cargill Company’s rate that imparts its profits. Government policies impart Cargill Company directly and indirectly. Taxation directly affects the Company’s profits resulting rise in prices to cover up production costs. Cargill Company also thrives where the government sets up rules and regulations that favor the Company. For example, monetary support from the government benefits Cargill Company in various operations (Hudson, 2017). In addition, the legal framework influences Cargill directly, where the government requires it to consider factors such as health and safety, labor law, and discrimination affecting the cost of production.

COVID-19 Impact on Cargill Company

COVID-19 is affecting the globe in unprecedented ways affecting individuals, communities, and businesses. Cargill Company has greatly suffered from the ravaging effects of the pandemic that has reduced production in some of its owned processing plants. In Canada, a beef processing plant owned by Cargill is badly hit by the virus and confirmed five hundred and fifty-eight COVID-19 cases among its workers. The Cargill management is blamed for the spike in the cases as they knowingly risked workers’ health by allowing them to continue working even after the employee’s union had predicted the virus outbreak in the plant (“Cargill knowingly risked the health of its workers,” 2020). In addition, the supply chains are disrupted, thereby affecting markets across the globe. Cargill organization faces a crisis in its supply chain, particularly around customer demand and distribution channels. Cocoa consumption had a significant decline due to the restriction in the movement where the consumers were not going to restaurants.

Ranchers and farmers are hit heavily by the outbreak of COVID-19. They cannot continue taking care of their livestock and crops due to the unavailability of farm fertilizers and livestock nutrition due to lockdowns in several states (“Farming, animal production, and COVID-19”, 2021). Therefore, the Cargill company will not meet its mission of ensuring that animal producers have the necessary feed to nourish the animals. For the Company, not meeting its mission and goal is a bad sight as it threatens its future. Market trends have shifted drastically as customers now opt to purchase products that enhance their health and wellness. Products of low health benefits, such as chocolate and cocoa, witness a drop in sales as consumers take a more proactive, holistic, and personal approach to health (Lindell, 2020). The Cargill Cocoa industry is experiencing a low market which is feared to remain a long-term effect.

Major Problems in Cargill Company and Remedy

Cargill Company has faced severe challenges ranging from pandemics to natural disasters such as drought and flooding. Major pandemics have included COVID-19 and the bird flu, which affected Company’s production. Some employees succumbed to the coronavirus resulting in the closure of several plants. Decreasing the number of employees in the processing plants to observe social distancing resulted in low production. The bird flu affected poultry farming, where production was reduced greatly, making it hard to meet the growing population’s demand. Food security in this sector is a major challenge. In addition, natural disasters such as drought affect the rate of production. Cargill company incurs losses in such instances and thus is forced to come up with measures to mitigate such effects. In most instances, industries are only interested in data but do not know how to use decision-making.

Cargill Company has adopted various strategies that cushion employees against the effect of COVID-19. Launching of the relief fund aimed at meeting the immediate needs of employees during the pandemic. Cargill’s employees are now able to cater to their loved ones during such catastrophic disasters. Alongside the relief fund, the Cargill company has been at the forefront of ensuring proper safety measures against COVID-19 (“Cargill response to COVID-19,” 2020). Keeping its employees safe acted as a measure to ensure efficient supply. The strategies need to be considered in times of crisis and during all periods of economic cycles.

In conclusion, the Cargill company executive department should set up policies to counter future external shocks. Such policies might include further diversification of its product portfolio, exploring markets that have not been reached, being at the forefront of digitalization to promote healthy diets, and leveraging technology. In addition, these policies will ensure consumer satisfaction, thus increase in its market share.

References

Cargill Inc. (2021). Cleverism.

Cargill knowingly risked the health of its workers during the COVID-19 pandemic to maximize profits. (2020). Food first. Web.

Cargill leverages technology to improve transparency in pursuit of the thriving cocoa sector. (2020). Cargill.

Cargill Response to COVID-19 Global Pandemic. (2020). Cargill.

Cargill to diversify its starches and sweeteners portfolio produced in Krefeld on address changing market needs. (2019). Cargill.

Cargill war against climate change. (2017). Cargill.

Farming, animal production, and COVID-19. (2021). Cargill.

Hudson, A. (2017). Cargill A case solution. Essay 48.

Hughlett, M. (2015). Cargill is affected by the spread of bird flu. Star Tribune.

Lindell, C. (2020). COVID-19’s impact on functional ingredient trends and other insights from Cargill. Candy Industry.

Nourishing growth in China. (2018). Cargill.

People and organization. (2018). My assignment. Web.

Sustainability and corporate responsibility (2021). Cargill.

The effects of climate change on Cargill’s supply chain. (2017). Digital HBS.

The start of a new supercycle in agriculture. (2020). Cargill.

Vorwerk, D., B. (2019). The power of food: Supply, demand, and what we choose to do about it. Cargill. .