Background

Walmart is an American company that operates the world’s largest wholesale and retail chain. The headquarters is located in Bentonville, Arkansas. The central regions of activity are the United States and Mexico. Moreover, Walmart has a significant presence in Canada, South America, South Africa, China, and Japan. Since 2003, the company has topped the Fortune 500, a list of the largest U.S. corporations, almost every year. To date, the company’s primary strategy is to provide customers with the maximum range of products and minimum prices. The company has retail stores and an online marketplace and provides related financial services like transfers and gift cards in the U.S. market. In the international market, the company focuses not only on retailers but also on wholesalers.

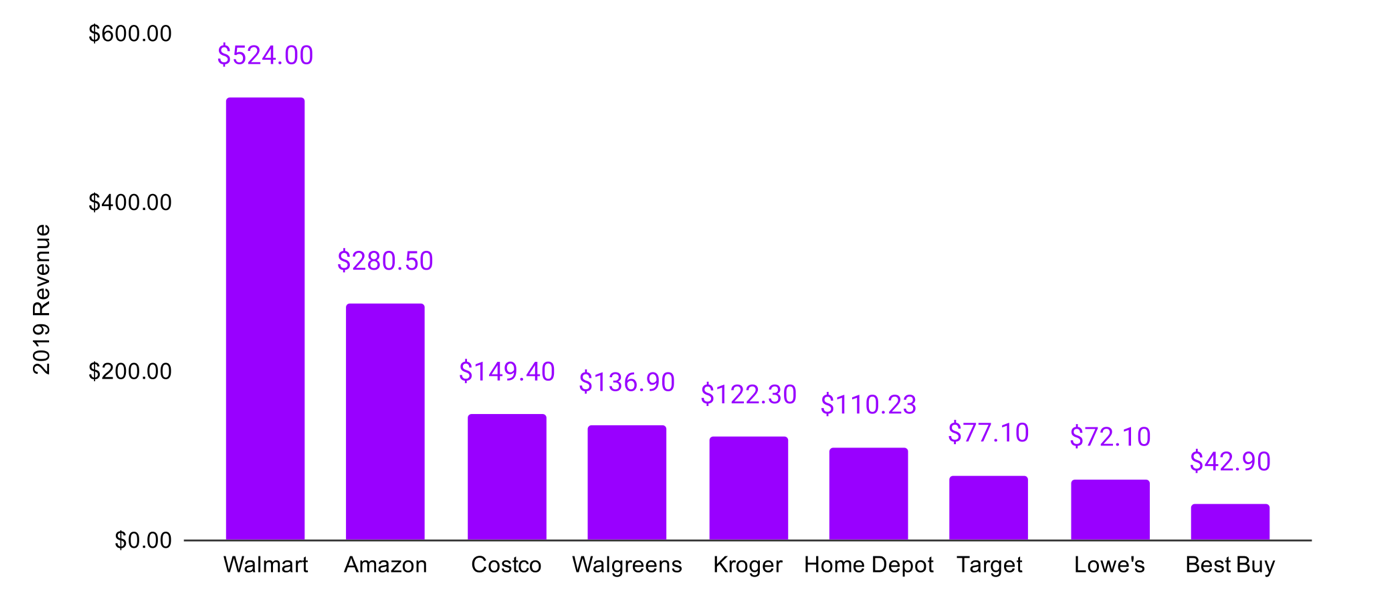

Walmart’s sales concept is not unique, so it is not surprising that the company has plenty of competitors. Tchibo.de is a German store owned by the world-famous Tchibo Certified Merchandise, producing instant coffee. Today, the product categories have expanded considerably. Now it includes food and clothing for the whole family, furniture, household goods, gadgets, jewelry, sporting goods, and much more. Target Corporation is the second-largest discounter in the United States after Walmart. However, Target offers higher quality and more fashionable items, unlike its competitor. This company is also regularly ranked on the Fortune 500 list. It is impossible not to mention Amazon among the competitors. This is an American organization, one of the largest in the world among companies involved in the sale of all kinds of goods and services over the Internet. It is also a leader in the field of sales of mass-market goods through the system of Internet services. In general, among other competitors, Walmart has a leading position (Fig. 1). However, to maintain this status, the company will need to make a significant amount of effort.

Corporate Costs

The marginal cost of capital is a metric that helps analyze different financing alternatives and make decisions for the company. Walmart Corporate’s cost of debt is 4.35%, compared to Amazon’s 4.25% (“Walmart WACC”). The company’s cost of equity is 6.1%, compared to 5.8% at Costco (“Walmart WACC”). Walmart’s preferred stock for the January 2022 quarter was $0 mil (“Walmart Preferred Stock”). The company’s WACC is 5.8%, while Amazon.com Inc.’s WACC is 8.1% (“Walmart WACC”). In general, it is possible to conclude that Walmart’s performance is within the average.

Growth Models

Multiple growth models are used for companies with stable growth rates. They are often utilized to model the value of fast-growing companies. A two-stage or two-phase dividend discount model assumes that a company will begin to pay dividends that grow at a constant rate at a certain point (Chen). Until that point, however, the company pays dividends that grow at a higher rate than the one that will be sustained over the long term. Because of this, the company is expected to experience an initial finite period of high boost, perhaps before competitors emerge, and then an endless period of sustained development.

The multiple growth model allows people to evaluate companies that pay the highest dividends within the business cycle. This model can be used within the business cycle fluctuations and covers continuous and non-standard financial activity (Chen). The multistage dividend discount model has an unstable initial growth rate and is flexible because it can be either negative or positive. This model is appropriate for valuing an older company that has already gone through a growth phase and is currently in a transitional phase (Chen). However, the choice of a two-step DDM should not be based solely on the company’s age. Older companies sometimes manage to achieve above-average growth, such as through innovation, entry into new markets, or corporate acquisitions. Long-term growth rates can also be interrupted by a period of solid performance.

Walmart continues to grow at a strong pace despite threats from trade wars as well as high competition. With investment and trade suppressed due to trade wars, consumption becomes the main driver of growth for the U.S. economy, which can continue this year. The company’s bet on the development of online commerce will allow the retailer to increase business margins in the long term (Townsend). With the increasing uncertainty in the stock markets, Walmart’s stable position has become its main competitive advantage. The isolation associated with COVID-19 has brought unexpected benefits to the company (Townsend). In addition to the infrastructure for online ordering and pickup, the company benefited further from the demand for essential consumer goods and the closure of many smaller competitors (Townsend). Walmart’s annual free cash flow for 2022 was $11,469B, down 55.93% from 2021 (“Walmart Free Cash Flow 2010-2022”). However, for investors, the risks are minimal, as Walmart forecasts growth in the second half of the year. The biggest danger could be a long-term decline in Walmart’s revenue growth rate in the online segment. At current prices, Walmart stock is a rather appealing investment.

Works Cited

Chen, James. “Multistage Dividend Discount Model.” Investopedia, 2021.

Townsend, Matthew. “Amazon, Walmart and How Covid Changed Shopping.” NDTV, 2021. Web.

“Top Walmart Competitors in the US.” Statstic, 2022. Web.

“Walmart WACC – Weighted Average Cost of Capital.” Value Investing, n.d.

“Walmart Free Cash Flow 2010-2022.” Macrotrends, 2022.

“Walmart Preferred Stock.” Gurufocus, 2022.