Product, Its Price, and the Type of Market

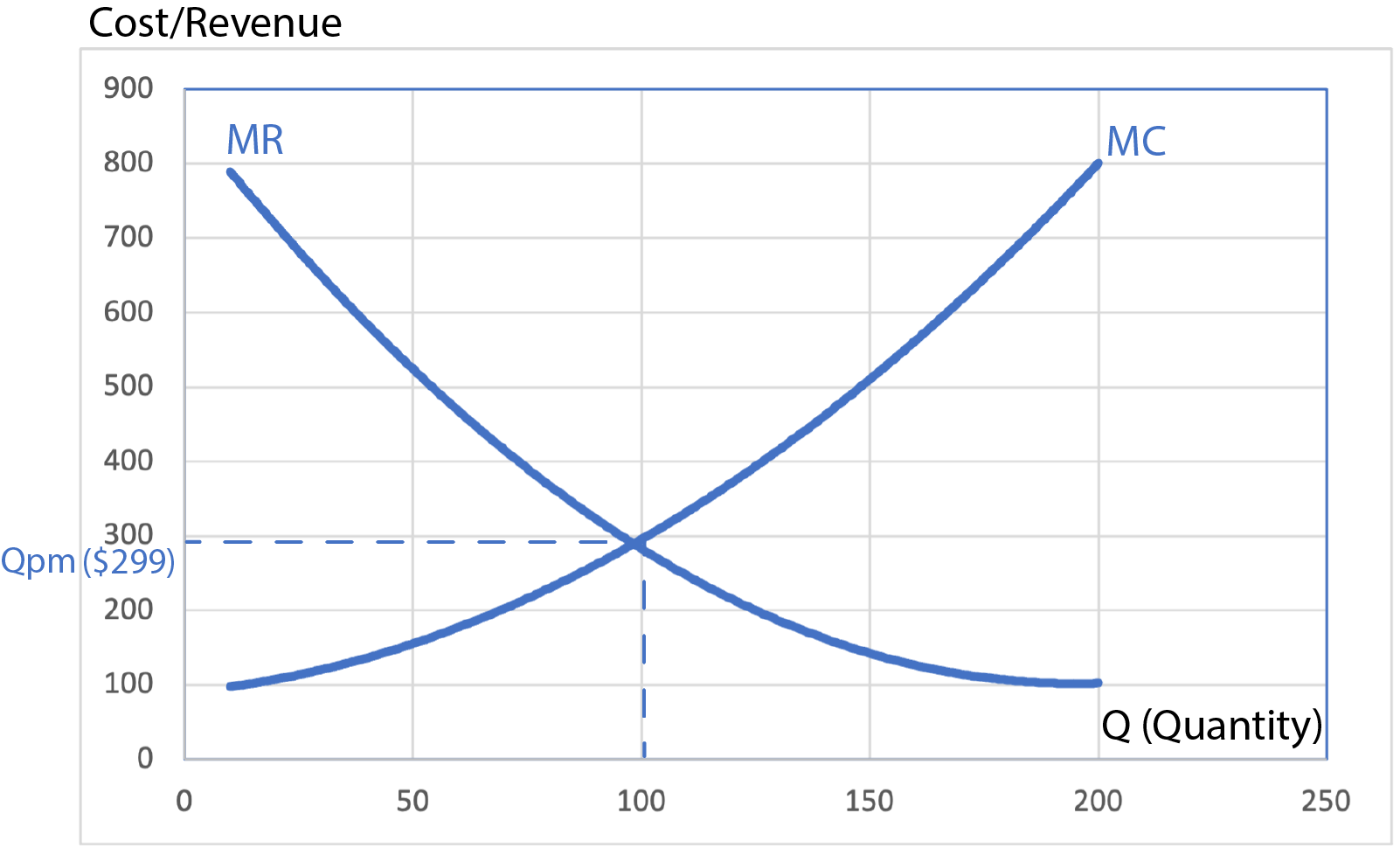

My product is a virtual reality headset called “Immersive Vision i24”. Its price is $299, which is a low price for these products in the market. The type of market is monopolistic competition since many companies, not only industry pioneers, present similar products in different price categories and for different segments of the target audience. My option is budget-friendly and offers extensive diving capabilities at an affordable price. The figure below shows a marginal analysis graph.

Marginal Analysis

The marginal cost curve has the same basic shape across products because it represents the cost of producing one additional unit. Regardless of the product, there are limits to how efficiently resources can be utilized, resulting in increasing costs as more units are produced. In my case, the price is equal to the profit maximization point since, at a low cost, the product costs approach their limits, and since this market provides particular products that are not essential, a small number of units sold is enough to maximize income without risk. Technologies have a relatively high marginal premium when sold to the end consumer. Therefore, my product, aimed at a broader target audience due to its availability, can achieve popularity in the market due to price dumping.

The Total Revenue at Qpm of 100 Units

However, producing an additional unit already carries risks since costs will become equal to the price, and the business will not make a profit or be left with unsold inventories. Accordingly, if the profit-maximizing quantity is also 100 units, as indicated in Figure 1, then the total income is calculated by multiplying the number of products by the price of the virtual reality headset alone. Therefore, calculations can be made using the following formula, in which it turns out that the income will be $29,900:

100 units * $299 = $29,900