There are many different bond kinds, and each has benefits and drawbacks for the parties involved. Municipal and corporate bonds will be reviewed in this session. They demonstrate different levels of risk and are accompanied by several considerations before investment. However, it could be argued that municipal bonds are effective for investment in relation to corporate bonds due to the lower level of risk associated.

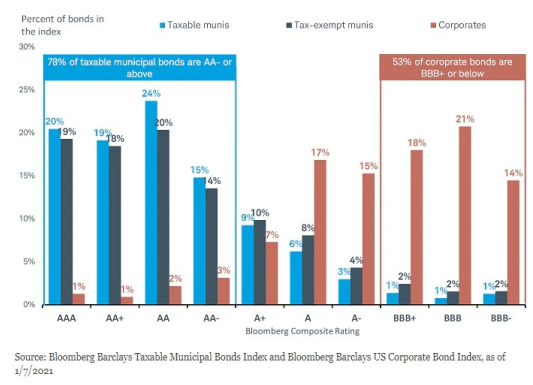

Municipal bonds are one sort of bond issued by cities, states, and counties and used to finance their public initiatives (Keown, 2019). One of the significant advantages of municipal bonds is the exemption from state taxation in regions where they are acquired. Additionally, compared to the typical corporate bond, their credit quality tends to score higher, which is seen in Figure 1 (Howard, 2021). The American High-Income Municipal Bond is one illustration (AMHIX). This particular bond has produced a 10-year annualized return of 5.46%, as reported in November 2020. Investors pay a 3.75% upfront sales load in addition to the mutual fund’s 0.67% expense ratio when purchasing shares (Horton, 2020). Both qualified and non-qualified investment accounts must have a minimum investment of $250 (Horton, 2020). Municipal bonds have several drawbacks, including the possibility of losing money invested, which would result in no return for the investor, and the potential difficulty in selling them before they mature because their market is less than that of other bonds.

Corporate bonds provide varying degrees of safety and return on investment. Smaller investors who want to diversify their portfolios without investing much money tend to be interested in them because they often start at around $1,000 (U.S. News & World Report L.P., 2021). It is possible to expect an average of 8-10% return given that the investments are made into high-rated companies. Corporate bonds have the largest default risk compared to other bonds, and they are taxed in three ways: through interest income, capital gains or losses from selling the bond before its maturity, and an original issue discount (Tarver, 2021).

In conclusion, corporate bonds carry the highest risk, but investment returns are often at a level that is twice as profitable. Corporate bonds are often pursued by venture capitalists, while municipal bonds are more likely to bring stable profit for investors. Therefore, given the lower risks associated, it is evident for novice investors, municipal bonds are more attractive.

References

Keown, A. J. (2019). Personal finance: Turning money into wealth. Pearson.

Howard, C. (2021). Why investors should consider taxable municipal bonds. Schwab Brokerage. Web.

Horton, M. (2020). 5 Municipal bond funds for 2021. Investopedia. Web.

U.S. News & World Report L.P. (2021). Everything you need to know about investing in Federated Hermes Corp Bd Strat Port. U.S. News & World Report.

Tarver, E. (2021). How are corporate bonds taxed? Investopedia.