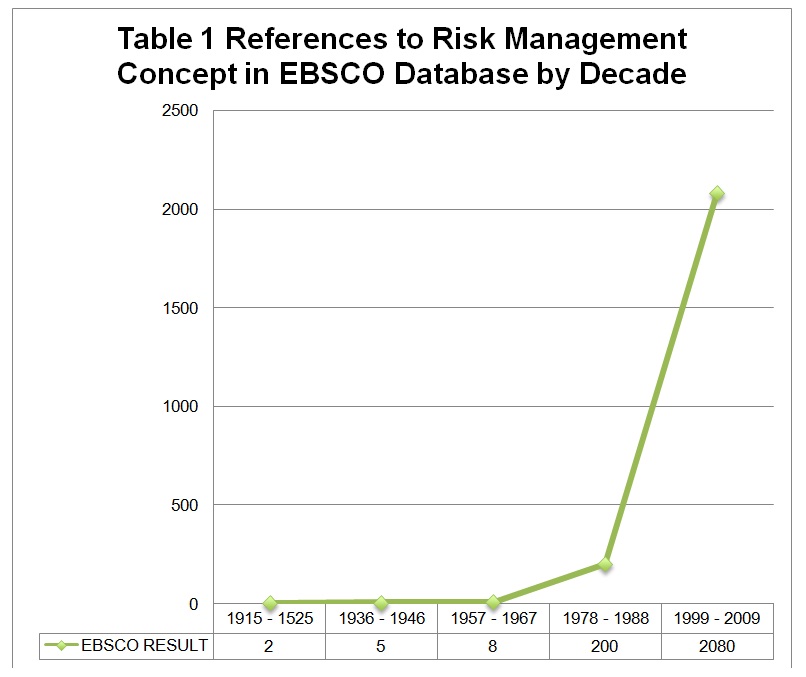

Risk Management refers to the process of identifying, analyzing, documenting, and presenting the possible risks that an institution is facing, and then devising techniques and strategies to mitigate those risks. The chart above shows how many references to the concept of Risk Management existed on the EBSCO database (one of the leading databases for academic research) in decades starting from 1915. It is evident from the chart that the area of Risk Management existed in academic research circles in a very limited context in the early 20th century. Risk Management was not adopted as a business function by organizations around the world until the late 1990s. Many factors, ranging from business to social and world climate contribute to this change. Although the modern world was first hit by the Great Depression in 1930, the focus of business owners and managers around the world was limited to minimizing crediti or financial risk. Why this concept increased dramatically in academic and business circles in the late 20th century should be explained by five major factors:

Increase in mergers, acquisitions

In the 1990s, businesses around the world witnessed an increase in the trend of mergers, acquisitions, and hostile takeoversii. As business managers increasingly focused on the need for business expansion, managing competition, and product development, business mergers became an integral part of corporate finance strategies. In such an environment, businesses hired risk management teams that analyzed possible takeover risks, as well as risks acquiring of target companies. Such roles are usually taken by Finance Managers or CFOs in the present day.

Increase in business competition

As multinationals emerged around the world, businesses invest heavily in finding niche markets and product mix. Risk management techniques in this area focus on competitor analysis, new market entry, and risks associated with working in less developed countries. Corporations have placed Risk Management and Strategic Development functions to ensure that planning and investment strategies keep in line with business objectives.

Increase in natural disasters

Research suggests that the number and frequency of natural disasters have increased over time. One strong school of thought refers to this change to global warming. Organizations have invested more in insurance covering natural disasters. As an academic concept, risk management of natural disasters has evolved in the public sector.

Increase in the use of technology and the rise of digital security needs

Digital security is probably the most important area for risk management today. Organizations have teams and departments in each geographic location who look after risk management related to digital information. As technology is evolving, digital security is also a developing area.

The recent recession and Increase in financial/legal/compliance requirements

Some of the biggest scandals in corporate history relate to financial scams by employees. Risk mitigation in this area has evolved from basic techniques such as internal audit and the third party audits to investment into compliance teams, process improvement, and corporate governance measures. The last decade in the chart above includes the period of 2007-2009 which marks the worst recession that hit the global markets since 1988. Although all the sectors were affected to some extent, financial institutions were hit the worst. As a result, financial institutions and academic circles have studied in detail why the recession and the damage it did could not be managed in advance and how to avoid the same in the future.

Footnotes

- Credit risk refers to the risk of default by a company’s debtors.

- Acquisition of another company by aggressive purchase of majority shareholding, without the cooperation of target company’s management.