Introduction

This paper utilizes data published by the Canada Mortgage and Housing Corporation‘s (CMHC) rental market. The CHMC report gives a comprehensive analysis of trends revolving around the availability and costs of rental units throughout Canada, with regards to its provinces and metropolitan areas (Canadian Mortgage and Housing Corporation, 2020). This paper will use this available information to provide an in-depth review of the Canadian rental market conditions with regards to the vacancy rates, turnover rates and rent controls. It will achieve this by emphasizing on the different tenures, property types, and bedroom units.

Vacancy Rates

Overall Vacancy Rates Decreased to 2.4% in 2018

According to the Canadian Mortgage and Housing Corporation (2020), since 1997, the national vacancy rates in Canada have been on the decline from a level of 3.5%. However, from 2015 to 2016, it registered its first increase to 3.7%. After that, it dropped to 3% in 2017 and finally 2.4% in 2018.

The current level of 2.4% is regarded to be beneath the international standards. To give a detailed breakdown of the decrease in 2018, the following data were obtained:

- Studio apartments have recorded a drop in vacancy rates from 3.5% to 2.9%;

- One-bedroom apartments have registered a reduction from 2.9% to 2.4%;

- Two-bedroom apartments have declined from 3% to 2.4%;

- Three-bedroom apartments have decreased from 3% to 1.8%.

The low vacancy rates are a consequence of the increasing house prices in recent years, which led to most potential homebuyers in Canada having no other option but to rent. Furthermore, compounded with other factors, such as the new and rising demand for rental housing among immigrants and individuals from the younger age group, an increased level of international migration that supports the demand for rentals, and increased employment for individuals aged between 25-44 years in the recent years, the vacancy rates have shrunk further. These absurdly low vacancy rates suggest the need for creating affordable housing. From a provincial perspective, in 2018, Saskatchewan had the highest vacancy rate of 8.7% while Prince Edward Island had the lowest.

Urban Rental Market had Higher Vacancy Rates than the Rural Rental Market

In 2018, the overall rental urban market had a vacancy rate of 2.3%, while that of the rural region was 6.4%. This relatively large disparity insinuates that the Canadian population prefers living in urban areas as compared to the latter. Furthermore, in both instances, bachelor studios had the highest vacancy rate of 3.1% and 11.0%, respectively. On the other hand, in the urban region, three-bedroom units had the lowest vacancy rate (1.8%), while for rural areas, two-bedroom units had the lowest rate of 5.6%.

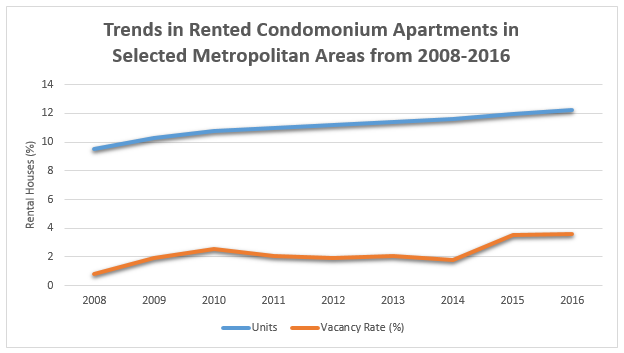

Vacancy Rates of Rental Condominiums

Condominium apartments account for a considerable portion of the overall housing segment. From 2008 through to 2016, the number of units has gradually increased, with 2016 accounting for the highest number of units. Regardless, data also shows that in the early years, the vacancy rates of condominiums were growing; nevertheless, this trend was shifted in 2010, whereby the rates started decreasing up to 2014. After that, they showed an upward trend. As a result, this trend suggests that Canadians do not like living in condos.

Vacancy Rates for Standard Senior Housing

Overall, the national vacancy rates for senior rental housing decreased from 10.8% in 2010 to 8.2% in 2016. It is essential to note that usually, the vacancy rates for senior residents are lower than those displayed in the marketplace, as higher rents and frequent turnovers often characterize it. With regards to metropolitan areas, in 2016, Nova Scotia experienced the most significant decline in the vacancy rate from 15.0% to 7.6%, followed by Newfoundland and Labrador where the rate dropped from 18.1% to 13.0%. On the other hand, in the same year, Prince Edward Island was observed to have the lowest vacancy rate (6.2%), followed by British Columbia.

Turnover Rates

Canada has illustrated a decrease in turnover rates which dropped from 18.7% in October 2018 to 17.1% in October 2019. At the provincial level, Saskatchewan recorded the highest decrease in turnover at 8%, followed by Newfoundland and Labrador (3.5%) and Alberta (3%). On the other hand, British Columbia had the least drop in turnover rates (0.1%), and it was followed by Manitoba (0.6%) and Ontario (1.9%). This surge in turnover might be a probable consequence of the increasing rent price and the relatively low house affordability among Canadians.

Rent Controls

The average national cost of rent in Canada has increased: for instance, the average rent for two-bedroom apartments rose by 3.9% from October 2018 to October 2019. This is regarded to be the fastest growth rate ever to be elicited by popular two-bedroom apartments since October 2001. Moreover, this increase is coherent with the trend over the past few years. Some of the significant factors that have influenced rental cost in Canada include unit availability, home-buying affordability, and net migration to Canada.

On a provincial level, Ontario had the highest rent increase by 5.8%, followed by British Columbia (4.3%), and Nova Scotia and New Brunswick at 3.5%. On the other hand, modest rent upsurges Manitoba (3.1%), Quebec (3.0%), Alberta (1.4%), and Saskatchewan (1.0%). It is essential to note that it was only Prince Edward Island that recorded a drop from 2.9% to 2.8%.

As of October 2019, British Columbia had the highest rental rates, with landlords seeking $1,468 per month on average (for popular two-bedroom apartments). Ontario had the second highest rental rate at $1,339. Conversely, New Brunswick and Quebec had the lowest rate in 2018 at $842 and $815, respectively. With regards to two-bedroom apartments, at the CMA level, Toronto, Halifax, Calgary, and Montreal illustrated a stronger rent growth in October 2018 to October 2019 as compared October 2017 to October 2018. However, Vancouver recorded the highest slow down. Moreover, among all CMAs it was only Vancouver and Toronto that exhibited rent growth above the universal average.

Comparison of Rent between Vacant and Occupied Units

Overall, the average rents of vacant units are statistically higher than those of occupied units. This leads to most potential homebuyers being subjected to financial barriers to home ownership entry. Therefore, some potential homebuyers might opt to rent long-term, hence, increasing the rental demand. At the CMA level, the average of two-bedroom units was higher than that of bachelor, one-bedroom, and those exceeding three bedrooms.

Average Rent by Property Type and Bedroom Count

In terms of housing by tenure, rental apartments are more popular among Canadians than condo apartments. Based on both bedroom counts, condos have a higher average rent of $1,577, as compared to rentals with $1,113. The different rental costs further mirror the disparity in the vacancy rate. Condos are avoided as they are more expensive. The difference is also evident in terms of location. For instance, in Alberta, the average rent was the lowest for all bedroom types in both rental and condo apartments, whereas the opposite was the case for Ontario.

By comparison, in 2019, the rent for a two-bedroom condo apartment in Ottawa-Gatineau, Ontario, was $1,720, while a similar form of unit in Edmonton, Alberta, was rented for $1,377. Condo apartments experienced a 1.7% increase between October 2018 and October 2019. Rental apartments that make up a majority of listings in the country experienced a year-over-year increase of 2.4%. Despite the rise, rental apartments had the lowest average rents of all tenures at $1,113.

Vancouver and Toronto showed moderation of the mounting pressure on rent growth due to the increasing construction of purpose-built rental homes. This unique trend can be attributed to the relief of financial barriers to homeownership in such cities that led to improved affordability of homeownership. Furthermore, in Toronto, the rent price of multiple-family dwellings, such as townhouses and condominiums, has registered a more robust growth as compared to other types of housing. This is because they are more admired by first-home buyers, thus, pushing their demand in the rental market.

Average Rent in Social and Affordable Housing

Generally, the rent for social and affordable housing in Canada is excellent. However, in various provinces like British Columbia, Alberta, Newfoundland and Labrador, and Yukon Territories rental prices relatively exceed the universal rate of $625. Nevertheless, in other provinces like Nunavut and Prince Edward Island, the rent is nearly half that of the universal price.

Note: * Not applicable.

The universal standard is $625

Rent Controls in Social and Affordable Housing

Several factors, which include operating cost, household income and the percentage of market rent, among others, are used to determine rents in social and affordable renting housing units. Household income is recorded to be the primary driver (51.9%), and it is preceded by unknown factors (25.9%), the percentage market rent (10.8%), operating cost (9%), and, lastly, others (2.5%). All of these before-mentioned values are excellent.

Summary

The data used in this analysis is based on listings published by the CMHC. Its primary rental data explicitly comprises of rental apartments and rental townhouses, which are centered on the entire universe of purpose-build rental units in the country. From the data above, it is observed that the rental market is experiencing an increase in rental prices and decreasing vacancy and turnover rates. Therefore, this suggests that the present economic conditions in Canada are characterized by increased employment of individuals and the influx of immigrants that has led to decreased vacancy rates and increased rental prices.

However, reduced turnover rates suggest that there are weak financial measures in place, such as mortgage loans that prevent potential home buyers from purchasing permanent houses; therefore, they opt to remain in the rental market to upgrade. Consequentially, this boosts short-term rental demand. Regardless of these poor housing conditions, the social and affordable housing sector remains unaffected as the rental prices in such properties revolve around the universal standard.

This excellent trend in social and affordable rental housing suggests the National Housing Department, through the Rental Construction and Financing Initiative (RCFI) and Affordable Housing Innovation Fund (AHIF), has been efficient in attaining its goal of creating affordable housing.

Reference

Canadian Mortgage and Housing Corporation (2020). Rental market data. Web.