Abstract

To discuss the statement “the optimal choice of entry mode depends on the firm’s strategy”, this paper would consider the relationship between International strategies and entry strategy, and the meaning of international strategy, and foreign market entry strategies etc. This essay would also evaluate the advantages and disadvantages of franchising & joint ventures and explain the issue with proper examples.

Introduction

The virtual system of targeting and penetrating the international market is a complex one since it involves a related but different decision of running own global business-level strategy by selecting one or more appropriate mode of entering into that market. Therefore, to understand the selected statement, it is essential to know the distinction between international strategies and entry strategies as a primary part of the analysis.

International strategy vs. entry strategy

International strategy can be simply defined as the selling of products in the market outside the national boundary which offers specific market opportunities while an organization is fully committed to being international, it decides to enter into the market by analyzing market characteristics (projected sales, cultural diversity, national barriers etc.), corporate capabilities and characteristics (market involvement and knowledge). International strategy can take two basic shapes regarding business and corporate-level. The first form involves four generic strategies of cost leadership; differentiation-focused cost leadership and focused differentiation while the latter one is formed up of multi-domestic, global, and transitional strategies. On the other hand, entry strategies can be distinct types considering export, licensing, turnkey contracts, franchising, joint ventures, and FDI etc. Finally, both sorts of strategies are different in terms of overall business goals, objectives, resources, formulation, functionality, and ultimate outcomes, which reassure that they are exclusive.

Insights of international strategies

Generally, international business strategies are focusing on the firm’s decision for running competition in every market segment those had been selected to enter. The major comparison factors can be visualized as below:

- Meaning: Hill (2008, p. 98) argued that international costs leadership is generally meant as an integrated set of actions designed to produce commodities or services at a lower cost than the competitors. Differentiation strategy can be defined as an attempt to founding and maintaining a unique image of the products or services from other competitors in the similar marketplace while international focus strategy is a combined action of marketing commodities for serving the needs of specific market segment. Finally, integrated cost leadership/ differentiation strategy is blending the major components of differentiation and lower costs in a foreign market.

- Operational factor: Cost leadership is developed in a country with huge demand while the operation is centralized in a home country. Differentiation is appropriate when the firm has advanced and specialized factor bequests (Anon. 2009). Focus strategy is notable when the firm has desire to utilize its core competencies of serving a specific product line or a special product line by emphasizing “operation of slight target dissimilarities from the equilibrium of the industry” while an integrated strategy incorporates flexible production system, internally and externally improved information networks and sophisticated level of total quality management (TQM).

- Operational centralization: Cost strategy is more centralized than any other form while differentiation is somewhat decentralized. On the other hand, focus strategy is more centralized than international integration (Cateora & Graham 2005, p.70).

- Corporate example: Wal Mart is the foremost successful global entity of introducing and maintaining cost leadership, Volkswagen is a follower of this. Japan’s NTT DOCOMO is globally recognized for differentiating its wireless communication network. Similarly, UK-based Citibank has focused on private banking sector by converting 83 branches in Spain as commodity advisory centers in which customers are allowed to use computer systems for assessing their risks. The case of Komatsu and Caterpillar is the best example of implementing an integrated cost leadership/ differentiation strategy since Komatsu had been able to overcome Caterpillar’s image by introducing lower costs and a unique brand image throughout their international operation.

- Others: Rather than above distinctions, all of those strategies also vary in case of economy, government influence, financing, labor force, market research, money and social context (Griffin & Pustay 2002, p. 1).

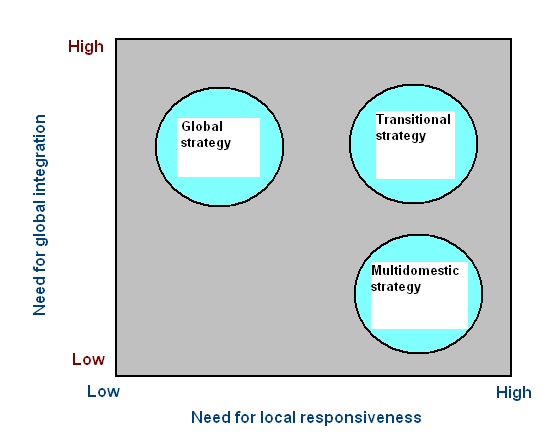

International corporate strategy involves focusing the operational location of a firm that also includes a number of strategic differences as following:

- David (2008, p 244) mentioned that by adopting a multi-domestic strategy, a firm takes operational decisions, which are decentralized to the strategic business unit in each nation for tailoring the goods to the local market. Coble (2009, p.97) stated that global strategy focuses on delivering standardized goods and transitional strategy those concerned to meet global and local efficiency and responsiveness.

- Those three policies are also different in terms of global and local integration and responsiveness, such as:

Foreign market entry strategies

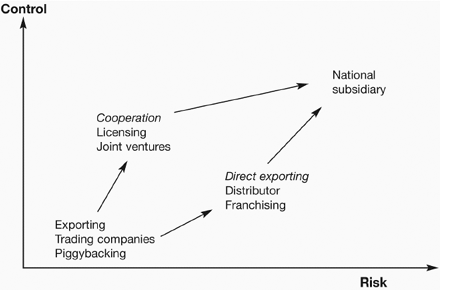

After setting primary strategies of international operation, the identical firm must choose the best approach for entering into the marketplace. Here, six modes are most common as- exporting, turnkey projects, franchising, licensing, international joint ventures, and wholly-owned subsidiaries Rhee (2008, p. 3-14). However, alternative market entry strategies can also be viewed in terms of their associated control and risk issues, as:

Among those, franchising and joint ventures are being selected to make closer analyses about them.

Franchising

It is equivalent to licensing but it focuses on long- term contractual agreement that the former one. Therefore, franchising can be simply termed as a distinct form of licensing that practices and utilizes other’s business philosophies. Here, the franchisor permits the free operator the chance of delivering its goods, services, technologies, patents and trademarks on the basis of percentage of per month sales as well as a fee of royalty. Blair & Lafontaine (2005, p. 210) added that franchising provides an important form of vertical integration as well as an effective mixture of centralization of skills and decentralization of operation. In UK, it has been estimated that annual fast food franchising sale is mere $2 billion accounting for 30% of overall consumption of food beyond the home.

Griffin 2006, p. 156) stated that several types of tangible and intangible terms including global advertising, training, and various supplementary services are frequently made accessible by the franchisor where the duration of agreements ranges from 5 to 30 years. Today, more than 70 industries are using such a pattern of business model.

Advantages: Some positive sides of franchising are:

- It offers higher opportunity for making capital investment with adequate control throughout the process since the franchisors can expand the business across domestic countries and continents by utilizing franchisees’ investment and assets.

- Reduction of risks and costs.

- Opportunity of influencing the franchisee for developing a distribution channel.

- Relief from many dull responsibilities, like- achieving essential license and permission as well as bearing the liability insurance which can be posed over franchisees duty.

- Protection from complaints from own franchises for the non-negotiable agreements.

- Scope of earning more profits as a portion of franchisees basic sales through an avoidance of operational costs for holding virtual inventories.

- Through the expertise of franchisor, franchisee can quickly expand the business.

- High breed training from franchisor.Forms of business ownership and employment;

- It is possible to quickly start a franchising business involving lease negotiation, training, development and other requirements.

Disadvantages: Several negative aspects are:

- For any specific region, there would be a narrow group of potential franchisees.

- Inefficient franchisees could be harmful to damage public image and goodwill.

- Complicated control.

- There exists no surety of monetary success of the business in the paperwork and the original agreement.

- Hammering of control.

- Lack of permission for allocating less costly alternatives.

- Possibility of occurring conflict between two parties because of incompetence and lack of trust.

Joint ventures

It is differentiated from other forms of strategic alliances (consortia) since it is a partnership of two or more participating organizations, which combine forces for creating a distinct legal entity.

Four factors are for the formulation of joint ventures, as:

- They are recognized, separate, and legal entities.

- They are the effort of sharing management skills by the partners.

- They are the contract between organizations and government, not any individual.

- Each partner must hold equity point.

Advantages: Some benefits of JVs are:

- Development of corporate strength;

- Expansion of expenses and lower risks from expropriation and nationalization;

- Local partners also have the potential to influence government policy.

- Improvement of accessing monetary assets;

- Introduction and transfer of modern technologies to society;

- Achievement of economies of scale through size facility.

- Achievement of greater innovative approaches.

- Scope of offering preemptive competition.

- Composition of greater competitive advantage.

- Protective reaction to blurring industry limitations.

- Greater alacrity to market.

- Greater flexibility.

- Greater diversification.

- Opportunity for both partners for meeting goals.

- Manipulation of growth structure of an industry.

Disadvantages: Some drawbacks are:

- A firm may face threats for offering control of technology to its collaborator (Icmrindia 2008, p.1).

- JV does not ensure the firm’s right to manage subsidiaries as needed for optimizing experience curve or economize of scale. For this reason, it is also impossible for a firm to maintain a strong control over the international subsidy to protect against competitive attacks (Griffin & Pustay 2002, p. 1).

- It may also introduce conflict between partners for the issue of control along with potential changes and differentiation in objectives from each other.

- Growing market situation may indicate expiry of venture existence.

Explaining the issue

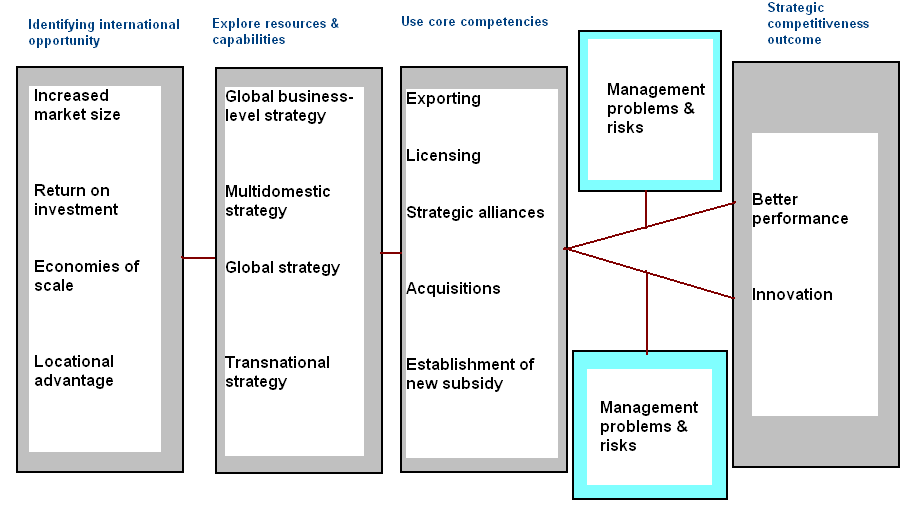

The presented statement of “The optimal choice of entry mode depends on the firm’s strategy” can be elaborated through our previously discussed knowledge about the international strategy of a firm about the decided mode of entry. To give a clear vision in this regard, it will be helpful to show the input-output features of these two issues:

By analyzing the relationship module of the diagram, it can be summed up that the relativity of international opportunities and the identification of resources and capabilities, which result in strategies and entry modes are practically based upon core competencies. More particularly, various types of international strategies can be melted as corporate assets and scopes, which lead to induce different corporate strategies. After that, various entry modes are utilized as aftermath, which is combined to generate management problems and risks and eventually, better performance and innovation take place. So, the decision relating to entry modes is utilized because of the firm’s competitive situation along with the unique set of resources, qualities, and core competencies.

In other words, when a firm has decided to implement various generic strategies including costs, differentiation or focus, it also judges the related costs and benefits of that approach casing the global market (Hill 2009, p. 132). It is essential to match the success and purpose of entrance with the viability of international strategies. Here, a company must consider several influential factors like- social, political, legal, economic, technological, and religious context of a nation. For this, in some cases, a strong global mega-retailer would like to create a joint venture with a less recognized local company rather than direct exporting to achieve an accelerated acceptance. Here, the introduction of differentiation or focused differentiation is viable to quickly penetrate the target market. Sony Ericsson is a perfect example in this case while the company is emphasizing such scheme by formulizing excellent joint venture.

Sony Eriksson – Functioning as a successful joint venture

Sony Ericsson can be placed as a classic example of one of the most notable joint ventures that had been evolved on October 1, 2001. The two major partners are Sony Corporation from Japan and Ericsson telecommunication Company from Sweden. The initial purpose of formulating such venture was to mix Sony’s electronic proficiency with Ericsson’s technological top position in the communication industry. By doing so, each of the companies had discontinued producing their own cell phones. Today, the company is operating its international business in London with skilled R and D team from Japan, Germany, Sweden, China, USA, UK and India. At the end of 2008, it had taken the position as the world’s 3rd cell phone producer immediately after Nokia and Samsung. The basic reason for achieving that sort of success is the combined efficiency and expertise of two giant entities.

Ericsson was the 3rd market leader in the cell phone industry, which had to strive with huge losses although there was enough sales volume in 2000 because of manufacturing more expensive handset than Nokia. To eliminate such losses, it thought of outsourcing manufacturing to Asian organizations, which would be able to make production at a cheaper rate. On the other hand, Sony was an insignificant company in the global mobile phone industry, which occupied below 1% market share in early 2000. Additionally, a significant pressure had also being existed although the company desired to obtain more concentration in this area. In 2001, April, it assured to make a discussion with Ericsson for establishing a mutual contact in the cell phone business. The time was immediately after Siemens and Toshiba had decided to collaborate in 2000 on 3G telecommunication networks that had also been rejected in 2001. So, in August 2001, both the organizations had agreed-upon of merging through a declaration in April. Primarily, the venture had started with 3500 workforces.

Today, this mega venture is experiencing a tremendous growth. However, in the 1st quarter of 2008, LG Electronics (South Korean Competitor) had taken it over because of deduced profits by 43% to €133 million and sales of 8% although the overall market share has assumed to be expanded by 10% in the same year (Rhee 2008, p. 3-14). Being highly pressured by the closest competitor of Motorola, Sony Ericsson retained profit in the 3rd quarter. In November and December, the company marketed a new model of C905 as one of the best sellers beyond UK. Till to 2008, July it has about 9400 personnel along with 2500 global out workers.

Conclusion

The overall discussion is supporting the feasibility of selected statement, as the international strategy of a firm is the prime motivator and indicator of overseas entrance decision of that.

Reference

Anon. 2009. Future of NUMMI: New United Motor Manufacturing, Inc. [Online]. Web.

Blair, R. D. & Lafontaine, F. 2005. The economics of franchising. Cambridge University Press, 2009. Web.

Cateora, P. R. & Graham, J. L. 2005. International Marketing. 12th ed. New York: McGraw- Hill Companies, Inc.

Coble, R. 2009. International Business Strategies: B2B Newsletter International Business Strategies. [Online]. Web.

David, F. 2008. Strategic Management: Concepts and Cases. 12th ed. Prentice Hall.

Griffin, R. W. 2006. Management. 8th ed. Boston: Houghton Mifflin Company.

Griffin, R. W. & Pustay, M. W. 2002. International Business: Components of an International Strategy. [Online]. 2009. Web.

Hill, C. W. L. 2008. International Business. 6th ed. New York: McGraw- Hill Companies, Inc.

Hill, C. 2009. International Business: Competing in the global marketplace. 7th ed. USA: McGraw-Hill.

Hitt, M. A., Ireland, R. D., & Hoskisson, R. E. 2001. Strategic Management. 4th ed. Singapore: South-Western Thomson Learning.

Icmrindia. 2008. Chapter 5: Competitive Strategy in International Business. [Online]. Web.

Rhee, J. H. 2008. “International Expansion Strategies of Korean Venture Firms: Entry Mode Choice and Performance”. Asian Business & Management. 7, (95–114). 2009. Web.