Events

Wilde’s Bramble, an organic food company in Vermont, experiences increasingly severe economic pressure due to an increasing credit card debt, endangering the business and its owners’ financial security. The sequence of events consists of establishing a business, rapidly increasing sales, investing into production expansion, switching to credit card funds, and reaching a critical point of debt exceeding profit at an increasing rate.

Patterns of Behavior

Alder and Calla Wilde started an organic food company in hope of establishing a family business on their joint land. Initial success was followed by increasing market pressure due to rising demand for their product, urging the couple to acquire additional land, equipment, and infrastructure. As a result, the business owners began to rely on a credit card since the available cash flow was not enough to compensate for the rising production costs. Over time, the income from selling the farm’s products became insufficient to cover the increasing production cost and the growing credit payments, leading to a further increase in financial crunch for the couple.

Structure

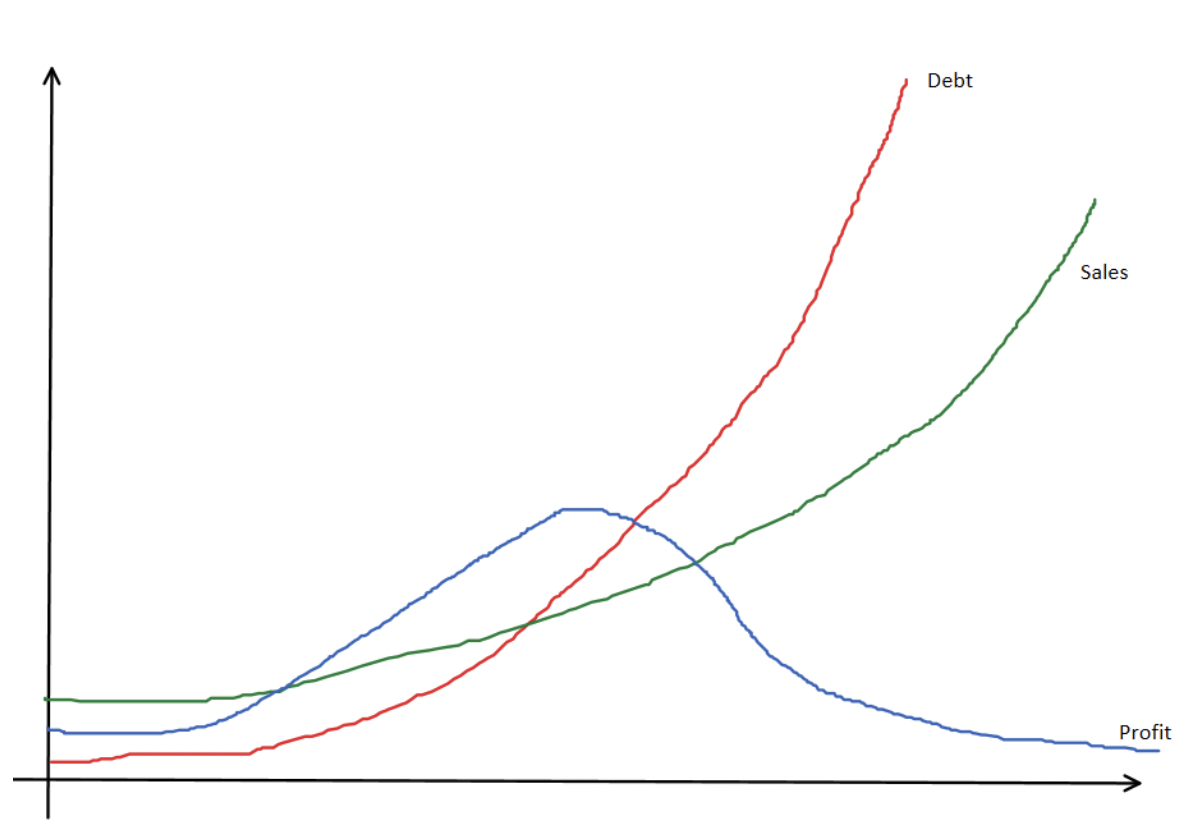

The critical point most likely came during a switch to credit card funds. As the significant portion of profit was allocated to covering the debt, the profit did not follow the increase in sales, while the couple’s credit debt kept increasing. This situation is best represented by the Behavior Over Time graph 2 (see Figure 1). The graph demonstrates how the farm’s profit, temporarily boosted by a rising demand in the beginning, failed to follow the continuing increase in sales as the debt increase rate began to exceed sales increase rate. The critical point when the profit began decreasing is clearly visible at an intersection of the Debt and Sales curves.

The current case study is an example of a business with an unfavorable debt to sales ratio, leading to an inability to increase profit despite a steadily increasing production. The Iceberg Tool provides an effective framework for a step-by-step analysis of the case study, revealing the underlying trends and structures that explain the business’ current state. For example, the Wilde couple overestimated the expected sales increase compared to debt increase, failing to account for factors such as local market saturation, low price elasticity, and a non-linear nature of production costs increase. The Iceberg Tool demonstrates how the underlying structure of a non-linear debt increase triggered the farm owners’ business behavior patterns, eventually jeopardizing the company’s financial stability.

The Behavior Over Time graph demonstrates how different aspects of Wildes’ business model interact and influence each other, revealing patterns and interdependencies between different variables. The graph clearly shows how credit card debt helped to ramp up production at an early stage but, over time, overwhelmed the sales increase. This could be influenced by external and internal factors, such as local market saturation, price stabilization, inability to scale up the production quickly enough, or too high debt percentage rates.

As a result, the company’s debt to sales ratio increased 100% at the point of two curves (Sales and Debt) converging and kept increasing after that (see Figure 1) (Debt to sales ratio, n.d.). So, the profit curve experienced a sharp decrease due to the company’s costs to maintain production rate and cover for the increasing debt kept increasing. Eventually, according to the data from the Iceberg Model and the Behavior Over Time graph, the farm’s profitability is likely to remain approximately on the initial sales level unless the owners manage to increase revenue.

Resource

Debt to sales ratio. (n.d.). Gridlex. Web.