Introduction

Globalisation is one of the forces in the external market environment that a firm cannot control. The emerging technologies in the field of communication and transport have made it possible for companies to explore foreign markets as a means of achieving growth. In Oman, various foreign firms have set up their branches in major cities such as Muscat and Bawshar. The entry of new firms increases the level of market rivalry, making it necessary for local companies to come up with unique strategies for addressing the challenge. One of the best ways is to explore foreign markets. Such a strategic move would require a firm to understand external environmental forces in the foreign market that would have a direct bearing on its operations.

Lokkesmoe, Kuchinke, and Ardichvili (2016) explain that before a firm can make an entry into a foreign market, the management should develop effective strategies for dealing with various forces in the host country. The primary aim should be to ensure that operations in the new market are not only sustainable but also profitable despite the existence of various challenges. This report focuses on how Omani Oil and Petroleum Company can make a successful entry into a specific foreign market to help achieve sustainable growth in this industry.

An Overview of the Company and the Industry

Company Overview

When planning to explore a new market, Zajda (2015) advises that one of the initial steps that the management should take is to conduct an initial analysis of the industry in the foreign market and define internal forces within the firm to establish if there is an alignment of the two. Omani Oil and Petroleum Company specialise in the refining of crude oil for local consumption in Oman. The company receives crude oil from different suppliers and processes it into different products, with the main ones being petrol, diesel, kerosene, and jet fuels. These products are then sold to various distributors within the country using the company’s large fleet of oil tanker trucks.

Once the product is delivered to the client, this company is no longer responsible for the activities of selling it to the final consumers. The company is currently undergoing integration with other firms operating under Oman Oil as a way of increasing its market coverage within the country. The management also made the decision of producing polyethene and polypropylene, which are the primary raw materials for plastic. The diversification of the product portfolio was a strategic move to help this firm to increase its profit in the face of increasing market competition. This company is currently planning to explore a new market beyond the borders of the country. In this study, the researcher will focus on explaining why India would be the best country for this company to target as it explores foreign markets.

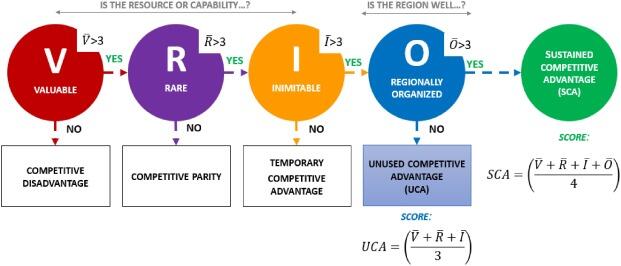

VRIO analysis. A critical analysis of the firm’s resources and capabilities can help in determining the ease with which it can make an entry into the foreign market. VRIO model helps in determining the resources and capabilities of a firm and its ability to achieve a competitive advantage over its rival firms. This model holds that a firm can only achieve a competitive edge in the market if its resources are valuable (Lewis & Mckone 2016). Oil products are in huge demand in the global market. The high value of these products gives it a competitive edge in the market. The second step in this framework is to determine if the product is rare.

Oil products are rare, as many countries around the world have to import them from the Middle East and parts of North Africa. The next stage is to evaluate the imitability of the product. Refined oil products (petrol, diesel, kerosene, and jet fuel) are standard products that cannot be modified in a way that makes them different from that of rival firms. The company is organised in a way that would support the decision to explore the new market. The top management unit made the decision to explore foreign markets, and a team of highly skilled has been identified to plan the process. In the four steps, it is evident that the imitability of the company’s product is the only area in the company that lacks a competitive advantage. Figure 1 below shows how the assessment should be done using this model.

SWOT analysis. Conducting a SWOT analysis makes it possible to identify strengths, weaknesses, opportunities, and threats that this company will face as it makes an entry into the foreign market. The financial strength of the company makes it possible to sponsor extensive market research in the foreign market to understand forces that may affect its operations. The fact that its refineries are located close to the oil field in Oman means that the company is assured of a steady flow of the product without interruption. Despite these facts, it is important to appreciate the fact that there are challenges that this company has to overcome. The biggest weakness of this firm is the need to operate in a market where the brand is barely known. Many customers often prefer dealing with known brands in the market. Another major weakness is the limited knowledge that top managers have about the new market.

The new market presents growth opportunities for Oman Oil and Petroleum Company. The huge population of Indian offers a large market for this company. The improving industrial and transport sector in the country means that petroleum products are in huge demand. A successful entry into this market will open avenues for entry into the regional market. The management should be ready to deal with various threats. Issues such as culture shock, stiff market competition, and policies set by the host government may affect the operations of this firm. Table 1 below summarises the SWOT analysis.

Table 1: SWOT Analysis.

Industry Overview

Oil remains the primary source of energy in the industrial sector across the world. According to Lokkesmoe et al. (2016), climate change and global warmings are realities and countries around the world are keen on embracing alternative and cleaner energy sources. However, the industrial sector still heavily reliant on petrol, diesel, kerosene, and jet fuel as the main sources of energy. The industry has been growing consistently in tandem with global economic growth. Although international oil prices keep fluctuating, major global economies such as the United States, European Union, and China still import large amounts of this product from various producers around the world. As explained above, Omani Oil and Petroleum Company should consider making an entry into the Indian market.

India has the second-largest population in the world, estimated to be around 1.3 billion people, and is currently the third-largest importer of oil, after the United States and China (Lynch 2015). The market is strategic because recent reports have projected that the country is set to experience continued growth over the coming years, which means that the demand for oil and related products, including the raw materials for plastic, will increase. India is one of the countries regulating the use of specific types of polyphone papers in an attempt to protect the environment. However, plastic bottles such as those used in soft drinks, plastic plates and cups, and numerous plastic materials are still commonly used in this country (Lynch 2015). With such a huge population, this company would have a huge market for its product if it uses effective strategies to enter this market. The petroleum industry in India is one of the most profitable, and as such, the management of this company would only need to define effective strategies to start operations in this country.

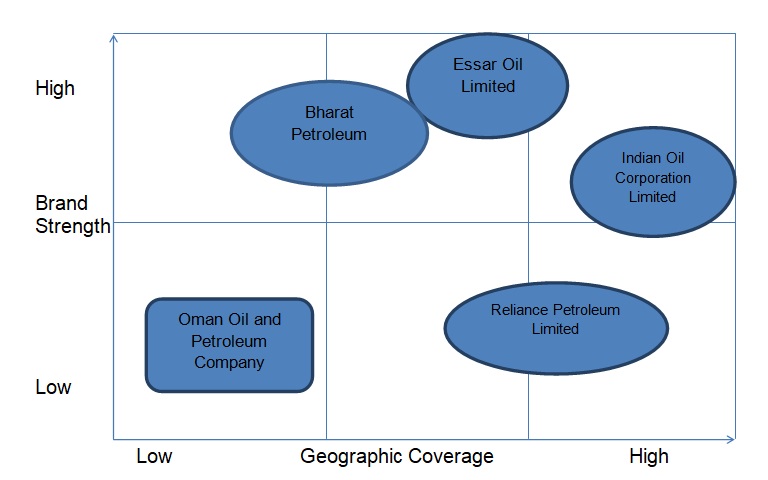

- Strategic groups. When conducting an analysis of the industry, Ayden, Demirbag, and Tatoglu (2018) argue that it is often appropriate to use a strategic group map to identify the position of a firm in relation to its rivals. As shown in figure 2 below, this strategy helps to determine the pricing/quality strategy against geographic coverage. Some top rivals in this market, such as Shell and BP, have focused on market coverage, while others have focused on pricing. This company will focus on pricing when it enters this new market.

- Competitors. Oman Oil and petroleum Company will face stiff competition from firms, which are already operating in this market. Some of the top rivals in this market include Indian Oil Corporation Limited, Bharat Petroleum, Reliance Petroleum Limited, and Essar Oil Limited (Glowik 2017). Some of these companies have been in this market for a long time, and they understand local market dynamics, giving them a competitive edge over new market entrants.

- Suppliers. The company has a competitive edge over most of the competitors in the Indian market because of its close working relations with major suppliers of crude oil. The company has a close working relationship with Grand Drilling & Petroleum Services LLC, one of the leading oil drilling companies in Oman. It is assured of a steady flow of this raw material throughout the year.

- Buyers. Oman Oil and Petroleum Company can sell its products directly to consumers or use intermediaries to help in distribution. Given the vastness of the market, it would be advisable for this firm to sell the product to specific distributors. The strategy will speed up market penetration. These distributors will become the primary customers of the firm.

- Product substitutes. The products that this firm sells do not have close substitutes. Although green energy such as solar power, wind energy, and biogas are gaining popularity in India and the rest of the world, they still lack the potential to support transport and industrial sectors. As Lasserre (2017) observes, renewable energy sources is yet to become a major threat to oil companies around the world.

- New companies. The Indian market already has numerous companies offering this important commodity. The Indian government has policies that make it easy for foreign companies to invest in the local economy. It means that the threat of new market entrants will still exist. Having a unique selling proposition is the only way of gaining and retaining a competitive edge in this market.

Strategic Factors to Consider When Selecting the Market

When planning to make an entry into a new market, Lasserre (2017) advises that it is important to take into consideration various strategic factors. Some of these factors, such as the competitiveness of the industry, the ease with which a firm can enter the market, and the internal capacity of the firm, have been discussed in the sections above. In this section, the focus is to discuss strategic factors in the external environment.

Strategic Environmental Assessment

The external environment plays a critical role in the success of a new firm. The PESTEL model is often appropriate when evaluating the external environment. The political environment in India is supportive of foreign investment into the local economy. Reeves, Haanaes, and Sinha (2015) explain that although there is always some political interference during periods of election, such issues are becoming less common. Economically, India is considered one of the fastest-growing economies in the world. The purchasing power of its citizens is also increasing consistently, which means that there is a huge opportunity for this firm. The social environment, especially the cultural practices in this country, is significantly different from that in Oman. However, cultural forces do not influence the commodity that this firm sells in this new market. Irrespective of their culture, Indians need the energy to facilitate growth in the transport and industrial sectors. Technology has become a key component of operations in this country.

Enterprise resource planning (ERP) has particularly become a critical tool in managing the acquisition of materials for companies in this market. It would be appropriate for this company to embrace this new technology. Ecologically, it is important to note that environmental conservationists have been championing the reduction of the emission of greenhouse gases in the country. They are also strongly opposed to the use of plastic materials because of environmental concerns. Such initiatives may have a negative impact on this company. The legal environment is supportive of both local and foreign companies operating in the country. The government has created a levelled legal ground for all firms. However, they have to operate with the legal confines asset in various regulatory policies.

Models of Market Entry Available for the Firm/Strategic Options

When planning to enter the new market, the management of the Omani Oil and Petroleum Company should consider the most appropriate model that can work in the Indian market. As Tihanyi, Pedersen, Devinney, and Banalieva (2015) observe, different environmental forces may influence the strategic decisions of a firm when choosing appropriate market entry strategies. In this section, the researcher will discuss four of the most viable options that the management of the company can choose from when exploring new markets.

Direct Exporting

Direct exporting is the most appropriate strategy that Omani Oil and Petroleum Company should use when entering the new market. In this context, the company will sell its products directly to the targeted market after meeting the conditions and requirements set by the host country. Keller (2016) explains that direct exporting can take different approaches depending on the size of the market, the local culture, the financial capacity of the exporting company, the level of competition, and other market forces. India has a population of over 1.3 billion people, and they all use petroleum products directly or indirectly. It may take a while for employees of this company (parent country nationals) to understand the local culture in this country. As such, the most appropriate approach that this company should use under the direct exporting strategy is having agents acting as distributors of these products.

The Omani company will be responsible for all the logistical operation from Omani to selected Indian deports. The suppliers will then distribute the products to different parts of the country. Although it is the most expensive of the four selected strategies, it is considered more effective because the exporting company will have full control of operations in the host country. It will give this company a competitive edge over rivals who may opt for other less assertive strategies such as franchising. The company does not need to worry about local cultural practices and beliefs because the distributors will be directly responsible for the sale of these products. However, Keller (2016) advises that the management should set a clear guideline that defines the relationship between the firm and its distributors.

Franchising

Franchising would be the least desirable of the four strategies discussed in this section but the easiest to embrace. In this strategy, the Oman Oil and Petroleum Company will focus on creating a strong brand in the international market that can rival Total, Shell, and BP. The firm will then find franchisees in Indian or any other foreign market it targets. The management of this company (the franchiser) will set standards of operations that must be met by the franchisees in the foreign market. The franchiser will not need to invest in a foreign country other than strengthening its brand globally.

Given the fact that oil companies in India import the product from various countries, the Oman Oil and Petroleum Company can have an additional arrangement with the franchisees that would make our company sell its products to these local firms at better terms than other firms that are not franchised by this company. The strategy was considered less desirable because it is not guaranteed that the franchisees will select the franchiser as the sole supplier. Other than the royalties, this company would not get profits from the sale of its goods (Tihanyi, Pedersen, Devinney & Banalieva, 2015). However, the strategy can work in a market that this firm considers hostile or too competitive to make a direct entry. It will allow the company to increase its revenue without making further investment abroad.

How to Achieve Competitive Advantage in the Foreign Market

The market has numerous challenges, as discussed above. However, it is important for Oman Oil and Petroleum Company to find a competitive edge over its rivals in the market. Keller (2016) explains that it is the responsibility of the top managers to find ways of gaining an edge over its market rivals in the market. It requires the top leaders to identify what the firm can do in a unique way to outsmart rivals. Porter’s generic strategies identify possible options that a firm may consider.

Porter’s Generic Strategies

Porter’s generic strategies can be used to define a path that a firm can take to overcome stiff competition in the market. As shown in figure 2 below, it can consider cost leadership, differentiation, differentiation focus, or cost focus depending on its core competencies and other internal factors within the firm. Oman will be selling petroleum products in the new market. It may not be possible to achieve differentiation when operating in the oil and gas industry. As such, the most appropriate strategy that this company should consider is cost leadership. Given the fact that this company has a close working relationship with oil extracting companies back in the home market, it can afford to lower its cost of making the products available in the foreign market. The strategy will ensure that even if this firm charges a price that is slightly below the market average, its profitability will not be compromised. Lien (2016) explains that many Indians often consider pricing as the most important factor when purchasing a product that cannot be easily differentiated, such as petroleum products. It means that this strategy will be effective in this market.

Strategic Group

The concept of strategic groups can help the management to identify the position of different market rivals in terms of factors such as geographic coverage, pricing, quality of products, distribution channels used, the strength of the brand, marketing effort, and integration (Lewis & Mckone, 2016). It makes it possible for a firm to compare its current position against that of its major rivals. In this context, the firm will use brand strength and geographic coverage as the main premises upon which the comparison will be made. It will be possible to determine if the current position of this firm gives it a competitive advantage. It will also make it possible for the management of this firm to understand major market rivals with the strongest brand and widest geographic coverage. Figure 3 below shows the strategic group map.

As shown in the figure above, it is evident that the Indian Oil Corporation Limited is the dominant company in this industry in terms of geographic coverage. It has numerous branches enabling it to make its products available in almost every part of the country. Essar Oil Limited has the strongest brand in this market in terms of the level of trust customers have towards it. Bharat Petroleum also has a strong brand, but it does not have wide geographic coverage. These are the main rivals that Oman Oil and Petroleum Company will have to observe closely in this market. Oman Oil and Petroleum Company has a weak brand and low geographic coverage in the Indian market because it is yet to start its operations.

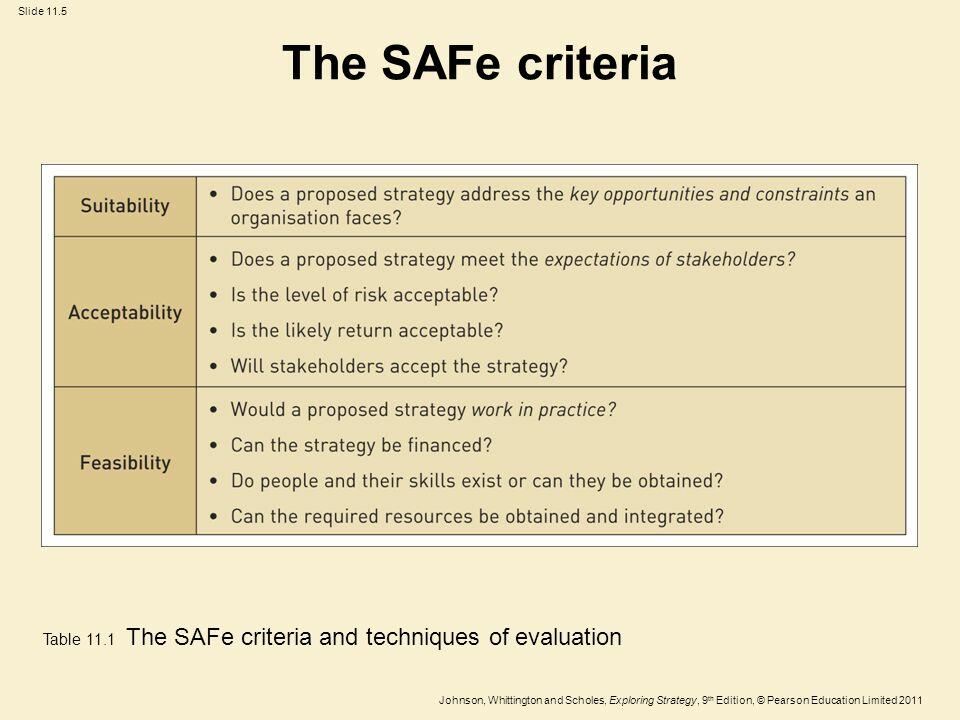

The SAFE Criteria

When a competitive strategy has been selected, Lien (2016) explains that one can use SAFe criteria to determine its appropriateness in the market. In this case, the cost leadership strategy will have to be assessed based on the local market forces. The suitability of this strategy can be assessed by looking at key opportunities and constraints. In a study by Keller (2016), over two-thirds of Indians live on $8 or less a day. As such, they are often keen on purchasing low-cost products. This strategy will earn the firm more clients within a short time. The second criterion is its acceptability. It must be acceptable to stakeholders. Shareholders and top managers of this company will find the strategy acceptable if it promises more revenues and improved profits. The last factor is feasibility. It must be practical, as Glowik (2017) observes. The cost leadership approach that will be embraced will not compromise the firm’s profitability and ability to remain sustainable in the market. Table 2 below summarises these factors.

Future Potential Options

The initial plan is to make an entry into the market with the refined oil product. The goal is to strengthen this brand with this popular product in the Indian market. When the brand gains popularity, Oman Oil and Petroleum Company will then introduce the raw materials for plastic. According to Glowik (2017), India, just like many other countries around the world, is coming up with policies meant to regulate the production of plastic products. The new policy is meant to eliminate the production and use of thin plastic bags because of their threat to the environment. During the initial years of operation, this company will have the opportunity to understand these new regulations, the requirements that have to be met by companies producing plastics, and potential customers who can purchase this product.

With established offices in India and strategic partners in this market identified, the company will have the capacity to introduce the new products in the foreign market without facing any significant challenges. The management will also consider exploring regional markets, especially in China. The Chinese market also presents a huge potential because of its massive population and strong economy. According to Glowik (2017), China has the largest population and the second-largest economy in the world. It presents a huge potential for both refined oil products and the raw materials for plastic.

Conclusion

Oman Oil and Petroleum Company has registered impressive performance in the home market. However, the management has made the decision that the firm should explore new markets beyond the borders of Oman. India has been selected as the preferred market because of its huge population and rapid economic growth. The most preferred market entry strategy is direct exportation. The firm will identify major oil distributors that will receive this product once it is delivered from Oman to major depots in India. This strategy will ensure that this firm can focus on making the product available in the country instead of focusing on marketing strategies. The report recommends that this firm should focus on cost leadership as a strategy of achieving a competitive advantage in the market. It should find ways of reducing its cost of operation in a way that would enable it to lower its operational cost in the market.

Reference List

Ayden, Y, Demirbag, M & Tatoglu, E 2018, Turkish multinationals: market entry and post-acquisition strategy, Palgrave Macmillan, Cham.

Glowik, M 2017, Global strategy in the service industries: dynamics, analysis, growth, Routledge, New York, NY.

Keller, W 2016, Ultimate guide to platform building, Entrepreneur Press, La Vergne, TN.

Kim, WC & Mauborgne, R 2015, Blue ocean strategy: how to create uncontested market space and make the competition irrelevant, Havard Business School Publishing Corporation, Boston, MA.

Lasserre, P 2017, Global strategic management, Palgrave, London.

Lewis, A & Mckone, D 2016, Edge strategy: a new mindset for profitable growth, Harvard Business Press, Boston, MA.

Lien, K 2016, Day trading and swing trading the currency market: technical and fundamental strategies to profit from market moves, Wiley, Hoboken, NJ.

Lokkesmoe, KJ, Kuchinke, PK & Ardichvili, A 2016, ‘Developing cross-cultural awareness through foreign immersion programs: Implications of university study abroad research for global competency development’, European Journal of Training and Development, vol. 40, no. 3, pp. 155-170.

Lynch, D 2015, Strategic management, Pearson, Harlow.

Reeves, M, Haanaes, K & Sinha, J 2015, Your strategy needs a strategy how to choose and execute the right approach, Harvard Business Review Press, Boston.

Tihanyi, L, Pedersen, T, Devinney, TM & Banalieva, E 2015, Emerging economies and multinational enterprises, Emerald Group Publishing Limited, Bingley.

Zajda, J (ed) 2015, Nation-building and history education in a global culture, Springer, Dordrecht.