Introduction

High inflation is considered a severe problem for many national economies, and there are several reasons for it. It takes place when the prices grow, and the purchasing power of money decreases. According to Sloman and Garratt (2013, p. 203), it is calculated as “the percentage increase in CPI over the previous 12 months.” When inflation rates grow, people are able to buy less, so the GDP decreases. Moreover, during the increase in inflation, businesses cannot manage the prices and predict the purchases. However, too low or negative inflation rates are not the most desirable scenario. That is why the nations try to keep the rates steady and moderately low to support sustained economic growth.

Aggregate Demand and Supply Model and Inflation

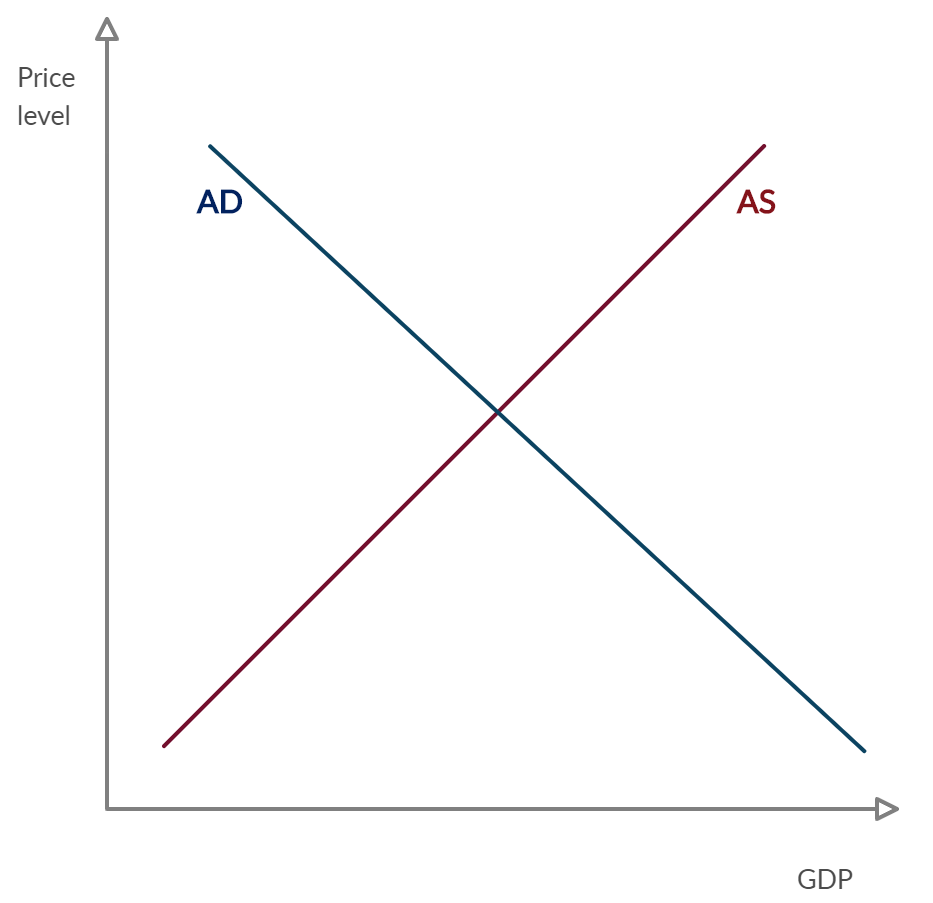

Inflation has a major impact on GDP as the decrease in purchasing power leads to its drop. The way it influences the growth of national output can be explained through the model of aggregate demand and supply (Figure 1). The demand curve (AD) has a sloping down shape as it demonstrates how the decrease in purchasing power due to high prices affects the GDP. Inflation also influences the aggregate supply (AS) level, which increases with the rising prices.

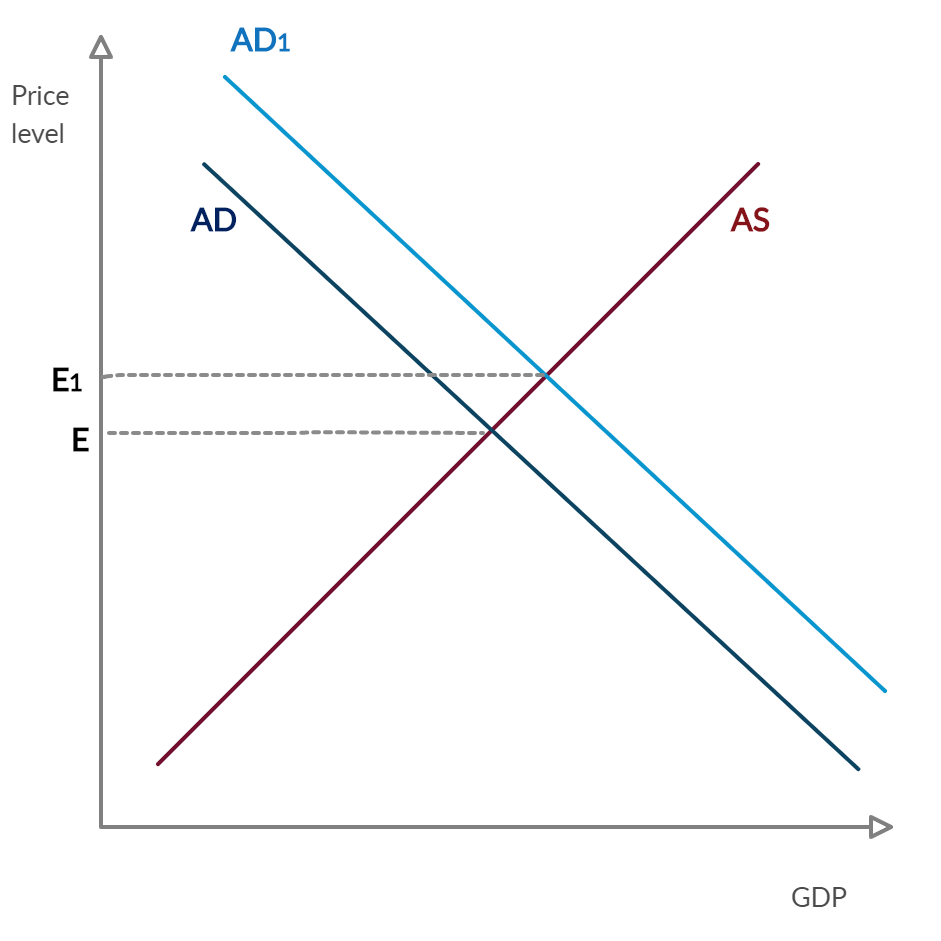

When demand-pull inflation takes place, the aggregate demand (AD1) increases (Figure 2). The curve shifts to the right and the equilibrium price rises, going from E to E1. Although the growth of prices is a negative moment as it diminishes purchasing power, the increase in demand (AD1) is responded with the growth of supply. As the model demonstrates, the rise of supply results in growing national output and thus to economic promotes growth.

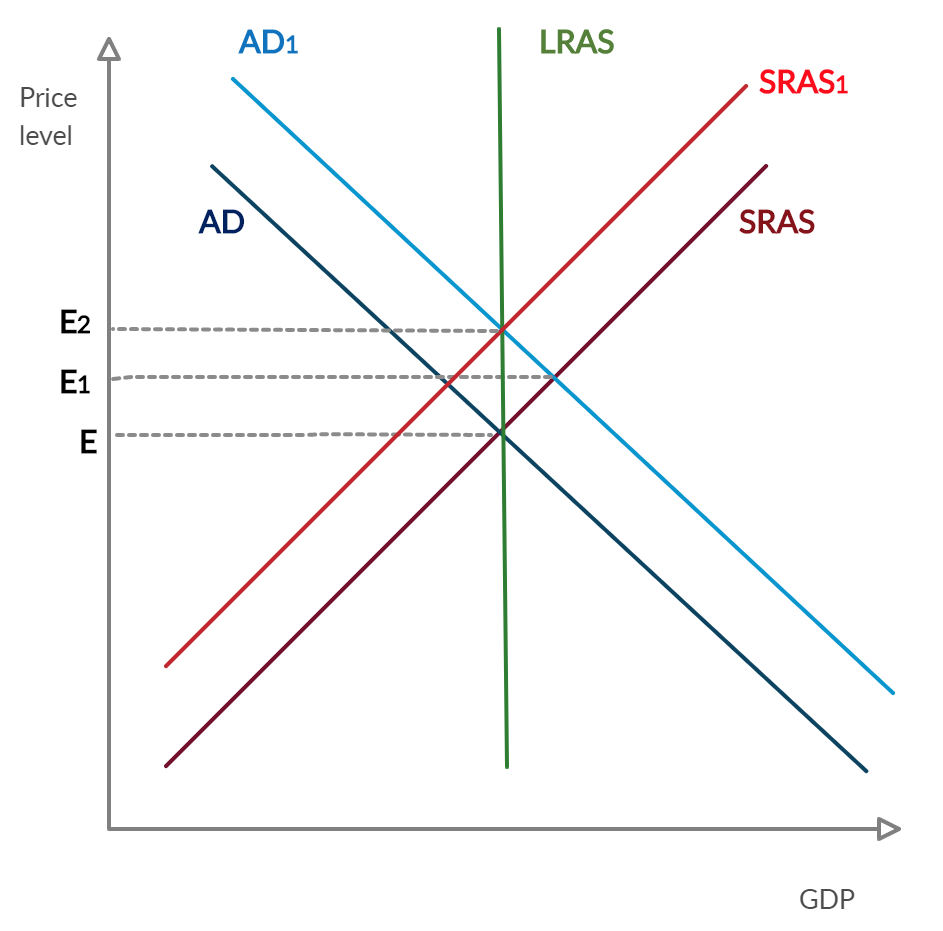

Nevertheless, the mentioned above model explains the short term reaction of the supply. According to Sloman and Garratt (2013, p. 232), “a rise in aggregate demand is likely to lead to a rise not only in GDP but also in prices.” During the more extended periods, national economies are regulated by market forces. The long-run aggregate supply (LRAS) is a vertical line that demonstrates how the changes happen (Figure 3). The short-run AS (SRAS) remains unresponsive for a limited period and gives only a temporary rise of the national output. In practice, it is followed by an increase in supply (SRAS1) that results in rising prices with no positive influence on the long-run output level.

Critical Analysis of Low Inflation

Although inflation harms the economy, many countries still try to maintain a low but positive rate. For example, the target level of inflation in the UK is set at 2% (Bank of England, 2019). According to the Bank of England (2019), any deviation of more than 1%, either positive or negative, will cause serious concern and result in an investigation. The reason for such policies is that investments and price expectations are critical factors of economic growth. When consumers or businesses expect an increase in prices, they tend to purchase immediately, giving a necessary boost to the market. On the contrary, when they predict a decrease in the price level, they postpone their activity, slowing down the economy. Sustained steady inflation is key to economic growth that enhances prediction, planning, and investments.

Conclusion

High inflation rates have an adverse effect on the GDP, decreasing the purchasing power of money and leading to a drop in national output. However, moderate inflation levels should not cause fear, as they are vital for the steady growth of the national economy. If the prices are growing slowly and steadily, with no rapid shocks, the investors can make their predictions, and customers tend to spend more, giving rise to the economy.

Reference List

Bank of England (2019) Inflation and the 2% target. Web.

Sloman, J. and Garratt, D. (2013) Essentials of Economics. 6th edn. Harlow, UK: Pearson.