Introduction

Monopolistic competition refers to a market structure where products are differentiated and a large number of producers compete with each other to satisfy the unlimited customer base. In this marketing structure, producers have a certain level of price control, trade barriers are few and the customer perception on price is that there is no price difference for substitute products.

There are six major characteristics of a monopolistic competition market structure. The first characteristic is that products are differentiated. This implies that the ability to distinguish a product from others is high. Likewise, competition among the firms is not based on price. The differences in the product may be based on functional features, quality, promotional activities like advertising, or product availability in terms of time and place.

The second characteristic is that the numbers of firms providing a collection of a similar product are many. Since the firms in this market structure are relatively small in size, this eliminates the possibility of market dominance. Each firm in the industry has the freedom to set its pricing and take any other action without making a significant impact on the market. The third characteristic is that firms have a significant level of market power. Market power arises from the limited competition and the lack of strategic decision-making by the few competitors. Perfect access to information is the fourth characteristic of monopolistic competition. This concept describes the ability of consumers to access information on prices, goods, product features, and the general market situation including the profit the firms are making. The fifth characteristic of monopolistic competition is based on industry freedom. In the long run, firms are free to enter and exit the market. The implication of freedom to enter and exit the market is that start-up capital is low and there are no exit costs. The sixth aspect of a monopolistic market structure is that decision-making processes by individual firms in the industry are independent. This means that each firm in the market is free to make key decisions on its market price, demand, or supply without much interference from other firms (Mas-Colell et al, 1995).

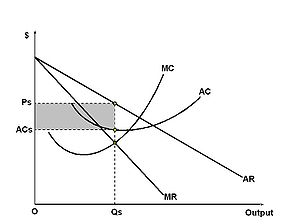

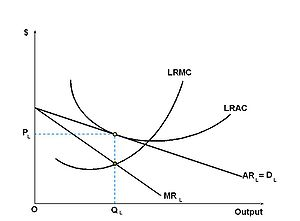

Monopolistic competition equilibrium curves

The diagrams below clearly reflect marginal costs and marginal revenue curves of firms under monopolistic competition in the short and long-run equilibrium.

Monopolistic competition equilibrium in the short run

In the short run, firms make profits with demand and average costs increasing in the long run. The firms can change pricing or the rate of production to meet market demand. In the short run, a firm can use the power of heterogeneous

Products to make high profits.

Monopolistic competition equilibrium in the long run

In the long run, freedom of firms to enter the industry results in a general reduction of sales by various firms. To maximize profits, firms keep long-run marginal costs equal to long-run marginal revenue. In addition, it is not certain that there will be an optimum number of firms in the industry and therefore at any particular moment there may be either too many products or fewer products.

In a monopolistic market structure, firms are marginally inefficient. This means that Marginal costs are less than the market price at optimum output. Some economists argue that customers are persuaded to spend on products by sales promotion activities that focus on product names rather than the value they offer. But the purpose of marketing and promotional activities is to provide consumers with information that they utilize to evaluate all the substitute products offered in the market.

Monopolistic competition models are also used in international trade. In this case, they are categorized under imperfect competition. The models are very useful in explaining trade activities between countries in a particular industry. They are also vital in determining the extent to which the national welfare of a country could be improved through international trade. This arises from the economies of scale realized when firms within the industry produce a large number of products (Gartner, 2006).

The major advantage of monopolistic competition is that firms have an opportunity to plan for the long term without the risk of industry changes. The fact that there are no entry or exit fees makes it simple for firms to experiment with their new products in the market. Another benefit of this kind of competition is that due to product differentiation and availability of perfect information, consumers have the opportunity to choose their favorite product among the available substitutes.

The disadvantage of the monopolistic market structure is inefficiency arising from the fact that the market is often not at the optimum level. Sometimes differentiation of products in monopolistic competition is not based on real value and therefore the customer loses (Colander, 2008).

Conclusion

From the above analysis, is it is clear that a firm operating in a monopolistic market structure can have market dominance over other similar firms. It is also apparent that the ease of entry and exit of the firms in the market ensures that the number of firms in the industry is sometimes not optimal. Similarly; perfect market information is valuable in that consumers are able to make buying decisions based on the strong awareness of the products existing in the market.

References

Colander, D. 2008. Microeconomics.McGraw-Hill: London

Gartner, M. 2006. Macroeconomics. Pearson Education Limited: London.

Mas-Colell, A. Whinstone, D. & Jerry, R. 1995. Microeconomic Theory. Oxford University Press: Oxford.