Introduction

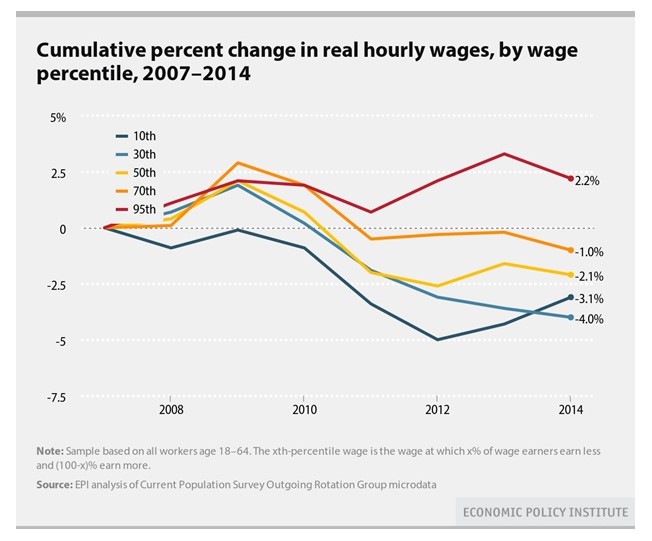

Poor wage growth has been observed over the last few years even for those employees who have an advanced or bachelor’s degree. Real hourly wages have decreased drastically in 2013-2014 for works across many spectrums with rather few exceptions.

Wage stagnation is not a new story for the U.S. economy and labor market. The majority of US employees had nothing to do but witness their real hourly wages declined since 1979 though GDP growth was observed in as well as the level of net productivity. “Economic policy-makers had become so confident in their ability to effectively control the capitalist economy that, just past the peak of the boom” (Brenner, n.d.). The same thing is in 2007 as shown in Fig. 1. The year is considered the last period of the so-called reasonable market before the Great Recession broke out.

As a result, wage stagnation appeared to be one of the toughest economic challenges for the country. Unfortunately, major employers’ input has also a negative effect as it comes with less desire to raise the wage. However, this is the only way to put most American middle-class families away from the poverty line and avoid income inequality. Stable wage is a key factor for improving the entire economic situation in addition to living standards in the USA.

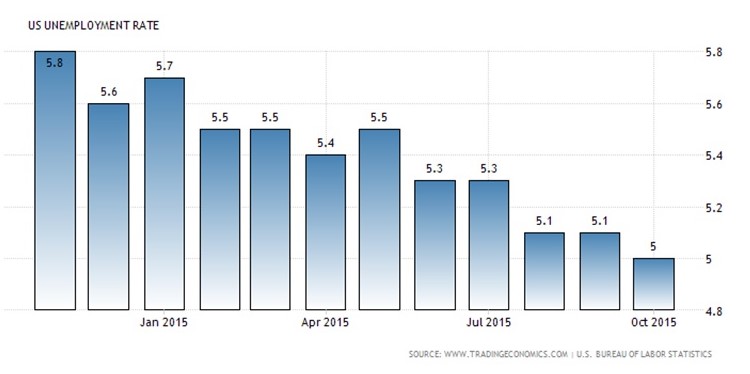

The latest statistic shows that unemployment rate in the USA has decreased to 5% during October 2015. The country’s economy has never witnessed such a low rate since April 2008. If not taking into account a few exceptions, unemployment has edged down practically in every field including health care, food and business services, retail trade, construction and other fields as shown in Fig. 2.

Such rate can result in an unexpected rise of inflation in the long run. The only way to deal with the situation is to keep rates low for a longer period. It will help to stimulate job creation and potential investments avoiding the increase of inflation rate. The idea is to bring the economy to full employment.

Clear targets should set to avoid the crisis that was observed in 2008. The rate of unemployment raised to 10.1% reaching its peak in 2009. The situation turned crucial for the majority of unemployed. They found it rather difficult to get back to work mainly because some of their professional skills have become out-of-date while their experience was of no use. It all led to the fact that those who have jobs are very unlikely to leave their positions in spite of any reasons. Fed experts have already established possible unemployment rate between 5.6-5.7%. It is not supposed to go lower that rate due to several key reasons. Firstly, most people will hardly leave their jobs even in case they do not like them. They are simply afraid of staying unemployed. At the same time, those who have been dropped out of the labor pool are no longer considered as unemployed by the Bureau of Labor Statistics. In other words, they will influence the rate of unemployment only in case they enter the labor force. These methods will make it possible to keep the rate higher.

Employers Input and Wage Stagnation Effect on Inflation

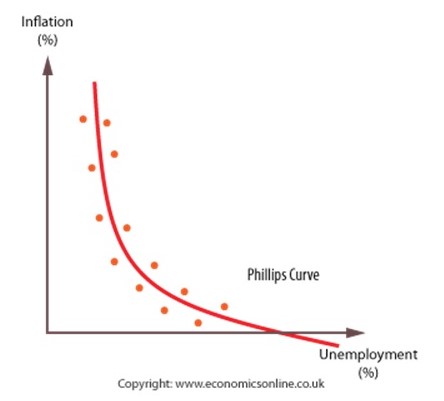

Such vital factors as the rate of inflation and unemployment should also be mentioned as the key elements to measure the health of the US economy. A misery index has been produced when combining the rate of inflation and unemployment. It is obvious that the natural unemployment rate can be affected by various important factors. The level of minimum wage is among those prior elements in addition to wage efficiency, the effectiveness of job search and more. On the other hand, inflation is mostly affected by the level of money supply controlled by the national bank. Though both terms inflation and unemployment rate are mostly unrelated economic challenges, they are still defining measurements of the economy performance as on Fig. 3.

The idea of the curve lies beneath the suggestion that the level of price inflation influences the level of unemployment directly. Moreover, the effect can be easily predictable. Though there are still many arguments regarding the curve, it introduces a particular unemployment rate that will stabilize the inflation. It means that the price increase will be at the same level each year in case of a particular rate of natural unemployment. Though some may not consider the Phillips curve, it appeared to be of great interest for Solow and Samuelson. Both were sure that the curve contains some of the vital lessons that should be taken into account by legislators. Moreover, “they suggested that the Phillips curve offers policymakers a menu of possible economic outcomes” (Mankiw, 2005). In other words, policymakers can opt for any point on this curve in case the aggregated demand is influenced by alternative fiscal and monetary policies. It is clear, that policymakers are eager to find a combination of low inflation level at the low unemployment rate. The Phillips curve shows that such combination is actually possible. It shows the trade-off between the rate of unemployment and inflation.

On the other hand, there are many complaints that workers are not paid decently, which can also have a negative effect on the overall unemployment rate. There is a statement, which says that managers should be paid vast sums in order to fit the station of life they have been placed. Nevertheless, one would hardly argue that the problem of inefficient bargaining does exist. New technologies and globalization made the process of wage negotiation with labor unions rather challenging.

People still believe that upcoming market forces will help to solve the problem of wage stagnation as well as attainment of the full employment. On the other hand, the recognition of the fact that workers still call for a level playing field is necessary. Otherwise, it will be extremely hard to avoid growing wage inequality.

Wage Stagnation as Economic Phenomenon

There is another explanation for the unemployment rate, which comes with the fact that wages are set above the equilibrium in some fields. Wage stagnation results in various key factors. However, the federal Government develops several efficient tools to cope with the situation. Those tools include special economic regulations, minimum-wage laws and labor units to negotiate the level of wage. The efficiency-wage theory could truly come in handy if it were not several crucial factors. They include globalization, college degree gap, declining of labor unions and woeful minimum wage.

College degree gap considers that more highly educated specialists are supposed to get higher wages. On the other hand, the role of globalization is often underestimated. The country meets a tough competition from China while one-third of manufacturing jobs simply vanished. The output can be rebuilt by new investments in technological development. However, it will not help to get anywhere near the number of well-paid jobs, that the country has lost.

At the same time, the number of labor unions continues declining. It means that working bargaining power is becoming weaker. 1980 appeared to be the defining period when the gap between wages has been shaped drastically. It launched the declining process of labor unions. It continues today. It all results in the fact that purchasing power of the minim wage is weakening. President Obama and is political allies offer to implement a minimum wage of $10.10 per hour. They believe such measures will help to restore the purchasing power and take some employees who are at the bottom of the wage distribution.

However, it should be clear that there is no single remedy for the problem of wage stagnation. One would hardly argue, national wage norm is necessary. However, it will not change the situation immediately as systematic approach is necessary. According to the last reviews, reestablishing of a simple age norm might not be enough. The level of wage and income should match the level of worker’s productivity. Both terms are supposed to work in one tandem. Of course, the effort must be launched from the very start including the education that is a key component of innovation-based economy. Technological changes come with new requirements and demands. Employees are supposed to meet those requirements featuring their updated skills and experience. It means that new strategies should be implemented within technical schools and apprenticeship programs. Problem-solving, technical and science skills are in high demand considering the level of global competition and outsourcing pressure.

The only way to increase the wage sector is to link it to profits of the enterprise. New reforms and norms can be used to provide low-wage employees with necessary support and protection. It will help to develop their purchasing abilities as well. Several economic indicators can be tied with the minimum wage. They may include living costs and some other components that will make it possible for the worker to minimize possible negative employment effects and adjust to changing economic strategies.

President Obama and the Federal Government seem to be on a course of implementing new norms and strategies. The president has already signed an executive order. It will require enterprises to have their compliance records disclosed. As soon as this stage is completed, it is time to move to another part of the project and let workers fairly share the economic growth they also produce and contribute in. New global economy appeared to be an innovative and knowledge-driven force that should meet well-matched needs of modern society. Summing up, we should never forget, that “America is a country blessed with abundant natural resources, a favorable agricultural climate, fresh water, and a history of manufacturing” (Hutzel & Lippert, 2014). All these factors are more than enough to establish some of the best living and working standards for the population the world has ever witnessed. Though labor market and the employment rate are only a part of the overall success, that part is vital.

References

Brenner, R. (n.d.). Uneven Development and the Long Downturn: The Advanced Capitalist Economies from Boom to Stagnation, 1950-1998. Web.

Cumulative percent change in real hourly wages, by wage percentile, 2007–2014. [Chart]. (2015). Web.

Hutzel, T. & Lippert, D. (2014). Bringing Jobs Back to the USA. New York, NY: Taylor & Francis Group.

Mankiw, G. (2015). Principles of Macroeconomics. Stamford, USA: Cengage Learning.

The Phillips Curve. [Chart]. (n.d.). Web.

United States Unemployment Rate. [Chart]. (n.d.). Web.