Introduction

Technical projects are exposed to risks that can be potentially damaging due to the cost of investments incurred in such projects (Kerzner, 2006). The exponential rise in project costs not projected before the start of a project are risks with the potential to damage project progress. McNeil, Frey, and Embrechts (2005) argue that the severity of risk must always be evaluated after the appraisal stage of a technical project to ensure the potential impacts of any risk are minimized. Potential risks are always evaluated against anticipated outcomes on a project. Risks may impede a project from accomplishing its set down objectives leading to a costly effort (Augustine, 1984).

A risk is an effective tool in identifying future project uncertainties and any potential losses or damages that may be associated with a project. That ensures that potential risks are minimized to acceptable levels.

Project managers’ keenness in identifying different risks associated with a project is vital to ensure accurate estimation of the impact of risks on a project in achieving laid down the objective. Smith and Stulz (1985) note that these separations enable project managers to select appropriate risk management strategies focused on a specific project. These separations include local and global elements. Local elements include variables that have a direct impact on a project and which can be controlled by the project manager while global variables can be influenced by external factors. External factors include government-controlled factors (McNeil & Embrechts, 2005). These factors can be classified into political risks that legal requirements, statute laws, and competition. Changes in the law can adversely affect the progress of a project and may be a potential source of loss in equipment and other capital investments. These investments can be in the form of machinery and equipment for engineering projects. On the other hand, environmental risks are another source of global risks (Montgomery, 2010). Environmental risks incorporate changes or variations in established standards that engineering projects have to conform to. Geanakoplos and Klemperer (1983) identify some of these environmental risks to include changes in environmental regulations and requirements targeted at maintaining and preserving the environment. Risk management guideline (2004) identifies the fact that project managers cannot be comfortable until commercial risks are identified, evaluated and strategies designed to avert or minimize them, an argument supported by (Montgomery, 2010). Commercial risks are characterized by the whole supply chain of products and materials used in the development of a project, consumer behavior, demand and supply for specific products or services, inflation, deflation, and other economic factors that may impact the economy of a country or region (Chadwick, Morfett & Borthwick, 2004).

Project managers are always keen on identifying, evaluating, and categorizing risks, particularly elemental risks associated with a project. Elemental risks span specific or target project factors. Montgomery (2010) argues that these include implementation strategy risks and risks associated with the operations of the project. In addition to that, the financial risks are also associated with engineering projects with the potential to stagnate a project. However, it’s worth noting that project financial risks are a subject of control and negotiation by project stakeholders (Bulow, Geanakoplos & Klemperer, 1983).

Risk

McNeil, Frey, & Embrechts (2005) define risk in an engineering project as the uncertainty associated with future events that may affect project progress. Similar sentiments are shared by Lowrance (1976) and supported by (Benford, 2001).

Project managers and stakeholders endeavor to steer their projects away from these uncertainties (McNeil, Frey, & Embrechts, 2005). However, project risks cannot be avoided completely. The potential impact on the outcome of a project can be disastrous (Risk management, n.d). However, these uncertainties are not always anticipated beforehand, therefore, risks and uncertainties can arise at any point in a project’s lifecycle. It is well worth noting that opportunities for success always carry associated risks and uncertainties. Therefore, it can be argued that risk can be characterized by damage, time, and the extent or degree of damage that may be caused by the unanticipated event (Lowrance, 1976).

The severity of risk can be mathematically expressed in a relationship that is determined by the product of the probability of an event occurring, and the potential losses associated with the cost of investment on the project and project schedule or lifecycle, that can be summed up as the performance of a project.

Risk Management

Risk Management in the Project Lifecycle

Benford (2001) qualifies risk management to be a dynamic process that enables project managers to continuously monitor and evaluate project progress against established performance criteria. The criteria include continuous evaluation of project costs and project performance in terms of the project development lifecycle (Bulow, Geanakoplos & Klemperer, 1983). A project’s lifecycle is determined by project schedule and milestones or project deliverables. In addition to that, project risk management is characterized by metrics that are benchmarked tools for evaluating the level of accomplishments in managing project risks (McCallum, 1995).

In Benford (2001)’s arguments, risk management is seen as a managerial tool that enables top-level management’s commitments in identifying the level of compliance to specified standards and programs. Lundgrun (1994) notes that the entire program of a project must always reflect risk management at all levels and should always reflect the promise that it ensures a project does not experience unexpected surprises (Benford, 2001).

Surprises come when project managers have not integrated the component of risk and can be overcome if project managers identify and incorporate proactive methods of anticipating risks and strategies of averting these risks in the entire management structure and project development.

Benford (2001) argues that risk management is a dynamically iterative process incorporated into projects which enable project managers and stakeholders to strategically position themselves on how to identify the kind of risks associated with their domains in a project. Managers and clients eye risk management differently. While a client may be interested in the potential impact of risk and the consequences such as financial consequences, a manager on the other hand views risk management as a wholesome process of retaining a company on its financial track, performance, and long term survival in the market (Montgomery, 2010). Clients and managers, therefore, hold divergent views on risk management and develop different strategies for addressing these issues. Sanguine managers also identify specific features that they may associate with a successful risk management strategy (Lundgrun, 1994).

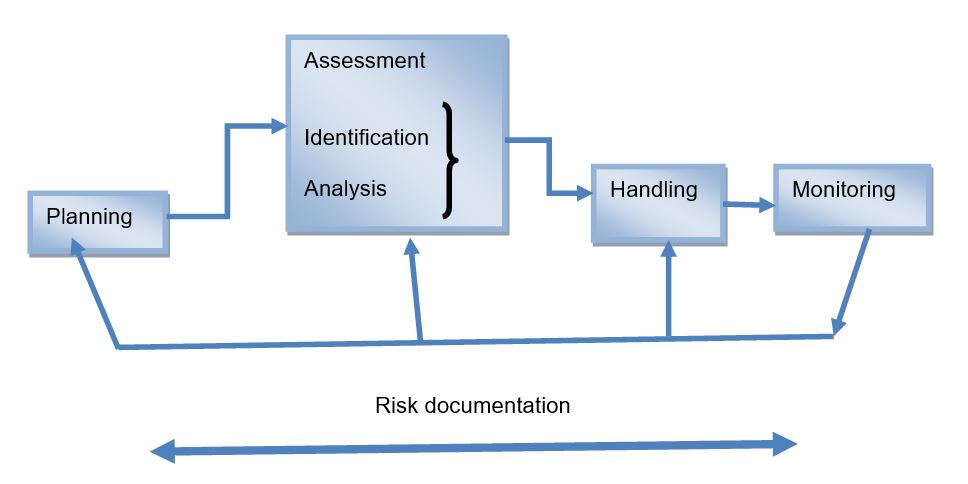

Lundgrun (1994) notes that experienced managers argue that risk management should be implemented as an iterative process by careful planning, dynamism, continuous assessments, handling, and monitoring in the whole cycle of risk management (Benford, 2001). They argue that the risk management process should be an approach characterized by iterative problem-solving strategies, continuous problem definition at every stage of the iteration process (Augustine, 1984).

Augustine (1984) argues that risk management is not restricted to top-level managers alone. Stakeholders not only hold their own view of risk management. They view risk management in terms of the party owning the risk associated with the project. Risk management, therefore, is an organizational strategy that spans every stakeholder of a project irrespective of the impact that may be associated with each concerned party.

Risk management is a fundamental process that comes with a number of benefits when integrated into running organizations. It is a discriminating element for successful organizations in anticipating, evaluating, and identifying potential problems, and other negative conditions that may be associated with a project in its development lifecycle.

Managers interested in improving the performance of their organizations understand well the negative effects and impacts on organizational performance and productivity due to risk. These managers plan well on tapping the benefits that come with risk management strategies by designing well-tailored plans targeting organizational goals and objectives. This is evident as a dynamic process in the management structure of engineering projects (Chapman & Ward, 2003).

Risk Management as a Dynamic and continuous Process

Risk management is an iteratively dynamic process that calls for continued improvements at every point of a project’s lifecycle. The process is dynamically iterative because the feedback loops characterize the process. It begins with risk planning, a risk assessment that incorporates risk identification and risk analysis, and risk handling and monitoring approaches. Each stage of risk management is characterized by a continuous risk management process. Risk management as a continuous process is illustrated below.

Risk Planning

Risk planning is a continuous process that optimizes efficiency in resource management. The planning process is characterized by risk management planning, as an important output from risk planning. The process is characterized by inclusion, efficiency, integration, and logic. Each risk management stage is a comprehensive process where each stakeholder, both the manager and the client, have a vested interest in every output from the process (Vose, 2008).

Risk planning management is characterized by the insight that enables project managers to capture problems associated with each project by clearly defining them within the domain of project objectives (Chapman & Ward, 2003). It enables project managers to identify options that are feasible that argue well with project objectives targeting specific needs of project stakeholders (Williams, 1993).

Problem definition should be comprehensive and should bring out the problem clearly in terms of project objectives and should be an analytical approach to solving the problem. It is important to note that once a problem has been defined, the process of solving it commences (Chapman & Ward, 2003). A problem well defined is a problem half solved. It leads project team members from straying from established goals and objectives.

Project objectives are identified in the project planning stage. Managers and other stakeholders undergo training techniques of identifying project goals and objectives at this stage of the project risk management process. In addition to that, risk management project staff are trained on all aspects of risk management, an additional benefit from the training programs (Chapman & Ward, 2003).

Risk planning, therefore, integrates risk assessment and analysis, specific plans tailored at risk handling approaches of developing risk handling methods and capturing resources for risk handling.

Risk assessment is characterized by the two activities of risk analysis in projects and risk identification. Project managers benefit from risk identification through techniques such as brainstorming (Chapman & Ward, 2003). At this stage, project managers evaluate and identify inputs from stakeholders and periodically set down to review project data against a set of established standards. Various tools are used to benefit stakeholders particularly project managers on project data in a continuous process. Then a taxonomy interview is conducted as a consequence of the classification of project goals and objectives (Chapman & Ward, 2003).

Any risk identification process in engineering projects is characterized by a description of the circumstances that may cause anxiety and concern in project managers and stakeholders. It should describe in detail the consequences of negative outcomes on a project in financial, environmental, and other terms identified earlier on. The risk identification process should incorporate all relevant information about every aspect of an engineering project to enable stakeholders to understand the nature of every risk involved in the project and prepare for anticipated and unanticipated outcomes (Vose, 2008).

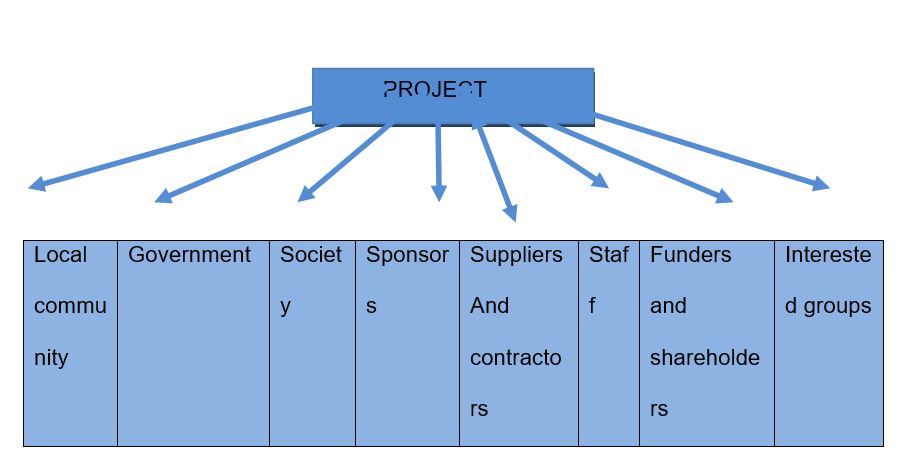

Each stakeholder offers useful suggestions for avoiding risks tailored towards project goals and objectives. They enable managers to design methods and techniques for overcoming adverse effects associated with risks. Stakeholders are defined by their primary and secondary roles. They are a critical component in adding value to the project development process. Stakeholders are always keen to avoid or avert any factor that may contribute to the failure of a project. Primary stakeholders are a critical element in defining the success or failure of a project (Vose, 2008). Project failure may adversely impact on business activities of the wider community. Below is an illustration of a stakeholder map for both primary and secondary project stakeholders. It is important for stakeholders to be well versed in their roles and the consequences of failure should an engineering project fail. A flailed project adversely impacts not only stakeholders but the larger business community as a whole.

Each stakeholder and the project management team should clearly understand project objectives and what they mean to them (Chapman & Ward, 2003). It should be well explained in financial and business terms. However, as a competitive strategy, most of the business objectives are never clearly divulged to all parties to the project.

Other information that plays a critical role in a successful project is secondary stakeholders. These stakeholders do not bear a direct relationship with a project but their role and impact extend beyond that f the government. It is important to know that project managers should collect information and relevant data about the likely impact of these stakeholders. They may offer support for an engineering project or act as a stumbling block to project progress.

Data and information about each stakeholder’s view should be collected in the process. It is worth noting that stakeholders largely view the project progress from their point of interest. Of significant interest, the information will reflect stakeholder financial interests and the technological influence on their business activities. Project managers know well that stakeholder attitudes and expectations towards a project and the likely benefits to accrue from a project directly affect their involvement and support for the project (Chapman & Ward, 2003). It is worth noting that when specialized services and technology are tools used in the process, stakeholder influence is likely to be strong.

However, other stakeholders may have a strong societal influence and have the ability to alter the feeling and opinions of the society where the engineering project is to be located. The outcome from these stakeholders may be a hindrance towards the progress of the project or facilitate project execution and success.

The potential for social stakeholders to facilitate and influence the attitude of other stakeholders characterizes them (Smith, 2007). These social stakeholders include environmental groups and consumer groups among others. Information about projected influence should be gathered and carefully documented at the early stages of the project development lifecycle. Evidently, due to stakeholder influence, examples of projects that have been decommissioned abound (Smith, 2007). Decommissioning may be socially and technically feasible, but largely unacceptable. It may come with adverse and undesirable economic consequences on other stakeholders, particularly those with economic interests.

Another information a project manager should be aware of is the social impact of stakeholders that have a significant relationship with the political mix. Governments at this point have a direct influence on the progress of a project and their involvements have significantly born a strong relationship with the outcome and progress of a project. Once a complete collection and evaluation of stakeholders have been done, decisions are then evaluated next (Smith, 2007).

Having gathered relevant information, the stakeholders take the last step of decision building. Decisions are an important technique of identifying the way forward for implementing a project. All decisions made between the project managers and stakeholders are evaluated at this stage and an appropriate procurement route is established (Smith, 2007). Data collected at this stage becomes critical in determining stakeholder attitudes and measures in risk management. The roles and responsibilities of stakeholders are identified at this stage of the risk planning g management process. As suggested above, one strategic approach of gathering data is through brainstorming, identification and evaluation of project inputs and outputs, and other relevant data and information that may create a positive impact on the progress of a project (Smith, 2007).

It is important to note that risk planning management enables managers and project stakeholders to critically prioritize projects risks and consequences from the rated risks. Risk prioritization is illustrated below.

Risk assessment

This is a critical stage of identifying program areas that are critical in meeting propjet costs, technical process risks, and other risks associated with costs and schedule objectives. A reliable estimate of project costs, project schedule, performance specifications, policies, and other components are identified in the process. The risk assessment stage incorporates a number of important techniques that are discussed below (Smith, 2007).

Risk Identification

Successful engineering projects do not proceed without project managers identifying technology-related risks, engineering project-related risks, cost, and schedule estimation risks, and human-related risks. At this point, risks that may affect the progress of a project are identified and documented. Risks are identified and categorized. Perilous situations that may arise or be attributed to risks are also identified (Smith, 2007). Risk hazards that have the potential to cause an undesirable event, and appropriate risk identification tools to be used in risk identification are identified. The identification process is characterized by a number of activities in all observable areas of the project. Each of these activities is documented and access to any related information can be accessed instantly or when required.

Most importantly, a number of techniques used in the process play a key role in helping project managers in identifying and filing or documenting project risks and other related engineering risks. Among the techniques involved in the process are brainstorming, critical examinations of historical data that may be closely related to the current project, interviewing project personnel and other stakeholders, and compiling a checklist that forms a fundamental part of the project’s progress. These techniques are continuously applied throughout the project’s lifespan.

One such technique is brainstorming. In order to generate information about the abilities of staff and other personnel in managing project risks, brainstorming sessions are initiated at this point. The staff incorporates the use of their expertise, experience, and skills in identifying potential risks that may arise in the project’s lifecycle. Their creative power is utilized particularly when the staff is from different backgrounds. The session is marked with identifying risk management issues in relation to the strategic goals and objectives of the project. The session becomes complete when the risk management staff is selected in the process. The selection process should be attended by all staff, a key element in the success of such sessions (Smith, 2007). The process should be critically characterized by a critical evaluation and analysis of a situation, ideation, a critical evaluation of risk management ideas, and complete wrapping up of the risk management identification process. Complete documentation and preparation of a checklist of possible sources of risks is another technique integrated into the process. The checklist may include risks associated with the environment, technical risks, financial and political risks, engineering risks, and geotechnical risks among others. The checklist is documentation of major project risks related to every stage of the project development lifecycle. At this point, the technique enables staff and other risk management stakeholders to identify a complete list of options for addressing risks associated with the development of the project (Vose, 2008). It is important for the risk management team manager to incorporate other techniques related to brainstorming such as idea campaigns. Idea campaign allows other project stakeholders to be involved in the risk identification process, therefore mitigating risks associated with these stakeholders in advance. These can be political stakeholders, environmental stakeholders, and a host of others identified in the risk management plan outlined above (Smith, 2007).

Workshops are another valuable technique for identifying every risk documented in the brainstorming stage. The staff analytically awards careful attention to each element in the brainstorming stage. A number of techniques are employed in risk identification. one among them is the SWOT technique. SWOT is defined by the strengths, weaknesses, opportunities, and threats in risk identification and management. The benefit of this technique is that it speeds up the process of risk identification particularly for critical projects (Vose, 2008). Internal and external factors are thoroughly considered in creating a list of strengths, weaknesses, opportunities, and threats. This is a dynamic process that continuously identifies new project risks and opportunities. It is worth noting that project staff can present a potential risk to the project. Potential risks include a skilled and experienced team member leaving a project midway. Therefore, the staff presents some of the internal risks or threats of a project (Smith, 2007).

Analysis

Engineering projects are continuously prone to risk at every stage of the project lifecycle. Project managers find risk analysis an indispensable component in enabling them continuously monitor the possibility of exposure to risk, risk associated consequences and endeavor to plan and integrate measures to steer a project away from the potential effects of risk that may be anticipated in the project lifecycle. Risks may be anticipated or unanticipated (Vose, 2008). In both cases, skilled project managers employ specific techniques in conducting risk analysis in the risk management strategy. Risk analysis will equip the project manager and stakeholders in evaluating and identifying risk-related variables and their consequences on the project in terms of cost estimates and cost overruns and the overall impact of cost overruns on project costs. It is important to note that risks associated with the economic performance and expectations of a project provide near precise answers to the potential impact of risk. Therefore, the probability of success or failure is a demanding factor that influences the outcome and sanctioning of a project by project managers and stakeholders. Different engineering projects are uniquely characterized by specific project risks that demand specific techniques in addressing them (Vose, 2008). It is important at this point for a project manager to identify and select the best technique to address the risk analysis strategy tailored towards addressing project risks based on project size, type, available information about the project or other similar projects, costs associated with the project, and the costs and time of processing specific project information and data. However, it is worth noting that current advances in computations have led to the development of software applications that generate an analytical report in real-time if appropriate data is made available. Such methods include Monte Carlo simulations that are based on probabilistic outcomes. Appropriate analytical reports reflect project objectives and goals. To this end, qualitative and qualitative analytical methods characterize the analytical process as discussed below (Chapman & Ward, 2003).

Qualitative Methods

One of the most important analytical techniques in risk analysis is the qualitative method. A qualitative method provides a qualitative measure of project risks and typical variance that enables project managers and other stakeholders to make appropriate decisions. Project managers are usually nonrisk takers but risk averters. When the chance for success is high and risk exposure is low, the bottom line is that decision-making is significantly eroded. Guide (2008) identifies many qualitative techniques, such as impact assessment, impact matrix, risk data, risk categorization, and risk probability as specific qualitative tools for risk analysis. Impact assessment and risk probability are the first qualitative techniques project managers use to investigate and identify short-term and long term negative and positive impacts on a project. The techniques are used to answer what-if questions about a project and the potential sources of risks on a project. Such answers are gathered through qualitative data gathering methods such as the use of questionnaires, interviewing skilled personnel on risk management, and stakeholders through meetings and other methods targeting project objectives and goals. Findings from observations and stakeholder meetings are documented and categorized based on the probability of their occurrence and the likely impact on a project. The probability ratings are into three categories, namely, zero ratings, low level, medium, and high as illustrated on the following scale (Smith, 2007).

The risk probability impact matrix is the second technique defined by characteristic processes that define the risk assessment technique. The striking similarities are evidently clear in the approach used in rating project risks. Risks are tabulated in order of their probability to occur and the level of impact on the project. Thus the rating starts from zero risks to worst risks. The unique characteristic of this method or technique is that boxes used in the risk rating process are tagged or labeled depending on the level of severity of a risk. These labeling vary between low and high bearing similar levels of meaning (Risk management guideline, 2004).

Different authors view different techniques with different perceptions. Different methods are uniquely characterized by the characteristics of available data for analysis. One of these is the risk data quality assessment technique. The technique focuses on the degree of accuracy of available data for determining the degree of accuracy of the outcome analysis. To verify the accuracy of data used in the analysis phase, risk data assessment is done on the data. The risk data assessment process provides verifiable accuracy of data in relation to the degree of reliability in decision making specific to the risks the project may be exposed to and their likely occurrence (Risk management guideline, 2004).

Key factors to consider in the process of risk analysis are target sources of specific risks such as environmental factors related to the project and a project’s lifecycle. This technique provides significant information about strategies for responding to any level of risk in the project’s lifecycle. Below is a tabulation of the impact level of risks and their ratings.

Quantitative methods

Quantitative measures on project risks provide specific measures on the impact of risks on project objectives based on techniques such as decision trees, Monte Carlo simulations, and sensitivity analysis. These techniques are focused on specific project risk areas and the levels of risks associated with each area. Quantitative analysis techniques have been widely applied in successful projects qualifying it to be a reliable technique in risk analysis. The risk analysis process is iterative as it is always conducted with project progress to evaluate the level of impact on the project and the degree to which such risks have been significantly reduced. Different researchers attribute different methods with different levels of success. Among the most qualified methods is the decision trees.

A decision tree is a quantitative technique characterized by decision networks. The network map of a decision tree is defined by nodes in the network. It clearly illustrated the project manager’s understanding of the outcome of events at specific stages of the project’s lifecycle (Chapman & Ward, 2003). The decision is characterized, as mentioned above, by different nodes, with the first one defined as the decision node. The decision tree is characterized by decisions that are made and the subsequent nodes are defined by chance events. A decision tree is defined by two options, the probability of an event occurring or not occurring. Mathematical calculations based on these options significantly influence the outcome of managerial and stakeholder decisions. On the other hand, it has been argued elsewhere that decisions can be qualitative if probabilistic values are assigned decision branches. Researchers argue that this technique comes with potential benefits in the decision-making process as all options are bound to be exhaustively analyzed in the process. It s worth noting that, decisions making based on this technique heavily draws on user experience and the degree of accuracy of data used in the risk analysis process (Risk management guideline, 2004).

The technique’s initial stages are based on the assumption that resources for the project are unlimited and proceed with no risks associated with the project. On further progress, other issues such as schedules and resource utilization come up, making it progress further into the actual impact of the specific impact on project activities.

Another qualitative technique is the Monte Carlo simulation technique. Monte Carlo simulation is a sophisticated technique that does not, however, demand specialized statistical and probabilistic knowledge to use (Vose, 2008). It is defined by the probabilistic influence of numbers in decision-making based on quantifiable probabilistic variables their magnitudes whose highs or lows significantly influence the outcome of a decision. One benefit of using this technique is that partially available data can be used to make decisions and is particularly helpful in new projects or projects with scanty information from similar past projects. The method is earmarked as one of the most reliable techniques for risk analysis in engineering projects. The technique presents probabilistic values with specific variances that engineers find valuable in decision-making (Smith, 2007).

The technique provides critical information about project costs, precisely models activities, logical organization of activities, and other project tasks such as resource scheduling, and performance risks among other project risks.

In essence, the technique involves the use of different input values with specific outcomes. It uses a random generator to generate appropriate information for decision-making. It focuses on problems that use random data or variables. Thus, different values provide a probability distribution or density describing the probable level of risk exposure. Engineers and stakeholders find the probabilistic model invaluable in providing specific information on the confidence interval related to the standard deviation of the outcomes based on variables that were used as input values in calculating the confidence interval in the distribution (Vose, 2008).

Overall, the Monte carol technique has been appraised by engineers as not only being an excellent tool for analyzing current risks but a specialized tool in appraising new and future projects. Moreover, the technique is modeled on a software platform that provides multiple users with the ability to simultaneously log into the application and use it concurrently, with the overall objective of providing multiple values of analyzed risks (Smith, 2007).

Engineering projects cannot be sanctioned until other risk analysis techniques have been exhaustively applied in the risk analysis process. One other such technique is sensitivity analysis. Sensitivity analysis is a technique that draws heavily on the replacement of single values and analyzes the overall impact of such replacements on the overall project plan. The technique allows project managers to identify economic risks more precisely and to identify specific risk areas that have the highest probability of occurring, thus affecting the overall outcome of the project. It has been argued by sanguine project engineers that sensitivity analysis is a tool that if valuably used at the onset of a project a host of specific benefits are bound to be realized (Smith, 2007). It is important to note that in the current age of the computer, a number of software applications are available for performing sensitivity analysis in real-time.

Risk Handling

As mentioned above, project managers are not risk-takers but risk averters. As an important component, risk handling is a process of identifying the most appropriate risk mitigation options targeted at steering a project away from anticipated or unanticipated risks. At this stage, risks are identified, and strategic options for setting risks at acceptable levels are integrated into the risk handling phases and the overall risk management process. The phase is characterized by four risk response strategic techniques categorized into risk avoidance, risk reduction, risk transfer, and risk retention in the overall project lifecycle (Smith, 2007).

Noteworthy in the risk handling process is the fact that risk avoidance and risk reduction can be merged into a single phase. Managers know well that risk avoidance strategies should be implemented at all phases of a project’s lifecycle to avoid any project risks. At the initial development stages of a project’s lifecycle, project characteristics can be modified with the specific target of reducing project risks (Chapman & Ward, 2003).

Project risk management teams endeavor to avert risks through risk response or risk transfer techniques. Risks response is where risk transfer between project stakeholders occurs without reducing the amount of risk inherent in a project. A number of stakeholders play role in the risk transfer process. These stakeholders can be insurance companies with specialized techniques of allocating resources tailored at addressing specific industry risks. Risk transfer, therefore, critically depends on the abilities of assigned parties in handling specific project risks. Each of these parties is uniquely characterized by abilities to deal with events that lead to the occurrence of risks and other parties that can deal with uncontrollable risks (Risk management guideline, 2004).

Risk identification becomes a complete task when risk retention is integrated as the last technique in the process (Lundgrun, 1994). This phase is critically unique as the only residual tool in the risk handling process if other risk handling techniques fail in the process (Risk management, n.d). Every step of the risk management process is characterized by a contingency strategy that is integrated into the process to address uncertainties that exist when making data and other information estimates such as cost estimates. Project managers allow for such contingencies by making it an organizational policy (Lowrance, 1976).

A number of risk analysis techniques detailed above provide precise contingency estimates. A strong correlation exists between client and management confidence on project resources such as cost estimates. It has been argued that Monte Carlo estimations provide reliable contingency estimations for engineering projects (Risk management guideline, 2004).

Risk Monitoring

The risk monitoring process is one of the indispensable components of the dynamic process of risk management. Risk management guideline (2004) identifies appropriate frameworks constituting reporting relationships, frequent audits, and benchmarks to significantly influence specific responses to project risks. Therefore, project managers and stakeholders dynamically identify events that lead to risks and monitor the progress of risks through a number of techniques (Vose, 2008). One such key technique is risk reassessment of a project’s current risks. Project risks are dynamic and their reevaluation should be dynamic. Influencing factors such as policy changes, currency fluctuations, and environmental factors are strong factors for integrating the dynamic process of risk monitoring (Lundgrun, 1994).

Another risk monitoring technique is risk auditing. Audits span observations of a project’s overall risks and observable abilities to respond to risks. A risk response checklist should be prepared in the process before audit meetings are conducted with specific agreements on the objectives with clarity set down (Risk management guideline, 2004). The checklist at most should contain specific plans, project manager’s experience in risk management, methodologies for risk motoring, and the reliability of risk monitoring techniques (Lundgrun, 1994).

The project manager and stakeholders should be assured of effective risk control mechanisms, clearly understood project policies, guidelines, and activities on risk management and risk control. It is worth noting that projects are run in dynamically changing environments. Therefore varying environmental factors should be well understood and in terms of risk control. Measures adopted for risk control should produce desirable results, appropriate and target information should be collected and used in decision making to influence the desired outcome, and specialized skills and knowledge on risk control mechanisms integrated in the process.

Conclusion

In conclusion, risk in an engineering project is the uncertainty associated with future events that may affect project progress and in the event that they occur, have the potential to damage the project progress with economic and environmental consequences that may be costly and undesirable. Therefore, risk must be continuously management by strategically designing risk management strategies tailored towards project objectives for both the project manager and stakeholders. Project managers and stakeholders use a number of tested and tailored risk analysis techniques that may be quantitative or qualitative to analyze the probable impact of risk and design strategic approaches of mitigating risks and the potential consequences of such risks on a project’s lifecycle. Therefore, a keen project manager endeavors to integrate at all levels of project lifecycle risk planning, risk assessment, risk handling, risk identification, and handling techniques to drive a project from risk despite projects cannot be risk free. Risk handling and monitoring tools are effective risk management tools for effective risk control mechanisms.

References

Augustine, Norman, R., 1984. Augustine’s Laws, American Institute of Aeronautics and Astronautics. New York.

Bulow, Jeremy I., and Geanakoplos, John D. 1983. Strategic Resource Extraction: When Easy Doesn’t Do It. Mimeographed. Stanford, Calif, Stanford Univ.,

Benford, T., 2001. Probabilistic Risk Analysis: Foundations and Methods. Cambridge University Press; illustrated edition edition The Journal of Political Economy, 93 (3), pp. 488-511.

Chadwick, A., Morfett, J., Borthwick, M., 2004. Hydraulics in Civil and Environmental Engineering. Taylor & Francis; 4 edition

Chapman, C., Ward, S., 2003. Project Risk Management – Processes, Techniques and Insights (2nd Edition).. John Wiley & Sons.

Kerzner, H. 2006. Project management: a systems approach to planning, Scheduling, and controlling, Hoboken, N.J., J. Wiley. Insights UK: John Wiley.

Lowrance, W.W., 1976. Of Acceptable Risk: Science and the Determination of Safety. William Kaufmann, Inc.

Lundgrun, R.,1994. Risk Communication: A Handbook for Communicating Environmental, Safety, and Health Risks. Battelle Press.

Risk management (n.d). Capability definition. Web.

McCallum, D.B., 1995. Risk Communication: A Tool for Behavior Change,” NIDA Research Monograph, 155, 65-89.

McNeil, A., Frey,R., Embrechts, P., 2005. Quantitative risk Management: concepts, techniques and tools. Princeton University Press.

Montgomery, Douglas, C., 2010. Applied Statistics and Probability for Engineers: International Student Version. John Wiley & Sons; 5th International student edition edition.

Risk management guideline (2004). Total Asset management. New South Wales Treasury. Web.

Smith, Clifford, W. Stulz, Rene, M., 1985. The Journal of Financial and Quantitative Analysis, December, 20(4), pp. 391-405.

Smith, N. J., 2007. Engineering project management, Oxford, Blackwell.

Tonn, B.E., C.B. Travis, Goeltz R.T., & Phillippi, R. H. 1990. Knowledge-Based Representations of Risk Beliefs, Risk Analysis, 10,169-184.

Vose, D., 2008. Risk Analysis: A Quantitative Guide. John Wiley & Sons; 3rd Edition edition

Williams, T M. 1993. Risk management infrastructures’ Inr. J. Project Manage, 11 (5), pp l-10