Introduction

When entrepreneurs decide to engage in futures investments, they must remember that it is always a risky business. The initial cost of buying a contract always changes, so it is difficult to guess whether the purchase will be profitable or not, and will bring only losses. However, using a mathematical apparatus, one can analyze and predict the ups and downs of the price to realize the transaction’s profitability. In this example, it was studied the purchase of a CME EUR contract as of July 26, 2020.

Main Discussion

First of all, it is essential to admit that the contract value is not a permanent number, and it is subject to probability fluctuations. As of July 26, 2020, 5:15 PM, the value of such a futures contract was 1.1670. According to the condition of the task, it must be assumed that this value is an opening price. In addition, the text of the task gives an idea of what price fluctuations are expected during the first three days. Knowing the fluctuation values, it is necessary to calculate the final price for each day, and only then calculate the changes in the bond account, as well as the bond account balance after the third day.

On the first day, the price change was observed at the level of +1% to the open value. Then the value after the first day is calculated by the formula:

In order to calculate the closing price, it is necessary to know the initial and closing price, in addition to the contract size of the futures which equal to 125,000 Euro.:

Similar calculations are given for the second and third days. Then, calculations for the second day:

And for the third day:

For ease of perception of information, the results of calculations are entered into a general table:

Table 1. Summary of information and fluctuations in the balance on the performance bond account:

Or in single line:

As seen from the above data, the final result after three trading days will be five times less than the initial balance. In other words, this situation seems to be extremely optimistic — an entrepreneur, investing money from a performance bond account into buying a futures contract, after three days, found themselves in a losing position. To restore the original balance, they will have to add their funds (Chen, 2019). It is important to remember that futures are traditionally understood as a buy/sell transaction, which guarantees that after some time the seller will sell the goods at a set price (Chen & Scott, 2020). In this type of speculation, there are always two outcomes — if the real value of the goods increases, the entrepreneur will be in the plus, because they bought it for a fixed price. On the contrary, if the value of the goods decreases over time, the buyer will be in the negative because they bought the goods at an increased price.

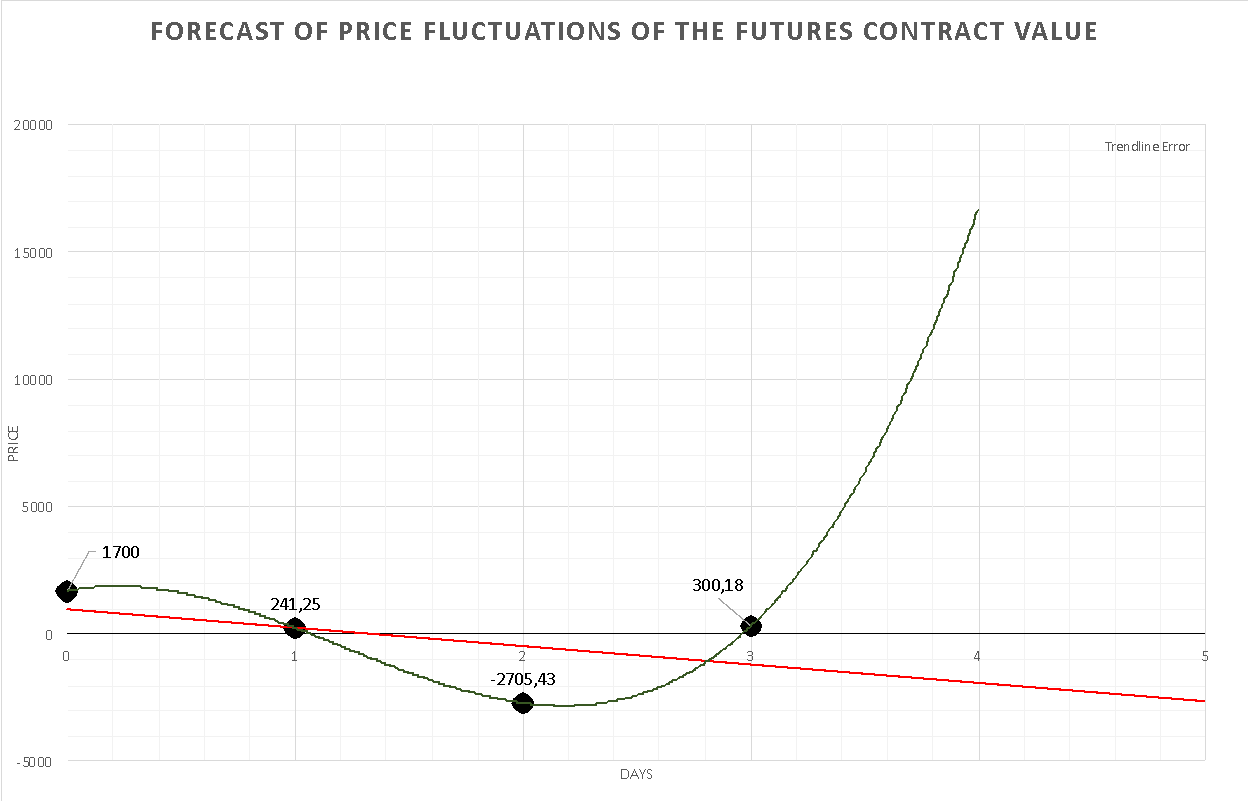

In the case of CME EUR, it is crucial to admit that a price fluctuation in three days gives an unpleasant result for the entrepreneur. However, it is essential to realize that the price is not constant and, as it was seen from the task, is continually changing. Thus, if one uses linear regression for the forecast, one can see a general negative trend in the contract value. Nevertheless, it should be remembered that the use of the linear model does not give reliable results for financial fluctuations, so it is more reasonable to use the polynomial function to study the price development. Without considering external factors of influence on the value, but based only on the trends, one can conclude that on the fourth and fifth days, the final balance on the performance bond account will exceed the initial investments.

For futures trades, it is important to investigate two scenarios — short position and long position. Long positioning implies that the value of securities is expected to rise in price soon (Chen, 2020). In this case, the following formula is typical for the calculation:

Therefore, within three days, long results are better than short positioning.

Conclusion

To buy futures contracts, it is essential to calculate financial investments and analyze the market situation correctly. In this example, the case of purchasing a CME EUR contract was investigated at the initial price of 1.1670 at the performance bond account of 1,700.00 and the contract size of 125,000.00. As the calculations showed, during the first three days, the account balance fell rapidly to 300.18. The fall was not smooth but instead experienced a periodic trend. In order to make up the initial balance, the entrepreneur will have to add additional funds to the account to make up the initial balance. However, the use of polynomial regression models for forecasting gives positive results for the next two days.

References

Chen, J. (2019). Short (short position). Investopedia. Web.

Chen, J. (2020). Long position (long). Investopedia. Web.

Chen, J. & Scott, G. (2020). Futures. Investopedia. Web.