Introduction

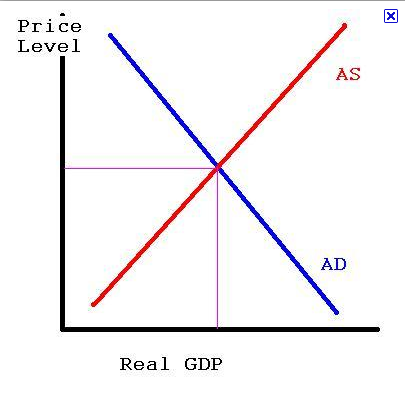

Aggregate demand is normally understood in the context of the total value of goods and services demanded by a given group of consumers at a given period and a given price (Brux 2007, p. 375). In other words, aggregate demand essentially refers to the value of goods and services consumers are willing to purchase at various price levels. In certain economic literature, the aggregate demand is often referred to as the ‘effective demand’ but it bears a close similarity to the gross domestic product of a given country when the inventory does not change (Murad 1962). The following graph best represents this relationship.

An increase or decrease in aggregate demand is brought about by several factors but the most common is the increase or decrease in investments and equal measure, the increase or decrease in consumers’ disposable income (Baumol 2009, p. 606). Aggregate demand shares a strong relationship with basic functional areas of the economy because economics is more or less defined by the demand and supply of goods and services (among other factors).

However, this study seeks to establish the relationship between aggregate demand and unemployment, inflation, the balance of payment (BOP), and the economic growth of an economy. This analysis will therefore constitute the overall overview of how aggregate demand interacts with basic macroeconomic factors.

Unemployment

Unemployment is normally represented as a state in the economy where the number of people willing and can work fail to find employment positions (Kheir-El-D 2008, p. 141). For computation purposes, unemployment is normally expressed as a percentage of the total number of the workforce a nation has but its correct ascertainment is usually a variation of several factors in the economy such as the aggregate demand.

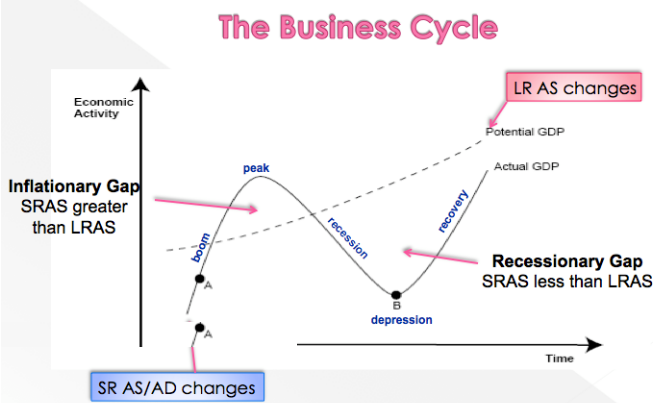

The aggregate demand has a unique relationship with unemployment. The relationship is however not evident to the ‘naked’ eye because it is rather indirect. Through the business cycle, it should be understood that during periods of contraction, unemployment is at its highest point but aggregate demand is low. However, during periods of expansion and peak, unemployment is at its lowest but the aggregate demand is at its highest.

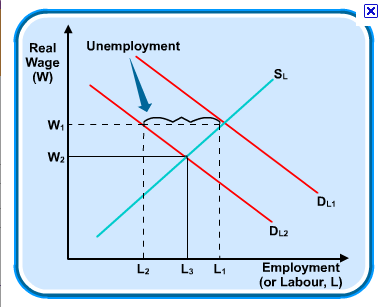

Aggregate demand is a function of the supply and demand of goods and services while the supply or demand of goods and services are also independent variables that affect unemployment in the long run and short-run (Wessels 2006, p. 123). This relationship can be best explained by the fact that for employment to be evidenced there ought to be a high demand for goods and services (a situation that enables production firms to have a higher capacity of employing more people). The following diagram exposes this relationship:

Aggregate demand is in fact in the middle of the entire equation because if the aggregate demand is high, the supply and demand of goods and services in the economy will essentially be high as well. This is caused by the fact that many consumers will have a higher disposable income when aggregate demand is high and this situation also has the potential of increasing the total gross national output as well.

The above relationship between aggregate demand and consumer disposal is brought about by the fact that there is a positive relationship between disposable income and aggregate demand which is best encompassed in the consumption function described by the Keynesian cross (Heijdra 2009, p. 25). This means that the economy will be robust and goods and services will be produced in mass. It is only when such conditions are evident that employment takes place. Many people will therefore be employed to sustain the high demand for goods and services while many more people will be employed to support the increasingly long supply chain.

This concept is best explained through the Keynesian theory which Kling (2011) summarizes that “When aggregate demand goes up in the economy, employment goes up and unemployment goes down. This makes sense because as firms strive to meet the need for more output, they have to hire more workers” (p. 12).

It is also important to note that unemployment does not occur when the aggregate demand is high because during times of high aggregate demand, there are more opportunities for job creation and this eventually leads to a decrease in unemployment. In this type of situation, it is even easy to sustain low levels of unemployment even when people leave their jobs because of termination, lay-offs, resignations, and the likes because they can easily switch one job to another without experiencing long periods of unemployment.

This was the situation experienced in the United States (US) during the 1990s period where the country’s major media corporations were extensively laying off their workers but interestingly, at the same time, the country was experiencing declining unemployment rates (Kling 2011). Needless to say, the aggregate demand for goods and services at this time was high. However, it is important to note that when aggregate demand is high and unemployment rates are low, there is a high likelihood that inflation will set in because many people will have a high disposable income, thereby leading to an increase in the prices of goods and services.

Inflation

Inflation is normally referred to as the persistent increase in the price of goods and services in an economy (Jain 2011, p. 245). It is normally caused by several factors but the most common factor is the increase in the supply of money in the economy. This variable (inflation) is normally ascertained through the consumer price index and the producer price index; both of which are normally relied on by many international economists. Inflation, therefore, implies that the number of goods or services a pound, euro, or dollar would buy at a given time will probably be less as time goes by.

Aggregate demand has a positive relation with inflation because of the simple fact that when aggregate demand is high the inflation rate is equally high (Tucker 2008, p. 291). This situation is normally evidenced both in the short run and long run. Aggregate demand, as noted earlier, is brought about by an increase in consumer disposable income or if there is a high degree of investments in the economy.

When focusing on the rate of investments we should understand that high rates of investments are normally determined by the credit lending rates in the economy. For instance, in periods where there is a high investment, there is a low-interest rate in the economy and it is widely acknowledged that in periods where there are low-interest rates, inflation rates are normally high (Tucker 2008, p. 291).

This relationship is evidenced because interest rates have a positive correlation with inflation rates. Through the business cycle, it should be understood that during periods of contraction, inflation is at its lowest points and aggregate demand is low as well. However, during periods of expansion and peak, inflation is at its highest and so is the aggregate demand.

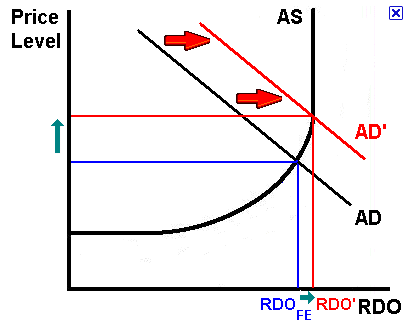

However, it should be understood that there are two types of inflation: demand-pull inflation and cost-push inflation. The demand-pull inflation occurs when the aggregate demand is more than the aggregate supply and it occurs when the GDP is rising and the overall rate of unemployment decreases. In this type of scenario, normally, there is too much money in the economy and there are not enough goods to satisfy the demand. The following graph best explains this situation

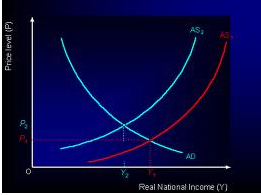

The cost-push inflation, on the other hand, occurs when the aggregate cost of goods and services rises in the economy and there are no alternative commodities to buy (for example oil). The graph below represents this relationship

In periods of high investments, therefore, there is the probability of high aggregate demand to mean that there is too much money circulating in the economy. In such a scenario, the prices of goods and services are likely to increase, thereby leading to a significant increase in inflation rates. The same scenario is also true in instances where there is a high disposable income among consumers which amounts to high aggregate demand. When consumers have a high disposable income, it means that there will be a high demand for goods and services which also implies that the prices of goods and services will significantly increase, thereby leading to inflation.

Economic Growth

Economic growth is normally referred to in economic circles as the increase in per capita income of the gross domestic product or a corresponding economic measure of a given country (Barro 2004, p. 6). Economic growth is often spurred by an increase in the production capacity of a given economy where more goods and services will be produced within a given economy using the existing factors of production. However, it is important to note that economic growth is normally perceived in economic terms within the context of the long run as opposed to the short run.

When analyzing aggregate demand in terms of economic growth we can establish that aggregate demand has a positive relationship with economic growth in the long run but in the short run, it amounts to nothing more than a business cycle (Carré 1975, p. 225). This diagram best represents the motions of aggregate demand in the business cycle:

In the long run, aggregate demand would essentially lead to increased economic growth because there would be a sustained increase in goods and services that eventually leads companies to expand, by increasing their production capacity. In the short run, aggregate demand would not have the same impact because investors or producers would not undertake significant production changes like purchasing new plants or equipment if aggregate demand is not sustainable for long. This would therefore mean that the production capacity of an economy would not proportionately increase with an increase in aggregate demand.

Balance of Payment

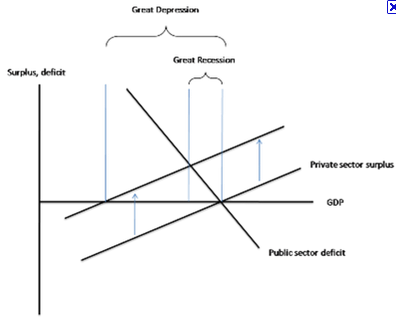

A balance of payment normally occurs when there is a difference in the amount of money spent on imports viz a viz exports (Riesenhuber 2001, p. 285). The balance of payment is normally portrayed either favorably or unfavorably. A favorable balance of payment implies that the exports are more than the imports and an unfavorable balance of payment means that there is more money spent on imports as opposed to exports. Aggregate demand has a unique relationship with these dynamics. This relationship is represented by the following graph:

When the above diagram is seen through the motions of the business cycle, economic depression amounts to periods of contraction and is symbolic of the lower point of the business cycle (trough). This period shows an unfavorable balance of payment and as will be seen in subsequent paragraphs of this study, it represents the short-run situation of aggregate demand. Periods of surplus are represented by expansion and peak in the business cycle and they can be equated to the long-run relationship between aggregate demand and balance of payment.

If the aggregate demand is high, this means that more goods are likely to be imported to satisfy the demand. This situation is especially noted in the short run because the aggregate demand would overwhelm the production and supply of goods and services mostly. After all, the existing production firms would be caught off-guard. This would therefore mean that in the short run, an unfavorable balance of payment would be experienced because there would be more money spent on imports to satisfy the surge in demand (Stern 2007, p. 8). This would surpass the amount of money received from exports (receipts).

However, if the aggregate demand persists and the situation is analyzed in the long run, a favorable balance of payment would be evidenced because the production capacity of the economy would have been increased and the aggregate demand satisfied. This implies that the amount of money spent on imports would be significantly reduced because the local production capacity would be in a position to satisfy the local demand.

Conclusion

This study establishes that aggregate demand either has a positive or negative correlation with inflation, unemployment, economic growth, and balance of payment. Comprehensively, we can see that aggregate demand has a positive relationship with inflation (both in the short run and the long run) and economic growth (in the long run). On the contrary, aggregate demand has a negative correlation with unemployment (in the long run and short-run).

With regard to the balance of payment, we can see that in the short run, aggregate demand will lead to an unfavorable balance of payment while in the long run; it leads to a favorable balance of payment. These dynamics best conceptualize the relationship aggregate demand has with macroeconomic factors

References

Barro, R. (2004) Economic Growth. New York, MIT Press.

Baumol, W. (2009) Economics: Principles and Policy. London, Cengage Learning.

Brux, J. (2007) Economic Issues & Policy. London, Cengage Learning.

Carré, J. (1975) French Economic Growth. Stanford, Stanford University Press.

Heijdra, B. (2009) Foundations of Modern Macroeconomics. Oxford, Oxford University Press.

Jain, T. (2011) Macroeconomics and Elementary Statistics. New York, FK Publications.

Kheir-El-D, H. (2008) The Egyptian Economy: Current Challenges And Future Prospects. Cairo, American Univ in Cairo Press.

Kling, A. (2011) Employment and Unemployment. Web.

Murad, A. (1962) What Keynes Means. London, Rowman & Littlefield.

Riesenhuber, E. (2001) The International Monetary Fund Under Constraint: Legitimacy Of Its Crisis Management. New York, Martinus Nijhoff Publishers.

Stern, R. (2007) Balance Of Payments: Theory & Economic Policy. New York, Transaction Publishers.

Tucker, I. (2008) Survey of Economics. London, Cengage Learning.

Wessels, W. (2006) Economics. London, Barron’s Educational Series.