Countries of the world, especially the larger economies, are passing through one of the worst economic crises since the Great Depression of the 1930’s. The global forecasts according to the major world lending bodies like IMF, WB and other credit agencies are that this may take more time to stablise, since economic reforms and capital injections, fiscal cutbacks and monetary tightening need time to show results, especially since this crisis is of unprecedented scale and depth.

It is widely believed that growth rates, including GDP, balance of payments (BoP) and other economic indicators would come down, more so in the developed economies and with US having a large fiscal deficit, the signs of present imbroglio would take time, may be till 2010 or beyond, to show signs of abatement.

However, it is believed that growing economies like India, China and Japan would be able to recover faster and have a good but lowered growth rate in the future years.

The outlook says that the U.S. economy will fall by 1.5 %, the Euro zone by 2% and Japan by 2.5 %. India, China and other developing countries, though continuing to be resilient, will suffer setbacks. The IMF expects China to grow by 6.75%and India by just 5 %.

Present scenario

It is seen that the world economic order is passing through an unprecedented and acute economic and financial crisis, beginning 2007, caused primarily by the sub-mortgage interest crisis in US, currency fluctuations and failure of banks & major corporations which has caused a major debacle in the financial circles.

It is also seen that this cannot be perceived to be a sudden occurrence, but has been the culmination of factors, controllable and uncontrollable that has been in the forefront in most developed economies spawned and spurred by globalization, culture of free trade enterprise and heavy borrowings and lending by major banks and credit institutions without collaterals and control procedures.

The main fallout of this crisis has been equity falls, lowering of exchange rates, low demand for housing and consumption patterns severely curtailed.

The major concern has been that since the crisis surfaced in 2007, more than 5 million jobs have been affected in just the USA, and the figures are rising.

“In this climate, growth prospects for both high-income and developing countries have deteriorated substantially, and a movement of global growth from 2.5 percent in 2008 to 0.9 percent in 2009 appears to be in the cards. “ (Prospect for the global economy 2009).

Future outlook for Developed countries

It is seen that a lot of economic imbalances are affecting the global economies caused due to economic meltdown and the failure or economic slowdown in the economies of developed countries like UK, USA, etc. Although there have been Improvements in the economies of certain countries, still it is necessary that persistent imbalances need to be reduced and structural reforms instituted if fast recoveries are needed. Having said that, it is necessary to state that with a new government at the head in US, it is believed that a turnaround is expected that could greatly improve the economic situation of the country, and bring it on the road to recovery and on the fast track of growth.

It is believed that the crisis being one of a financial nature, would take much longer to end unlike a political or natural crisis. It is believed that the present crisis is even deeper and more significant than the Great Depression that swept the US during the 1930’s.

This is also because every major area of public accountability has been affected by the present catastrophe, including housing, insurance, employment, balance of trade and payment, currency valuation in global currency market, etc.

Therefore it is necessary that major financial remedies, like strong financial policies, lowering interest rates and stabilizing exports and currency need to be introduced.

Equity injections will have to be made into the economy and all kinds of subsidies and concessions allowed need to be reduced if not stopped.

The global outlook is that a financial calamity of this kind is unprecedented and whatever measure may be taken would have to be in sync with need of the hour and also in terms of bringing the economy back on the rails as fast as possible.

The Americas, Japan and European Union are predicted to fall into simultaneous recession, before progressive recovery sets in during the first half of 2009. Recovery for the group in 2010 is predicted on continued progress in stabilizing international financial markets, and melting of current freeze in credit. OECD GDP may fall by 0.1 percent in 2009 and revive to 2.0 percent in 2010.

The main concern would be that of bringing the core sector back on the rails, including housing and employment areas, which has suffered considerably during the present economic crisis. The failure of Lehmann Brothers and the not too bright position of the financial markets as such, have raised issues as to how long the present state could continue and whether the new government would be able to stimulate investments and make all round recoveries on the economic front.

“However, there are notable downside risks related to the potential for further intensification of the negative interaction between the real and financial sides of the economy: the housing sector could continue to deteriorate, further declines in asset values could increase insolvency problems for banks and further reduce credit availability, deflation could raise real debt burdens, and demand from other economies could fall more than anticipated.” (World economic outlook 2009, p.64).

It is seen that the present employment condition in the US is a major cause for concern having increased to 8.5% and since December 2007, it has touched 5.1M million.

This private asset falls has to be arrested, including that of housing sector and necessary stimuli need to be provided to banks to increase lending and securing loans from turning bad or doubtful for recovery.

From the graph provided below regarding household assets, liabilities and net

worth of four advanced countries of the world, it is seen that net worth has been rising in all these countries since 2002, and has only dipped during 2006/07, apparently, the fallout from the economic meltdowns that have affected the world.

Coming to liabilities, except for Japan and the Euro belt, liabilities have been falling in predominant countries like UK, USA.

Coming to another major aspect of evaluation of long-term viability of financial Institutions, it could be said that issues of profitabily and business models need to be carefully assessed before any action is taken. Once standards have been recognised for the suitable levels of capital that is needed to absorb future losses, capital injection into the corpus of banks with inadequate capital will have to be done fast, and public equities may also be utilised if required.

It is now believed that in developed counties the economic scenario has improved and by 2010, most of the issues that are now being faced, would either be surmounted, or eliminated.

It is seen that household balance could affect economic activity in many ways. The first aspect is the wealth effect, since loss in net worth could force consumers to cut, or arrest their spending propensities at par with cut in wealth. It is argued that even if home prices fall, the physical existence of homes is still there and the service and benefits which they provide still exist. The fall in prices cannot be taken as a permanent feature since it is quite possible that prices may rise again, as a consequence of increased economic activity, fall in interest rates, increase in housing demand, supply shortages, government’s promotion of the housing sector, etc. Thus, it is quite possible that areas where household balances need to be struck, and parity restored would be in terms of rising demands, lowering of housing interest rates, etc.

Yet It could be surmised that the loss of wealth could pave way for rise in the household savings and weaknesses in usage of consumer articles, especially in advanced economies like UK, US, EU countries, etc.

(World economic outlook 2009, p.69).

Emerging countries and developing countries

It is seen that the economic patterns of East Asian countries are different from those of Latin American countries and in the LA countries economic recovery may be slower and more pronounced compared with other developing countries.

Again, coming to the Asian belt, it is seen that, although Asian region had been relatively not directly a part of the US security assets programme, yet it has to be affected by the American meltdown, sine it affected most part of the globe.

Post September 2008, it is seen that Japan suffered a trade contraction of 12%, and in the case of Taiwan, Korea, Singapore, this figure could been higher at 10-25%. (World economic outlook 2009).

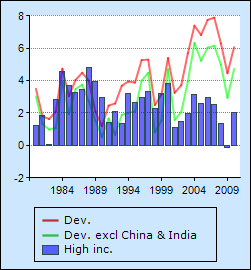

For developing countries, growth will be impacted by the OECD falls through depressed trade flows, dropping oil and non-energy commodity prices, as well as disruption to financial flows. Softer investment growth in 2009 is expected to reduce aggregate growth to 4.5 percent, down from 6.3 percent in 2008. Recovery in 2010 should follow that in the high-income countries, with growth rebounding to a 6.1percent pace. (Prospects for the global economy 2009).

Further, the good news is that the global forecasts for developing counties seem to suggest that the goal of reducing global poverty by 50% may be achieved by year 2015. This year’s poverty forecast marks a major change from the past in that consumption prices seem to be rising more than anticipated. The price surveys is suggestive of this fact.

The main aspect that needed to be addressed was the currency valuation which was falling since it was in many cases linked with UK and US currencies. With fall in exports and low imports, most developing and Third world counties needed to take acute measures to reduce their balance of trade deficit which was causing concern and loss of confidence in the money market.

The main aspects that need to be considered is also in terms of the fact that the Real GDP growth of developing countries like China, for instance has come down from 11. 6% in 2006 to just 8.5 % forecasted for 2010.

It is seen that the rate of GDP growth of developing countries is substantially lowering, in comparison with that of developed countries.

It is believed by the experts that growth in developing countries would come down from the 6.3% figures during 2007/8 to 4.5% during 2009.

Again, the denial of global capital markets to smaller and developing countries would severally affect their export prospects and also make them less competitive in global markets.

So also, the infrastructural aspects of international trade would reduce credit avenues for developing countries, make it more expensive and may also encroach into their margins in terms of increased servicing costs.

The main aspects that have hit developing countries are the fall in exports and revenue avenues. The sharp fall in energy prices has accentuated the crisis and made the current environment gloomier. According to the IMF, while all countries have been affected by the crisis, the economies of advanced countries will shrink, while those of developing countries will continue to grow, although at a much slower pace.

Advanced countries will witness their sharpest ever reduction since the Second World War: The U.S. economy will fall by 1.5 %, the Euro zone by 2% and Japan by 2.5 %. India, China and other developing countries, though continuing to be resilient, will suffer setbacks. The IMF expects China to grow by 6.75%and India by just 5 % in 2009. (Business 2009).

Conclusions

Thus, it is seen that the global outlook for developing and emerging economies may be comparatively slightly better than that of developed economies, in that the resilient nature of economy and the flexibility and mobility of their economies may impart a greater degree of flexibility in operations and ability to recover and recompense with measures to counteract economic crisis of the present kind.

Thus, it is seen that the economic prospects for developed and developing countries of the world would be that till 2010, the economic meltdowns would not abate fully, and even after that period, it would take more time for its indirect and direct effects to wear off. Thus, developing countries need to take strong and robust measures to protect their economies by reducing their interest rates, strengthening their currency in the global currency markets, boost exports, especially to trading partners and seek ways and means to lower the impact of global economic downscaling though appropriate economic, financial and fiscal measures.

References

Business 2009, The Hindu, 2009.

Prospect for the global economy: outlook summary 2009, The World Bank.

Prospects for the global economy: forecast summary 2009, The World Bank.

Prospects for the global economy: global economic prospects 2009: commodity markets at the crossroads 2009, The world bank.

World economic outlook: crisis and recovery: the United States is grappling with the financial core of the crisis 2009, World Economy and Financial Surveys.

World economic outlook: crisis and recovery: what are the likely effects of household balance sheet developments in the current circumstance 2009, World Economy and Financial Surveys.

World economic outlook: crisis and recovery 2009, World Economy and Financial Surveys. Web.