Introduction

Managing Employees Performance involved numerous activities, far more than simply reviewing what an employee has done. This system must fulfil several purposes. Developing and conducting performance appraisals should not be done in isolation. The performance appraisal is closely related to a number of human resource management that should be considered. The performance appraisals should be based on a thorough job analysis. The results of job analysis can be used to produce a job description that describes the work to be performed, and job specifications, which outline the requirements necessary to accomplish the job. For a better understanding of Managing Employee Performance this paper would go for HSBC, the UK as a case study and then go for theoretical analysis

Managing Employees Performance at HSBC

HSBC Private Bank (UK) Limited is part of a worldwide group of businesses within the HSBC Group known as HSBC Private Bank which is ultimately owned by HSBC Holdings plc. HSBC believes the best reward for employees in today’s market should offer a challenging and thrilling global career. HSBC Private Bank presents the prospect to work with and learn from the extremely best inhabitants in the industry within a dynamic, client-based culture. They spend a lot to generate working environments and sustain systems that make life more and easier for individuals who put a lot into work. It’s a practical commitment to looking after the inhabitants who look after HSBC’s business.

With a wide-ranging training and expansion, HSBC offers a variety of very lucrative benefits packages including an aggressive package with speedy rewards for the correct people Performance-based additional benefit scheme as –

- Pension.

- 25 days’ holiday.

- Private Healthcare.

- Life assurance.

- Life insurance.

- Preferential rates on a range of HSBC products.

- Season ticket loan.

- Sports and social scheme.

- Employee Assistance programme.

- Corporate discounts.

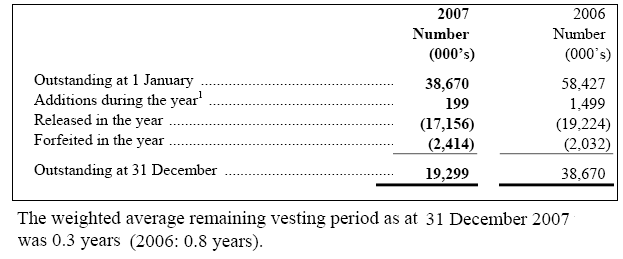

HSBC introduced restricted share awards granted to eligible employees from 2000 depending on employees’ performance in the previous year potential and demonstrated as –

The above performance benefit of employees’ appraisal should encourage the organisation to employ and managing diverse individuals gives them a more balanced organisation and makes HSBC more adaptable to new situations.

The Performance Appraisal System

Anthony, W. P. Prrewe, P. L., and Kacmar, K. M. (2002) stated that the employees should be evaluated on a number of specific dimensions of job performance rather than on a single global or overall measure. Global measures are more prone to distortion on the part of the evaluator. In UK Employee’s Rights Act 1993 ensured the performance appraisal and the fact that no specific job dimensions of performance were assessed. Raters were asked to make evaluations of employees by comparing them to one another bases on a single, global rating. The court found significant racial differences on the criterion (the overall rating), with no “objective” information to back it.

Assessing Performance

Rory, B., (2003) argued that the actual performance assessment is the determination of the employee’s strengths and weaknesses. One purpose of the performance appraisal is to improve employee performance, thus performance weaknesses must be assessed. However, it is also important to reinforce behaviour that is deemed to be strong.

If multiple raters are used, assessing performances also includes compiling all ratings into summary form. If the raters agree as to the employee’s performance, high inter-rater reliability exists and summarizing the ratings is not problematic However, if there is a substantial amount of disagreement as to the employee’s performance, inter-rater is reliably low. The supervisor must use this information as more of a heuristic device or guide for the final evaluation.

Performance Review

Rory, B., (2003) also added that the performance review is the actual discussion that transpires between the rater and the ratee regarding the rate’s performances. Research suggests that the performance review should be approximately 60 minutes long and be a mutual discussion. Newstrom, J. W., Davis, K. (2002) argued that employee responses to an employment survey indicated that most performance review is relatively short. In fact, most employees reported that their last performance reviews are relatively short. UN fact, most employees reported that the last performance review session lasted less than 15 minutes.

Performance reviews should be considered an exchange of information not simply a one-way communication from the rater to the subject. Success in this area is usually tied to the supervisor’s ability to get the employee to express thoughts and ideas. However, many supervisors find it easier to talk than to listen. The result of not listening does not understand the employee’s point of view. If the goal of the supervisor is to encourage better performance, this can best be achieved from an open exchange of thoughts, which ultimately can be the key to motivating the employee to perform better. One approach to an exchange of information is to ask the employee to give a general assessment of his or her overall performance.

Future Plan of Action

By this point in the review, the employee should have an accurate his or her performance evaluation. The employee should know where he or she stands. Recapping key points and asking the employee to summarise the major issues discussed is usually a good way for the supervisor to assure joint understanding before ending the performance review.

Next, the supervisor and the employee should focus on the future. Job performance objectives should be discussed in order to establish a future plan of action. This is often an appropriate time to explore, the employee’s career interest and developmental needs. The employee should be aware of the plans listed and the supervisor’s interests and expectations in this area. In addition, the employee should be able to have some input into these plans.

Finally, the supervisor reviews the job performance and development plans and then set objectives for the next rating period. This will provide the employee with direction and guidance as to what is expected. The employee needs to understand areas where improvement is needed and how to strengthen job performance. In closing the discussion, the supervisor may wish to reassure the employee that the supervisor is interested in the employee’s success and should indicate a willingness to talk further at a later date.

Given the importance of the performance evaluation, it is surprising that most supervisors do not receive any training in this area. It has been estimated that over 90 per cent of raters receive no training at all in how to conduct a performance appraisal. As the opening Westinghouse case illustrates, comprehensive training programs can help ensure the success of a new performance appraisal system. Performance appraisal training can also help the success of an existing performance appraisal system by fine-tuning the evaluator’s skills.

Types of Performance Appraisal Methods

Luis R. Gomez-Mejia, David B. Balkin, Robert L. Cardy, (2006) stated that a number of different Performance Appraisal Methods or formats are available from which to choose. Some methods focus more on employee behaviour, while others are more result-oriented and emphasize the results of employee behaviour (such as the extent to which an employee reaches goals and objectives). Within the behavioural method, the employees can be evaluated bases on an organisational or departmental standard or they can be evaluated relative to others.

Advantages of individual-Based for Performance plan

Anthony, W. P. Prrewe, P. L., and Kacmar, K. M. (2002) addressed that there are four major advantages to individual-Based plans:

- Performance that is rewarded is likely to be repeated. A widely accepted theory of motivation, known as expectancy theory, is often used to explain why higher pay leads to higher performance. People tend to do those things that are rewarded. Money is important when a strong performance- pay linkage exists. In other words, because employees value money as a reward, they will work harder to achieve to exceed a performance level if they believe that they will receive money for doing so.

- Individuals are goal-oriented and financial incentives can shape an individual’s goals over time. Every organisation is interested not only in the level at which employees perform but also in the focus of their efforts. A pay incentive plan can help make employees behaviour consistent with the organisation’s goals. For example, if an automobile dealer has a sales employee who sells a lot of cars, but whose customers rarely to the dealership, the dealer might implement a pay incentive plan that gives a higher sales commission for cars sold to repeat buyers. This plan would encourage the sales staff to please the customer rather than just sell the car.

- Assessing the Performance of each employee individually helps the firm achieve individual equity. An organisation must provide rewards in proportion to individual efforts. Individual-based plans do exactly this. If an individual is rewarded, high performances may leave the firm or reduce their performance level to make it inconsistent with the payment they are receiving.

- Individual-based plans fit in with an individualistic culture. National cultures vary in the emphasis they place on individual achievement versus group achievement. The United States is at the top of the list in valuing individualism and US workers expect to be rewarded for their personal accomplishments and contributions. This cultural orientation is likely to enhance the motivational value of pay for performance system designed for US employees.

In contrast, the Japanese do not tend to reward individual performance. It’s against their ethic, says a consultant with Tasa, Inc., which has concluded executive searches for the US offices of many Japanese concerns. That ethic has its costs outside Japan. Japanese banks in New York, for instance, often have trouble recruiting and keeping first-rate US managers. Who are used to reaping rewards for their accomplishments? Economic pressures seem to be moving the Japanese toward a more American model. In a land that once guaranteed employment for life, no job is secure being slowly replaced by individual-Based pay for performance plans. In a 2002 survey, 70% of Japanese leaders said that they plan to cut wages and that only top performers may be able to keep their prior earnings.

Disadvantages of individual-Based Pay-for-Performance plans

Anthony, W. P. Prrewe, P. L., and Kacmar, K. M. (2002) also pointed out that many of the pitfalls of Pay-for-Performance programs are most evident at the individual level. Two particular dangers are that individual plans may

- create competition and destroy cooperation among peers and

- sour working relationships between subordinates and supervisors.

And because many managers believe that below-average raises are demoralizing to employees and discourage better performance, they tend to equalize the percentage increases among employees, regardless of individual performance. This, of course, defeats the very purpose of an incentive plan.

Disadvantages of individual-Based plans include the following

- Tying pay goals may promote single-mindedness: Linking financial incentives to the achievement of goals may lead to narrow focus and the avoidance of important tasks, either because goals are difficult to set for these tasks or because their accomplishment is difficult to measure at the individual level. For example, if a grocery store sets a goal of happy satisfied customers, it would be extremely difficult to link the achievement of this goal to individual employees. Individual-based plans have a tendency to focus on goals that are easy to measure even if these goals are not very important to the organisation. They also tend to encourage people to “play it safe” by choosing to accomplish more modest goals instead of riskier goals that are harder to achieve.

- Many employees do not believe that pay performance is linked. Although practically all organisations claim to reward individual performance, it is difficult for employees to determine to what extent their companies really do so. As we saw, many managers use the performance appraisal process for reasons other than accurately measuring performance. So it should come as no surprise that many surveys over the past three decades have found that up to 80% of employees do not see a connection between personal contributions and any raises. The beliefs underlying this perception, many of which have proved to be very resistant to change.

- Individual-pay plans may work against achieving quality goals. Individuals rewarded for meeting production goals often sacrifice attention to product quality. Individual-Based plans also work against quality programs that emphasize teamwork because individual programs generally do not reward employees for helping other workers or coordinating work activities with other departments.

Conclusion

When beginning the performance review discussion, the employee should be told something about the review, such as its purpose and the goal. If the employee has done an outstanding job, it is a good practice to acknowledge this in the beginning. This will help set a positive tone for the meeting. When performance is less than satisfactory, it is often best to avoid a definite statement of the overall negative rating at the beginning. Instead, the rating will become self-evident as the accomplishments are reviewed with the employee. The overall rating can then be summarized at the end of the review.

The format for the performance review is likely to undergo some significant changes in the future. As organisations move toward a more involved employee orientation the supervisor-subordinate formal appraisal is no longer effective. Instead, a performance review discussion based upon the employee’s evaluation of his or her own work for a specified period of time may be more useful. When this format is followed, the manager becomes a counsellor instead of a judge. These types of review sessions appear to be more useful and enjoyable for both the rater and the employee.

Bibliography

Anthony, W. P. Prrewe, P. L., and Kacmar, K. M. (2002), Strategic Human Resource Management, 4th ed., The Dryden Press, London. Web.

HSBC (2008), Rewards and benefits, HSBC Private Bank. Web.

HSBC (2008), Diversity, HSBC Private Bank. Web.

Luis R. Gomez-Mejia, David B. Balkin, Robert L. Cardy, (2006), Managing Human Resources, 4th edition, Prentice Hall: Londom, pp-362-390. Web.

Newstrom, J. W., Davis, K. (2002), Organisational Behavior, 11th Edition, Tata-McGraw Hill Publishing Company Limited, New Delhi, pp. 163-175. Web.

Robbins, S. P., Judge, T. A. (2007), Organisational Behavior, 12th Edition, Prentice-Hall of India Private Limited, New Delhi, pp. 178-181, 289-296. Web.

Rory, B., (2003), Project Management: Planning and Control Techniques, 4th edition, pp. 251-279. Web.