State of Economy

Japan has been known as one of the countries with the most advanced economy and the best-developed entrepreneurship. In 2017, Japan’s GDP reached $4.873 trillion, which made it the world’s third most economically prolific country in the world (Central Intelligence Agency). Similarly, other economic indicators have proven that Japan’s economy is on the rise, with unemployment rates having dropped from 3.1% in 2017 to 2.9% in 2018 (Central Intelligence Agency). The inflation rate has risen slightly (from -0.1% to 0.5%), whereas the retail sales have dropped to a greater extent (from -2.10 to -2.90) (“Japan Retail Sales”). In turn, the interest rate has been at the 0.1 mark for several years, with the further changes being unlikely (“Japan Interest Rate”). However, while the current rates of the economic development place the Japanese economy at the third spot in the global ranking, there are certain issues about which the Japanese government should be concerned, namely, the deflation caused by the economic bubble of 1989.

Export Analysis

The current state of Japanese import is rather stable, especially in regard to its relationships with Canada (“Report – Trade Data Online”). The observed trend is quite expected Japan’s natural resources are rather restricted due to its specific geography and location. Therefore, constitute the bulk of the current import from Canada to Japan. Most of the export belongs to the brand names of Toyota and Mitsubishi.

Table 1. Export (Canada to Japan) (“Report – Trade Data Online”)

As the table above shows, Japan has been extraordinarily prolific in its car manufacturing industry, as well as its relationships with foreign customers. The extent of export has been growing consistently, in no small measure due to the rise in the automotive industry. As the table above shows, the amount of products needed for sustaining the industry, including copper ore and coal briquettes, is quite ample. Similarly, raw cobalt and nickel, which are also used in the automotive industry, have been imported from Canada to Japan in rather substantial amounts.

However, apart from the supplies required to sustain Japan’s transportation industry, Canada’s import to Japan also includes wood and packaged medicaments. The specified trend can also be explained by the scarcity of natural resources in Japan caused by its specific geography. It is also noteworthy that the rate of importing from Canada to Japan has increased significantly for some products, while having dropped for others. For example, there has been a continuous and quite tangible trend with food exports from Canada to Japan, which is similarly explained by the scarcity of food resources in the latter. Apart from its location, the devastating effects of WWII are still echoing in the Japanese economy, which defines the need to utilize the support and food resources provided by other states. Canada, in turn, can be described as quite prolific in its food industry due to the vast range of the relevant resources and the capacity to produce assorted types of food (Welch 446). Therefore, the food exports from Canada to Japan have been growing increasingly.

Arguably, the extent of food exports from Canada to Japan could use more explanation since the population growth rate in the latter has been on slight decline recently. According to the available statistical data, the population decline of Japan has been barely noticeable yet consistent over the past decade, which is mostly attributed to the phenomenon of population aging (Katagiri 18). As the average life expectancy of Japanese citizens increases, the percentage of newborns has been dropping, leading to the aging of Japanese society (Welch 447). The propensity toward population aging has defined the type and number of products that Japan currently needs to import to a significant degree.

The need for coal briquettes has also been systematically growing in Japan. While the need to transfer to a more sustainable type of fuel and environmentally friendlier sources of energy has become more apparent recently, a significant part of Japan is powered by the energy obtained from coal (Tabuchi). Furthermore, the trend for Japan to import coal is expected to be on the rise in the nearest future based on the recent announcement made by the Japanese government: “a coal-burning power plant, part of a buildup of coal power that is unheard-of for an advanced economy” (Tabuchi par. 1). According to the latter, there are plans to build a greater number of coal plants to produce more energy and, thus, the increasing need for more coal to be imported from Canada (Tabuchi).

However, there is another trend in the current picture of the Japanese import from Canada, which has been enhanced to a considerable extent by the increase in the influence of innovative technology and the recent scientific breakthroughs. Namely, the demand for medical instruments and the related devices is a signifier of a change in the Japanese approach toward managing health concerns. In addition, the trend in purchasing a greater number of medical instruments overseas, specifically, from Canada, aligns with the tendency toward population aging in Japan described above. While the general health rates are impressively high in Japan, the health-related needs and concerns of aging people require improved quality of healthcare and more effective tools for diagnosis and treatment. Thus, the need for imported medical tools and instruments of the highest quality emerges.

Another peculiar trend in the export from Canada to Japan includes pork, the demand for which has been increasing steadily but surely. At first glance, the observed situation is not quite surprising since pork constitutes a crucial part of a range of traditional Japanese dishes and, therefore, is frequently requested by buyers. However, it is worth remembering that a range of Japanese farmers also grow pigs to sell them on local markets (Tabuchi). Therefore, the rise in demand for pork raises the question of whether Japanese citizens refuse to support local farmers or whether the current rates of farming are not enough to satisfy the demand for pork.

Currency Analysis

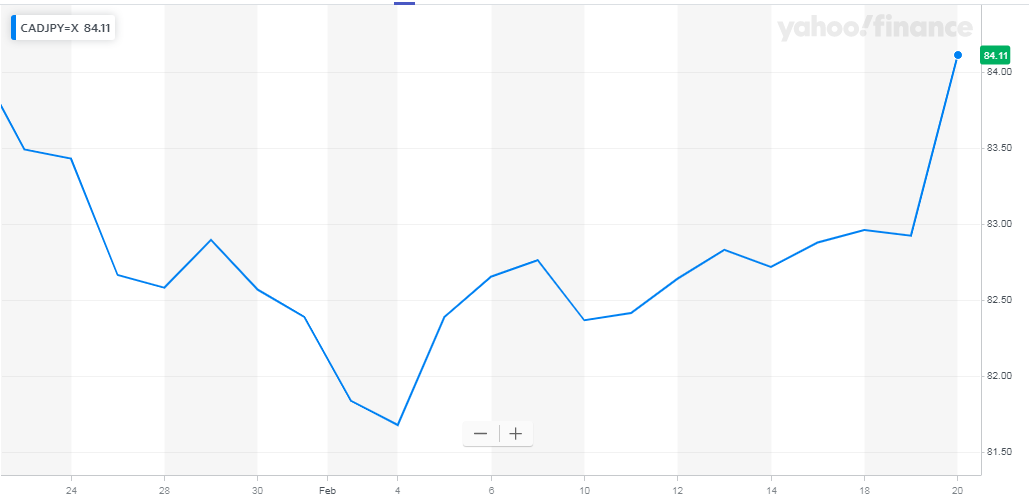

Another important characteristic of the economic development observed within a state concerns changes in its currency rate. In Japan, yen is used as the national currency, with one yen being equal to roughly $0.009 (Belke and Volz 41). The stated number represents the evidence of a gradual yet noticeable decline in the value of a yen as the Japanese currency (Belke and Volz 4). As Figure 1 shows, the monthly changes in the exchange rate for yen are quite unstable, with the beginning of February showing a gradual decline in the value of the currency, and the second half of the month representing a quick rise in its value from 81 to 84 yen being equal to one dollar. While the specified leap might not seem as important in the grand scheme of the relationship between the Canadian dollar and the Japanese yen, it is still representative of the lack of stability in the Japanese currency market.

The observed trend of the Japanese yen first dropping in value and then gradually increasing aligns with the fiscal deficit and the desperate attempts of the Japanese government to stimulate the state’s economic performance by using artificial catalysts. According to Belke and Volz, the phenomenon of negative yen recessions can be clearly observed in the fluctuations of the yen exchange rate since 2008 when the infamous crisis hit Japan (3). Therefore, the uneven development of the exchange rate is a quite expected phenomenon under the specified circumstances in Japan. The chart above shows that the exchange rate of yen has dropped sharply recently as the Canadian dollar increased in value (see Figure 1). Indeed, there have been issues with the management of the dropping rate of the Japanese currency recently, which has not led to any tangible results.

The reverse correlation between the Japanese yen and the market stock prices is another issue to be discussed. According to recent reports, the opposite connection between the specified variables is explicit since the stocks have ben systematically moderate in their value while yen plummeted down and its exchange rate became increasingly worse (Hughes). According to the assessment performed by Hughes in 2018, the described situation mirrors exactly what Japan has been undergoing since the infamous recession of 2008:

“You’ve had a lot of people come in and buying the Topix via leveraged ETFs [exchange traded funds] — and hedging that,” says Nicholas Smith, Japan strategist at CLSA. “Now with the Topix falling they’re dumping those bets and those hedges — and buying back yen in the process. (Hughes)

Therefore, the current problem can also be blamed on the inefficient use of hedging where it should not have been deployed in the first place, leading the country to further economic stagnation. However, the reverse correlation located between market stock prices and the exchange rate of yen suggests that a strategy for handling the crisis can be located and employed correspondingly. Namely, export led growth can be pursued as a possible solution.

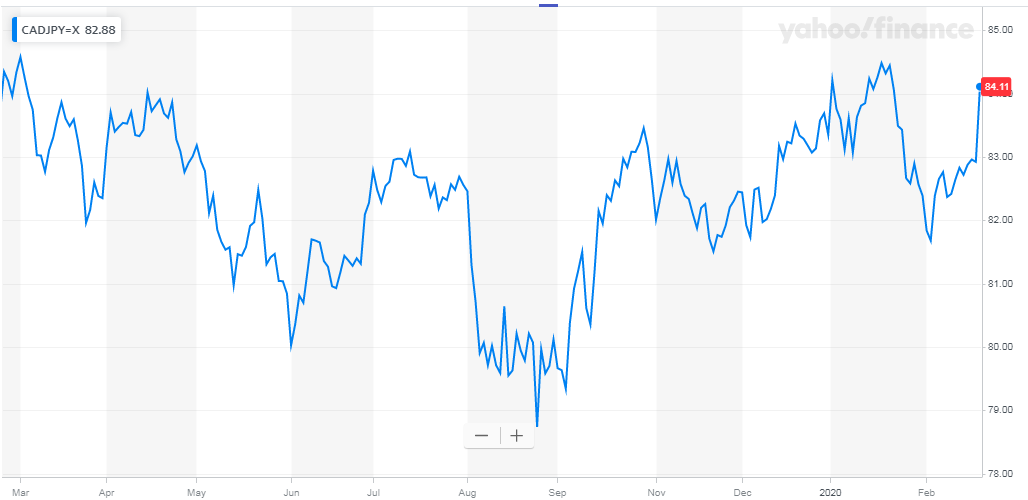

A similar trend in the Japanese yen showing the lack of stability in its fluctuations in connection with the Canadian dollar can be observed when comparing the changes that took place the past year. In fact, on the annual scale, the fluctuations of the Japanese currency turn out to be even harsher, with abrupt shifts from an increase in its value to an equally sharp decline. The described peaks and valleys are representative of the outcome of the financial crisis mentioned above and the attempts of the Japanese government to amend the situation artificially.

One could argue that the charts represented above signify a step forward in the management of the challenges that the Japanese economy has been suffering recently. Reports published recently claim that the present state of the Japanese economy represents a much healthier policy and a significant improvement (Hughes). For instance, according to the analysis published in Forbes in 2019, the actual situation is significantly more nuanced: “The Japanese economy today is arguably healthier than it has been in over a decade, with annual GDP growth averaging 1.3% since 2012, again according to the IMF, double the 0.63% average in the previous decade” (Hedrick-Wong). Therefore, the wavering exchange rate of the Japanese yen compared to the Canadian dollar can be explained as the aftermath of the previous long-term economic recession and is not representative of the current attempts at managing the financial problems.

Nevertheless, a more recent assessment of the scenario observed in Japan shows that the state’s economy is currently flagging and is at a place of high uncertainty. For instance, the increase in the VAT rate in Japan is very untimely and is likely to lead to detrimental outcomes (Inman). Inman also suggests that the utilization of hedging in the management of financial resources is the main reason for the exchange rate of yen not to plummet immediately but, instead, move in zigzags. According to Abdel-Khalik, hedging is:

A method of reducing the risk of loss caused by price fluctuation. It consists of the purchase or sale of equal quantities of the same or very similar commodities, approximately simultaneously, in two different markets, with the expectation that a future change in price in one market will be offset by an opposite change in the other market. (Abdel-Khalik 109)

Therefore, the application of hedging is believed to be one of the main factors that shape the exchange rate of the Japanese yen. In turn, Hughes quotes Mitul Kotecha, who convinces that the correlation between the use of hedging and the distorted nature of the yen exchange rate is not to be ignored: “’Everyone is talking about huge, huge outflows. But we think they’re increasingly being hedged and that’s limiting their effect” (Hughes). Consequently, it is fair to suggest that there a pressing need to determine the exact correlation between the application of hedging strategies to the Japanese financial market and the deviations from the norm observed in the jen exchange rate.

Overall, the assessment of the fluctuations in the exchange rate of yen points to the increasing weakness of the currency in question in general, and in relation to Canadian dollar, in particular. The specified issue raises the concern of whether the strategy geared toward the reinforcement of the currency is legitimate given that it will entail a drop in the market shares value. Thus, the next step that needs to be undertaken in order to amend the situation in Japan is to enhance the performance of its key companies. Thus, japan will be able to secure its place in the global economy and focus on the strategies for addressing its export and import issues.

In addition, it will be necessary to assess the competitiveness of yen by industry to create a map of the problematic areas in the current landscape of the Japanese economy. Thus, the Japanese government will be able to use the identified assets of the state to the benefit of entrepreneurship and economy, simultaneously taking time to address the weaknesses that hamper the Japanese economic progress.

Implications for Trade

The current trend within the Japanese economy has direct and rather unfortunate implications for trade. The uneven exchange rates and the issues related to the export and import of crucial products define the choices that Japanese authorities make in regard to trade with Canada. Overall, the current implications for trade include a possible drop in the amount of imported products and the likely chance of quality reduction in the exported goods. Since the specified alterations will affect the Japanese economy even more adversely, a change in the choice of investments and the further development of China’s leading industries, including the automotive one, is likely to occur.

Export

Since Japan is presently in a very conflicting economic situation that is highly likely to hamper its further progress, the existing export endeavors are quite scarce. As explained above, with the automotive industry being one of the highlights of Japanese entrepreneurship, vehicles and vehicle parts are likely to constitute the basis of exports from Japan to Canada in the future. While Canadian car manufacturers have quite a lot of competitors in the Canadian market, including American car producing organizations, the properly set quality to price ratio may help Japan to handle the situation and gain the competitive advantage needed to remain a powerful figure in the Canadian automotive market.

Import

The conflicting nature of the present situation in the Japanese economic setting requires the consistent inflow of products and materials for sustaining the performance of Japanese organizations. However, with the intermittent progress of Japanese exchange rate, the financial opportunities for purchasing the necessary raw materials and products overseas may be shrinking for Japan. Consequently, the model for export relationships with Canada will have to be based on careful and thorough considerations of the weaknesses of the Japanese economy. For instance, the recent decision to boost the levels of export by cutting the yen price could be seen as a temporary solution, yet more drastic changes are currently required for long-term improvements.

The described forecasts are justified by the long-lasting relationships between Japan and Canada. Taking introspect into the history of their economic and diplomatic ties, one will discover that Canada and Japan are bound by the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) along with four other countries (namely, Australia, Mexico, New Zealand, and Singapore) (Government of Canada “Canada-Japan Relationships”). CPTPP was expected to encourage closer connection between Western and Asian pacific states, with quite substantial success. However, the restrictions that the present regulations impose on the participants of the agreement may lead to dire outcomes for Japan unless its attempts at improving the state economy turn out to be effective.

In addition, when discussing the current financial and economic situation in China, one will need to touch upon the possibility of the repatriation of profits. Defined by Beatty et al as the scenario in which “an investing company pulls its earnings out of a foreign country and takes it back home,” the concept of profits repatriation implies the opportunity to avoid a financial collapse and, thus, prevent an economic crisis from unraveling (Beatty et al. 221). The use of profit repatriation can be considered the ultimate measure that should be applied when no other tools for keeping the state economy afloat cannot possibly be utilized. Indeed, depending on the specifics of the contract signed with the recipient of investments, the option for using profit repatriation may not be available on a regular basis, which is why the application of the said approach can be viewed as the decision taken when other strategies for business recovery are impossible.

In the context of Japan and the problems that it has been having with importing products from Canada and exporting them to it, the use of profit repatriation may become a grim necessity given the observed signs of economic recession. In addition, when considering the idea of profit repatriation as the means of holding the state economy together, the Japanese government will have to take the side effects of their decision into consideration. For Japan, the repatriation of profits from Canadian organizations with which Japan businesses have ties will imply several major consequences. The disruption of economic and business partnerships is on of the major concerns that needs to be remembered since it will have direct outcomes in the future. Once profit repatriation is utilized with Canadian companies, the latter may become unwilling to collaborate with Japanese organizations in the future. The described outcome concerns not only the firms that will use the repatriation of profits as the means of escaping bankruptcy but also Japanese business, in general, thus depriving other Japanese organizations o potential partnerships with Canadian entrepreneurship. Given the vast opportunities that collaborating with Canadian organizations provides for the Japanese business currently, taking the described step will jeopardize Japan’s future success.

In addition, when considering the repatriation of profits as the possible leeway in managing the risks associated with financial losses, Japanese entrepreneurs should keep in mind that the Canadian repatriation tax rate is quite high (Inman). While the Canadian government has been trying to introduce more lenient standards for foreign companies that collaborate with Canadian organizations and use their investments, the current legislation restricts the opportunities for Japanese businesses to save money when using the repatriation strategy as the means of avoiding large risks (Abdel-Khalik). Therefore, the tax issue presently poses a major impediment for Japanese companies in regard to the management of the financial risks within the Canadian investment market.

However, at this point, the specifics of the economic collaboration between japan and Canada needs to be addressed. While the tax issue is likely to become a major source of discord in case Japanese entrepreneurs decide to cease their performance in the Canadian market, the existing regulations may alleviate the negative consequences for Japanese entrepreneurs. The Canada-Japan Income Tax Convention signed in 1986 and amended in 1999 states that both parties should be protected from unfair use of the existing regulations and, therefore, provides an opportunity to reduce the impact that the current Canadian taxation system will have on Japanese companies. According to the regulation, “The profits of an enterprise of a Contracting State shall be taxable only in that Contracting State unless the enterprise carries on business in the other Contracting State through a permanent establishment situated therein” (Government of Canada). Thus, while the regulation does not specify the details of the repatriation tax, it implies that all business parties involves must follow a rigid set of rules aimed at reducing the probability of fraud or tax evasion.

Summary

The present-day state of the Japanese economy leaves much to be desired since the state is still recovering from the recession that it witnessed in the late 2000s. Therefore, the national currency rates have been fluctuating quite noticeably and showing the clear lack of stability within the state economic system. While the Japanese government has been making efforts to control the situation and implement damage control, very little effect has been produced so far. Nonetheless, the levels of export and import remain roughly the same, which indicates that Japan is ready to continue its relationships with Canada. However, due to the challenges linked to the financial disturbances within the state, it is critical for the Japanese government and business owners to be wary of the economic and financial risks associated with the Canadian market. Since some of the projects may not return the profits that they are expected to bring, some of the investments will have to be rejected, which will entail the payment of retribution taxes according to the Canadian law.

Therefore, reinforcing the role of economic standards and legal regulations is critical for Japan present. By using the set of standards that the specified regulation system offers, one can guarantee that the needs of Japanese entrepreneurs are met fully and that the issues concerning investments and the related concerns are resolved.

Conclusion

The economy of Japan has sustained quite a substantial amount of damage over the past decade due to the economic collapse that occurred in the 2000s, as well as the failed attempts of the Japanese government to revive the economy. As a result, the current performance of the state’s business organizations leaves much to be desired as very few leaders dare to take the risk and invest in the enterprise that may turn out to be a financial failure. As a result, the state has not been attempting at experimenting with the products that it exports to Canada and imports from it. The described strategy, while being very safe and cautious, allows Japan to maintain its automotive industry running and delivering the revenues of the expected rate.

For this reason, it will be necessary to revisit the principles that the 1994 act set as standards. Specifically, it will be necessary to pay closer attention to the implications of the tax-related requirements, which will define the extent of opportunities that Japanese companies can expect when attracting investors from Canada.

In addition, the approach toward importing and exporting products, Japan will need to shape its relationships with Canada and its market. While the automotive industry has to be kept afloat so that Japan could export its manufactured vehicles and vehicle parts to Canada, it will be necessary to reduce the expenses taken to import and export products. The specified change can be achieved by altering the supply chains created by Japanese organizations.

Moreover, with its automotive industry being at the forefront of the country’s economy, the increase in demand for metal and, specifically, copper and aluminum, as well as coal, is expected to happen in the nearest future. The implications for import are quite evident, with the demand for coal along with copper and aluminum increasing exponentially. As a result, Japan will need to reinforce its relationships with Canada as one of the main sources of the specified products and the most advantageous price-quality correlation. Along with coal as one of the main sources for fuelling the production, Japan will also require a greater amount of wood to be imported from Canada. Namely, wood pellets as the essential source of energy to power Japanese manufacturing plants will be needed in greater quantities. Therefore, the focus will have to be kept on obtaining sustainable resources.

As for the exporting options, Japan is likely to continue to provide Canadian customers with vehicles and vehicle parts since car manufacturing constitutes the largest portion of the country’s GDP. Arguably, one could state that Japan may need experimenting with its export potential since its economy requires an immediate revival. However, changing the current framework for managing its economic relationships may cost Japan a massive amount of financial resources. Unless Japanese entrepreneurs locate the opportunity that will guarantee an immediate success, further economic downfall will inevitable. Due to the losses that Japan has suffered in the 2000s, risking to invest in the ventures that may turn out to have no potential is something that the government and entrepreneurs cannot afford. Therefore, following the set course for the enhancement of the automotive industry should be regarded as the most beneficial opportunity.

Works Cited

Abdel-Khalik, A. Rashad. Accounting for Risk, Hedging and Complex Contracts. Routledge, 2013.

Beatty, Jeffrey F., Susan S. Samuelson, and Patricia Abril. Business Law and the Legal Environment. Cengage Learning, 2018.

Belke, Ansgar, and Ulrich Volz. “The Yen Exchange Rate and the Hollowing out of the Japanese Industry.” Open Economies Review, 2020, vol. 1, no. 1, pp. 1-36.

Central Intelligence Agency. “Japan.” CIA.gov, 2019, Web.

Government of Canada “Canada-Japan Relationships.” CanadaInternational.gc.ca, 2019, Web.

Government of Canada. “Convention between the Government of Canada and the Government of Japan.” Canada.ca, Web.

Hedrick-Wong, Yuwa. “Japan’s Richest 2019: Why Country’s Zombie Economy Is Finally Staggering Back To Life.” Forbes, 2019, Web.

Inman, Phillip. “Japan’s Economy Heading for Recession, and Germany Wobbles.” The Guardian, 2020, Web.

“Japan Interest Rate.” TradingEconomics.com, 2020.

“Japan Retail Sales.” TradingEconomics.com, 2020.

Katagiri, Mitsuru. “Economic Consequences of Population Aging in Japan: Effects Through Changes in Demand Structure.” The Singapore Economic Review, 2018, vol. 1, no. 1, pp. 1-23.

“Report – Trade Data Online.” IC.GC.ca, 2020, Web.

Tabuchi, Hikoro. “Japan Races to Build New Coal-Burning Power Plants, Despite the Climate Risks.” New York Times, 2020, Web.

Welch, David A. “It’s Time to Think Boldly about Canada–Japan Security Cooperation.” International Journal, vol. 74, no. 3, 2019, pp. 445-452.