Introduction

Tesla motors is an American based company that manufactures electric trains and cars at affordable prices in the American, European and Asian market. Its name was adopted from an electrical engineer and physicist Nokola Tesla. This paper will discuss the competitive and financial analysis in Tesla motors.

Competitive analysis in Tesla motors

Through the use of the marketing department in Tesla Company, the competitive analyzes are carried through the application of the analysis of the porter’s five forces. The process is mainly carried out to identify the level of competition within the industry; therefore, it helps in analysis the reaction to the SWOT analysis in the market structure (Tesla, 2013). Since Tesla exists in a highly profitable market, there are several new entrants who are ready to enter into the market. There is the existence of barriers to entry due to large capital requirement, product differentiation and brand equity that the customers have already built a royal relationship with its customer (Mangram, 2013).

Through the analysis of the company’s competitors, the company can create a legitimate competitive advantage over its competitors. The company has achieved in the creation of a customer value this has been done through production differentiation promotion and advertisement. From year 2010, Tesla started to make right-hand drive cars. This move was made to guarantee that the company penetrated the European market where it can now sell its cars in U.K and other countries that use the right-hand drive cars. The company has dominated the local and international market where it sells luxurious car that are identified by being more environmentally friendly (Mangram, 2013).

Financial analysis

As a company and its products are currently moving towards more competitive markets, these markets will pose both opportunities and threats to the company. Tesla motors require a working corporate strategy that will ensure its financial abilities are optimized. Based on the company’s financial statements, the company’s revenue is on the increase, this has been influenced by increased sales that the company has been conducting over the years. The increased number of sales can be directly attributed to the venturing to new markets approach, therefore, more customers to the company (Marcovici, 2013).

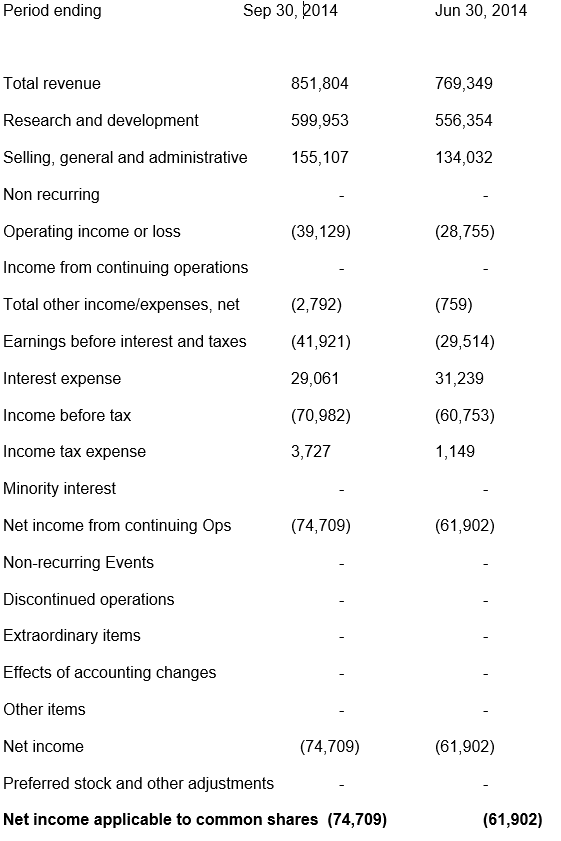

In the September 2014 the company had a total net income US$ 74, 709 thousand dollars, Through the use of financial statements; the revenue received over the years can be used to perform financial analysis. Taking the income that was registered in December 2013; the company had a net income of about US$16, 264 thousand dollars. The record shows that the company had an increase of income of more than 464% profit increase (Tesla, 2013).from the balance sheet, the company’s current assets increases rapidly. Within a period of five years the asset shoots from 330.78 Million to 2.42 billion. From data taken from the cash flow statement in the year 2013 the company has undergone a general increase as shown by the increase in their revenues for the year 2010. In each quarter the company post an increase in profit.

The income statement of tesla motors presented in quarterly data in to thousands

The introduction of the bluestar vehicle that will be worth US$ 30,000 will make the sales per unit made by the company to increase hence achieve more financial returns (Tesla, 2013).

Conclusion

Tesla Motors should ensure that it achieves a competitive advantage by ensuring it satisfy its customers. Market diversification and penetration strategy should also be implemented as they will increase sales, hence increase in the revenue that the company receives. Tesla should ensure that it uses its market strength and opportunities to gather more customers for its products. The move will help it to have a competitive advantage over its competitors. The financial analysis shows that the company has had increased sales with an outstanding percentage this transverse to total increased profit.

References

Mangram, M. (2013). The globalization of Tesla Motors: A strategic marketing plan analysis. Journal of Strategic Marketing, 289-312.

Marcovici, M. (2013). The Tesla Motors way How to build a car manufacturer from scratch (1. Aufl., Neue Ausg. Ed.). Norderstedt: Books on Demand.

Tesla, N. (2013). A New System of Alternating Current Motors and Transformers and Other Essays. Lanham: Start Publishing LLC.