Abstract

The high growth rate of demand and the high price premiums charged on organic food are the main drive of the organic food market. The U.S. organic food market is the largest in the world. In addition, demand is growing at a higher rate than in most countries. The launching of the USDA Organic Seal played a key role in building confidence in the organic products market. Several countries in Europe show high demand growth rates similar to the U.S. However, the U.K. and Japan have no indication to follow the same trend. In the U.S., convention food retailers have replaced farmers and whole food retailers as the main retailers of organic food. One of the illusions of organic food is that higher production costs is the only factor to the higher organic food prices.

Introduction

The definition of organic food under the USDA description is products that have been produced using organic inputs (Dimitri et al., 2009). Organic inputs are biological materials that do not contain industrial chemicals such as fertilizers and pesticides. Organic food must be composed of 95% organic ingredients or more, before it can be classified as organic food. Products manufactured from organic components must contain at least 70% organic content. In both cases, the products must be free from sulfites (Dimitri et al., 2009). In most cases, “organic” refers to products considered to have no inorganic ingredients. Organic products are considered to have been produced under organic management.

In organic management, the natural cycles of growth, maturity, and decay of waste are enhanced to preserve soil fertility. Organic agriculture is defined as an “ecological production management system that promotes and enhances biodiversity, biological cycles, and soil biological activity” (Chassy et al., 2014). It follows the environmental approach that considers the ecosystem to be self-sufficient and self-regulating. For example, pesticides eliminate microorganisms in the soil that would decompose organic matter. As a result, application of pesticides interferes with biological cycles.

Regulations have been set to protect consumers from misleading information through the USDA organic certification (Chassy et al., 2014). The main regulator of organic food standards is the U.S. Department of Agriculture (USDA). The Organic Trade Association also plays a role in creating standards. In the U.S., farmers who produce organic products worth $5000 must apply for independent certification (Greene, 2013). In Canada, the Canada Organic Trade Association plays a role in developing standards. The BC Organic Seal is the main certification label used to differentiate products (COTA, 2013). In Japan, the JAS Certified Organic Seal is used on approved organic products (USDA, 2013).

In the U.S., farmers who convert from conventional production methods to organic food crop production must apply organic methods for a period of at least three years, before they can be certified to label their products “USDA Organic” (Dimitri et al., 2009). Dimtri et al. (2009) explains that “soil fertility, pests, weeds and diseases are controlled through physical, mechanical, and biological control methods” (p. 14). Organic food must be transported in separate containers from nonorganic food. Organic food must not come into contact with inorganic ingredients in the production and supply process. Dairy products must be obtained from cows that have been reared under organic management conditions for at least a year. Their feeds must be obtained from organic sources. Poultry, meat and eggs must be obtained from animals whose feeds are organic (Dimitri et al., 2009). Growth hormones and antibiotics are not allowed. However, vaccines may be used to prevent diseases.

Demand for organic food

The high prices are justified by the cost of production and the high demand for organic food. Dimitri et al. (2009) describes that the growth of demand exceeds the increase of acres of land certified for organic food production. Some of the organic food handlers reported critical shortages for some organic products between 2004 and 2007 (Dimitri et al., 2009). The growth rate of demand surpasses the growth rate of certified organic farmlands.

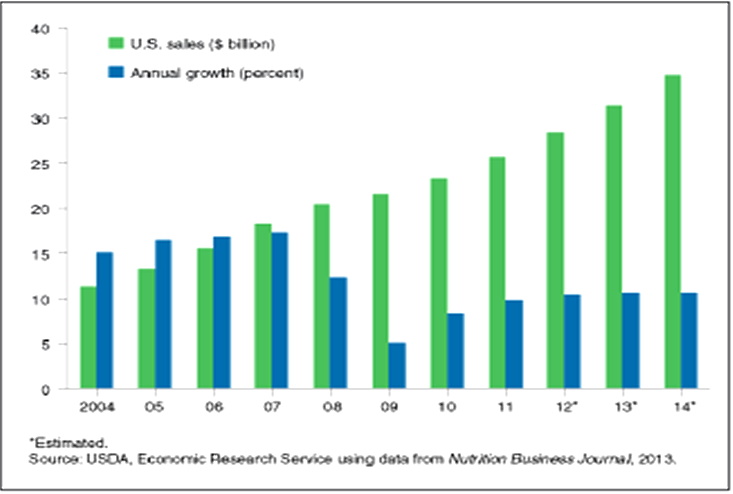

There is a high organic food demand growth rate in many regions in the world. The U.S. is among those countries with the highest growth rates in organic food demand (expressed as a percentage change of the increase in annual sales). Organic food sales in the U.S. grew by 11.5% in 2013 (Haumann, 2014). In 2012, it grew by 11% from the previous year (Greene, 2013). In 2011, it grew by 9.4% (USDA, 2013). It was valued at $28 billion in 2012 and $32.3 billion in 2013 (Haumann, 2014). Countries in Europe that showed high growth rates in 2011 include Croatia (20.3%), Finland (50%), Netherlands (15.9%), Italy (11%), and France (11%) among others (Shaack et al., 2013). The U.S. growth rate is an indication that the organic food industry demand may continue to grow at a high rate in most developed economies.

Source: Chassy et al. (2014)

On the other hand, Japan and the U.K. are countries with lower growth rates of demand in the organic food market. Japan organic food demand grew by 0.24% in 2011 (USDA, 2013). It has been growing at a lower rate in the past few years. In the U.K., demand grew by 2.8% in 2013 (Soil Association, 2014). In Ireland, sales declined for three consecutive years that ended in 2011 (Shaack et al., 2013). It shows that the U.K. consumer has not been attracted to the organic food consumption trend.

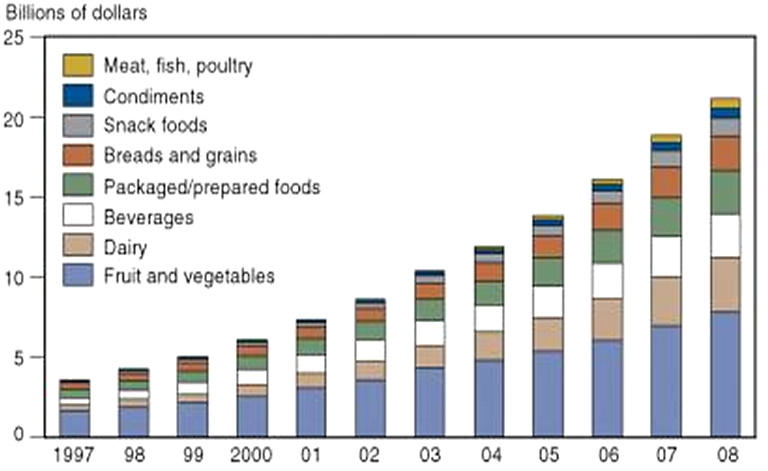

Fruits and vegetables are the main type of organic products demanded in large quantities. In the U.S., they accounted for 46% of total organic food sales in 1997 (Dimitri et al., 2009). In 2012, they accounted for 43% of the total organic sales. In 2012, dairy products accounted for 15%, bread & grains about 11%, and meat, fish and poultry 3% (Greene, 2013). In Japan, 86% of local organic food production is vegetable and rice. Japanese organic food imports constitute 58.9% vegetables by the proportion of value (USDA, 2013). In Canada, over 40% of total organic food sales are contributed from the sale of fruits and vegetables (COTA, 2013). It shows that fruits and vegetables are the main drive of the organic food industry (see Figure 2 below).

Source: Dimitri et al. (2009).

In 2013, organic food sales accounted for 92% of total organic product sales in the U.S. (Haumann, 2014). Non-food organic products contributed 8%, which includes flowers, fiber, pet food, and other products. Organic food is the main drive of the organic product market.

One of the trends that have occurred in the organic food industry is the increase in African Americans who purchase organic food. In the 2001, research indicated that Asian Americans spent more on organic food than other ethnic groups on a capita basis. By 2004, African Americans had become the main consumers of organic food (Stevens-Garmon, Huang & Lin, 2007). Whites and Asian American remained with almost the same levels of consumption.

Figure 3. The U.S. sales after the launch of USDA seal in 2001

Source: Chassy et al. (2014)

Reasons for high demand

One of the reasons provided for the high growth rate in demand in the U.S. is the USDA certification (Dimitri et al., 2009). In Canada, the BC Organic certification has been termed influential in increasing demand (COTA, 2013). The certification of farmlands and organic food handlers has created trust in the products. As a result, buyers are willing to buy more of the organic products. The U.S. is the largest market for organic food followed by the European Union (Shaack 2013).

Another reason that is increasingly becoming a factor in the high demand for organic food is the aversion of GMO products (McNeil, 2014). McNeil (2014) discusses that 25% of consumers listed avoiding GMOs as the main reason for buying organic food in 2014 compared with 16% in 2013. They specifically look for the “Non-GMO” label (McNeil, 2014). In Canada, parents with children aged less that 2 years are the main customers (COTA, 2013). There have been concerns over the use of hormones to speed up physical growth in some animals (Chassy et al. 2014). Most of the people who are considered to avoid GMO products are parents with children younger than the teenage.

The USDA’s Organic Seal is considered one of the main reasons for the increased demand in the U.S. A 2005 survey indicated that a product labeled with the USDA’s Organic Seal made 65% of consumers to perceive them as healthier, 70% as safer, and 45% as more nutritious (Chassy et al., 2014). The growth rate of demand for organic food accelerated after the USDA formal launch in 2001.

Food safety is considered one of the strongest motivations for organic food demand. Chassy et al. (2014) explains that there are concerns over toxic chemicals used in conventional food production. The long-term effects of GMOs, pesticides and herbicides cannot be ascertained. It causes some people to avoid nonorganic food in certain products. However, the high price of organic food is a barrier to daily consumption of organic food. Chassy et al. (2014) discuss that it is contradictory for people who have been raised up feeding on nonorganic food to claim that it is not good for their children. Chassy et al. (2014) highlights the risk messages in the organic food marketing as the most influential factor. The negative publicity given to conventional products by organic food advertisers has been blamed on the high concern about toxins.

The taste of organic food and the environmental concerns have been mentioned as some of the factors that encourage the consumption of organic products. However, Chassy et al. (2014) assign them little influence in the high demand for organic products.

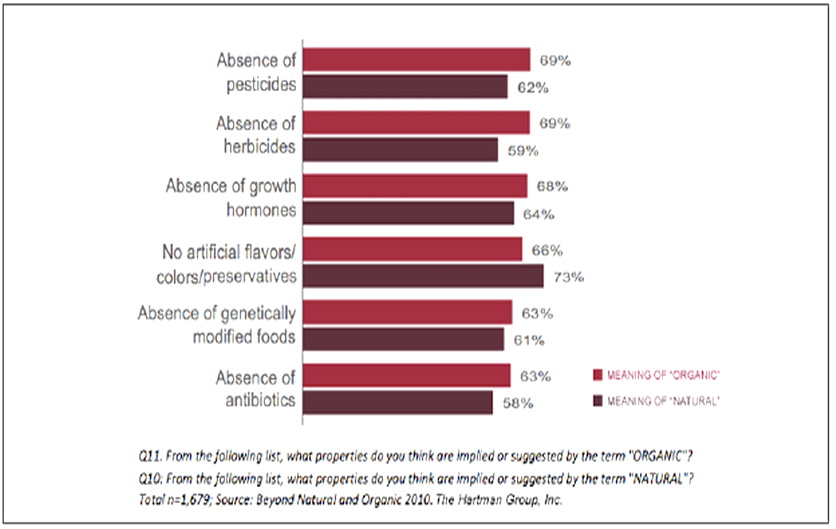

According to the Hartman Group survey conducted in 2010, the reasons for purchasing organic food are shown below (Chassy et al., 2014)

Source: Chassy et al., (2014).

The study also found that consumers consider that natural products and organic products mean the same thing.

There is little consistency in organic food consumption levels based on income levels. Stevens-Garmon et al. (2007) discuss that there is little difference between households that earn less than $25,000 annually to those that earn over $100,000. However, the study indicates that between 2001 and 2004, that those who earned less than $25,000 annually had a slightly higher per capita consumption of organic food than other groups (Stevens-Garmon et al., 2007). The trend is that high income earners, especially those earning over $100,000 annually, are increasingly becoming higher per capita consumers of organic products.

Supply of organic food

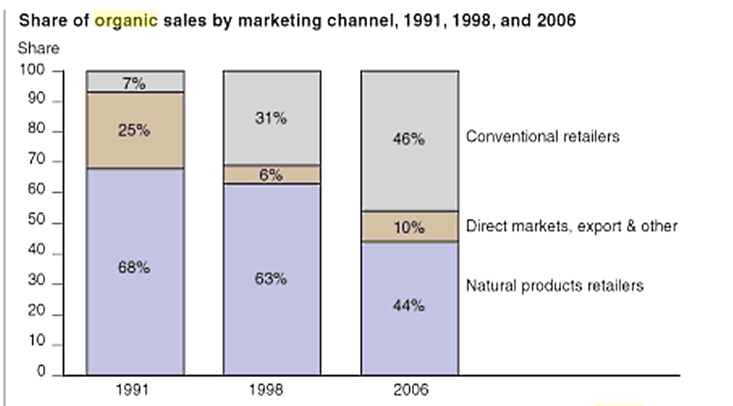

Initially, the sellers of organic food were mainly whole food retail stores and direct producers. Currently, conventional food retailers are competing with the initial sellers directly to store organic food in their retail outlets. According to Dimitri et al. (2009), 82% of retail stores in the U.S. had organic food in their list of products by 2007. Today, more firms engage in the supply of organic food. Their sizes have also become larger.

Dimitri et al. (2009) explains that some of the initial firms that used to engage in both organic and nonorganic food supplies have shifted to specialize in organic food supplies. In 2004, 70% of conventional food handlers shifted to deal in organic food or a combination. In 2007, 63% of conventional food handlers shifted to include organic products in their stock (Dimitri et al., 2009). The organic food market is attractive to conventional food handlers and retailers.

Conventional retailers have emerged as a major outlet for organic products as shown below.

Source: Dimitri et al. (2009).

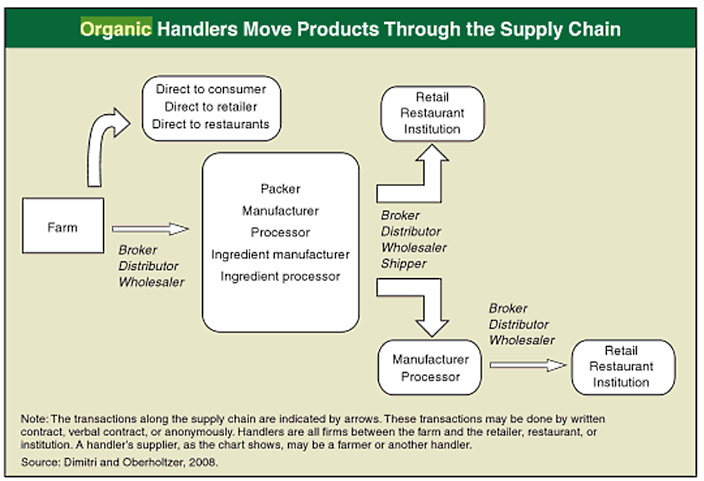

The supply chains are controlled by certified organic handlers. The firms follow the strict regulations set by USDA to prevent organic food contamination by inorganic ingredients (Dimitri et al., 2009). Figure 6 below shows the flow of organic products from the farms to retail outlets.

Source: Dimitri et al. (2009).

Farmlands that require their products to be sold as organic food must apply for certification from the USDA. The average size of farmlands dedicated to organic agriculture has increased. In 1997, the average size was 268 acres of farmland dedicated to organic food production per farm. In 2005, the average size increased to 477 acres (Dimitri et al., 2009). It shows that bigger parcels of land are committed to organic agriculture than a decade ago.

The feasibility of the organic food market depends on the existence of the conventional food products. However, the organic food market has been criticized because it would not be able to meet the nation’s food needs if there were no supply of conventional food (Chassy et al., 2014). The conventional production methods are feasible because they provide higher yields, and incur lower production costs. Without conventional food sources, there would be less food and the prices would rise. People would revert to conventional food because of their availability.

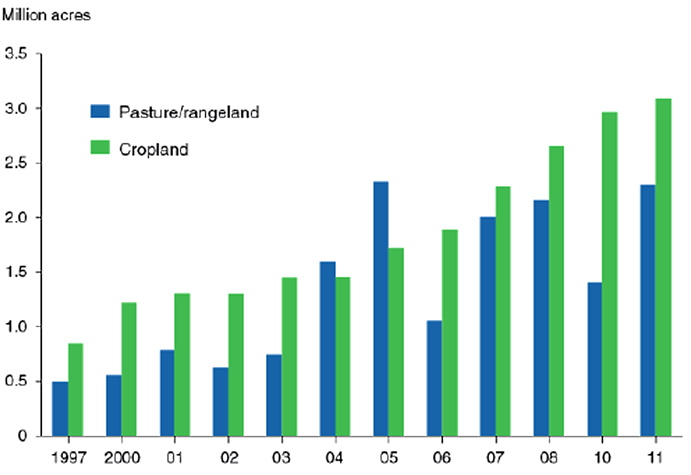

Source: Greene (2013).

Certification of farmlands has played a major role in regulating the supply of organic food. Farmlands with an annual production of organic food valued at $5000 or more must seek individual certification (Greene, 2013). In 2011, there were 3.1 million acres of farmland approved for crop production and 2.3 million acres assigned for organic animal feeds. The certification on farmlands to the USDA Organic Seal on the products has prevented contamination with inorganic products.

The U.S. organic market relies on local production. In other countries, such as Japan, local production is the main source of organic food. However, they also purchase from countries with certified organic farmlands (USDA, 2013). Canada also relies on local production (COTA, 2013). The U.S. imports of tropical and sub-tropical products totaled $667 million in 2011 and 495.9 million in 2012 (Greene, 2013). In the U.S., consumers raise concern over the authenticity of imported organic food. It gives local produce a higher demand.

Pricing of organic food

Organic food has a higher price than conventional food. The high price includes a premium for high production costs (Stevens-Garmon et al., 2007). The high price is also justified by a high demand and a shortage of supply. Stevens-Garmon et al. (2007) explain that the high prices signal a demand surplus.

The high price premium of organic food over conventionally produced food is the main source of higher profitability. In Canada, the average price premium of organic food over conventional food is about 40% (COTA, 2013). Organic meat and poultry prices had a ratio of 1.8:1 when organic is compared with conventionally produced products. Vegetables had a ratio of 1.6:1, and fruits 1.3:1, which translates to 60% and 30% premium respectively. The high demand results in prices with a higher markup than conventionally produced products.

Source: Post & Schahczenski (2012).

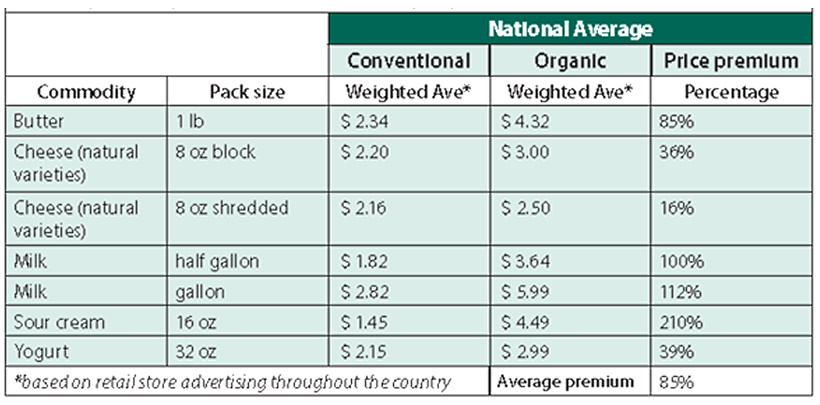

Figure 8 indicates that the price premium is likely to be higher in groceries than in the other two markets.

In the U.S., the average price of organic food exceeds conventional products by less than 30% (Greene et al., 2009). According a 2005 survey, organic milk exceeded conventional products by 72% in the Western states and over 126% in the Eastern states (Green et al, 2009). In Canada, yoghurt had the highest price premium, about 360% (COTA, 2013). Organic dairy products have a higher premium because of higher production costs.

Source: Post & Schahczenski (2012).

In the U.S. Northwest, dairy cows kept for organic milk production are continually auctioned for slaughter as organic beef (Dairy Market News, 2014). The main reason is the high production cost associated with the organic feeds fed to dairy cows.

Higher mark-up on production costs may result in higher profitability than conventionally produced food. According to Post & Schahczenski (2012), a study conducted in blueberry production realized that the organic blueberries had slightly higher costs. However, they gave higher returns than conventionally produced blueberries. The difference in profitability was about five times the difference in costs.

There are several studies that have been conducted to ascertain whether there is a significant production cost difference between organic agriculture and conventional production. The production of corn was one of the products that showed a large difference in production costs. In one study, organic production of corn had total costs amounting to $619.19 per acre compared with $378.74 per acre for conventional corn (Post & Schahczenski, 2012). In another study carried out in 2010, organic soya beans had lower costs than conventional soya (Post & Schahczenski, 2012). However, the low yields of the organic soya beans would have created the need for higher prices for the products when retailed. A 2005 survey also indicated that organic dairy products exceeded conventional products by $4 to $6 per hundredweight (Dimitri et al., 2009). The overall outcome is that organic production may incur higher costs and provide lower yields. As a result, the end products will have a higher price than conventionally produced products.

The pricing strategies of different markets consider a number of factors. Firstly, they consider the production cost on which they add a mark-up for the desired level of profits. Secondly, the price may also depend on the brand, image, quality of product, and reputation of the private certifier (Post & Schahczenski, 2012). When the demand is very high, the price increases. Competitor’s production costs and prices may also determine whether a farmer may shift between different products. In case of organic dairy products, higher production costs have caused farmers to sell their organic dairy cows for organic meat.

In the organic food production, some of the factors that contribute to the higher production costs are the mechanical weeding, biological control of pests and diseases, and biological manure (Post & Schahczenski, 2012). The lower yields also contribute to higher cost spread over fewer quantities leading to higher average costs of production per unit. The cost structure for the production of organic food includes soil amendments, pest control, labor, irrigation, machinery expenses, marketing, and land (Post & Schahczenski, 2012). The variable costs may incur twice as much for organic food production in some crops than in conventional production.

Conclusion

The organic market has an upward trend with a double-digit demand growth rate in the U.S. and several countries across Europe. The U.S. is the largest market for organic food. Its size is larger than the European Union combined. The demand of organic food was revamped by the official launch of the USDA Organic Seal in 2001. The sale of organic food in the U.S. has been growing at an increasing rate since 2001. The growth rate reduced during the economic recession, but it has resumed.

Fruits and vegetables account for about 45% of organic food sales. They are the main drive of the organic food market. Dairy products contribute the second largest portion in terms of value. However, the high production costs for dairy products are hindering the growth of organic dairy production. Dairy products have the highest price premiums in the U.S. and Canada.

As a result of the high demand, conventional food retailers have changed to combine conventional food products and organic food products. Some of the initial dealers in organic food products have shifted to specialize in organic food products only. The organic food market is so attractive that large retailers have become the main sellers.

In North America, trust on organic food products has been enhanced by certification of farmlands and labels on products. In Canada and the U.S., consumers have a perception that products labeled “organic” are safer, healthier and more nutritious. However, some scholars have criticized negative messages about conventional food used in organic food marketing. They are considered the main drive of increased consumption. Consumers want to avoid risks associated with conventional food. Many people believe that concern for the environment has a strong influence on purchasing decisions. Scholars consider safety as the main influence in purchase decisions.

Parents with growing children are the main customers who consider safety when purchasing organic food. They have been criticized for avoiding conventional foods for the sake of their children when themselves they were raised through conventional food.

One of the aspects that make organic food appear like an illusion is the period required by regulation to convert from conventional production to organic. It is only a single year for dairy products and three years for crops. Someone may be concerned if the period is adequate to eliminate all inorganic chemicals found in the soil. The period appears inadequate.

Another illusion of organic food is that the high price premiums are driven by the high organic production cost. In some products, the costs of conventional and organic production are almost similar or slightly different. It indicates that other factors contribute to the prices rather than the production cost. One of the factors is the shortage of supply, which is made worse by the lower yields of organic production.

Another aspect of the organic market illusion is that the world can satisfy every person’s need with organic food. With less conventional methods, the prices of both conventional and organic products will rise, causing people to consume them indiscriminately.

References

Chassy, B., Tribe, D., Brookes, G., Kershen, D., & Schroeder, J. (2014). Organic marketing report. Academics Review. Web.

COTA. (2013). The BC organic market: growth, trends and opportunities. Web.

Dairy Market News. (2014). Organic dairy fluid overview. Dairy Market News, 81(38), 8-9.

Dimitri, C., Oberholtzer, L., USDA., & Economic Research Service. (2009). Marketing U.S. organic food trends from farms to consumers. Washington, DC: USDA, ERS.

Greene, C. (2013). Growth patterns in the U.S. organic industry. Web.

Greene, C., USDA., & ERS. (2009). Emerging issues in the U.S. organic industry. Washington, DC: USDA, ERS.

Haumann, B. (2014). American appetite for organic food breaks through $35 billion mark. The Organic Trade Association Press Releases. Web.

McNeil, M. (2014). Aversion to GMOs becoming driving factor to buying organic. The Organic Trade Association Press Releases. Web.

Post, E., & Schahczenski, J. (2012). Understanding organic pricing and costs of production. Web.

Schaack, D., Lernoud, J., Padel, S., & Willer, H. (2013). The organic market in Europe 2011 – nine percent increase compared with 2010. Web.

Soil Association. (2014). Organic market report. Web.

Stevens-Garmon, J., Huang, C., & Lin, B. (2007). Organic demand: a profile of consumers in the fresh produce market. Choices Magazine, 22(2), 109-116. Web.

USDA. (2013). Japanese organic market. Gain Report. Web.