Abstract

Fraud examination requires determining who may be guilty of the crime and finding vulnerable places in the organization that made the crime commitment possible. The fraud triangle is a model that analyzes three components: pressure, opportunities, and rationalization. They are connected with fraudulent behavior, and usually, the crime is committed when all of them are present. Pressure motivates one to commit fraud, and opportunities are weak places in the organization that enable it to be done. Rationalization is a personal justification used to describe why one committed a crime. The triangle may be extended: for example, a model of fraud diamond adds the fourth component, the capability, which shows personal qualities, influences, and resources that may be used to commit a crime. The scheme enables checking the vulnerable places in the organization’s structure. In addition, it helps in determining who may be guilty of fraudulent behavior by analyzing their motivation, resources, and conditions in which they are working.

Introduction

The fraud triangle is a toolkit for examination, showing the motifs and prerequisites for the crime committed. When all three elements of the triangle, which are opportunity, pressure, and rationalization, are present, the possibility of fraudulent actions is heavily increased. In that way, analysis of such activities may be significantly facilitated by using this model. It shows the pressure to commit them, opportunities that enabled this, and personal justifications about why it was done. There are various extensions to the triangle and various ways to use it as a forensic accountant.

Fraud Triangle Description

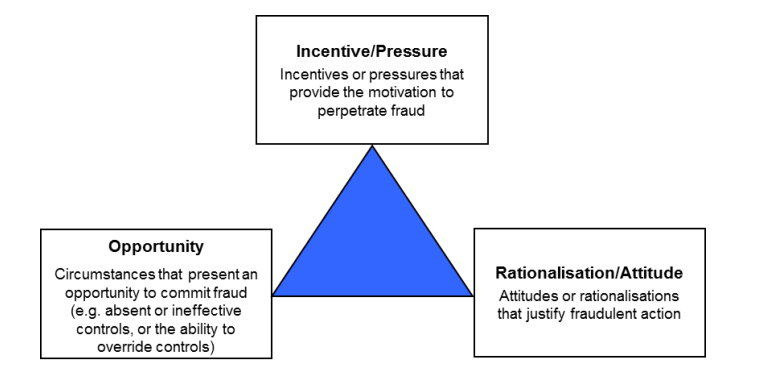

It is a formula that shows three main elements that are prerequisites to fraud. They are presented in Figure 1: pressure or incentive, opportunity, and rationalization or attitude. According to law dictionaries, fraud is defined as deceiving a person or any entity, such as a company or organization, with the reason to obtain money from them, either directly or indirectly (Abdullahi & Mansor, 2015). An example is stealing money from a corporation using a position in the company. Other common examples are political corruption and corporate whistleblowing, which is illegal spying on competitors to steal their know-how (Homer, 2019). To understand how the three triangle components are related to fraud, each should be described separately.

- Pressure, or incentive, is the element of motivation that defines the reason for committing a crime. There may be external and internal motivations: an example of the former is a bad financial situation, which may be changed by fraudulent actions. The latter includes qualities such as greed, which motivate one to commit those actions (Abdullahi & Mansor, 2015). Pressure is usually shown at the top, as it provides information about the primary motivation to commit the crime.

- Opportunity is the chance present in the organization subjected to fraud, as well as the position of those who commit fraud. For example, in the case of government organizations, a lack of transparency enables using government money for personal enrichment, which is fraudulent action.

Rationalization, or attitude, is the personal position that justifies fraud: it is necessary to make the action psychologically possible for a person. For example, one that steals money from the company may convince themselves that their employer deceived them first, unwilling to pay them a sufficient salary (Abdullahi & Mansor, 2015; Maulidi, 2020). This component is often omitted, as specialists may see it as the least important compared to the motivation and opportunity and hard to evaluate (Huang et al., 2016). However, rationalization enables one to analyze why a person commits fraud and see how one may avoid fraud in the future.

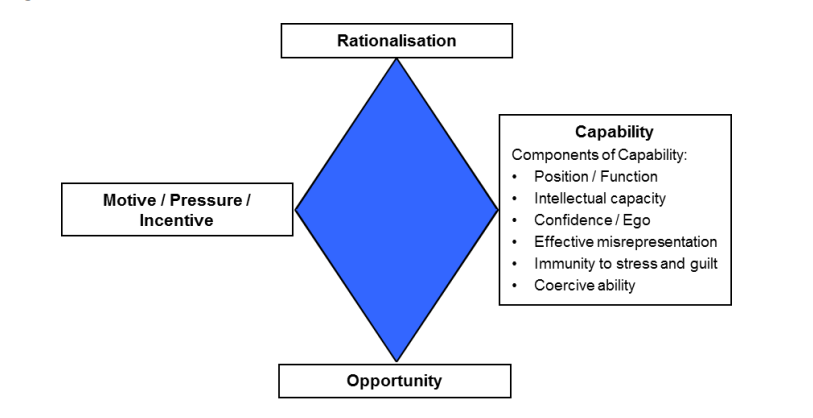

The triangle is often extended to a fraud diamond: it shows the three mentioned elements and adds the fourth one, the capability. It includes the skills for committing fraud and the moral condition necessary to do it (Abdullahi & Mansor, 2015). In that way, it is interconnected with rationalization and opportunity elements. One may see a fraud diamond scheme in Figure 2: the capability element has several components, such as position in the organization, intellectual capacity, and personal confidence. It shows resources available for committing fraud, both external and internal, and this element may be used to evaluate whether the suspected person was able to commit fraud.

Fraud Triangle Discussion

The triangle model is widely accepted and used by fraud accountants worldwide. According to the Huang et al. (2016) article, specialists often use the toolkit, but not all of its components are equally utilized. The pressure/incentive component is the most widely used by researchers and accountants, while rationalization is often omitted and understudied. The possible reason is that rationalization is an internal and invisible process connected with the psychology of people who commit fraud (Homer, 2019). Unlike that, the pressure may be directly seen, as it is mainly the result of external processes, such as the dire financial situation of a person or company committing the crime. However, all three components have internal components as well: the pressure component may include personal greed, for example, and the opportunity component may consist of the person’s readiness to take risks of committing a crime (Abdullahi & Mansor, 2015). The capability component may be used to analyze people suspected of fraud to see whether they have the necessary traits to commit the crime.

Thus, this toolkit enables fraud accountants to see the main reasons behind the crime and determine which people and organizations are prone to committing fraud. High work pressure, low wages, and anxiety may be the prerequisites for committing fraud (Maulidi, 2020). In this case, the pressure component is a chance to reduce one’s poverty by fraud. At the same time, the opportunity is the position in the company that enables access to its money and lacks transparency in its processes. The possible rationalization, in this case, is that one thinks they had no other choice and that the fraud was necessary to obtain money for the family, for example. In that way, even an honest person may do fraudulent acts in certain conditions, and the usage of the fraud triangle may elucidate those conditions. Political corruption is another example of fraud, which the triangle may illustrate well (Homer, 2019; Maulidi, 2020). In countries without transparent governments and low life quality, people engaged in politics have a significant opportunity and motivation to obtain money dishonestly.

The model is designed to show what lies behind the fraudulent actions, enabling forensic accountants to check who may be guilty of those actions and how one may prevent them in the future. It allows consistent analysis of situations, such as those described above, elucidating who may be guilty, why they committed the crime, and how such crimes may be prevented. For example, the analysis of rationalization and motivations shows how people justify their criminal actions: in some cases, it reveals weaknesses in the organization’s structure that influenced those people. The analysis of opportunities shows flaws, too: a typical example is a lack of transparency mentioned above, where no one can trace where the money comes to and from and who is using them. In that way, using the fraud triangle and its extensions, such as the fraud diamond, helps the accountant see the situation more consistently, check those suspected, and prevent further cases of fraud.

Fraud Triangle Usage for Fraud Examination

In my opinion, the examination needs to include exploring the reasons behind the fraud and, thus, figure out who may be guilty based on those reasons. Thus, it entails interviewing and surveying everyone related to the fraud in the organization, and then analyzing surveys’ results using fraud triangle model. For example, it enables checking whether one has personal qualities that make them able to commit fraud. Not all organizations are vulnerable to it, and not all people are tended to commit it even when they have opportunities. I would use the triangle to determine one’s motivations and rationalization, and then decide whether one can commit a crime and under which conditions.

It may also be used to examine the company’s structure, finding possible flaws in it that enable fraud or create additional motivation for it. There are four components, elucidated by specialists, that often are the primary motivations to commit fraud: money, ideology, coercion, and ego (MICE), which are often used in connections with the triangle (Free, 2015; Maulidi, 2020). That means one commits it primarily to obtain money or due to their belief that it is the way they should do things (ideology). Two other points are due to hardships or pressure, such as blackmail (coercion) and increasing personal power and influence (ego). By examining the company, a specialist may find whether those motivations are present in its structure and among its people and show what may be changed to prevent further crimes.

Forensic Accountant Requirements in Florida

To become a forensic accountant in Florida, one needs to obtain a Certified Public Accounting (CPA) license first, and there are several requirements for this. First, it is necessary to complete at least 150 academic hours of college education in accounting and then obtain work experience by working over one year of a full-time accountant (Accounting Schools in Florida, 2022). Those working hours should be approved by a currently licensed CPA. Then, one should apply for a Uniform CPA Examination: in the case of Florida, the organization to apply to is the Division of Certified Public Accounting in the Florida Department of Business and Professional Regulation (DBPR). The exam consists of four parts and is taken via the National Association of State Boards of Accountancy (NASBA).

After the exam is passed, one should apply for a license via DBPR, filling out the application form and providing the exam results either online or offline. The license will be received within three to six weeks after the approval of the application form. To become a certified forensic accountant, one should first register with the Florida Board of Accountancy. In addition, one should comply with all local and federal laws, have no felony convictions, and have at least two years of accounting work experience (CRFAC® – Certified Forensic Accountant® Credentialing Program, 2022). The Certified Forensic Accountant program application should include the curriculum vitae, all degrees and licenses, and at least two professional references.

Conclusion

The triangle and diamond schemes are good to check whether the suspected people are guilty and to see weaknesses in the company’s or government’s structure. They show basic elements of fraud: motivation to do the crime, opportunities in the organization’s system and person’s position, and rationalization of the action. Examination of the pressure and motivation helps to figure out which factors encourage corruption and other fraudulent acts in the organization, allowing it to function more efficiently and adequately. Opportunities show weak places in the company, and analyzing the existing fraud schemes and cases may help to decide how those weaknesses may be overcome. Lastly, rationalization analysis shows how those who committed crimes justify their actions and why they did them: it often shows additional problems in the organization that may be resolved. In addition, the capability element may be used to indicate resources available for those who committed the crime.

Reference

Abdullahi, R., & Mansor, N. (2015). Fraud triangle theory and fraud diamond theory. understanding the convergent and divergent for future research. International Journal of Academic Research in Accounting, Finance and Management Sciences, 5(4), 38–45. Web.

Accounting schools in Florida. (2022). Masters in Accounting. Web.

CRFAC® – Certified Forensic Accountant® Credentialing Program. (2022). American Board of Forensic Accounting. Web.

Free, C. (2015). Looking through the fraud triangle: A review and call for new directions. Meditari Accountancy Research, 23(2), 175–196. Web.

Homer, E. M. (2019). Testing the fraud triangle: A systematic review. Journal of Financial Crime, 27(1), 172–187. Web.

Huang, S. Y., Lin, C.-C., Chiu, A.-A., & Yen, D. C. (2016). Fraud detection using fraud triangle risk factors. Information Systems Frontiers, 19(6), 1343–1356. Web.

Maulidi, A. (2020). When and why (honest) people commit fraudulent behaviours? Journal of Financial Crime, 27(2), 541–559. Web.