Strengths

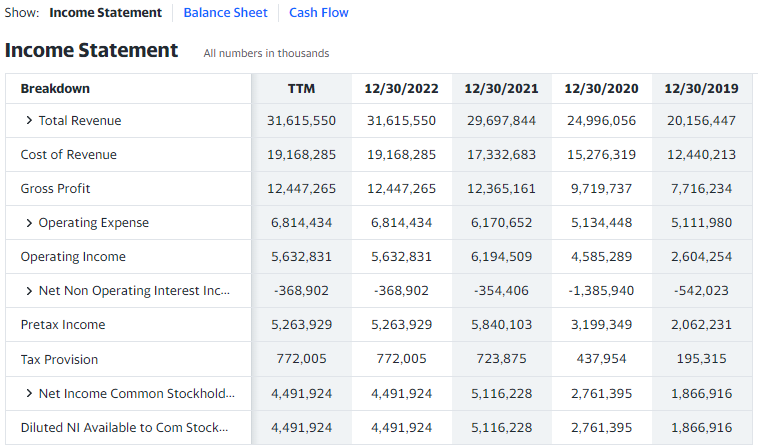

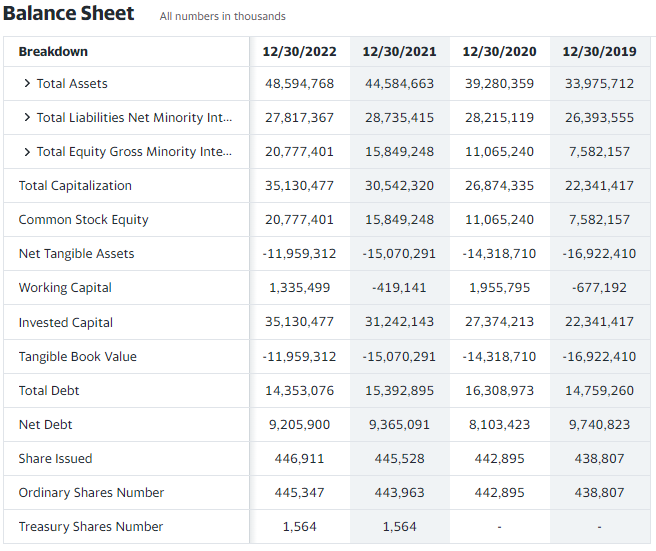

Netflix’s primary strengths include its brand value, focus on customers, and global scope of influence. Over the years, the company has established a highly loyal fanbase in many countries by providing video services of the highest quality and using an effective regional pricing strategy (“The remarkable Netflix,” 2022). Consequently, Netflix produces a significant amount of original and interactive content, which is only available on the platform (“Inside Netflix’s content, 2020). Lastly, the company demonstrates high levels of adaptability by constantly adjusting to new industry standards and rapidly changing customers’ preferences (De Silva, 2022). As a result of these intelligent strategies, Netflix has achieved the dominant position in the video streaming market and solid financial performance (see Figure 1 and Figure 2).

Weaknesses

Netflix’s major weaknesses include its vulnerability to copyright regulations, a lack of pricing customization, and debatable decisions concerning service availability. Although the company has multiple original shows, the majority of the content is copyrighted, leading to legal risks and less overall profitability (Parker, 2022). Moreover, the company has recently made a number of ambiguous decisions regarding service availability, which damaged brand value and the reputation of a customer-oriented company. Namely, Netflix substituted its password-sharing policy with a costly alternative, and thousands of people criticized this decision online (Solsman, 2023). Reputation damage is one of the most significant potential weaknesses due to Netflix’s reliance on its brand value and customer-oriented services for product differentiation.

Opportunities

Netflix’s primary opportunities include collaborations/partnerships, a focus on innovative technologies, and the expansion of pricing strategies. The company has achieved notable success through associations with relevant companies, such as Nike, to pursue shared objectives and attract new customers (Stern, 2023). It is plausible to continue this approach and initiate more partnerships to expand the company’s scope of influence. For instance, collaboration with research & development (R&D) organizations is helpful for testing innovative technologies and their applications in streaming services. Lastly, Netflix can improve its pricing customization options to attract more viewers or collaborators. For example, the implementation of advertisements on several subscription plans is beneficial both for customers and investors (Pallotta, 2022). As a result, the company has a large number of opportunities to grow in the market.

Threats

Netflix’s primary threats emerge from the high competitiveness in the video streaming market and piracy complications. At present, multiple competitors, such as HBO, Amazon Prime Video, Disney+, YouTube, and Vudu, continually improve the quality of their services and implement innovative solutions to attract more customers (Parker, 2022). This development provides significant risks for Netflix and saturates the market. In this sense, it is possible that another company will achieve an advantageous position in the sector, depending on its product differentiation and marketing strategies (Parker, 2022). Additionally, piracy presents immense challenges in the video streaming industry, and Netflix loses billions of dollars annually due to this threat (Parker, 2022). The complete SWOT analysis is presented below in Figure 3:

Critical Issues

Among the examined issues, the most critical ones include the policy-making that might harm the brand value and dense rivalry in the industry. As mentioned before, Netflix’s most notable advantage is its positive reputation associated with its focus on customers and high-quality services. However, if ineffective management and decision-making obstruct this strength, it will become a critical issue that might result in significant changes in the market. Customers might start looking for alternatives and switch to Amazon Prime Video, HBO, or other platforms in the highly competitive industry. Moreover, these companies provide comparable services of the highest quality, meaning that customers might not return to Netflix.

Trends, Competitive Forces, and External Factors

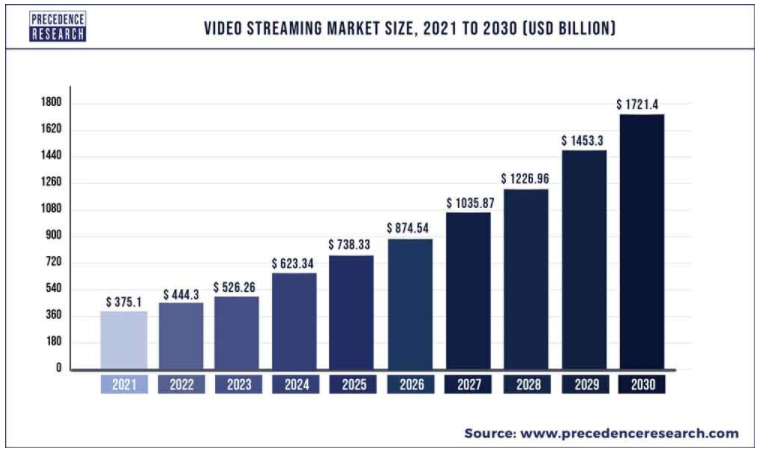

The video streaming market service is expected to grow exponentially in the 2020s, providing opportunities for relevant companies in this sector (see Figure 4). The most notable trends include technology focus, emphasis on educational videos, and live streaming (“Video streaming market,” 2022). The dense competition will create demand for more innovative ways of product differentiation, meaning that companies will have to continually improve the quality of their services to stay relevant in the market. The primary external forces that might affect the development of the industry in the 2020s concern copyright regulations and associated punishments. At present, piracy presents a significant challenge for companies in the market, and external legislative standards might help mitigate this obstacle.

Major Implications

The major implications of the examined issues suggest that Netflix should reconsider its policy-making to satisfy the customers’ needs and evaluate the current trends. Although the sector is expected to grow, the dense rivalry might cause irreparable damage to Netflix if the company makes a series of unfavorable decisions and loses public trust. In the realities of the video streaming industry, even solid financial performance does not guarantee success. The overall market size is expected to grow from $444,3 to $1,721.4 billion in eight years, and Netflix’s position at the end of this period will be dependent on its decisions concerning customer management and policy-making.

Recommendations

Based on the present analysis, the following recommendations might help Netflix maintain its advantageous position in the market:

- Evaluate industry trends;

- Implement more customer-oriented policies;

- Maintain a positive brand reputation through a series of pricing customization and original content strategies;

- Collaborate with R&D companies to implement innovative solutions and attract more viewers;

- Invest in long-term projects due to the expected growth of the video streaming industry.

References

De Silva, D. (2022). Netflix is adapting to survive and grow. Seeking Alpha. Web.

Inside Netflix’s content strategy. (2020). 8traordinary. Web.

Netflix, Inc. (NFLX). (2023). Yahoo! Finance. Web.

Pallotta, F. (2022). Netflix with ads is here. Here’s everything you need to know. CNN Business. Web.

Parker, B. (2022). Netflix SWOT analysis 2023 | SWOT analysis of Netflix. Business Strategy Hub. Web.

Solsman, J. E. (2023). Netflix’s password-sharing crackdown has come: Everything to know. CNET. Web.

Stern, M. (2023). Netflix/Nike collab looks like the future of streaming commerce. Forbes. Web.

The remarkable Netflix global expansion journey. (2022). Centuro Global. Web.

Video streaming market. (2022). Precedence Research. Web.