Introduction

The identified risk is the fact that teller connects are currently being implemented in SunTrust Bank to allow clients to access banking services remotely (Santana, 2015). Traditional banking allows clients to physically visit a bank and do their transactions. However, through SunTrust’s teller connects, the clients can use just video call a teller and do their transactions remotely through specific ATM machines (Santana, 2015).

Despite being revolutionary, there are several risks that can be identified from the use of teller connects. One of such risks is the fact that there are some clients who go to the bank specifically to speak to a person. Today, there are many online services that clients use to make different banking transactions. The fact that they choose to physically visit a branch from time to time suggests that they are also interested in the person-to-person exchange.

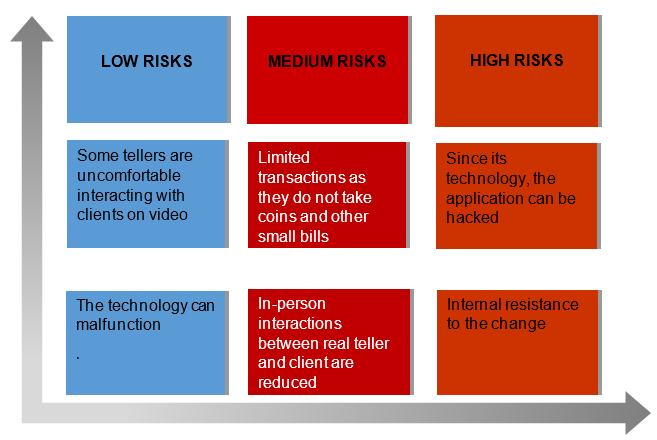

Another risk that can be identified is the fact that, like all technologies, virtual teller connects can malfunction or even be hacked. This would put both the bank and the client at risk of losing money. This essay provides a risk matrix of several identified challenges that can arise from using teller connects. A risk response plan will also be shared to highlight several ways the identified risks can be mitigated.

3×3 Risk Matrix

Risk Response Plan

Yauger (2017) defines a risk response plan as a measure to eliminate or mitigate potential risk in project management. It is important that the risk response plan be developed before any risk is experienced. This will ensure that all the people involved are well prepared for the challenges they might face. Additionally, the plan can put everything into context and even allow the management, and all those involved, to seek opportunities within the identified risks.

This section of the essay will pick two risks that were identified in the risk matrix and develop a risk response plan based on the two risks. The two chosen risks are limited transactions (medium risk) and internal resistance (high risk). It is important to note that the current teller connects only accepts 30-dollar and 50-dollar bills or checks. Business people, who transact on a daily basis, find it challenging to use the virtual teller application as they have different notes that they want to bank.

References

Santana, M. (2015). Technology helps banks meet consumers online. Banking Strategies Daily, p. 3.

Yauger, V. (2017). When risk management meets risk realized: Mitigating project impact. PM World Journal, 6(10), 1–13.