Background of the company

Westlake Lanes is located in Oregon, United States. The company is a family business in downtown Raleigh and was founded in the early 1970s. The company is located on 11,000 square feet of an old mill in the downtown acquired on a long term lease. Dane Sugar funded the lease with a $150,000 on the bank loan and $100,000 on savings. The building hosts 16 Ten-Pin bowling lanes. The founder of the business died in 2008.

Thereafter, his son and close friends became the business owners and board members. After his death, the board members stepped in to run the business. It was a challenge to obtain his successor to run the business. Prior to his death, the business was in a financial crisis. Westlake Lanes faced the risk of being declared insolvent. This treatise attempts to discuss a number of problems that the business faced. It further makes a recommendation on practical solutions and financial analysis of alternatives. Finally, it makes a summary of the implementation of the proposed recommendations.

Key issues facing the company

After the death of the company founder, the board offered longtime employee Shirley Smith a chance to run the company as a general manager. She was offered a pay rise of 30%. Further scrutiny revealed that she lacked formal managerial experience and therefore, did not have the capacity to turnaround the company. This presented itself as a major setback for the success and growth of the company. Shelby Givens joined the company in the position of a general manager to repair the falling company.

At the time of her joining, the company faced financial challenges. The company experienced declining sales and increasing costs. Revenue declined while costs took an upward trend. Especially costs for employee health insurance, maintenance, and utilities. Further, before his death, Dane Sugar funded the improvement of the business with credit. In addition, in late 2008 the board loaned the business $100,000 from a personal savings account in order to sustain the collapsing business.

Givens also realized that there were plenty of unpaid invoices and unopened mails. She realized that payables were 50% more than the estimates the board had given to her. Apart from financial challenges, the condition of the facility was deteriorating and this forced the management to charge fairly low prices. Further, on her first day at work, she realized that the employees were demoralized. The board’s infrequent communication left the employees disgruntled. The employees never had a job description and they just carried out their routine jobs. They imagined that the business would be closed down soon. She noticed that the low morale of the employees made the business sluggish.

Another challenge that the business faced is outdated machinery. These machines had fully depreciated. This increased maintenance costs. Givens further was not able to obtain important information about the business. The staff member kept simple records.

They lacked detailed records on the performance of the business. For instance, she could not obtain details of revenue in terms of how many customers are served per hour and average spending on a customer per hour. Finally, Givens learned that the business was not well advertised. The previous management used the traditional form of advertising, that is, newspaper which was costly. The previous management did not explore other cheap ways of advertisements such as the internet.

Analysis

Correct use of strategy concepts

The problems that Westlake Lane Company faces can be summarized into two categories. First, the company is in worse shape financially. Second, the employees of the company show signs of negligible productivity. Therefore, the new general manager has to turn around the company which is at the brink of bankruptcy and at the same time builds employees’ morale. From her nine months of performance, it is apparent that the company has the potential for growth and making profits. However, the company pressing debts cast doubt on its ability to survive in the near future. The debts are urgent and the profitability of the company might not successfully repay the debts in a good time.

External and internal analysis

During her first 9 months of operation, Gives employed some of the short term turnaround strategies which saw the company made profits. Some of the strategies Gives employed are summarized in the table below.

Qualitative and quantitative analysis

Analyzing the business location

As pointed out earlier, Westlake Lanes is located in the downtown of Raleigh. There are about four other companies offering the same facility in the neighborhood. Therefore, Westlake faces competitions. However, Westlake has an upper hand since it is located in a prime location. It is a lively neighborhood with plenty of restaurants. This gives it an upper hand in the competition.

Analyzing the financial statements

The table below summarizes the financial results of the Westlake for four years.

Insightful analysis

From the above table, it is evident that the performance of the company has been on a downward trend. This is shown by net profit margin, return on assets, and return and equity. The ratios declined to a negative position. However, the gross profit margin for the four years was positive and high ranging from 74% to 81%. This shows the ability of the company to manage the cost of sales so as to generate gross profit from the revenue earned.

Summation of External and Internal Analysis

Westlake Lanes require turnaround strategies for its survival. It is necessary to know the stage of decline of the company’s performance so as to employ an effective restructuring strategy. A viable turnaround strategy should be able to reverse causes of distress, resolve financial performance, regain stakeholders’ support, and overcome unfavorable industry characteristics and internal constraints. From the above discussion, is clear that Givens made use of short term turnaround strategies. These strategies were successful as they ensured that the business is well managed and stable. She demonstrated control of the business and re-introduced the predictability of the business. However, these were short term measures that aimed at getting the business out of the hole. The strategies cannot sustain the business in the long run.

Recommendations

It is important to employ long term turnaround strategies that will ensure the flow of income over a long period of time.

- Revenue enhancement: This strategy aims to increase sales through improving systems, processes, and technology. Some of the activities that characterize this strategy are customer management processes, operations management processes, and innovation processes.

- Cost reduction: Reduction of costs impacts the profits of an organization in a faster way. Both direct and overhead costs need to be reduced.

- Asset reduction: The Company can also reduce idle assets. This will improve efficiency in the business.

- Reorganization: This focuses on people’s issues in the organization. It entails restructuring, change of skills and staff in the organization, and turnaround leadership.

- Strategic positioning: Strategic positioning changes the mission and customer value proposition of the company. It also aims to change the products the company offers in the market.

- Stakeholders’ support: Shareholders need to return for their money and may get impatient when they do not get the return for their money. In most cases, shareholders would like to see short term results before approving long term investments.

From the recommendations, Givens had exhausted all the short term strategies. She succeeded in generating profits for the company. This might convince the board to approve the long term strategies she has in mind. The table below summarizes the cost of the expected venture assuming a worst-case scenario that is when expenditure is on the higher side.

Apart from putting up the kid-friendly and lounge options, Givens should also consider restructuring the loan obligations. The total liability of the company stood at $154,208 as at the end of 2009. Givens needs to discuss with the creditors how to restructure the loans. She may consider changing the terms of the loan from short term to a long term loan payable on a monthly basis. This will increase the cost of interest and will give the company room to grow. Besides, the manager should diversify the products.

Implementation

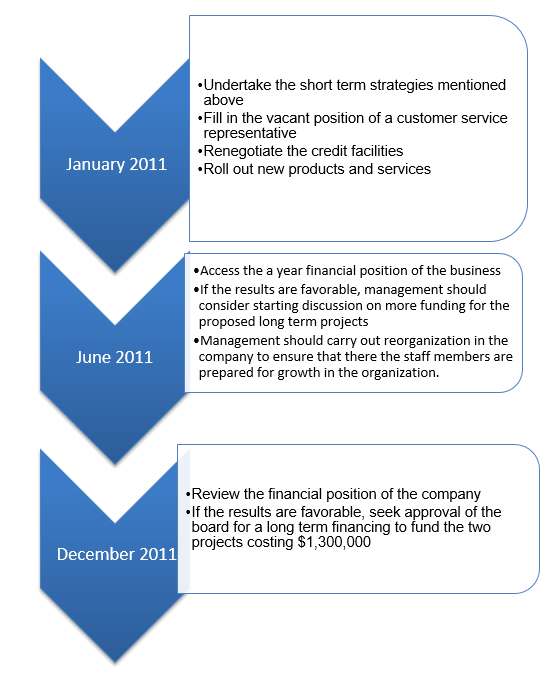

The implementation plan focuses on long term strategies. The table and Ghant Chart below shows the timeline for implementation of the strategies.

Contingency plan

In the worst-case scenario, where the business fails to turn around, the management and board of directors have several optional actions to ensure that the business survives in the market. First, the management may consider disposing of idle assets of the company. This will ensure that only assets in the business are actively used to generate revenue. Second, the management may undertake aggressive cost-cutting in the form of downsizing, employing cheap labor, and cutting on health insurance. Management may also consider leasing the facilities for use to established businesses for revenue.

Practicality of plan

The plan is achievable. It requires the support of all parties. It is based on the assumption of a ‘best case scenario’ where it is possible to obtain a credit facility considering the financial position of the company. It also assumes that the new products will penetrate the market with ease. These assumptions may cast doubt on the practicality of the project. This is not realistic since the future market condition is uncertain.