Introduction

The 21st century embodied technological progress that has encompassed most spheres of human activity. In the current age, new advancements are developed at a rapid pace and introduced across various spheres of work, leisure, and entertainment. Furthermore, this unprecedented level of progress leads to profound transformations of the industries. More specifically, new players emerge on a regular basis, quickly attaining resounding success and becoming major companies in their fields. At the same time, seemingly well-established leaders of each industry often lose their value and disappear from the business landscape. This scenario is conditioned by the lack of ability to adjust to the rapidly changing environment and the pace of the industry demonstrated by the aforementioned companies. The presence of such a tendency is descriptive of the contemporary markets that pose serious requirements in terms of organizational agility and wit. In other words, modern companies are expected to have both a clear understanding of the market development direction and the means of sustaining the required pace. The inability to observe and react to the possible changes in the environment entails adverse consequences for organizations, leaving little or no room for mistakes.

Technology has rightfully taken the position of the cornerstone of contemporary business activities. In the current environment, increased attention is paid to the concept of digital transformation. This notion suggests the profound implementation of new advancements in all aspects of an organization’s sphere of activity with the intent to redefine its practices (Schallmo et al., 2019). According to Schwertner (2017), the ultimate objective of digital transformation is to eliminate the “barriers between people, businesses and things” (p. 388). Spoken differently, this process creates a nexus of value between organizational processes, stakeholders, and progress for the benefit of all parties involved. The purpose of technologically advanced business is not to cause additional complications but to facilitate the processes and increase the value. However, accomplishing this mission is highly demanding in terms of strategy and analysis. Under these circumstances, digital transformation tends to become the only avenue of ensuring sustainable growth and forming a competitive advantage.

However, digital transformation can transcend the level of individual companies, encompassing entire industries. Consumers become the key driving force at the heart of the process. More specifically, their behavior and desire for new, technologically advanced solutions prompt companies to seek new digital sources of value (Morakanyane et al., 2017). The sphere of video content entertainment has been a prominent example of the way in which rapid progress leads to profound transformations in a relatively short time span. By the late 1990s, consumers relied on video rental to access on-demand content. Initially, this format provided an array of opportunities for the customers who could enjoy their preferred films at home. Nevertheless, at the time, video rental services were mostly compared to movie theaters and television that lacked convenience in terms of time and variability. As the progress continued, the wider availability of broadband Internet and computers prompted strategic decision-makers to develop online streaming platforms (Jenner, 2018). As enabled by the immense choice and unprecedented convenience, this format acquired colossal popularity, attracting millions of users. Ultimately, stakeholders opted for the bespoke digital experience, leaving obsolete formats, such as the one offered by Blockbuster Videos, in the past.

While the process described above became relatively fast on the scale of history, it cannot be considered sporadic. Moreover, there were complex market processes behind it that prompted such serious transformations of the sphere. As a result, a new sphere of online streaming services has emerged and continues to win over larger shares of the global market. Digital consumer behavior is at the heart of this ongoing process, and it deserves additional exploration. This paper represents a comprehensive feasibility report of the online streaming industry. The analysis relies on the contemporary body of knowledge provided by the academic literature, statistics, and expert opinions in regard to the expectations of 21st-century consumers. The report recounts the key players of this industry from the dawn streaming to present days, providing a framework that describes their success, or lack thereof, from the point of view of consumer behavior. The ultimate purpose of the report is to outline the current profile of the streaming industry, as well as recommendations for the new project feasibility.

Review of the Market

The industry of online streaming is a paragon of the contemporary approach to leisure and entertainment. Today, most people have used such service to at least some capacity, and the ranger of regular users has been on a stable increase. Online content streaming embodies the most breakthrough ideas of modern technology, becoming a perfect platform for the implementation of new advancements, as well. At the same time, this sphere remains highly complex due to several important factors. First of all, the surge in the popularity of such services was not a spontaneous phenomenon by any means. On the contrary, the rise of online content streaming is enabled by an effective combination of critical factors related to consumer behavior and strategic development. Organizations that have been able to grasp the expectations of the public define the sphere and ensure its further growth.

Second, while the history of streaming barely exceeds two decades, this timespan has been filled with various turning points that instigated its development. Finally, the popularity of streaming has prompted many new players to enter the industry, thus promoting intense competition. Under these circumstances, the view of new prospects in the sphere is to be based on the examination of the history, participants, and trajectories of the market that account for its current state and development avenues.

Evolution of the Sphere

The history of the video content business predates the emergence and rise of streaming by a fine margin. Previously, this industry was mostly represented by offline stores that offered rented video content on VHS tapes or DVDs. In this context, Blockbuster remained the prominent example of a veritable business empire that dominated the market for many years. According to Ash (2020), in the late 1990s, this company “owned over 9,000 video-rental stores in the United States, employed 84,000 people worldwide, and had 65 million registered customers” (para. 1). Blockbuster saw the immediate success that is recounted by its founder, who reports having to close the doors of the first store on its opening day due to the excessive number of visitors. The company relied heavily on the technological advancements of the time, including a bar code tracking system. Through its efficiency, the business became multimillion, yielding high profits for the owners (Olito, 2020). At the same time, the company paid considerable attention to customer relations, engaging them with well-crafted marketing campaigns and tangible benefits (Okami et al., 2020). Ultimately, Blockbuster became the ambassador of video content streaming.

Nevertheless, in the end, the company fell victim to the very phenomenon that instigated its development in the first place, namely the technological progress. The initial success of Blockbuster was enabled by its innovative approach to the organization of the business processes (Olito, 2020). Subsequently, a similar approach promoted the emergence and rapid growth of streaming services that shortly replaced Blockbuster. At the turn of the century, the Internet became a widespread commodity across most developed nations. Before that point, the worldwide web was present in few households, which did not provide technological leaders with sufficient incentives to develop online services. In the early 2000s, the situation changed dramatically as millions of new users gained access to the Internet (Hastings, 2020). Following this development, numerous organizations allocated the funds to the creation of faster, cheaper, and more reliable Internet-based services. As the connection speed became sufficient, it rendered video content streaming feasible, as well.

The following decades of the development of streaming platforms are widely associated with the rise of Netflix. The company was founded in 2000 and provided customers with on-demand videos. However, the format of its operations was different from the current situation, as Netflix attempted to conquer the market through DVDs delivered through the mail, as the Internet download speed remained insufficient for many customers. According to Zetlin (2020), while this approach was highly promising at the time, the pace of the segment’s growth could not ensure the company sustained development. As a result, Netflix experienced serious financial issues in the early 2000s. At that point, Blockbuster had an opportunity to secure its position and issued an acquisition proposal to Netflix. Nevertheless, as the latter’s CEO mentions, the proposed amount was not sufficient (Hastings, 2020). Following the negotiations, Blockbuster refused to meet the requirements of its counterpart’s management. As a result, Netflix was forced to channel its remaining resources into the further development of advanced video content delivery services. This process resulted in the creation of the most popular streaming platform known today, determining the creation of the streaming industry in its current state.

Current Situation

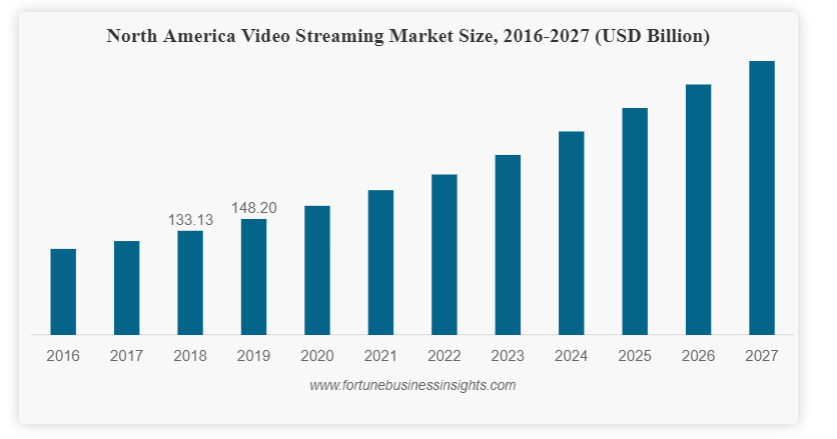

The initial competition between Netflix and Blockbuster has entailed global implications that changed the landscape of the entertainment industry. More specifically, this impact was not limited to redefining the existing market but created an entirely new sphere. The development of the streaming segment was mostly simultaneous with the technological progress in the spheres of telecommunications and the Internet (Lobato & Lotz, 2020). While the general public remained skeptical regarding the prospects of video streaming, the industry in its current state has acquired a global scale (Burroughs, 2018). Appendix A demonstrates the growth of this segment by year, showing the considerable pace at which online content streaming continues to develop today. Such a tendency is enabled by several important factors, most of which are based on technology.

First of all, the online environment has attained an unprecedented level of accessibility for end consumers. Most households in developed countries are now equipped with computers and portable gadgets with a broadband Internet connection. Second, such a growth pace allows key players to allocate serious budgets to their production and distribution departments, providing users with high-quality, on-demand content in nearly all places (Valuates Reports, 2020). The industry actively utilizes recent advancements for the benefit of the content, including virtual reality, augmented reality, and artificial intelligence research (Fortune Business Insights, 2019). Furthermore, leading business experts state that such a pace of development can be sustained in the mid-term, projecting the market to at 12% and attain $842 billion by the year 2027 (Fortune Business Insights, 2020). Such forecasts portray video content streaming as a highly promising industry for investments.

On the other hand, such markets retain the risk of becoming overheated as more players opt for entering them. In the case of video streaming, the industry has been associated with Netflix for a considerable period. In fact, this company’s input has been key to the development of the market, despite possible technological constraints of the early 21st century (Fagerjord & Kueng, 2019). In other words, Netflix was in the vanguard of content streaming development, managing to adapt the required technologies and attract the public to the new format.

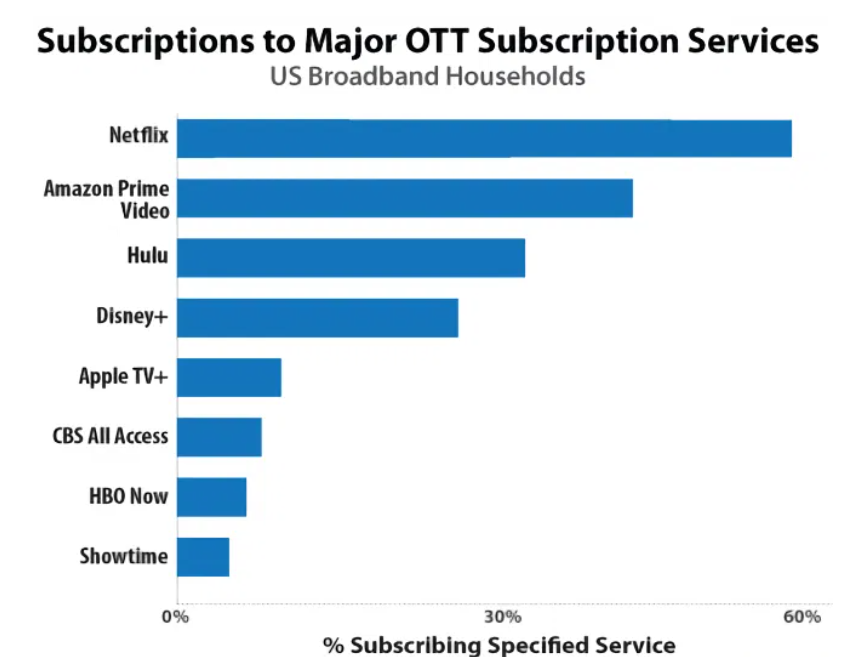

However, the industry’s image of today has become highly diverse as new companies continue to develop their own streaming segments. This tendency comprises not only streaming-exclusive offers but also traditional broadcast and production networks that attempt to seize their portions of the market. Gruenwedel (2021) reports that Netflix already lost 30% of its share in the United States market in 2020. Appendix B highlights the diversification of players in the current video streaming industry. As can be inferred from the statistics, the offer continues to increase, and the question arises of whether the demand will remain on the required level. The diverse representation of existing organizations in the market deserves additional exploration.

Key Players

The market of video content streaming today is represented by an array of prominent companies. Evidently, Netflix remains the primary player within this industry, with over half of the market share (Market Watch, 2021). This company stood at the source of video content streaming as a global phenomenon, having made an immeasurable contribution to the development of the segment. In the minds of many people, Netflix is synonymous with the idea of on-demand video streaming per se.

However, similarly to how it outperformed Blockbuster in its turn and pushed the competition toward oblivion, Netflix risks losing a fine portion of its market share to new projects. Today, Netlfix remains loyal to its objective of entertaining the world through the distribution of accessible, on-demand content of distinguished quality (Netflix, 2021). The company aims at a global presence, providing over 190 countries with the best documentaries, films, shows, and television series in 30 languages. A major component of Netflix’s success is embedded in its original content, exclusive to the platform. The company allocates considerable resources to the development and production of its own series and films that often engage prominent actors and directors (Pilipets, 2019). The success of Netlfix translates into a global impact that forces other production companies to increase their efforts in order to remain in the competition. According to Daidj and Egert (2018), this idea includes both other streaming platforms and traditional entertainment media. Therefore, it is difficult to outperform Netflix under the current circumstances, yet it is not impossible.

In the 2020s, Netflix faces increasing competition enabled by other prominent players. As per the statistics presented in Appendix B, Amazon Prime Video is the second largest company in the U.S. content streaming market. This platform is founded with the resources of the world’s leading electronic retail store, adding a serious financial dimension to the project. Amazon Prime pursues similar objectives of providing its customers with a bespoke selection of content, including Amazon Originals. This format includes highly popular titles, such as “The Boys” and “Lord of the Rings.” The company values the technical aspect of its platform, actively developing 4K, UltraHD formats for state-of-the-art equipment (Amazon, 2021). In addition, Amazon Prime has interesting features for mobile users, allowing them to download content with a convenient application. In order to enhance the experience, the platform emphasizes its X-Ray function, offering access to behind-the-scenes materials. The combination of technological advancements and high-quality original content makes Amazon Prime a serious opponent of Netflix.

Hulu is another well-established participant of the online streaming segment mostly represented in the United States. Similar to the two companies that are placed above it in the market share ratings, Hulu pursues the value of original content for its subscribers. Having been founded in 2007, the company, thus, has a long history in the industry. Hulu presently positions itself as one of the leaders of the market, offering live and on-demand content to millions of users (Hulu, 2021). The financial support of the platform is enabled by its profound cooperation with Disney’s Media and Entertainment distribution system. For a considerable time, Hulu was the primary medium of Disney’s web-based representation. However, the situation has changed, following the creation of its own platform titled Disney+. This service combines the best-known and exclusive content from all Disney’s assets, such as Star Wars and Marvel universes. While Disney+ is still at the beginning of its path, it already counts over 100 million subscribers in 59 countries (Disney, 2021). This way, even the leading four players of the market already constitute a highly competitive, hostile environment for new entrants.

Digital Consumer Behavior

The analysis of profiles of the most prominent companies in the video content streaming segment provides a comprehensive image of digital consumer behavior. In spite of all variations between the companies, they are united by the primary features of their format of operation. More specifically, they offer on-demand videos that allow viewers to access them at any time within the subscription period. This function is driven by the principle of convenience that separates it from previous formats. Budzinski and Lindstädt (2018) note that free-to-air, tightly scheduled content used to be the norm for consumers in the pre-digital era. However, modern users are quick to recognize the benefits of new, convenient formats. In the case of video streaming, consumers appreciate the ability to launch, pause, and resume their favorite programs at any suitable time (Oliveira et al., 2020). Many of them remember the period when they had to be present in front of their TVs to watch one episode at a time while enduring commercial breaks. Evidently, the ability to avoid such inconveniences outweighs the necessity to purchase a subscription. Therefore, modern customers are willing to pay for convenience and access.

However, the need for purchase is expected to be justified by the quality, as well. As can be inferred from the examination of prominent streaming services, key players emphasize the value of original content. This tendency suggests that the sense of exclusivity also plays an important role in the eyes of the customers (Corfield, 2017). This way, they feel as if they gain access to a special piece of content, which raises their expectations. If previously, Netflix was able to gain its follower base with the help of an abundant library of secondary content, this approach can no longer be sustained (Wayne, 2017). More specifically, new market entrants can hardly compete with the giants of the industry without original content, which, in turn, is more expensive. Overall, consumers are accustomed to the original content and expect to see meaningful efforts on behalf of video distributors.

On the other hand, the market of video content streaming remains subject to the aforementioned overheating, not only in terms of economy. The number of platforms continues to increase on an annual basis. Currently, the traditional triumvirate of Netflix, Amazon, and Hulu has been complemented by Disney+, Apple TV+, HBO Max, and other emerging services. From one perspective, the diversity of content is positive, as it enables better selection and prevents one company from establishing a monopoly. Nevertheless, beyond a certain point, the increase in service providers may have a detrimental impact on the industry. From a consumer’s standpoint, the necessity to purchase multiple subscriptions at once may become annoying. For now, the increase in offer appears to be counteracted by a corresponding growth of demand. In 2020, the subscriber base of streaming services doubled, as enabled by the coronavirus pandemic and corresponding lockdowns (PWC, 2021). However, this effect may not last, meaning that the inertial emergence of new streaming services will not find a sufficient response from the public. Under these circumstances, forming a competitive advantage will be the ultimate and the most difficult goal for market entrants.

Recommendations and Conclusion

Based on the analysis presented above, it appears possible to form a set of recommendations for the envisaged project in the industry of video content streaming. First of all, it is vital to evaluate the necessity of such an endeavor. The stable growth of the industry may create unrealistic expectations among founders, but such a situation is to be avoided. The presented growth is mostly enabled by the established giants of the market who have earned their reputation. Even the most recent entrants may be new to streaming but not to content production. Apple, Disney, and HBO are well-known companies with their own pre-existing customer bases that partly translated into platform subscribers. Moreover, these services have another common feature that consists of immense financial resources. Colossal funds allow them to finance multimillion projects, original content, and substantial marketing expenditures. Accordingly, the envisaged entry to the market is to rely on serious monetary support, as well. Overall, despite the promising statistics of the streaming industry, it appears wise to postpone the entry until all requirements are met. In addition, the delay will enable a better evaluation of the post-COVID market of digital entertainment.

References

Amazon. (2021). What is Prime Video? Web.

Apple TV+ captures a significant share of streaming market. (2020). MacDaily News. Web.

Ash, A. (2020, August 12). The rise and fall of Blockbuster and how it’s surviving with just one store left. Insider.

Budzinski, O., & Lindstädt N. (2018). The new media economics of video-on-demand markets: Lessons for competition policy. Ilmenau Economics Discussion Papers, 24(116). Web.

Burroughs, B. (2018). House of Netflix: Streaming media and digital lore. Popular Communication, 17(1), 1–17.

Corfield, J. (2017). Network vs. Netflix: A Comparative Content Analysis of Demographics Across Prime-Time Television and Netflix Original Programming. (Master’s thesis). Web.

Daidj, N., & Egert, C. (2018). Towards new coopetition-based business models? The case of Netflix on the French market. Journal of Research in Marketing and Entrepreneurship, 20(1), 99–120.

Disney. (2021). Disney+. Web.

Fagerjord, A., & Kueng, L. (2019). Mapping the core actors and flows in streaming video services: what Netflix can tell us about these new media networks. Journal of Journal of Media Business Studies, 16(3), 166–181.

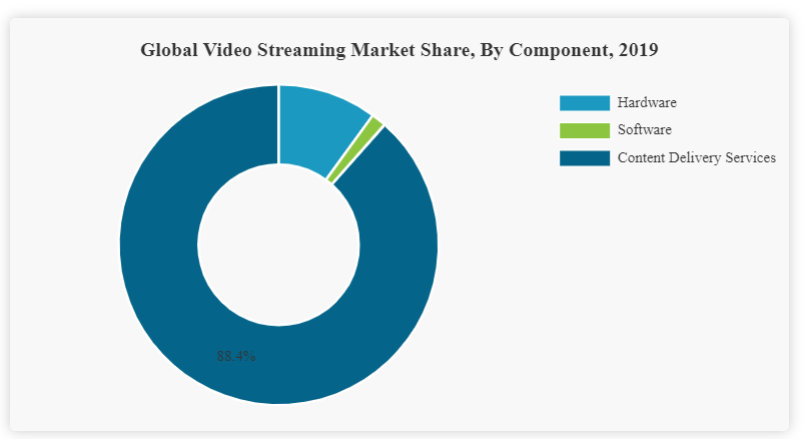

Fortune Business Insights. (2019). Video streaming market size, share & industry analysis, by component (hardware, software, content delivery services), by streaming type (live video streaming, on-demand video streaming), by streaming model (advertisement-based, subscription-based, transactional-based/rental), by deployment (on-premise, cloud), by end-use (commercial, residential), and regional forecast, 2020-2027. Web.

Fortune Business Insights. (2020). Video streaming market worth USD 842.93 Billion at 12.0% CAGR, presence of advanced network infrastructure and high internet connectivity to bolster growth. Web.

Gruenwedel, E. (2021). Report: Netflix lost 30% U.S. market share in 2020. Mediaplay News. Web.

Hastings, R. (2020). CEO Reed Hastings on how Netflix beat Blockbuster. Marketplace.

Hulu. (2021). About Hulu.

Jenner, M. (2018). Netflix and the re-invention of television. Palgrave Macmillan

Lobato, R., & Lotz, A. D. (2020). Imagining global video: The challenge of Netflix. JCMS: Journal of Cinema and Media Studies, 59(3), 132-136. Web.

Market Watch. Video streaming market share 2021 qualitative insights, competition landscape, growth rate, development trends, prominent players and opportunity assessment till 2023. Web.

Morakanyane, R., Grace, A. A., & O’Reilly, P. (2017). Conceptualizing digital transformation in business organizations: A systematic review of literature. BLED 2017 Proceedings, 21, 427–444.

Netflix. (2021). About Netflix. Web.

Okami, L. E., Yamanoto, K. N., & Lloyd, R. A. (2020). Exploring the return on customer (ROC) model in the video sales and rental industry: An Intramodal analysis of Blockbuster, Redbox, and Netflix. Review of Integrative Business and Economics Research, 9(4), 358–371.

Olito, F. (2020). The rise and fall of Blockbuster. Insider.

Oliveira, A., Azevedo, A., & da Silva S. M. (2020). Streaming Services Consumer Behaviour: A Netflix User Case Study in Brazil and Portugal. n Proceedings of the 17th International Joint Conference on e-Business and Telecommunications, 3, 173-180. Web.

Pilipets, E. (2019). From Netflix streaming to Netflix and Chill: The (dis)connected body of serial binge-viewer. Social Media + Society, 5(4).

PWC. (2021). After a boom year in video streaming, what comes next?

Schallmo, D., Williams, C. A., & Boardman, L. (2019). Chapter 5: Digital transformation of business models — best practice, enablers, and roadmap. International Journal of Innovation Management, 21(8), 1–17.

Schwertner, K. (2017). Digital transformation of business. Trakia Journal of Sciences, 15(1), 388–393. Web.

Valuates Reports. (2020). Video streaming market size is projected to reach USD 149.34 Billion by 2026. Web.

Wayne, M. L. (2019). Netflix, Amazon, and branded television content in subscription video on-demand portals. Media, Culture & Society, 40(5), 725–741.

Zetlin, M. (2019). Blockbuster could have bought Netflix for $50 Million, but the CEO thought it was a Joke. Inc. Web.

Appendix A

Video Streaming Market in North America (Fortune Business Insights, 2020)

Appendix B

U.S. Video Content Market Share by Company (“Apple TV+ captures significant share of streaming market”, 2020)