Introduction: Foreign Exchange Calculations

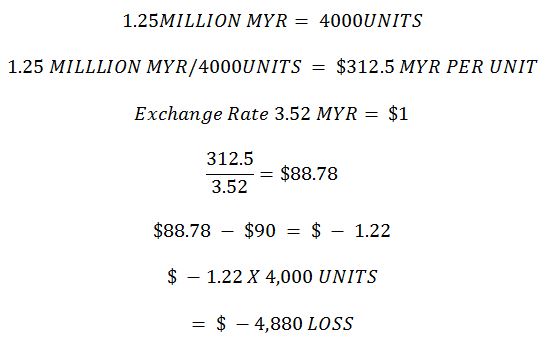

No matter what the underlying spot prices are on April 1st, the corporation has agreed to sell its 4,000 units on January 1st for $1.25 million. This is dangerously near the point where the business stops losing money. The mathematics computation is shown below;

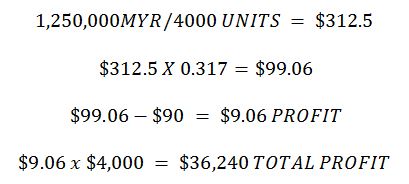

The corporation locks in a foreign exchange rate for its projected 1.25 million MYR in sales on January 1st using the forward rate on that day. This means that on April 1st, the company was obligated to convert 1.25 million MYR at the forward rate set on January 1st. This is the optimal case for the company since it results in a higher profit of $36,240, or $9.06 per unit. Here are the results of these calculations:

Spend or Save

When deciding whether or not to use foreign currency to purchase raw commodities, the corporation should prioritize the bottom line. The spread between the forward rate and the spot rate is the primary metric by which foreign exchange profits are calculated (Dunung, 2020). Based on the facts, the corporation may profitably lock its 4,000 units and sell them on April 1st at a forward rate contract rate of $0.317/MYR. In order to protect itself from fluctuations in the value of its currency on the foreign exchange market, the corporation may choose to consider locking its cash for four months.

Conclusion

Financial exchange risks in the market are illustrated above, highlighting the importance of which businesses should think. Financial exchange risk may be mitigated by using forward rate contracts, which are made possible through hedging (Leonidou & Hultman, 2018). In this case, the corporation would not have earned the $36,240 profit if it had utilized the spot rate on April 1st. Considering foreign exchange risk is important in ensuring a company’s financial success. With the fluctuation of currency rates and values, it is essential for a company to be aware of the potential gains and losses and to create strategies to manage risks.

References

Dunung, S. (2020). Global Business Management. Boston, MA: FlatWorld

Leonidou, C. N., & Hultman, M. (2018). Global marketing in business-to-business contexts: Challenges, developments, and opportunities. Industrial Marketing Management. Web.

Merkert, R., & Swidan, H. (2019). Flying with (out) a safety net: Financial hedging in the airline industry. Transportation Research Part E: Logistics and Transportation Review, 127, 206-219.