Summary

Corporations should use financial securities as their products because they are widely available and easy to find. It would make it possible for the company to profit from investments and raise money as needed. In any event, if a business has a real site that clients can visit, it is a good idea to set up an office there. If the business does not need a physical address, one could wish to consider creating an online presence. This makes it possible for their clientele to get in touch with them from different perspectives.

The Purpose and Operations of the Raw Data

They thoroughly investigated and organized through hundreds of columns of data to determine the best location for a brick-and-mortar office within the state of Connecticut. It became clear that the most efficient way to determine this would be to separate the data into respective categories and then further review it from there. This makes it easier to spot places where there might be some overlap between zip codes, which eventually makes it possible to pinpoint the optimal site. After the final project component was turned in, the data were further processed, cleaned, and filtered to find the best placements. Although the margin of error was significant, it was not immediately alarming because the numbers declined more sharply in the zip codes with higher densities. It is not an apparent cause for concern because the margin of error should be considered once the data has been sorted for the locations with the highest concentration of individuals.

All parameters in the general labor force category with an estimated population of less than 15,000 were removed. Regions with bigger populations are inherently thought to be better places to locate the office. The charts can also be made clearer and cleaner thanks to data filtering, allowing for the greatest possible understanding of the numbers. Homes with an income of $50,000 were maintained, but those with a $75,000 to $99,000 income that showed anything less than 2,000 were eliminated. This is due to the belief that households with higher earnings have greater potential for investing, even though households with an income of $50,000 were maintained.

The category of income between $100,000 and $200,000 was altered by excluding all households with incomes between $150,000 and $199,000. There were fewer than 1,5000 households in this group. Calculations were based on the groups that produced the highest levels of income. However, the population decreases as household income increases. This is the rationale behind the removal of anything less than 2,000 from the $50,000 to $100,000 group and less than 1,500 from the $100,000 to $200,000 category.

When examining the households with an annual income of $200,000 or more, the total number of households with a population of less than 2,500 was eliminated. This category was interesting because there were more sites in it than in the earlier trends seen in the project. Another unexpected finding is that there were no zip codes that coincided with the over $200,000 category and the retirement section after the data was purged and sanitized. This will be discussed in more depth below. For those with salaries under $50,000, retirement was sorted and removed because, in the current economy, that is scarcely enough to get by. It must be presumed that these retired household members did not continue to get income from sources other than their retirement funds, even though the information on the subject in this category was ambiguous.

The Geographic Locations of Accredited Investors

To qualify as an accredited investor, one must meet several conditions and benchmarks. For instance, they need to be wealthy individuals who have access to assets that are restricted to particular individuals. However, there are other drawbacks to being classed as an accredited investor that must be considered. Investing in constrained assets boosts investors’ chances of seeing big returns but comes with numerous risks, requires a lot of money upfront, and has high costs (Baldwin, 2022). The ideal accredited investor for this part of the project will be someone who makes a significant income. The only data offered are the population size and income, which serve as the decision-making foundation. Thus, the key types of families represented in the locations where accredited investors are concentrated will be households with retirement income, households with incomes between $100,000 and $200,000, and those with incomes exceeding $200,000.

Greater urban locations tend to have a concentration of accredited investors. The majority of investors are located in or near industrial districts. There are numerous ways to find where authorized investors are located. A person is considered an accredited investor by the Securities and Exchange Commission (SEC) if their purchase at the time of the transaction exceeds $1 million (Baldwin, 2022). The investors’ combined income for the two years prior to the purchase date must be greater than $300,000. Accredited investors are the only ones permitted to participate in private placements of securities (Ribes, 2021). According to this definition, accredited investors are more likely to be found in regions with high average incomes and high net-worth populations.

The following zip codes have been determined to be appropriate for accredited investors after considering all of the selected data criteria: 06010, 06902, 06484, 06824, 06880, 06426, 06378, and 06282. Examining statistics pertaining to investments is another method for determining accredited investors’ regional distribution. For instance, according to information submitted to the SEC on Form D, the majority of accredited investors are located in the states of New York, Texas, and California. Because Form D applications are submitted primarily in larger cities, the data may be slanted in that direction. On the other hand, it provides some data regarding the geographic distribution of authorized investors.

The Structure of Investor Household

Investors can be individuals or organizations, as was previously said. The analysis takes into account the two categories in order to ensure ownership diversity. When examining the investor’s mix of retirement income, there are many factors to consider. Accredited investors will likely have a variety of sources of income during their retirement years to start with. Regarding salary and net worth, investors make more money than ordinary people. Accredited investors are also more likely to have retirement funds than others (Baihaqqy et al., 2020; Mills et al., 2020). They generally have a better handle on their finances since they frequently manage their money efficiently and are aware of the need to prepare for retirement. Retirement funds held by authorized participants are likely to include a variety of financial products (Baihaqqy et al., 2020). This is because they typically have a broad range of investments and are aware of the value of having a diverse portfolio.

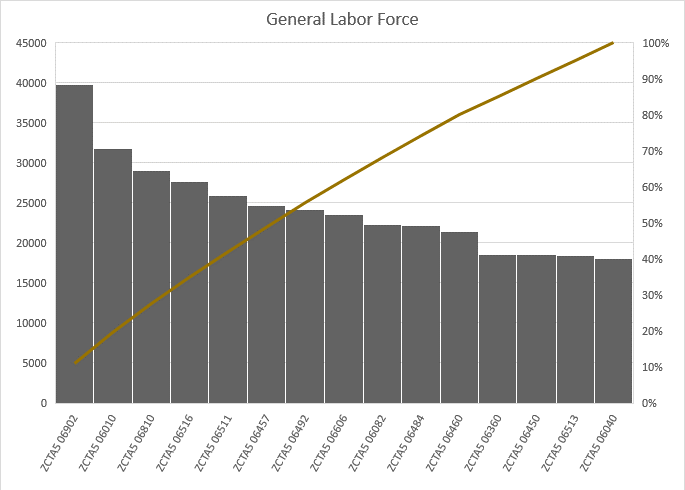

Figure 1 summarizes the distribution of investors based on geography. The highest-earning investors belong to the 06902, 0610, 06810, and 06511 categories, respectively. The distribution of the investors varies significantly with their salaries and savings. However, a few of them have high salaries and investment ratios. For instance, the investors in the 0360, 06540, 06513, and 06040 households have their savings differing by a small margin.

The Retirement Income Mix of the Investor

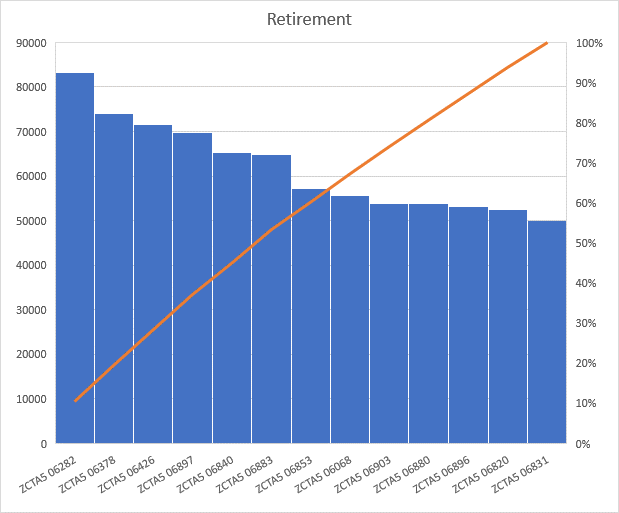

An investor’s retirement income mix must adhere to the 80:20 rule. The purpose of the retirement perks is to guarantee that the investors will remain motivated and cooperative (Kimiyagahlam et al., 2019; Baihaqqy et al., 2020). The figure below presents a visual distribution of incomes and benefits with respect to average retirement income in 2019.

Figure 2 illustrates the discrepancy between the number of individuals working, but not saving for their retirement. For instance, the fact that an individual earns $80,000 may not translate to direct or actual investments. Reference figure 1 above, the majority of average retirement income ranges between $50, 000 and $60,000.

A suggestion for an Office Location

Setting an office for an authorized investor must be decided based on a variety of variables. Accredited investors are more likely to be found in places with high average earnings and high concentrations of high-net-worth persons. The second point is that most authorized investors are presumably clustered in larger cities. This is because a significant portion of Form D filings is made in more populated locations. Thirdly, regions with a wide range of investment prospects are more likely to be home to authorized and approved investors. They often have a variety of investments, and they are experienced investors who recognize the need to maintain a broad portfolio. After weeks of screening, wiping, reviewing data, and conducting research, it has been determined that zip code 06902 would be the best location for the workplace. When looking at the Spreadsheet in Excel, this zip code is the most consistent across all categories except retirement, which is a good indicator. This zip code is marked in peach on all of the papers with the general labor force to those exceeding the $200,000 mark.

In Connecticut, 06902 has the most workers overall, starting with the general labor force. This is significant because it shows that there is a sizable population, which is good for business and raises the likelihood that potential investors will become aware of the company. If households in that zip code were interested in investing, they would probably learn about the company through others who spoke to them about it rather than just because it was close by, therefore, it does not matter if nobody in that zip code receives retirement income. The $50,000 to $100,000 range is at the top of the chart. This is great because the corporation wants to make money irrespective of stockholders, so keeping a steady job while also earning a salary that can sustain a good quality of life offers an excellent opportunity. The primary assessment categories that are given the greatest weight in this selection are the $100,000 to $200,000 households and those exceeding $200,000, all of which exceed expectations of success.

Available Services in the Field of Asset Management

There are a variety of considerations to be made when recommending wealth management options to an eligible investor. Accredited investors are more likely to be generally interested in a larger choice of investment goods. They often have a variety of investments, are savvy investors, and recognize the need to maintain a broad portfolio (Kimiyagahlam et al., 2019). Accredited investors may be interested in a variety of wealth management services, which brings us to the second point. They generally have sound financial management practices and understand the significance of expert advice, which explains why. Furthermore, accredited investors are likely drawn to a wide choice of different investment vehicles. This is due to the fact that they usually have greater wages and investment potential than average-income individuals.

The final part of this project is to evaluate and provide wealth management strategies. This is one of the most important decisions a business can make because it has the potential to make or break it. The corporation must work with a wealth management company to manage its wealth and ensure healthy wealth growth (Ribes, 2021). The objective of wealth management is to maximize the overall value of a company’s assets while also optimizing its utilization. The fact that corporate tax information is quite technical and accurate is another reason why a company should make sure they have the greatest wealth management system they can acquire; the best recommendation for a physical location’s wealth management services in Connecticut’s 06902 zip code is to use the service that Connecticut Wealth Management, LLC offers (city of Stamford). In addition to a number of other achievements, they are an accredited business with stellar evaluations and were even selected as the top financial advisors for the year 2020 (Ribes, 2021). Always stay on top of your financial planning and engage the aid of a reliable person.

References

Baldwin, J. G. (2022). How to become an accredited investor. Investopedia. Web.

Ribes, E. (2021). What is the impact of introducing productivity tools for wealth management professionals? A case study for the French market. HAL open science. Free and Accessible Knowledge, 10(5), 110-124. Web.

Kimiyagahlam, F., Safari, M., & Mansori, S. (2019). Influential behavioral factors on retirement planning behavior: The case of Malaysia. Journal of Financial Counseling and Planning, 30(2), 244-261. Web.

Baihaqqy, M. R. I., Disman, D., Nugraha, N., Sari, M., & Ikhsan, S. (2020). The effect of financial literacy on the investment decision. Budapest International Research and Critics Institute (BIRCI-Journal): Humanities and Social Sciences, 3(4), 3073-3083. Web.

Mills, F., Willetts, J., Evans, B., Carrard, N., & Kohlitz, J. (2020). Costs, climate, and contamination: three drivers for citywide sanitation investment decisions. Frontiers in Environmental Science, 8, 130.