Abdullah Al Othaim Markets is one of the leading Saudi food and non-food retailers. The company is famous for meeting the clients’ needs, participating in social responsibility programs, and others (Abdullah Al Othaim Markets, n.d.). That is why it is not a surprise that the business impresses with a significant market share and economic benefits. Thus, the paper is going to present an organizational overview of Abdullah Al Othaim Markets by focusing on its ownership structure, shares number, non-controlling interest, and operational outline.

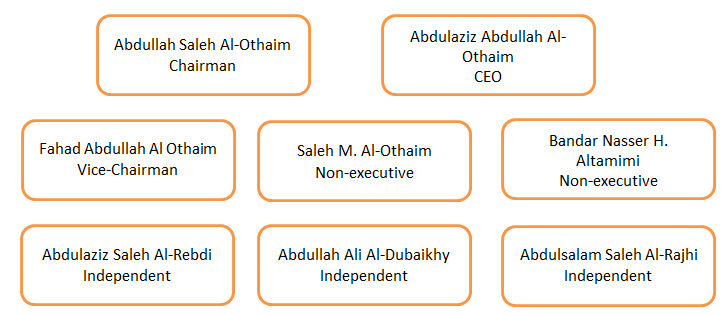

In the beginning, it is necessary to explain the company’s ownership structure. According to Abdullah Al Othaim Markets Company (2020b), it is a joint-stock company. The following tree diagram will present the business’s board of directors that consists of eight members, including a chairman, a CEO, as well as independent and non-executive members. Considering the ownership structure that has been mentioned above, it is evident that the business is owned by its investors and shareholders. The current information demonstrates that the company does not have any significant agency problems.

The second significant point of the overview refers to the number of shares authorized and outstanding. According to Abdullah Al Othaim Markets Company (2020a), the business has 90 million outstanding shares that account for SAR 900 million. The information by Tadawul (2020) shows that the number of shares authorized equals the figure above. This information denotes that the company provides its investors with access to all the shares, meaning that it does not have flexibility in determining how many additional shares it can sell depending on financial needs.

Another essential aspect is to consider whether the company deals with controlling or non-controlling interest. It is non-controlling when shareholders own less than 50% of the company’s outstanding shares. Tadawul (2020) demonstrates that minority interest has become SAR 37,745 thousand in 2020 for Abdullah Al Othaim Markets. This information denotes that the business deals with non-controlling interests, meaning that shareholders do not have control over decision-making processes.

Furthermore, a reasonable step is to present the business’s operational outline. Firstly, the company specializes in both retail and wholesale spheres. The firm keeps developing these two directions, and a 7%-growth in the number of stores in 2020 is an indicator that successful results are achieved (Abdullah Al Othaim Markets Company, 2020b).

As has been mentioned above, the company deals with food and non-food products, including home care goods, electronics, and others. Secondly, one should admit that this Saudi Arabian company operates in Saudi Arabia and Egypt. As for the country of origin, the business has either a supermarket or a wholesale store in each province (Abdullah Al Othaim Markets Company, 2020b). Thirdly, Abdullah Al Othaim Markets is a famous brand that was ranked second according to its market share of 11.3% (Argaam Special, 2020). That is why the given company occupies a stable position in the market.

In conclusion, the paper has presented the organizational overview of Abdullah Al Othaim Markets. This joint-stock company has an 8-member board of directors that deals with the business operation. It is so because non-controlling interest is used, meaning that shareholders have less than 50% of the company’s outstanding shares. All this information results in the fact that the company increases its presence in Saudi Arabia and Egypt, which inevitably leads to a higher market share.

References

Abdullah Al Othaim Markets. (n.d.). About us. Web.

Abdullah Al Othaim Markets Company. (2020a). A Othaim market organizational structure.

Abdullah Al Othaim Markets Company. (2020b). Investors presentation Q2/2020.

Argaam Special. (2020). A look at market share of major Saudi retailers in 2019. Web.

Tadawul. (2020). Abdullah Al Othaim Markets Co. Web.