Introduction

Aims of the Report

The current paper contains an analysis of the recent major issue faced by Pfizer, Inc, and the way the company solved it. In addition to that, the report critically analyzes Pfizer’s problem-solving approach and suggests alternative approaches to the issue that will be outlined below.

Overview of Pfizer

Pfizer is a multinational pharmaceutical company headquartered in New York City that produces medicines to treat diseases in the spheres of immunology, endocrinology, oncology, and neurology, to name but a few. For 26 years, the business magazine Fortune includes Pfizer in the list of 500 largest companies globally (Fortune, 2020). In 2020, Pfizer took 215th place with total revenue of $51,750 (Fortune, 2020). According to the data provided by Statista (2020), 88,300 people were employed at Pfizer in 2019. However, the number of employees in 2019 is the lowest compared to the five preceding years (Statista, 2020). The most recent significant achievement of Pfizer is the creation of the COVID-19 vaccine in collaboration with BioNTech. Although the vaccine has not been approved by the US Food and Drug Administration yet, it has authorized the vaccine “for emergency use” to prevent COVID-19 (Pfizer, 2020, para. 1). Pfizer is also famous for the development of medicine called Lipitor which lowers cholesterol levels in the blood.

Description of the Problem

One of the loudest Pfizer scandals occurred in 2012 when the Securities and Exchange Commission (SEC) charged the company “with violating the Foreign Corrupt Practices Act (FCPA)” (US SEC, 2012, para. 1). More precisely, Pfizer was caught bribing health care professionals employed by “Pfizer’s subsidiaries in Bulgaria, China, Croatia, Czech Republic, Italy, Kazakhstan, Russia, and Serbia” (US SEC, 2012, para. 2). The goal of these bribes was to make medics prescribe drugs produced by Pfizer. For instance, in China, Pfizer created a remuneration system that motivated doctors to prescribe Pfizer’s medicines (Ceresney, 2015). The “high-prescribing doctors” were invited to “club-like meetings that included extensive recreational and entertainment activities” (Ceresney, 2015, p. 2). Similar bonus programs were established in other countries mentioned above.

Pfizer was aware of the fact that the undertaken measures violate FCPA and, hence, the company tried to conceal illicit activities. According to the SEC (2012), in Pfizer’s accounting records, the transactions related to bribery were marked as “legitimate expenses for promotional activities, marketing, training, travel and entertainment, clinical trials, freight, conferences, and advertising” (para. 2). Nonetheless, the truth was revealed, and the company was charged.

At this point, it is critical to notice that the issue of briberies and FCPA violations worth being discussed because the illicit actions not only harm ordinary people and destroy market competition. What is more important, the beneficiaries of such illegal activities might be terrorist organizations (Nagel, 2019). The analysis conducted by the Department of Justice (DOJ) reveals that Pfizer, along with other companies such as Johnson & Johnson and General Electric, signed a contract with the Iraqi Ministry of Health for giving it free medical supplies (Nagel, 2019). At those times, the Ministry of Health was under the Mahdi Army’s control which was selling free samples of medicines to the black market (Nagel, 2019). The revenue from these sales was used to sponsor terrorist attacks in Iraq since 2004 (Gardiner, 2018). This aspect of bribing public companies questions how to deal with such a situation even more critically.

Description of Pfizer’s Approach to the Problem

Considering how Pfizer reacted to the accusation, it should be noted that it did not disclaim the numerous facts of bribery. What is more, the corporation facilitated the SEC to investigate of the case. Six years earlier, in 2006, Pfizer voluntarily informed the Commission and the DOJ of violations conducted by the subsidiaries in other countries (SEC, 2012). Most importantly, Pfizer’s leadership claimed that the parent company was unaware of illicit payments conducted by subsidiaries without approval (SEC, 2012). Ultimately, Pfizer Inc. agreed with the Commission to pay approximately $60 million to settle the described charges (ElBoghdady, 2012). In addition to that, Pfizer H.C.P. Corporation, a subsidiary organization of Pfizer Inc, paid $15 million to the DOJ and turned down more than $44 million in illegal profits (Jessee Jr, 2016). From what is written above, it could be inferred that the critical aim of such actions was to maintain the reputation and image of the parent organization.

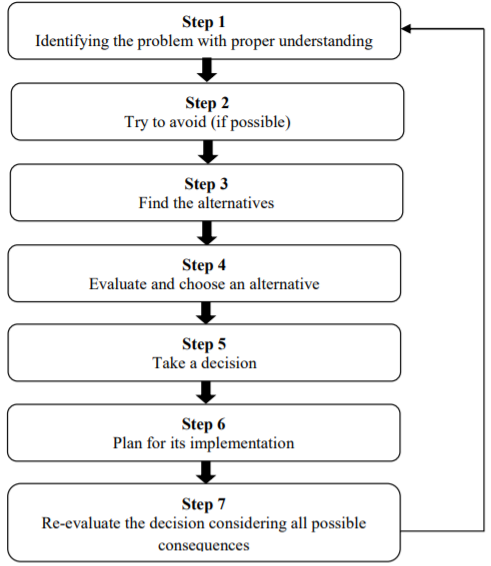

The traditional decision-making process consists of five steps. First, the managerial personnel should identify the problem, identify possible solutions, and evaluate them. While evaluating potential solutions for the problem, it is essential to consider how it will affect not only the well-being of the entire company but also stakeholders, including employees and consumers (Dash et al., 2017). The following steps require managers to choose the best one and implement it. Then, the outcomes of the implemented decision should be analyzed, and the cycle should be repeated in case if the results were not satisfactory. Dash et al. (2017) developed the “hybrid model of the decision-making process” that allows coming to more effective decisions (p. 1813). Figure 1 illustrates the process suggested by Dash et al. (2017). Still, this more complex model reflects the basic decision-making process.

From the analysis of the decision taken by Pfizer’s administration, it seems reasonable to infer that the rational approach to decision-making was employed. The rational approach implies that the decision-makers are well informed and aware of the consequences of each possible solution. Undoubtedly, the rational approach’s critical weak side is that decisions are made by people affected by emotions and personal experience. However, the analysis of the existing literature and information provides no justification for the claim that the core decision-makers were guided by emotions. Moreover, Pfizer has experience with settling issues with fraudulent marketing. In 2009, the company was accused of illegally promoting its medicines and had to pay $2.3 billion (DOJ, 2009). Since Pfizer’s goal was to secure the existing sales contracts for its products and the public image, it seems purely rational to agree to pay a fine and cooperate with the DOJ and the SEC.

Critical Analysis of The Approach Taken by The Organization

Strength and Limitation of the Approach

Pfizer had no choice but to repay the fines exposed by the DOJ and the SEC. Furthermore, “the openness and speed with which Pfizer voluntarily disclosed and addressed” the violations were a useful way to show the commitment to values (O’Toole, 2012, para.8). Besides, Pfizer and the DOJ’s agreement obliges the pharmaceutical company to “implement rigorous internal controls and cooperate fully with the department” (DOJ, 2012, para. 9). At the same time, the subsidiary companies are “not required to retain a corporate monitor” (DOJ, 2012, para. 10). From this point of view, the decision to cooperate with the DOJ and closely monitor transactions of affiliated structures could be described as rational.

Nonetheless, the undertaken decision seems to be too simplistic because it is, to a greater extent, the solution was aimed at the mitigation of consequences but not on the eradication of the cases of briberies. Undoubtedly, it could be argued that since 2012 there was no information about frauds, briberies, and FCPA violations. Hence, the control system aimed at the prevention of illicit activities works. Still, there are no guarantees that these illegal transactions are just nowadays are better hidden than eight years ago in 2012.

One of the criticisms of the rational approach to the decision-making process is that the officials responsible for taking actions choose an acceptable option over the optimal and the most efficient one. In other words, it was relatively easy to pay the fines and agree to report regularly to the Commission on the situation with illegal marketing. The better solution would be to implement the incremental model of decision making and carry out a reorganization of the communication between the subsidiary companies and the parent one. The incremental model will be discussed in the following section of the report.

Improvements of Pfizer’s Approach

As it has already been suggested, Pfizer’s approach to the described issue seems to be superficial. It does not lead to any profound changes in communication between the affiliated and the parent companies. Besides, their implemented solution does not imply any changes in how companies are managed. Hence, it seems reasonable to suggest that the incremental model should have been employed.

The incremental model’s main idea is that the entire process of decision-making is not considered a unity; instead, it is split into several steps. These steps, to a certain extent, resemble phases of the rational approach. More precisely, these stages are identification, followed by development and selection. Logically, these stages are followed by the implementation and evaluation of the outcomes. The difference is that the incremental model is based on small-scale evaluations that boost the final decision’s efficiency (Halpern & Mason, 2015). Therefore, the outcome will be a more complex solution to the existing problem, not a superficial one.

The incremental model employs a divide-and-conquer technique of problem-solving. This technique’s core idea is that the entire complex issue should be divided into smaller problems that are easier to solve (Blahut, 2010). Therefore, one part of the problem was what to do with the charges brought by the DOJ. Another aspect of the situation should be how to eradicate the possibility of bribery in Pfizer’s affiliated companies.

The analysis of scholarly and newspaper articles revealed that Pfizer H.C.P. Corporation’s managerial personnel guilty of the violations was not dismissed. The briberies of the affiliated companies’ medical staff members would be impossible without the approval of the people who run these companies. In the US Constitution, it is stated that bribery is one reason for the impeachment of a President (Black Jr & Bobbitt, 2018). This way, it seems unfair that the subsidiaries’ leaders got off with a fine and were obliged to report to the parent company regularly. A better solution for the described problem would be to change the corrupted administration of the subsidiaries with the new one and the appointment of an independent third-party member who would monitor the situation with illegal transactions and marketing actions.

Other approaches to solving problems

Another approach to Pfizer’s issue that should be discussed there is scenario planning. This method is employed when a company should make a flexible plan in the long-term perspective. This approach might be useful because it enables managerial personnel to consider numerous factors and the ever-changing environment in which a business operates. Schoemaker (2016) developed a range of conditions that are inherent to organizations in which the scenario planning method works effectively. This way, a company should use scenario planning if it operates in a state of high uncertainty and unpredictability and expects changes in the industry (Schoemaker, 2016). This method is also recommended when the company has already faced similar issues before, and the ultimate decision in that situation was poorly thought through (Schoemaker, 2016). Finally, when the competitors use scenario planning, applying the same method would help sustain market competition (Schoemaker, 2016). The only criterion that matches Pfizer is the previous experience with frauds and briberies.

Nonetheless, the fact that prior to 2012, Pfizer faced several issues related to violations proves that the decision taken at those times was not created to protect the company in the future. Consequently, Pfizer is highly recommended to consider previous difficulties and employ the incremental model and scenario planning. The adherence to this advice would help the company’s administration develop a strategy that would allow the mitigation of the consequences of the 2012 problem and prevent the emergence of analogous issues in the future.

In addition to the approaches identified above, Pfizer could also use the following problem-solving strategies: root cause analysis (RCA). The RCA is used not only to solve the problem but also to understand why this problem appeared (Latino, Latino, Latino, 2019). The RCA applies to Pfizer’s case because the administration should discover how it became possible to hide transactions and why auditors did not reveal these bribes for such a long time.

Evaluation of the best approach

The best solution to Pfizer’s issue will be reached via the combination of scenario planning, and incrementalism, including the divide-and-conquer technique, and the root cause analysis. The employment of the previously mentioned strategies would enable Pfizer’s administration not merely to fix the issue with charges. These methods would create a more complex solution to the big problem of bribery and fraud. Combining all these methods is essential because it would produce a solution that would protect the company from repeating this sad scene in the future.

Stock Market Analysis

Initially, it was expected that Pfizer’s share price would fall in 2012 because this year, the company was accused of an FCPA violation. This suggestion is based on the experience of other organizations. For example, the data scandal of Facebook that occurred in 2018 turned into a fall in share price by seven percent (Rodriguez, 2018). Nonetheless, the analysis of historical data on Pfizer’s share price retrieved from Macrotrends (2020) reveals that there were no significant changes in share price for the given period. Figure 2 presents the chart of share prices from 2002 to 2015. Such a broad period is chosen to compare prices in 2012, when the company was charged, with prices in other years.

Figure 2 demonstrates that despite some fluctuations, overall, the share price continues to grow and remains higher than in the preceding years. Figure 3 reflects Pfizer’s share price in July and August 2012. To remind you, the company was accused of FCPA violations and fined in August. Nonetheless, the share price in July is significantly lower than in August. This way, it could be inferred that investors did not pay a lot of attention to the scandal with the briberies at the affiliated companies. Such a calm reaction of investors might be explained by the fact that the DOJ decided not to bring criminal charges against the parent company that claimed its lack of information on the subsidiaries’ illicit activities and assisted the Department and Commission to investigate the issue. More importantly, the company kept producing medicines and making innovations and discoveries in the sphere of healthcare. Thus, investors had no reason to worry about the company’s future. This, in turn, led to the absence of share price drops.

Conclusion

The solution to the described issue with the violation of the FCPA proposed by Pfizer, Inc. could be described as superficial and aimed at maintaining the company’s public image. It also lacks drastic measures for the eradication of possibilities of bribery and fraud within the company. Without a doubt, the decision not to deny accusations, repay charges, and cooperate with the DOJ and the SEC allowed Pfizer to escape severe consequences and animosity with the government. Furthermore, the absence of similar cases since 2012 indicates that the parent company effectively monitors the situation and prevents the possibility of any violations. Still, it could be suggested the company would have been better off if it applied the incremental decision-making model combined with scenario planning and the root cause analysis. Hence, Pfizer should have decided to reorganize communication with the subsidiaries and change the corrupted administration. It could have obliged affiliated companies to regularly report all transactions and allowed an independent third party to monitor subsidiaries.

Reference List

Black Jr, C. L., & Bobbitt, P. (2018). Impeachment: A Handbook. New Haven: Yale University Press.

Blahut, R. E. (2010). Fast algorithms for signal processing. Cambridge University Press.

Ceresney, A. (2015). ‘FCPA, disclosure, and internal controls issues arising in the pharmaceutical industry’, Paper presented at CBI’s Pharmaceutical Compliance Congress.

Dash, A. K., Bhattacharjee, R. M., Singh, C. S., Aftab, A., & Sagesh, K. M. R. (2017). ‘A decision can be a disaster: A descriptive analysis of a case study, International Journal of Applied Environmental Sciences, 12(10), pp. 1803-1820.

Department of Justice (2009) ‘Justice Department Announces Largest Health Care Fraud Settlement in Its History, The United States Department of Justice.

ElBoghdady, D. (2012) ‘Pfizer agrees to pay $60M to settle foreign bribery case’, The Washington Post, Web.

Fortune (2020) ‘Global 500’, Fortune. Web.

Gardiner, H. (2018). ‘Justice Dept. Investigates Claims That Drug Companies Funded Terrorism in Iraq’, New York Times.

Halpern, D., & Mason, D. (2015). ‘Radical incrementalism’, Evaluation, 21(2), pp. 143-149.

Jessee Jr, J. T. (2016). ‘Pay to Prescribe: A Case for Strengthened Enforcement of the FCPA in the Global Pharmaceutical Industry in 2017 and beyond’, Rich. J. Global L. & Bus., 16, pp. 81-97.

Latino, M. A., Latino, R. J., & Latino, K. C. (2019). Root cause analysis: improving performance for bottom-line results. CRC press.

Macrotrends (2020) ‘Pfizer – 48 Year Stock Price History | PFE’, Macrotrend.

Nagel, H. (2019). The External and Internal Impacts of FCPA Violations: a study on how bribery enables wide-scale corruption, facilitates international terrorism, and affects firm value, Texas: Departmental Honors in the Department of Accounting Texas Christian University.

O’Toole, J. (2012) ‘Pfizer settles foreign bribery charges’, CNN.

Pfizer (2020) ‘Pfizer and BioNTech celebrate historic first authorization in the US of vaccine to prevent COVID-19’, Pfizer, Web.

Rodriguez, S. (2018) ‘Here are the scandals and other incidents that have sent Facebook’s share price tanking in 2018’, CNBC.

Schoemaker, P. (2016) The Palgrave Encyclopedia of Strategic Management, London: Palgrave Macmillan UK.

Statista (2020) ‘Pfizer’s number of employees from 2006 to 2019’, Statista.

US Securities and Exchange Commission (2012) ‘SEC charges Pfizer with FCPA violations’, US Securities and Exchange Commission.