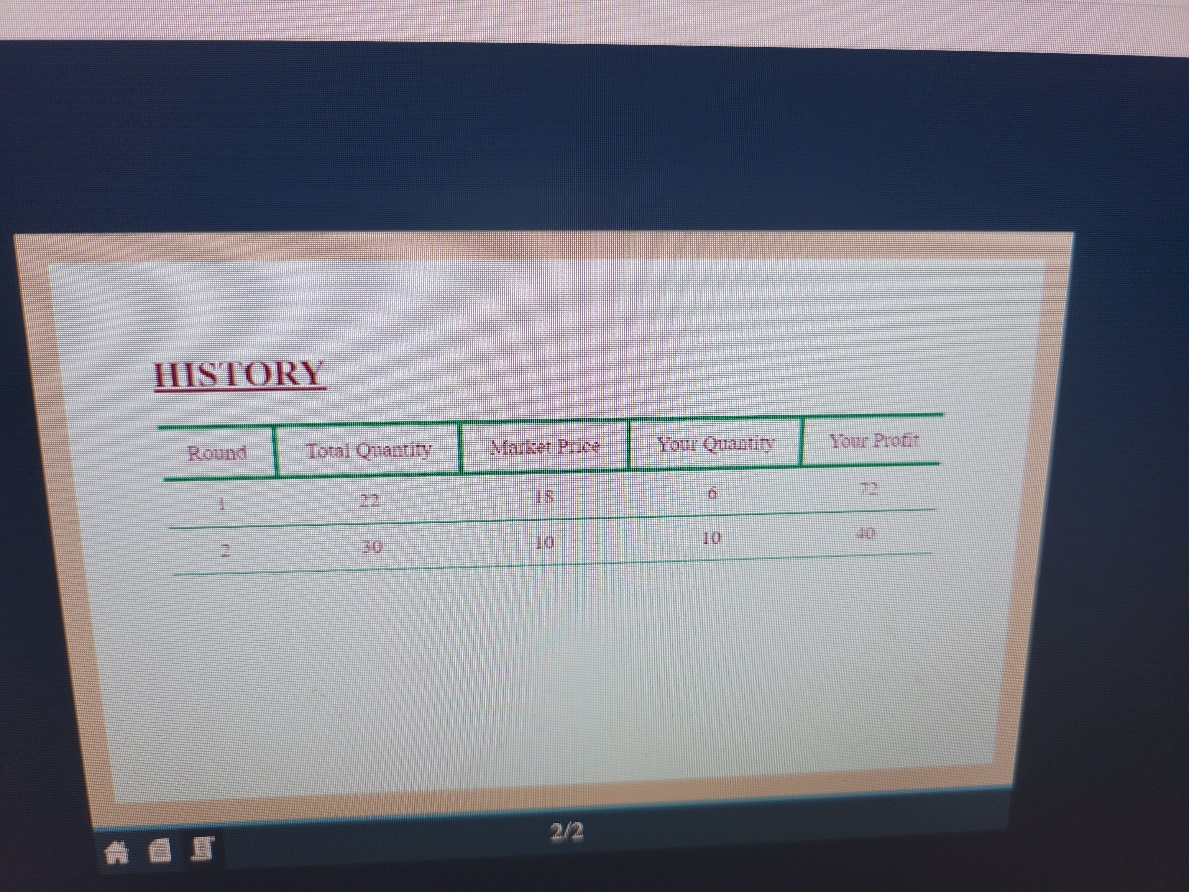

After running the simulation, we have noticed that our profit in the first run is higher than in the second run, despite the lower possessed quantity of the product. Our market price was higher in the first scenario, making us more stable and confident in participating in the market competition.

The main feature of an oligopolistic market is the dominance of few large firms over the global market. The firms are interdependent, where the actions of one firm have an impact on other firms. Since the firms have the power to influence the prices, they tend to avoid doing that to preserve price stability. Instead, they compete with each other in terms of technological advancement, better services, and advertisement. Oligopoly is a highly controlling market structure that restricts other firms from entering the industry.

The products produced under oligopoly are either homogeneous such as steel or plastic, or differentiated (finished products), such as refrigerators or automobiles. Mankiw, Kneebone, and McKenzie (2020) describe how oligopolies set their prices based on what type of product they produce. If a firm makes homogeneous products, the changes in its prices and output will affect other firms; therefore, it will enforce collusion. If a firm produces differentiated products, it will not provoke adverse reactions from other firms if it changes its price policy. However, there is always a chance for monopolistic competition to arise.

The difference between oligopolistic and monopolistic firms is in the sizes of their influence areas. Most new outlets in the United States are oligopolistic structures such as USA Today, The New York Times, The Wall Street Journal, Daily Mail, and Los Angeles Times. An example of a monopolistic company is Microsoft that dominates the software industry, owning more than half of the market shares.

Reference

Mankiw, N. G., Kneebone, R. D., McKenzie, K. J., & Rowe, N. (2020). Principles of macroeconomics. Cengage Learning.