Business Indicators for (Foreign) Investors

Foreign Exchange Stability

Chowdhury & Haque (2008) pointed out that the foreign exchange stability and virtual exchange rates of currencies in SAARC nations were more stable on average throughout the past decade than the US Dollars, Euro, and Yen, which prevail in the Special Drawing Rights. SAARC countries pursue stable exchange rates to attract foreign capital by fixing their currencies to exchange rate of more stable nation, through a practice called pegging; however, Tiwari (2003) stated that pegging causes reduced risk-perception whilst borrowing in foreign currencies and removes the need to hedge; therefore, when a crisis does occur, its upshots are extremely relentless for SAARC nations.

Liquidity of the Foreign Exchange Market

Noman & Ahmed (2008) noted that the foreign exchange markets in SAARC countries possess low liquidity than the foreign exchange market of United States and EU; as a result, the markets of the SAARC countries are quite fragile, whereas the US and EU markets are greatly competent from many spheres.

Exposure to Major Currency Trends

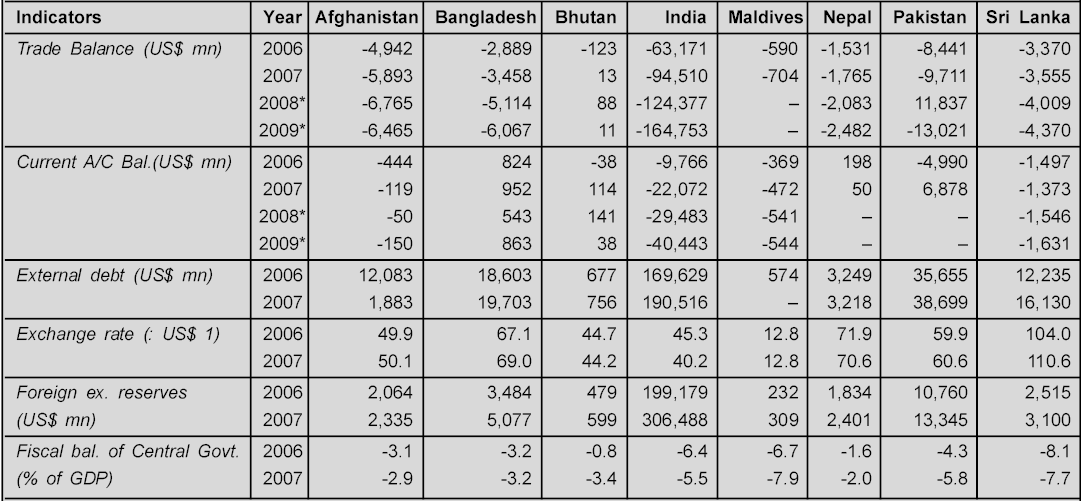

The following figure shows the major currency trends of SAARC countries, such as exchange rate, foreign exchange reserves, etc.

Ranked/Compared Vs. HI / LO

The following figure shows the rank and comparison of the SAARC nations in terms of their basic development indicators.

Public Sector by Member State & Composite for Bloc

Although comparisons of public sector and composite of the SAARC members are not quantified, EXIM Bank of India (2008) reported that SAARC nations like India, Sri Lanka, Maldives, and Bangladesh comprise of growing public sectors than the rest of the SAARC nations.

Transparency / Corruption

Recent report from Transparency International reveals that India is listed amongst the most corrupt countries of the globe; however, it has been positioned at 87th whilst Sri Lanka is at 93rd, Pakistan is at 143rd, and Bangladesh at 134th; amongst the other SAARC countries, Nepal is positioned at 146 (Adminkan, 2010) –

Table 1: Transparency / Corruption Ranking. Source: Adminkan (2010).

Civil Society Ratings

Although direct comparisons and rating of the civil society in the SAARC region is not quantified until now, it has been suggested by Behera (2009) that there has been a rapid pace of growth of the civil society in countries like Bangladesh and India. Even after having such a strong base of intellectuals, countries such as Bangladesh and India are not capable of using their abilities resourcefully in the development works because unlike SAARC, civil society in South Asia is not a unified entity.

Sovereign Debt Rating(s) vs. Levels of Public Indebtedness

Sovereign dept rating shows the risk-level of investing atmosphere of a nation by considering political risks; EXIM Bank of India (2008) suggested that in the SAARC region, the sovereign dept rating position of India is quite impressive as investors are eager to invest, whereas the investing atmosphere of Bangladesh is constantly improving. However, the condition of Nepal, Bhutan, and Afghanistan are not quite impressive. Conversely, according to United Nation (2008), public indebtedness is worsening in the SAARC region with countries like Pakistan and Sri Lanka facing rising troubles.

Private Sector by Member State & Composite for Bloc

EXIM Bank of India (2008) pointed out that throughout the past ten years, the private sectors of India are growing rapidly and contributing good revenues in the GDP. The private sector of Bangladesh and Sri Lanka are constantly developing, but the growth of Pakistan’s private sector has suddenly slowed down due to political unrests.

Commercial Credit Ranking/Assessment

Tiwari (2003), Wade & Veneroso (1999), and EXIM Bank of India (2008) suggested that India takes high amount of commercial credit in SAARC region; moreover, commercial credit rates are high at Pakistan as well. However, the commercial credits taken in Sri Lanka and Bangladesh are lower than India, but higher than that of Nepal or Bhutan.

Levels of Private Indebtedness

According to Wade & Veneroso (1999), the levels of private indebtedness vary widely in each of the SAARC member states. India shows a growing tendency of private indebtedness due to various social reasons (Wade & Veneroso, 1999). In Maldives, Pakistan, Sri Lanka, Nepal, and Bhutan, however, private indebtedness is not a major factor

Policy issues impacting on business

Harmonization of regimes: It will discus many points considering following factors

Tariff

Alam, et al. (2011, p.1) reported that SAARC countries entered into a contract South Asian Preferential Trading Agreement (SAPTA) in 1993 to reduce tariff within the regions and to identify the key barriers to remove trade barriers among the member states by imposing legal provisions and ensuring numerous facilities. Ali & Talukder (2009, p.5) and Udagedera (2010, p.2) further added that SAFTA has four prime components where tariff in number one priority to harmonize business among SAARC nations and to fix tariff for different products of different countries, for example, in first round India reduced tariff for 106 commodities, and Pakistan decreased tariff for 35 commodities.

Corporate

Alam et al. (2011, p.7) pointed out the view of the president of SAARC who stated that corporate bodies should take fruitful action in order to reduce poverty level among South Asian Countries; however, SARRC always play vital role to reduce political and economic trade barriers and develop relationships among SAARC countries.

Contract & Property Law

The World Bank (2011) investigated on the enforcement of contract & property rights in SAARC countries and found that least developing countries like Nepal and Bangladesh are not taking action in order to enforce properly the property rights and developing countries like Pakistan are facing similar problems though India theoretically ensured property rights.

Institutional capacities

SAARC has brilliance of organizational capabilities in regional agricultural cooperation, methodological research, food safety, terrorism control, but with its SAIC (SAARC Agricultural Information Centre), STC (SAARC Tuberculosis Centre), SMRC (SAARC Meteorological Research Centre), SDC (SAARC Documentation Center), but failed to flourish SAPTA and South Asian Fund.

Nominal vs. Realities of SAARC

Within the long journey of SAARC, it has dreamed a lot to the greater population of this region, but gained very little, and sustained only of greater geopolitical importance.

Personal tax regimes

Personal tax regimes have not implemented within this territory though people have long-term dream to enjoy personal tax regimes and hindrance free movement in SAARC region.

Foreign Direct Investment

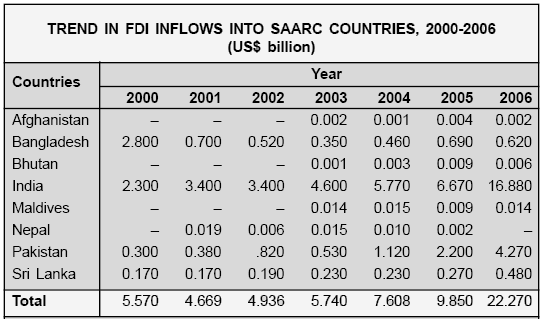

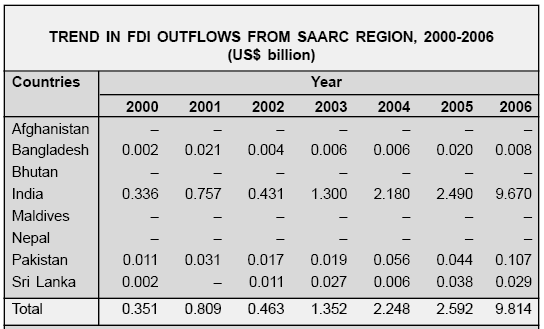

According to the report of EXIM Bank (2008), India has experienced outstanding success in case of FDI inflows for implementation of flexible legislations, low tariff rates for most of the products, and limited competition to enter into this market. At the same time, India invests in other South Asian countries to develop national economy using experience in different industry sector, technological advancement, low cost labors, diversity management system, liberal approach of policy makers, and other competitive advantages (EXIM Bank, 2008). However, the following tables show the FDI inflows and outflows of South Asian Countries –

Competition Policy

European Commission has implemented effective competition policies for the EU Zone, but SAARC’s competition policy is not too effective compared with the EU zone; however, different member states of SAARC has taken different measures, such as –

Table 2: Competition Policy. Source: Self generated from Beek, Khan & Nanda (2011).

Anti-monopoly Policy

Rupesinghe (2011) stated that anti-competitive practices are usually classified into three major classes, such as, collusive behavior among the companies, abuse of leading market players and mergers that create market dominance; therefore, member states of SAARC is going to develop Anti-monopoly policy in order to reduce anti-dumping.

Agriculture

The economy of the Member States of SAARC is dependent largely on agriculture; therefore, the governments and policy makers of these countries always concentrate on the development of agricultural productivity to poverty alleviation in this region (SAARC Tourism, 2009; and Ali & Talukder, 2009, p.5).

Table 3: Tariff rates for Agricultural goods and GDP Shares. Source: Ali & Talukder (2009, p.5) and SAARC Tourism (2009).

Policy

Member States of SAARC mainly followed trade liberalization policy from 1993, but now different countries take different measures in order to develop internal trade relationship, for example, Bangladesh is pursuing a policy of export promotion and India is working for recognizing barriers to removing them (EXIM Bank, 2008, p.45).

Tariff liberalization

Hassan (2000, p.1) stated that trade liberalization has created both challenges and scopes of the business in SAARC and Ali & Talukder (2009, p.2) argued that trade liberalization along with regional financial incorporation are able to assist a region boost intra-regional trade by expanding the volume of the market. According to the view of Hassan (2000, p.10), the main feature of trade liberalization is the replacement of quota rations with equivalent tariffs, for instance, this provision allows Pakistan and Bangladesh to encourage its export sector (Alam, et al, 2011, p.4; and Ali & Talukder (2009, p.2).

Tariffs in detail

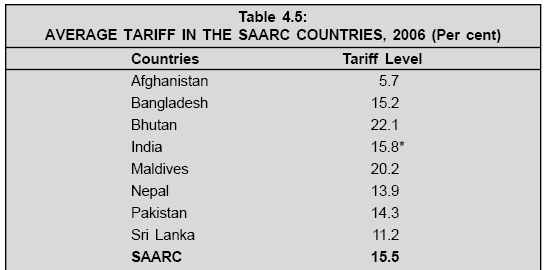

Average tariff rate x commodity:

Average tariff rate x member state:

According to the report of EXIM Bank (2008, p.45), Afghanistan imposes the lowest tariff and Bhutan persistently imposes the highest average tariffs; however, the following figure shows average tariff for SAARC –

Harmonization of Trade Policy & Globalization Posture

The SAARC Secretariat (1993, p.1) mentioned that the foreign ministers of the member countries of this regional cooperation had met in Dhaka, Bangladesh on 11th of April 1993 and signed SAPTA (SAARC Preferential Trading Arrangement) with the aim to harmonizing the trade policy providing the espousal of a variety of instruments and trade liberalization for both regional and international collaborators on a preferential basis. The SAPTA has signed with integration of WTO principles of regional cooperation in a greater extend to provide uninterrupted entry to the western investors within the SAARC member countries including their stock exchanges while most of the members have their own efforts to attract FDI (Foreign Direct Investment) inflow.

Coordination on WTO issues

In the SAPTA agreement Article – 4, it has integrated the WTO issues by keeping a provision of expertise committee to assess and measure to what extents the member countries have gained capabilities within their practice relevant to the WTO provisions. The objective of keeping expertise committee is to examine and recommend both the non-tariff and para-tariff determinants time-to-time and smooth the progress of least trade barriers intra trade provision and extra block easy entries (The SAARC Secretariat (1993, p.4). Meanwhile the expertise committee has guided by the Article -XIX of GATT -1994 along with WTO Agreement while such efforts would undoubtedly safeguards WTO principles and concerned issues.

Intra-bloc

Under Article -2 of the preferential trading arrangement of SAARC countries, it has established the SAFTA (South Asian Free Trade Area) with the aim to encourage and boost multilateral trade and economic collaboration along with the member countries by enhancing special consideration in the common trade factors in accord with core essence of the agreement.

Common interests

The area of common interest of the member countries that inspired to come in this collaboration has aimed to eradicate trade barriers, prop up state of affairs for fair competition within the free trade region of SAFTA, and undertaking equitable benefits for all member states, and gradually gain free movement of goods without any disturbance of border barriers.

Divergent interests

Behera (2009, p.9) pointed out that although SAARC member countries have aligned to strength their economic collaboration within the nations, there are huge divergent interests with the region that made the alliance very slow to gaining its objectives. With the state wise divergent interest, there are opposing interest between the private and public sector of the Sates, while the public sectors of this region is eager to open the market for foreign direct investment, the private sector is striving to protect the national industries from the global competition.

The core essence of SAARC has upraised the WTO principle and welcomed the web of globalization, but the civil societies of this region strongly protest against the globalization arguing that it would abolish the national tradition and culture. On the other hand, there are huge numbers of divergent interests, for which the actual cooperation among the states are hampering. For Instance, due to historical accord, Bangladesh offered a solid friendship and solidarity with India, but without bothering for the interest Bangladesh, India is making dam in the joint rivers by violating UN rules of Joint River.

Extra-bloc

Common interests with 3rd parties / states Formal Group affinities

The EXIM Bank of India (2010, p.83) identified SAARC as an emerging trade zone in the globe, while China has been leading another regional collaboration ASEAN (Association of Southeast Asian Nations), under the global financial crisis both the alliance have evidenced less impact in relation to rest of the world. SAARC and ASEAN are negotiating to bring greater cooperation while a number of new counties and negotiating to get entry in the SAARC with common interest and others as affiliate group like EAC (East Asian community), EAS (East Asia Summit), SCO (Shanghai Cooperation Organisation), and BIMSTEC (Bay of Bengal Integrated and Multi Sectoral Technical and Economic Cooperation).

Conflict resolution & institutional support

FES (2007, p. 26) argued that after twenty one yeas of establishment, the slow success of SAARC has lied behind the lack of strong institutional support to resolute the conflicts among the States, while United State has a diplomatic involvement in this region and patronize regional conflicts with the aim to establish its influence in this region.

Enforcement of trade regimes

Sawhney and Kumar (2010) criticized SAFTA, the trade body of SAARC for not to implementing any conflict resolution body for the region, though SAARC has extended its huge efforts in industry and culture and urged for immediate integration of Court of SAARC.

Institutions

For SAARC, SAFTA is the body to enhance trade and commerce among the Member States; however, it failed to act as an institute to mitigate trade conflict negotiation, although SAFTA has a Ministerial Council (SMC) to negotiate; nevertheless, it is not quite successful; thus, to trade conflict negotiation, member countries have move to the World Trade Organization.

Procedures

Nath (2010, p. 339) pointed out that under the Article 10 of SAFTA, it has clear identification that it is the right wings of SAARC to resolute trade conflict, and it will take 120 days to analyze and decide the matter to come in a decision. If amicable conflict fails, SAFTA members have to go to the dispute settlement body of WTO, and this body handles a number of conflicts according to GATT dispute settlement system the bilateral hearing of the conflicting parties (Wang, 2010, p.3).

Institutional Capacities of Enforcement Regimes/Mechanisms

– In some context, SAFTA has evidenced a Committee of Participants to handle trade dispute, but there is no exact guideline for them to make-decision, as a result, the committee argues the cases in the light of previous reviews.

Nominal vs. Realities

Although the nominal is extended to a greater level for SAFTA, the realities are quite poor as a whole.

Noteworthy cases

It is significant to note that in Dec 15 2001, for example, Bangladesh confused in rejoinder to Indian anti-dumping investigations.

Evolving cases and/or emerging trade conflicts

In December 2001, India imposed anti-dumping duties on lead acid cells showing it a material of injury under WTO’s reference; Bangladeshi Commerce Minister protested to Indian Authority, but did not get any positive reply. Therefore, Bangladeshi agencies placed a dispute settlement pledge to the SAPTA, but it consumed 120 days without any mitigation. At last, Bangladesh went for WTO dispute settlement process that delivered a positive achievement of Bangladesh on the point of their claim (Nath, 2010, p. 7)

Reference List

Adminkan. (2010). Ranking in Corruption 2010 – India, Pakistan, USA, Russia – Transparency International. Web.

Alam, H. M. et al. (2011). Trade Barriers and Facilitations among SAARC Economies. International Journal of Business and Social Science, 2(10).

Ali, E. & Talukder D. K. (2009). Preferential Trade among the SAARC Countries: Prospects and Challenges of Regional Integration in South Asia. JOAAG, 4(1).

Beek, R. Khan, K. & Nanda, N. (2011). Approaches to Competition Policy in South Asian Countries. Web.

Behera, N. C. (2009) SAARC & Beyond Civil Society and Regional Integration in South Asia. Web.

Chowdhury, A. & Haque, S. E. (2008). Prospects and Possibilities of Introducing a Common Currency in SAARC Countries. BRAC University Journal, 5(2).

EXIM Bank of India (2008). SAARC: An Emerging Trade Bloc. Web.

FES (2007) SAARC 2015 Expanding Horizons and Forging Cooperation in a Resurgent Asia, pp. 1- 80. Web.

Hassan, K. M. (2000) Trade Relations with SAARC Countries and Trade Policiews of Bangladesh. Journal of Economic Corporation, 21(3). 99-151. Web.

IMF. (2007) SAFTA: Living in a World of Regional Trade Agreements. Web.

Nath, A. (2010). The SAPTA Dispute Settlement Mechanism. Web.

Noman, A. M. & Ahmed, M. U. (2008) Efficiency of the foreign exchange markets in South Asian Countries. Web.

Rupesinghe , P. W. (2011). Competition Law in Sri Lanka. Web.

SAARC Tourism. (2009). Agriculture in SAARC Countries. Web.

Sawhney, A. & Kumar, R (2010). Why SAFTA? Web.

The SAARC Secretariat. (1993). Agreement on South Asian Free Trade Area (SAFTA). Web.

The World Bank. (2011). Property Rights Institutions, Contracting Institutions, and Growth in South Asia: Macro and Micro Evidence. Web.

Tiwari, R. (2003). Post-Crisis Exchange Rate Regimes in Southeast Asia: An Empirical Survey of De-Facto Policies. Web.

Udagedera, S. (2010). SAPTA Negotiations: Constraints and Challenges. Web.

United Nation. (2008). Domestic and External Public Debt in Developing Countries. Web.

Wade, R. & Veneroso, F. (1999). The Asian Crisis: The High Debt Model versus the Wall Street-Treasury-IMF Complex. Web.

Wang, B. Y. (2010). Beyond Multilateralism and Regionalism: Analysis of the Review Process of Global Trade Dispute Resolution. Web.