Arguments for Government Intervention vs. Market-Based Solutions

Since its inception in 1965, Medicare has been the cornerstone of health insurance coverage for older people in the US. Whatever their wealth or health, everybody over 65 is eligible for coverage. Those insured by the program have found it very simple to comprehend the benefits offered and locate a doctor who would treat them. The program strongly emphasizes fulfilling healthcare claims rather than refusing them, as commercial insurance sometimes does. Medicare also allows seniors to sign up for private insurers’ health plans.

When Medicare was created, many senior citizens in the United States had no private health coverage, and many faced financial ruin when they became sick. As the initiative’s backers said, Medicare has provided a crucial safety net. Even those who prefer government involvement to private sector competitiveness had to get involved. Because of the factors mentioned above, a market failure existed that Medicare was created to remedy. However, the opposing argument, which has been reasonable to an extent, is that the initiative’s outcome was a governmental monopoly.

Impact Analysis: Beneficiaries and Those Hurt by Government Intervention

The government leverages Medicare’s market strength to lower rates and reduce expenditures since it may buy medical care for much less money than private insurance can. Due to Medicare’s significant market share, hospitals and physicians often serve Medicare patients even if they may turn away a patient from a commercial insurer receiving the same amount. Hence, it seems reasonable to state that the elderly population of the US was the primary beneficiary of Medicare. Private insurance companies, in turn, were the ones who were hurt as a result of the intervention.

Externalities and Unintended Consequences of Government Intervention

At this point, it should be stressed that Medicare has had several externalities. In a recent study, the scholarly dimension finds several manifestations of such outcomes. “Medicare [is] … associated with several unintended consequences including decreased access to necessary post-acute nursing care, increased out-of-pocket costs, …, increased concerns related to the cost of care, and inadequate patient understanding of observation policies” (Goldstein, 2019, p. 26). Thus, although the intervention has some crucial benefits for the population, the mentioned outcomes are likely to negatively affect the healthcare system routine and citizens’ awareness regarding their insurance status.

Trends in Intervention Costs: Analyzing GDP Share and Participant Numbers

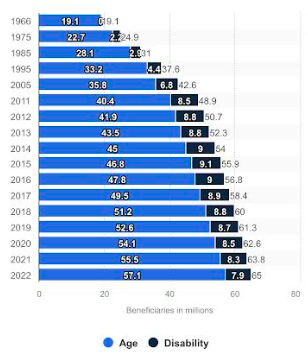

Graph 1 displays the Medicare program’s enrollment numbers from 1966 through 2022 according to the beneficiary type. In particular, almost 40 million individuals received Medicare benefits in 2011 because of their age, while an additional 8.5 million individuals received benefits because of a disability. Although the number of Medicare beneficiaries who are eligible owing to age has increased to 57.1 million by 2022, the number of eligible enrollees due to disability has stayed relatively stable and was likewise 7.9 million in that year.

Since the intervention was implemented in 1966, the number of people enrolled has increased significantly. Such a trend is evident from the constantly growing number of individuals included by age, which is the main aim of Medicare. The explored statistics allow the assumption that the program works, considering that the increased tendency confirms citizens’ readiness to enroll.

Economic Perspectives: Evaluating the Success or Failure of Government Intervention

It seems rational to explore economists’ opinions on Medicare in light of its latest ‘for-all’ initiatives. Proponents claim that the best method to ensure universal coverage, particularly for those who are financially disadvantaged, is to enroll everyone in the same plan. Then, the government might manage the cost of medicines and medical services via legislation and bargaining (Frakt, 2020).

Moreover, people might change jobs without abandoning their current insurance or plan. However, the opposite is that the government might not use its negotiating position to cut prices as rapidly as proponents claim (Frakt, 2020). The cost of health care would decrease, raising demand for services and clogging up the healthcare system. Doctors who are not compensated adequately can be less motivated to provide suitable treatment.

Some people may be surprised that economists, who often favor market-based strategies instead of government programs, favor the way Medicare is now set up. Although economists appreciate free markets, they also think market distortions are detrimental. Many economists believe that direct government service provision benefits society in certain situations, like medical insurance for older people.

Recommendations for the Future: Continuation, Discontinuation, or Modification of the Program

Thus, considering the provided arguments and facts, it might be assumed that the best scenario for Medicare would be to stick to the current course – maybe with some adjustments. The exploration of the theme revealed that statistically, the population is satisfied with the program; there are only some aspects within the scope of funding to be addressed. A solution here may be to raise the age of Medicare eligibility, which would correlate with the tendency of the increasing life expectancy of the US population. Medicare seems to cover the needs of society for today, and it is not necessary to implement any drastic changes within the scope given.

References

Frakt, A. (2020). The health system we’d have if economists ran things. The New York Times. Web.

Goldstein J. N. (2019). The unintended consequences of Medicare observation status. Delaware Journal of Public Health, 5(5), 26–28. Web.

Statista. (2023). Enrollment in the Medicare program from 1966 to 2022, by type of beneficiary. Web.