Introduction

Coinbase nonfungible token (NFT) is separate from the cryptocurrency business, and research and development create new products to improve existing offerings. NFTs are different from cryptocurrencies because they are unique and not interchangeable. Coinbase NFT saw increased operating costs and research and development, although they would not see a 7% increase in earnings from 2022 to 2023 due to a slump in quarterly shares.

NonFungible Token (NFT)

NFTs, come out as a unique form of cryptocurrency assets stored in the blockchain network, enabling their exchange or sending to another person. NFTs are counted as tokens stored within the blockchain, representing digital assets such as pets, virtual real estate, and recordings (Pinto-Gutierrez et al., 2022). NFTs are representations of digital assets that someone might own. Take the example of a digital asset like artwork. Physical artworks are valuable in their right, where the artist can determine prices or market forces. The case for NFTs provided a platform for people to exchange digital assets on the network. A primary difference between NFTs and cryptocurrencies is that the latter are interchangeable since they have equal worth (Bao, & Roubaud, 2022). NFTs are nonfungible, implying that each has unique characteristics and cannot be interchanged with another. An NFT asset is sold at a special price due to its unique features. They are sold on the blockchain network, implying that the seller can set contractual agreements when selling. Once a buyer is found, they can pay with standard currency funds offered by a platform such as Rarible, Coinbase, and OpenSea.

Coinbase Operating Costs

Coinbase’s operating costs saw a remarkable increase that marked the rise of NFTs and cryptocurrency trades and investments. In 2021, Coinbase saw operating costs that stood at $4.763 billion (WSJ, 2022). The increased operating costs reflected increased investments that might spell improvements for the industry. The 2021 figures are exponential when considering Coinbase’s operating expenses for 2020 stood at $869 million (WSJ, 2022). Most of the progress happened during the COVID-19 pandemic when most countries were on lockdown. The minimal physical businesses that occurred at the time led to increased digital engagements and renewed interest. With increased trade on cryptocurrency and even NFT, companies like Coinbase benefitted directly. The period during the pandemic marked a time when most companies that relied on the digital space for business grew. The time was known for technological increases, with companies such as Tesla, Facebook, Twitter, and Coinbase seeing marked improvements. These could reflect on the operating costs such as Coinbase’s. The result was that Coinbase used part of its funds on research and development, and it is necessary to assess the viability of the investments.

The Viability of the Research and Development Costs

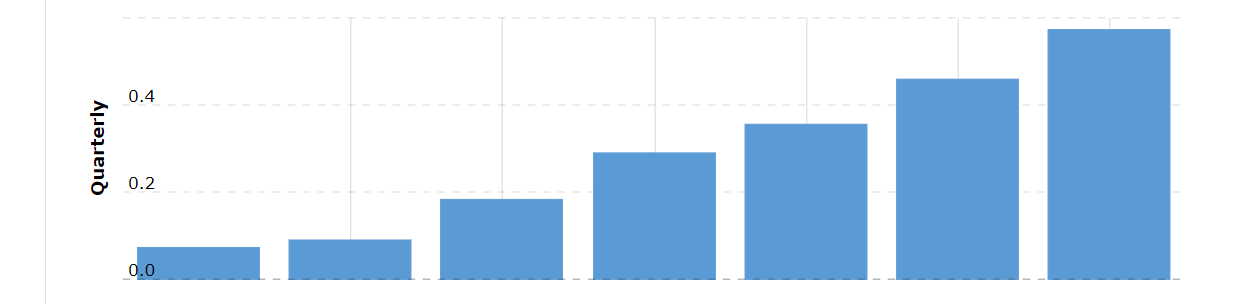

Coinbase prides itself in investing in research and development to improve operations and find new frontiers for investment and interest. In 2020 and 2021, Coinbase spent $272 million and $1.292 billion in research and development, respectively (Macrotrends, 2022). The increased spending on research and development sought to create new products that could be used to improve current services provided by the company. The graph below, created by Macrotrends (2022) revealed that Coinbase Global spent $571 million on research and development for the period ending March 31, 2022. The amount introduced concerns whether Coinbase can realize a viable gain from the investment.

Admittedly, Coinbase’s primary business relied on both cryptocurrency and NFT sales that saw reduced value, especially since February 2022. The increased selling of NFTs meant led a dip in Coinbase stocks. Kharif & Yang (2022) stated that Coinbase’s shares fell by 16% in May, and revenues for the first quarter reduced to $1.17 billion from the projected $1.48 billion. Taking this stand, it is evident that Coinbase will not realize a 7% increase in its earnings for the year 2022 to 2023 despite the high spending on research and development. Even when Coinbase creates successful products, it might gain traction in another financial year.

Conclusion

Thus, Coinbase NFT provided a platform to trade nonfungibles assets with unique characteristics. The spending on research development will not yield the projected 7% increased earnings due to a slump in both NFT and cryptocurrency sales. NFTs rely on blockchain, where sellers put contractual agreements when selling assets like virtual real estate. The increased spending on research and development did not guarantee a 7% increase in earnings since Coinbase should first recover from a drop in quarterly payments and transactions.

References

Bao, H., & Roubaud, D. (2022). Non-fungible token: A systematic review and research agenda. Journal of Risk and Financial Management, 15(215), 1-9.

Kharif, O., & Yang, Y. (2022). Coinbase sinks after warning the slide in volume to worsen. Bloomberg.

Macrotrends. (2022). Coinbase Global research and development expenses 2020-2022 | COIN.

Pinto-Gutierrez, C., Gaitan, S., Jaramillo, D., & Velasquez, S. (2022). The NFT hype: What draws attention to non-fungible tokens? MDPI, 10(335), doi: doi.org/10.3390/math10030335

WSJ. (2022). Coinbase Global Inc.