Introduction

So games are contemplating outsourcing the production of variety of games. The term outsourcing can be defined as the premeditated application of exterior investment to carry out commerce purposes conservatively run by domestic personnel(Linder, 2004). Outsourcing is done when a corporation takes a fraction of its commerce and gives that piece to another business but it should viable to the eyes of the management. This expression has been for the most part made use of technology-linked inventiveness. It can yet again be used to refer to non-technological services. In most cases, the beneficiaries for outsourced actions are by and large in a similar nation-state.

There is also offshore outsourcing whereby it involves a local corporation and another corporation from a different continent. Nearshore outsourcing is for those companies involved in outsourcing, which are not in the same country but the same continent.

Corporations and outsourcing

Corporations of all magnitudes struggle with increasing expenditure of full-time human resources. It is greatly improbable for one to have power over all the proficiencies indispensable to put together his company, raise his company and overlook his bazaar. When a company employs its staff, other aspects such as training, absenteeism, workspace, apparatus, appointment, benefits, and management are experienced. These all cause the corporations’ overall revenue to be so high. For this reason, company outsourcing is very important since there is improved knowledge, less time wastage, less management headache, expenditure lessening, and huge financial advantages among other benefits for a company involved in outsourcing.

This is achieved through increasing competence by leveraging the aptitude, expertise, and skills of third-party purveyors. Also, the time required to employ and coach employees may not be necessary for the purpose of meeting your market objectives. Though the most important goal of outsourcing is expenditure cutback, lots of corporations fail to comprehend whichever cost reimbursements. This is because company outsourcing also comes with other disadvantages like hammering managerial power, the risk to the safety measures and privacy of matters of a corporation, inauspicious agreement lengths, among others if not well monitored ( Linder, 2004).

Since lowering the expenses of a company is one of the major reasons for outsourcing, various measures can be put into action such as lowering the staff costs. Through outsourcing career obligations to non-employees, a company may not encounter unswerving pays or put forward supplementary member of staff reimbursements. The company ends up paying minor duties since the sovereign service providers, those people who work on the outsourced ventures, pay their individual preservations, communal protection, and additional levies. This can increase extensive investments.

A number of companies opt to acquire their outsourcing an extra step by selecting a merchant, sited in a different continent. By so doing, this characteristically saves them additional capital as they end spending less than would be obligatory in their native nation-state. The shortcoming of such is that these merchants may not comprehend in English causing communication a little more complicated. For example, for a customer who is phoning in with a consumer service matter and there is a language barrier between the customer service representative and the client, he would end up getting more frustrated instead of solving the dilemma (Dess et al, 2007).

According to Bragg (2006), a predominantly alluring motive for toggling to outsourcing is the abridged want for huge assets expenses for computers, (this is in particular significant for cash-strapped corporations). Where outsourcing is involved, the purveyor acquires and uphold all the statistics center calculating ability that it requires to uphold the services to the corporation as well as obtaining every one of the corporation’s information center computers for open money.

The purveyor may still have the capability of merging a corporation’s complete information center into a single purveyor run facility, thus getting rid of a big principal asset. This may result to be a boom for corporations that cannot manage to pay for sustenance with the most recent and mainly classy expertise and that would somewhat use up their resources on roles other than computer services. Abridged assets expenses draw many corporations to outsourcing.

Another cause for espousing outsourcing is the fact that it is mainly hard to supervise computer services. Lots of corporations make the error of advancing programmers into administration places that they are incapable of managing. On the other hand, corporations may have difficulties locating executives who are knowledgeably managing the mainly complex computer shops. This consequence is deprived effectiveness by the computer services personnel, insufficient scheduling, and expenditure swarming. One means to keep away from this trouble is to outsource a corporation’s computer services purpose to a purveyor exclusively to bring into play its improved supervision squad (Bragg, 2006).

Research conducted by Tipton & Krause (2007), found out that the initiative following outsourcing is that the outsourcing company can dedicate itself in an exacting locale, for example, monetary supervision, chip development, workforce organization, or software administration and trade the expertise to a corporation for a reduced amount of money than the corporation might use up if it were to produce the expertise itself.

The outsourcer administers the labor force and the customer corporation describes the exact service intensities it needs from the outsourcing company. If the two companies calculate their steps well, they are both beneficiaries of outsourcing. The outsourcing company can uphold outsized expansion personnel and control the expenditure of that workforce over lots of clients. The customer corporation acquires experienced advancement know-how in a field exterior to its center experience.

Company outsourcing can however be hindered by some other factors. This is because the managers of the companies involved ought to be entirely conscious of the premeditated repercussions of such pronouncements and wholly investigate the perils and the consequences of outsourcing. According to Benaud & Bordeianu (1998), when a corporation engages itself in outsourcing, its welfares and those of its staff regularly do not correspond.

He feels that what is an improvement to the corporation may well be disadvantageous to the human resources. He feels that the advantages and disadvantages are more often than not pinched along the management positions with managers as supporters and workers as detractors. He also feels that pros and cons are reliant on corporations’ exceptional distinctiveness for the reason that what may be again for an individual corporation may not apply for another.

Due to outsourcing, there is a loss of control over yields and services in view of the fact that a corporation is in due course accountable for the merchandise it distributes to its consumers. In case the feature suffers due to inferior workings supplied by an outsourcing company, it is liable for the expenses connected with the faults. Due to such a case, a good quality agreement is merely the instrument that provides the corporation power over its outsourcing associates. (Benaud & Bordeianu, 1998).

A widespread trepidation concerning outsourcing is that in the instance a procedure is constricted out, proficiency departs the corporation. The thrashing of skill weakens the corporation’s probability of fetching the action back in-house at a potential era. This causes the corporation to be susceptible and reliant on foreigners. This however should not be the case since a definite intensity of inner know-how is considered necessary to administer the outsourcing array and to bargain current and potential agreements (Dess et al, 2007).

Relevant costs

It is quite common to sub-contract the making of components to specialist firms or to cheaper producers. This practice does increase their dependence on outside suppliers reduces due to their control on the quality of the components. The opportunity cost approach to this type is obtained from alternative uses of the productive capacity releases as the result of subcontracting the making of components.

This is a case of outsourcing where relevant costs analysis is carried out. Outsourcing is the ordering of goods or labor from outside the vendor manufacturing plant. In this case, the company is intending to outsource the production of 2,500,000 CDS. The decision to be made here is about whether the goods should be outsourced or produced in-house. Apart from the quantitative analysis, qualitative factors will also be considered as necessary. The qualitative factor that should be considered in this case is the factor of transfer of technology to Thailand and the loss of business in case the firm decides to produce without referring to the company after the expiry to the contract period.

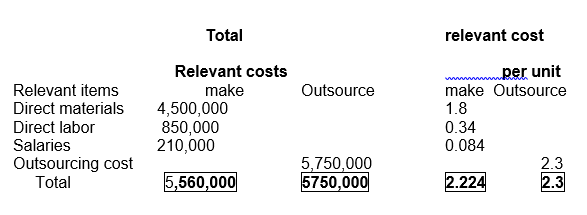

In the analysis, in this case, we shall consider relevant costs only in this case of outsourcing or producing locally. Let us now consider the possibility that the firm accepted the offer, the productive capacity released as a result will not remain idle and will be used to extend the production line of CDS. The following is the calculation of the 2,500,000 units that will be incurred.

I have assumed that the supervisors will not be deployed once it is outsourced. If they can be deployed then it could have been changed the analyzing.

The difference in the production in-house and outsourcing is 190,000 in total per year after taking into consideration all relevant costs. It is expensive for the company to outsource this product for 2.3. This is after considering two expenses general company overhead and supervisory labor as a relevant cost and heat, light phone, and depreciation as irrelevant costs. From this case, I will advise the company to not outsource the production of these units unless the company that wants to outsource offers a price that is lower than 2.224.

The allocated fixed costs are irrelevant to the decision since they are not affected, and will continue to be incurred by Sergo games irrespective of whether the CDS are made or outsourced. Since the relevant costs of making are less than the costs of buying the firm should reject the offer and continue to make the CDS.

Time value of money

However relevant costs are not enough without considering the time value of money. Companies can also use an ROI calculation which is similar to IRR but different in small detail.

Net Present Value (NPV) and Discounted Cash Flow (DCF):- this method takes into consideration the time value of money, on the elementary basis that cash flow at present time is worth more to the company compared to cash flow in future periods. In the evaluation of a project, the first step is to estimate the cash outflow and inflow to determine the net cash inflow resulting from its implementation.

This net flow is discounted by a rate determined by the businesses’ required rate of return on investment. The estimate of the salvage value of the capital assets at the end of their productive life is made and also discounted by the discount rate to arrive at the present value of all cash flows resulting from the use of the assets and their salvage value. Comparison of the total present value of the discounted cash flow and salvage value with the investment required helps determine the viability of the project. In the case of projects with long gestation periods, it is also necessary to discount the investment made in subsequent periods.

If the investment required subtracted from the discounted cash flow (NPV) is positive, it indicates that the need of the businesses’ required rate of return has been met. For most businesses, the required rate of return is the cost of capital, i.e. the rate they have to pay to obtain capital (money) from their creditors and investors. If there is risk involved when cash flows are estimated into the future, some companies add a risk factor to their cost of capital to compensate for uncertainty in the project and, therefore, in the cash flows. Some businesses may also factor in an ‘opportunity cost’ into the required rate of return, which implies that the consideration is for the alternative means of investment available for example in securities and bonds or in the capital markets.

The basis for the capital is to use the whole amount of capital used including the debt that might have been acquired by the company to run the business operation. The profits are measured in terms of the total assets used to conduct the business operation and not just the equity of the owners themselves. Aside from NPV and IRR, there are also criteria’s that do not make use of the numerical assessment because there are other components in the success of a business that has nothing to do with the numbers of any kind at all. These qualities are intangible or qualitative. They simply can’t be measured by using numbers but rather by reason and experience or sometimes using self-prediction (Revsine 2004). The net present value for the outsourcing will be

The differential present value for outsourcing using the net present method is negative 886,101.3.

The disadvantage of the NPV calculation is the fact that the decision-making is highly dependent on the rate of return that the calculation makes use of. The rate used is the opinion of the analyst or the researcher of the future growth rate that the company might be able to achieve. There is no such thing as sure-firere way to foretell the future (Collins 2003). It is almost guaranteed on the other hand that the prediction will be proved false by a very wide margin of error. Although the reasoning behind the use of the NPV’s formula is useful for comparison, it is not immune to a fatal flaw in the design of its model’s computation.

It does have the ability to clearly compare options for approval if they are good investments or not. The researcher will be able to present in numbers the exact degree of profitability that a business might have. On the other hand, all of the calculations are simply based on the rate at which the business is supposed to grow. This is the reason why the calculations can go off the true path by a very wide margin. This is also the reason why NPV is not a very good measure of an investment’s soundness or chance for success.

It can’t accommodate the intangible things a business needs to survive and succeed.

The cost of capital can make the decision-makersrs say yes or no to the project. The higher the cost of capital is, the higher the rate of return. Inversely, the lower the cost of capital is the lower the rate of return. If there are two or more projects or investment that a decision maker has to choose from, the one with the lower cost of capital will be disregarded since they are not as profitable as the one with a higher cost of capital. They are very useful tools for comparison.

They show the researcher or the businessman the potential profits and the returns in numerical terms. Although it is also far from perfect, it nevertheless provides the kind of basis for a more intelligent decision rather than relying on just feelings alone. The cost of capital also gives investors a basis for their capital allocation decisions since the rate of return can be clearly compare to each other (Collins 1994). All the other factors that they have evaluated are to be added in conjunction with the rate of return that a business has. This is slightly different with the usual ROI calculation since the cost of capital also takes into account the debt that was used by the business to operate. The rate at which the debt has to be paid is also taken into consideration with this kind of calculation. It provides a more sensitive insight as compared to the understanding that a plain ROI calculation can provide.

Conclusion

In conclusion, many companies embark on outsourcing business enterprises for the reason that there are a lot of benefits they recognize. The piece of information that company outsourcing is so widespread points out that in numerous cases, the rewards of outsourcing prevail over the shortcomings. The profits such as monetary increases and amplified competitiveness have a tendency of functioning at the large-scale stages; the negative aspects arise at the meticulous point. Many of the companies which decide to outsource for a short term end up formulating an enduring obligation exhibiting the many and worth taking advantages of company outsourcing (Dess et al, 2007).

I this regard the company should not outsource the production of the games production as it is expensive considering relevant cost and present value.

References

Benaud, C, L., & Bordeianu, S. (1998). Outsourcing library operations in academic libraries: An Overview of Issues and Outcomes. New York: Libraries Unlimited.

Bragg, S, M. (2006). Outsourcing: A Guide to Selecting the Correct Business Unit, Negotiating the Contract, Maintaining Control of the Process. Canada: John Wiley and Sons.

Dean G., Joyce and Blayney(1991); strategic management accounting survey.

Dess, G, Lumpkin, G.T., & Eisner, A. (2007).Strategic Management: Creating Competitive Advantages. New York: McGraw Hill/Irwin.

Glautier M. W.E & Underdown B (1977); Accounting theory and practice P. 422.

Horngren C.T Datar S.M and foster G (2003); Cost accounting: a managerial emphasis Prentice Hall Page 375-377.

Linder, J. (2004). Outsourcing for Radical Change: A Bold Approach to Enterprise Transformation. New York: AMACOM.

Tipton, H., & Krause, M. (2007). Information Security Management Handbook. New York: Auerbach Publications CRC Press.