The sales manager of State Manufacturing is venturing into new frontiers by gaining a distribution channel in Italy. However, the manager finds himself in unfamiliar territory because State Manufacturing has never engaged in the export market before. The pricing of export commodities presents a challenge for manager Jim Madison, mostly because he does not want to make a ‘wrong move’. Mason has done preliminary consultations from various parties including a Freight Forwarding Company. Nevertheless, Mason has various plausible options when it comes to State Manufacturing’s pricing strategy for the export market in Italy. This paper offers assistance to Mason during his decision-making process by outlining the various available options for analyzing and fixing the CIF export price.

Before embarking on the analysis, there are vital details that need to be put into perspective throughout the whole process. First, there is confirmation that Agricole Italiana is a reputable company that has the potential of opening up new distribution avenues for State Manufacturing. The company is also interested in a big quantity of equipment and this puts pressure on Mason for him to get everything right.

Nevertheless, at this moment Mason has not yet created a sustainable competitive edge for State Manufacturing (Onkvisit & Shaw, 2004). For instance, this initial engagement with the Italian distributor might be a trial run whereby Agricole wants to test the terms of engagement for State Manufacturing. The reliability of the Italian distributor means that Madison has room to engage the company freely and with minimal risk (Albaum & Duerr, 2008). Preliminary research indicates that Madison’s avenue for being a competitive exporter lies in his export terms and not necessarily the price.

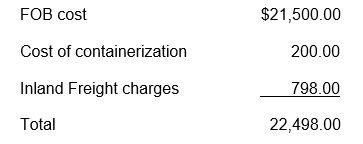

The very first option that Mason considered was to charge Italiana the usual FOB (Free on Board) plus the FAS (free alongside ship). This would be calculated as follows:

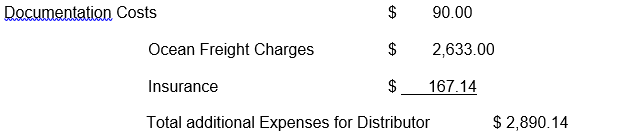

When this approach is used, Madison would have to charge approximately $22,498 to Agricole Italiana. However, the Italian distributor would have to incur some additional expenses before the goods get to the company warehouse in Italy including

The expenses that the Italian distributor will have to pay in the end amount to approximately $25,388.14 against a quoted price of about $22,498. Also, the terms that are set by the credit manager are fixed via “an irrevocable, confirmed letter of credit” (Ball, Geringer, Minor, & McNett, 2002). These terms mean that once State Manufacturing (the seller) has laid out the credit terms, the buyer (Italian distributor) cannot change the contract or even alter its details without prior agreement between the two parties. In the export and import business environment, “letter of credit means that the buyer’s bank had to draw up a document that states that the bank promises to pay the seller a specified amount under specified conditions” (Diamantopoulos, 2002, p. 159).

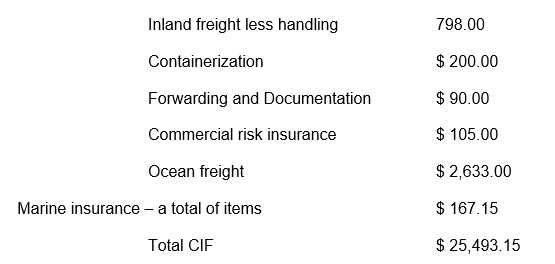

The next step in Mason’s price analysis is to explore the option that the sales manager was given by the staff from the Freight Forwarder. First, Mason was advised to emulate his competitors’ method of quoting only the CIF price. Mason’s computation of CIF comes to:

The total CIF price comes to about $25,493.15 whereby this cost is only slightly higher than the $25,388.14 FAS+FOB price that the distributor would have to incur through the first option. Consequently, quoting the CIF price does not give Mason any significant competitive edge.

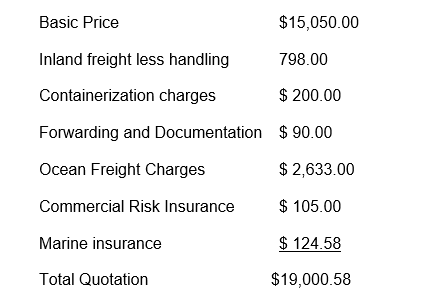

All the above options do not present Mason with any distinct pricing strategy, which calls for another competitive method. This method involves conforming to the distributor’s request and also incorporating the risk factor in the final price. To calculate this new cost, Mason will factor out the advertising, sales expenses, and research and development costs. The most logical and competitive strategy for Madison is to exclude advertising, sales expenses, and advertising costs from the quoted price. However, the 10% costs for research and development should remain intact. The new quoted price will be 30% less as indicated here:

This is the cost that Mason would charge the Italian distributor as the CIF price. The total comes to $19,000.58 and this is arguably the most competitive CIF price out of all the above options. Deducting the R&D the price would bring down the total CIF cost to about $16,863.39. State Manufacturing could take a chance with this new CIF because it offers the company the most competitive pricing strategy.

References

Albaum, G. S., & Duerr, E. (2008). International marketing and export management. New York, NY: Pearson Education. Web.

Ball, D. A., Geringer, J. M., Minor, M. S., & McNett, J. M. (2002). International business: The challenge of global competition. New York, NY: McGraw-Hill Companies. Web.

Diamantopoulos, A. (2002). Antecedents and actions of export pricing strategy: a conceptual framework and research propositions. European Journal of Marketing, 36(2), 159-188. Web.

Onkvisit, S., & Shaw, J. J. (2004). International marketing: Analysis and strategy. Boston: Psychology Press. Web.