The Role of Government in Market Economies

Market economy refers to an economy, whereby it is little or no interference from the government and the prices and availability of goods and services are purely dependent on the forces of demand and supply. The various assumptions in a market economy include: Individuals are rational and driven by self-interest, the market has invincible and that works to ensure that only efficient actors will remain in the market and that the market is so complex that no single actor can manage it better than the mechanism of the free market. All these conditions exist and work well in an ideal situation because there are times when the mechanisms are deficient and the government has to come in. The government, therefore, has some roles it plays in a market economy to help it function better (Denny, 2006).

To provide public goods

One of the characteristics of a market economy is that actors only exchange commodities based on comparative advantage. Therefore, no individual will be willing to produce goods that he has no control over usage or cannot charge. Public goods are those goods such as roads or national defense that everyone in the country can enjoy without regulation. Considering that no private investors would spend on producing such goods the government takes a role to provide for such goods. For instance, the government can produce jet fighters to defend the country and everyone in that country would be protected (Martinez, 2009).

The second role is to prevent monopoly. The invincible hand works to ensure that only efficient actors remain in the market. An industry that has few large firms can lead to the collusion of those firms to charge high prices and create barriers that lockout new entrants. Therefore, it is upon the government to maintain an effective level of competition by preventing collusive behavior within the system. This has caused most governments in market economies to introduce antitrust laws. The third role of the government is to enforce laws and act as a neutral referee. One of the characteristics of a market system is that the actors always seek self-interest. This means that without regulation they may end up hurting each other as well as destroying the environment in their pursuit of profit (Martinez, 2009).

An example of such a case is preventing pollution of the environment. A company producing goods and dumping its by-products in a river will be polluting that river. Therefore, the more it produces in an attempt to make more profit the more it pollutes that river. Hence, the need to be a neutral party who can advocate for the rights of all the parties in the market. The government comes to ensure that as much as the company is allowed to produce it does not pollute the river which is a public good. Fourth, the government is needed in a market economy to enforce equity and correct the inefficiencies of the system (Denny, 2006).

In any given society there will be some people who will not have the skills or resources to earn income. A market economy is not an exception as there are the elderly and the handicapped. The government has a responsibility to redistribute income and promote equality. The government initiates programs such as tax policies to redistribute income. Lastly, the government has a role to provide conditions that will enable the private systems to function effectively. It does this by developing and employing monetary and fiscal policies. One such role is to provide a stable currency that is widely accepted and is supposed to institute monetary policies that limit inflation. Fiscal policies can be employed whereby the government spends in putting infrastructure that is necessary for efficient trade operations (Martinez, 2009).

The mechanism through which Monetary Policy operates to control inflation

Inflation refers to a persistent increase in the general price levels. There are two types of inflation; demand-pull inflation and cost-push inflation and there are various ways through which monetary policies can be used to control inflation. To control demand-pull inflation the central bank raises the interest rates. This will force the commercial banks to also raise their interest rates. As a result, the demand for the borrowed money will go down because few people will be willing to borrow at that high rate of interest. This will in turn reduce consumer spending as well as investment spending because disposable income will reduce. With a reduced disposable income the demand for goods and services will go down. When demand goes down because of reduced consumer purchasing power the prices of goods and services will go down and inflation will go down. Therefore, increasing interest rates is a monetary policy that can be used to control inflation during demand-pull inflation (Solman, 2006).

On the other hand, we have cost-push inflation which results from a sustained increase in the cost of production. When firms are faced with the increasing costs of inputs they always pass the cost to the consumers by increasing the prices of commodities. When this is sustained for a period of time it leads to inflation. To control this type of inflation the Central Bank will introduce monetary policies that aim at reducing the interest rates. When the Central Bank reduces its interest lending rate to commercial banks they will also reciprocate by reducing their lending rates. This will make loans relatively cheaper hence, the demand loans will increase. The investors will take loans at cheaper rates and they will invest more to minimize production costs. As a result, they will produce goods cheaply and the consumers will have increased disposable income to spend on the produced goods. This will, in turn, lead to a reduction in the inflation rate.

The long-run trade-off between unemployment and inflation

The trade-off between employment and inflation refers to a situation whereby high growth policies are meant to reduce unemployment, while slow growth policies that are meant to reduce inflation will end up increasing unemployment. According to the Philips curve when unemployment goes up the inflation rate will go down and when the inflation rate goes up unemployment will go down. This theory was practical for a long time until the 1970s when many countries experienced both an increase in unemployment and inflation. This occurrence faulted the theory and showed that in the long-run unemployment is not related to inflation. Therefore, various scholars sought to explain this occurrence (Boyes & Melvin, 2010).

During the short run, there is a trade-off between unemployment and inflation, therefore as the unemployment rate goes up policymakers will employ expansionary measures that will reduce unemployment rates while the inflation rates will go up. However, the reduction in unemployment will only be for a short period because in the long-run unemployment rate always goes back to the natural unemployment rate. This will, therefore, result in a higher inflation rate in the long run. Both inflation and unemployment rates will have increased in the long-run, hence, proving that in the long run there is no trade-off between unemployment and inflation rate (Piekkola & Snellman).

Trends in the four main macro-indicators over the past 10 years

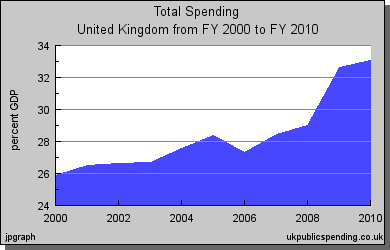

One of the macro-economic indicators is government spending. This has shown an increasing upward trend from 2000 to 2010. A larger percentage has been spent on pensions, welfare and healthcare. For instance, in 2010 the amount spent on pensions was the highest with 117,000 sterling pounds, indicating the large elderly age group in the country. This is a worrying trend considering that the amounts spent on development sectors such as transport were the least. Therefore, the economy will in the near future be overburdened by pensions because it will be producing less than it can pay the pensioners. The graph below shows total government spending over the past ten years (Steil, Nelson & Council on Foreign Relations, 2002).

Unemployment Rate the United Kingdom 2000 – 2010

From the above graph on unemployment, it is evident that the unemployment rates were relatively steady between 2001 and 2006. However, the period between 2008 and 2009 saw a sharp increase in the unemployment rate. This is attributed to the global economic crisis that was at its strongest point during that period. Initiatives by the government to increase public spending and lower interest rates saw a rate leveled between mid-2009 and the whole of 2010. The measures led to the creation of more job opportunities; however, the number of jobs created was not enough to absorb all those who had lost their jobs during the recession of 2008-2009 (Steil, Nelson & Council on Foreign Relations, 2002).

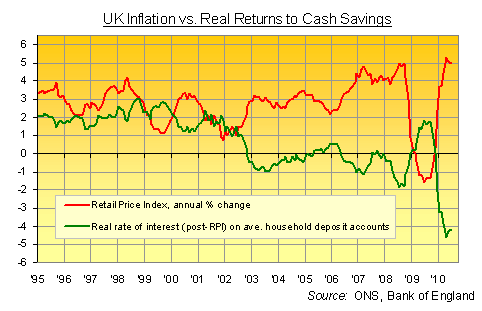

The figure above shows the graph of inflation against the interest rates on savings. The first two years of the past decade were characterized by relatively steady price levels as well as interest rates. However, in 2003 the inflation rate went up and the interest rate on savings went down. This shows how the sterling pound lost its value as inflation continues. The trend was worsened by the r2008-2009 recession where the recession reached its highest and the interest rates were at their lowest. However, when the government initiated monetary and physical policies which included stimulus packages and a reduction in lending interest rates the inflation rate went down suddenly. This shows that when inflation rates increase people prefer to own property over money, because money loses value at a faster rate when recession sets in (Ash, 2010).

It is therefore clear that the economy was doing well at the beginning of the decade. However, the economic downturns especially that of the 2008-2009 periods slowed the growth and led to an increased unemployment rate. From the graph of unemployment, it is evident that there is no trade-off between unemployment and inflation in the long run. Although expansionary measures will reduce the unemployment rate, they will not go down past the natural rate. The graph on government spending shows that during the period when the recession was at its worst the government spent more. Government spending created job opportunities and helped in increasing consumer purchasing power. As a result, there was a demand for the produced goods and the cost of production also went down (Ash, 2010).

References

Ash, A., (2010). People buy gold. Web.

Boyes, W. and Melvin, M. (2010). Economics. Mason, MA: Cengage Learning

Denny, J. A., (2006). The role of government in economy and business. Jakarta: PT LKiS Pelangi Aksara

Martinez, M. A. (2009). The myth of the free market: the role of the state in a capitalist economy. Danvers, MA: Kumarian Press

Piekkola, H. and Snellman, K. (2005). Collective bargaining and wage formation: performance and challenges. Heidelberg: Springer

Portal Seven. (n.d). Unemployment rate the United Kingdom 2000 – 2010. Web.

Solman, J. (2006). Economics. Oxford: Prentice-Hall.

Steil, B., Victor, D. G., Nelson, R. R. and Council on Foreign Relations. (2002). Technological innovation and economic performance. Oxfordshire: Princeton University Press.

UK Public Spending. (n.d). Time Series Chart of UK Public Spending. Web.