Abstract

This paper confirmed the high organizational transformability of accounting, but it did not prove the real problem of replacing human labor. The key emphasis of the study, unequivocally reflecting its brief essence, was recognizing the idea of a change in the role of the accountant over the past decades. Moreover, based on the lessons learned from the materials studied, it is appropriate to outline a general outlook for the development of the profession shortly. From a methodological point of view, this dissertation has reflected the clarity of following the primary goal and the sequence of tasks that fill the work with academic meaning and theoretical and practical relevance. Ultimately, it should be recognized that the research conducted is highly significant and relevant not only to the student community but also to those interested in the development of accounting, given the current threat of the disappearance of their occupation. The study’s findings can reassure current and future students and reliably show them that the vector of accounting development, although undergoing metamorphosis, generally remains stable.

Introduction

The work of accountants today is quite different from the work their predecessors did a hundred, fifty, or even ten years ago. The accountant in the company of the present day is the operator among automated processes, beginning with collecting information for a particular reporting period and ending with the formation of final reports. Indeed, the employee of this department, especially in large companies, no longer has to deal with the early routine tasks, which creates some concerns about the prospects of the position in general. If already today, much of accounting turns out to be automated and works with little or no human input, one can expect that workers will be replaced entirely by robots in the coming decades. This assumption is a widespread opinion, which only adds resonance to the discussion of the accountant’s role in future companies. Against this backdrop, the logical question arises as to whether it makes sense to study to become an accountant at all (Flavin, 2019). The counterarguments in this direction are usually considered ideas that giving a few years of life to a profession that may no longer be relevant seems a completely illiterate investment of personal time, effort, and finances. Such considerations are especially true in countries with the most remarkable economic and technological growth in recent years (Dancey, 2016). Notable among these is Wales as one of the four administrative and political parts of the United Kingdom. Although Wales is not a densely populated region of the United Kingdom, its GDP growth rate is comparable to that of the most developed countries in the world. Thus, Welsh students are of heightened research interest as potentially vulnerable to human labor substitution by automated accounting.

Accounting Background/History

The vector of development of different spheres of human life is directly determined by highly rapid technological progress, which is rapidly changing the agenda. Such transformations are particularly strongly felt in industries associated with routine work, in which an employee tends to perform the same actions over a long period. Accounting as a professional field is such a field, and thus it is appropriate to focus on it to trace the pace of technical progress. It is worth saying that the term accounting is broad and ambiguous, and different dictionaries and sources uniquely interpret it. For the purposes of this paper, the whole essence of accounting comes down to an understanding of it as a continuous and systematic collection, fixation, and interpretation of specific information relating mainly to the financial activities of an enterprise. Consequently, accounting should be seen as a multifactorial area of professional activity that has several stages (Axtell et al., 2017).

In fact, ever since the emergence of the first companies, the functions of the accountant as a separate department of the firm have been critically necessary. Ever since human consciousness came to recognize the critical need to combine individual forces and resources in order to maximize benefits, the first companies began to emerge (Gerber, 2017). This is also when the recognition of the critical need for accounting departments as a significant component of the overall organizational structure seems to have arrived (Smith, 2021). The first accountants were masters of manual labor, accumulating, measuring, calculating, and estimating each transaction by hand or non-automatic calculators. Thanks to such employees, factories knew exactly or roughly what their product inventories were and whether their business was profitable at all: in other words, all financial and business accounting was the responsibility of accountants. The unstoppable progress of time could not help but affect this area, and with the advent of electronic calculators, spreadsheets, and computer software, accountants’ work has changed considerably. It is inappropriate to view this change as a movement in a more straightforward direction because the very essence of accounting was transformed. Although employees no longer had to perform calculations manually, it was necessary to set up and evaluate the validity of the use of working applications. Consequently, the qualitative change in the accounting structure is not facilitative but optimizing for the enterprise (Cooper et al., 2019). This is a crucial detail that is necessary for further discussion in this dissertation.

Research Problem

The central problem of this study is to determine the place of accounting automation in the phenomenon of human resource substitution and job decline in the industry accounting market, if such phenomena occur, in the context of Welsh graduate students. The task of this study should be considered a theoretical and practical synthesis of the existing relationship and an explanation of current and projected accounting market trends. It is still a big question to understand the outcomes to which such accounting optimization will lead. One probable reason is the dramatic reduction of jobs due to their replacement with more reliable, adaptable, and customizable systems (Cooper et al., 2017). Thus, exploring the potential of accounting automation is fundamental to this dissertation.

Purpose of Research

The idea that automation will replace manual labor is not coincidental and has historical roots. Over the past centuries, humanity has actively watched the industrial industry change, seeing how factory workers, without whom a factory could not seem to work, were soon replaced by conveyor belts and machines. Similar substitutions are occurring now, with robotic kiosks replacing cashiers, mobile vending machines with embedded machine technology replacing janitors, and cab drivers being replaced by autopilots. In people’s minds, such transformations are automatically extrapolated to more intellectual work, particularly accounting. According to Thomson Reuters (2021), these fears are supported by statistics: more than 78% of accounting processes will be automated soon. In turn, this creates fear for people already working in the industry and for students who one day decide to learn the accounting trade. This is evident in an analysis of students’ posts on social media, and Reddit in particular (u/Slick_Deacon, 2018). It is worth mentioning that Reddit is one of the most popular active social networks that combines the functions of a public forum (Record et al., 2018). The reference to Figure 1 shows the novice student’s experience of whether his or her profession will be in demand shortly. Similar thoughts are evident in the analysis of the response comment (Figure 2), in which a user who has already earned a bachelor’s degree in accounting asks the same question. It can be seen that this person, who has already gained knowledge and competencies as a certified public accountant, senses market trends and understands that Artificial Intelligence is likely to be a great optimization tool but not a replacement.

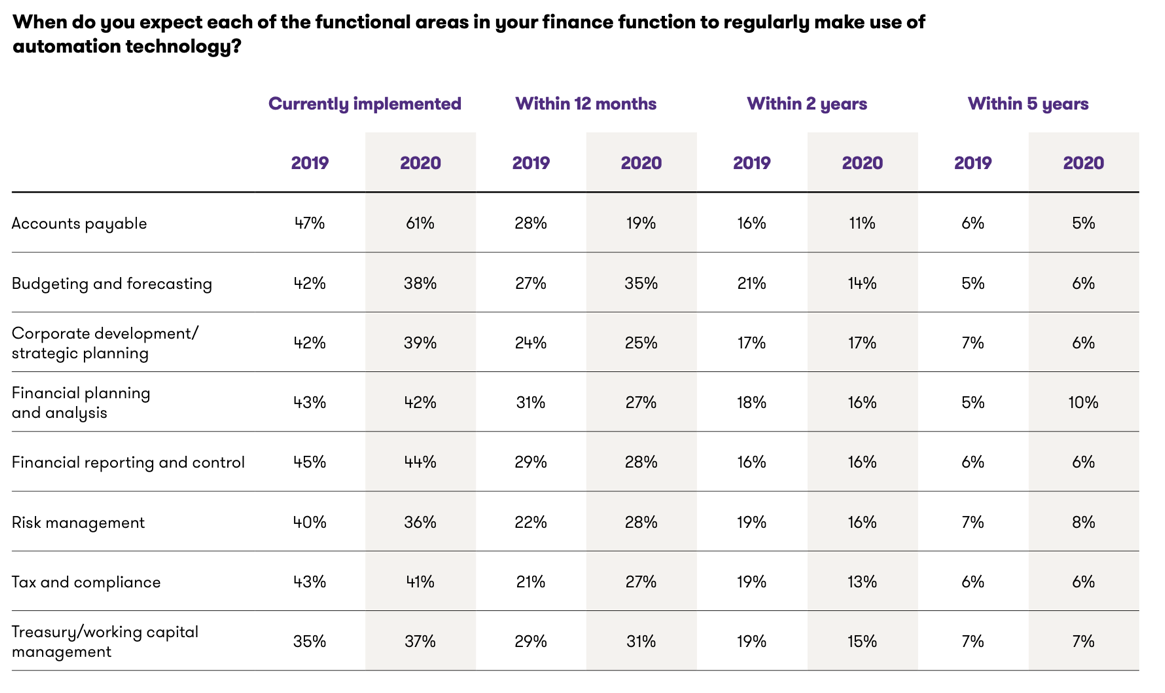

It is important to emphasize that such changes are not an intangible future but will likely happen within the next decade. Opinions differ somewhat, however, as to when full automation will occur. According to GrantThornton (2020), about 96% of all financial accounting functions will be fully automated by 2025, as shown in Figure 3. On the other hand, Törnqvist & Forss (2018) noted that full automation will not be available until twenty years from now, that is, by the early 2040s to 2045s. Gulin et al. (2019) showed that most of the companies surveyed expected automation to be available by 2018. That said, in 2018, Everatt told in his article that by 2020, all accounting processes at large companies would be automated. By 2020, however, Axson (2015) foreshadowed the death of digital technology because the 40% mark of automated operations would be reached. As can be seen, there are some parallels in the five opinions above. For example, many authors sincerely expect automation as if it were the most effective cure for business. At the same time, most authors wish to accelerate the integration of full automated accounting by shortening the time frame. According to some of them, automation should have been completed by now, but in practice, it is clear that this is not the case at all. Only one conclusion can be drawn from such discussions of the time frame for full automation: the process itself is sensitive and dynamic and weakly subject to external rules. Although the effect of this trend cannot be avoided in the Welsh context, research will provide an in-depth assessment as to how automation in the accounting field has impacted students’ employability is Wales.

Government support for the digitalization of accounting cannot be ignored either. The British authorities have proposed an automated system for managing taxes, including VAT, at the enterprise level (Kefron, 2021). As a component of HMRC’s ambitious program, MTD has a focus on easing the VAT refund system and substantially reducing risks and the likelihood of errors. For example, businesses with a total taxable turnover in excess of £85,000 of VAT were required to keep digital records and use HMRC-compatible enterprise financial management platforms from April 1, 2020 (Kefron, 2021). From this, it is already reasonable to conclude that the pace of accounting automation is increasing and that the agenda for fully digital accounting, supported by government initiatives, is approaching.

Research Objectives & Questions

Research aim and objectives:

- Identify the automation changes in accounting practices.

- Identify the strengths and weaknesses of automation in accounting practices.

- Examine the changes have occurred in the Welsh graduate employment market.

- Assess the skills Welsh accounting graduates currently need, to be employed in accounting practices.

The primary research questions of this dissertation are as follows:

- What are the automation changes in accounting practices?

- What are the strengths and weaknesses of automation in accounting practices? Including a critical review of disruptive technologies.

- What changes have occurred in the Welsh graduate employment market?

- What changes have occurred in the skills requirements for Welsh accounting graduates in the past 10 years? And what skills are now needed to be employed in accounting practices?

Summary

The overall structure of the work is represented by five chapters, each of which consistently solves its functional problem. The first chapter introduces the reader to the general nature of the problem, describes its significance and urgency, and postulates the purpose and questions of the entire thesis. The second chapter is presented by a voluminous literature review that characterizes the current academic agenda and critically assesses the body of accumulated knowledge. The literature review outlines not only the central vector of the topic of the entire thesis — that said, the problem of accounting — but also reviews additional knowledge necessary for a deeper understanding of the essence of the topic under study. The third chapter of the work is a discussion of the methodological part, giving an idea of the strategies of search and analysis of materials, research design, and observance of ethical norms. Chapter four is a summary of the essential findings and conclusions gathered through the literature review. Chapter five is a summarizing conclusion, highlighting the central theses of the entire thesis and offering some recommendations for students of today.

Literature Review

Introduction

It is generally believed that world accounting has its medieval origins in Luca Pacioli, an Italian mathematician of the fifteenth century. Pacioli is not called the founder of modern accounting for nothing, for it is to his name that such advances in algebraic and geometric sciences are associated (Sangster, 2021). In his hereditary work, a textbook of commercial arithmetic, Pacioli described such applied problems as the calculation of compound interest, the solution of biquadratic equations, and the applicability of algebraic solutions to geometric problems. However, although Pacioli’s contribution to accounting is undoubted, it would be a mistake to regard him as the first expert in history. For example, the first attempts at arithmetic accounting are more than 7,000 years old and were found in the remains of ancient Mesopotamia (Axtell et al., 2017). Accounting was then used for its direct purpose: with the help of an account, farmers counted and predicted livestock production, estimated profitability from crops, and planned future inventories: in other words, they conducted actual economic and economic activities.

Between ancient Mesopotamia and Pacioli, the accounting craft underwent several stages of evolution. For example, in Roman times, according to Cavalletti (2020), Emperor Augustus recorded all his financial decisions, whether of land distribution, donations, or public expenditure, as the book Res Gestae Divi Augusti attests. Gradually the economy ceased to be in kind and took on a monetary approach: in doing so, individuals gave an amount of money equivalent to the value of the goods being sold or bought. Obviously, this turn in the development of accounting required specialists to accumulate, measure, and evaluate large quantities of financial data, which forcibly steered accounting toward progress.

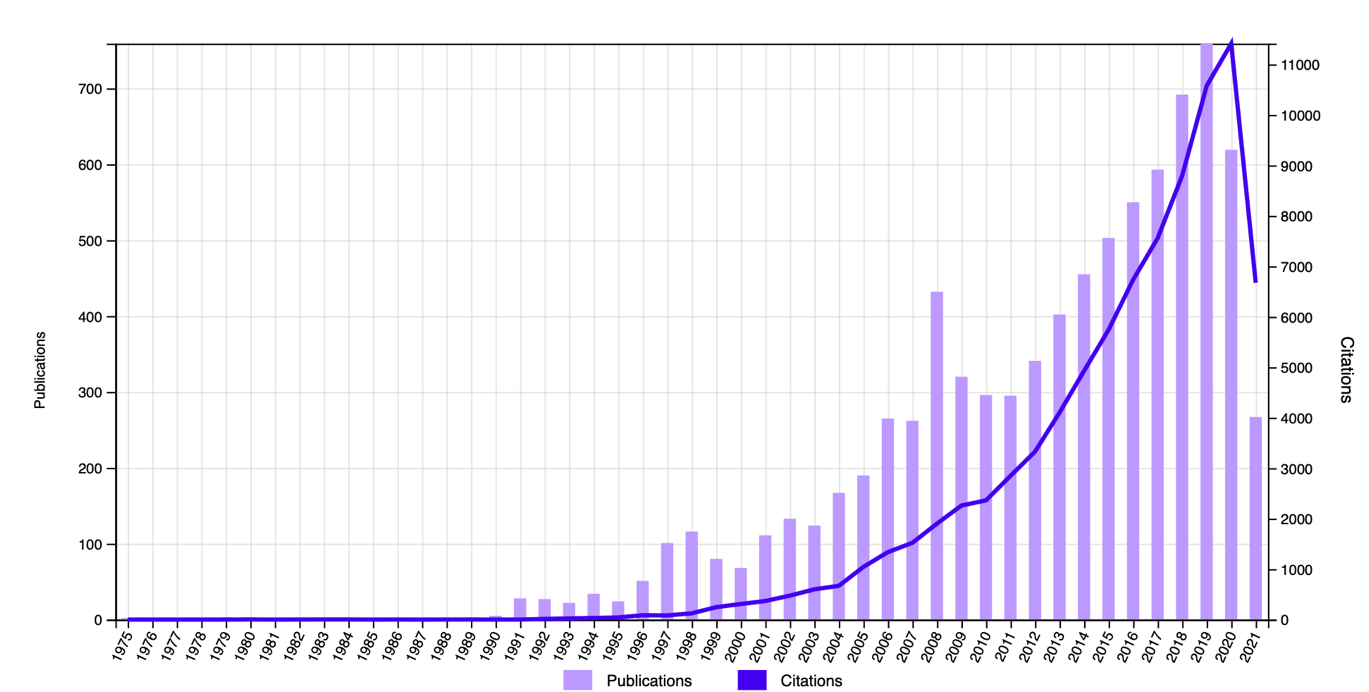

Accounting Practices Today

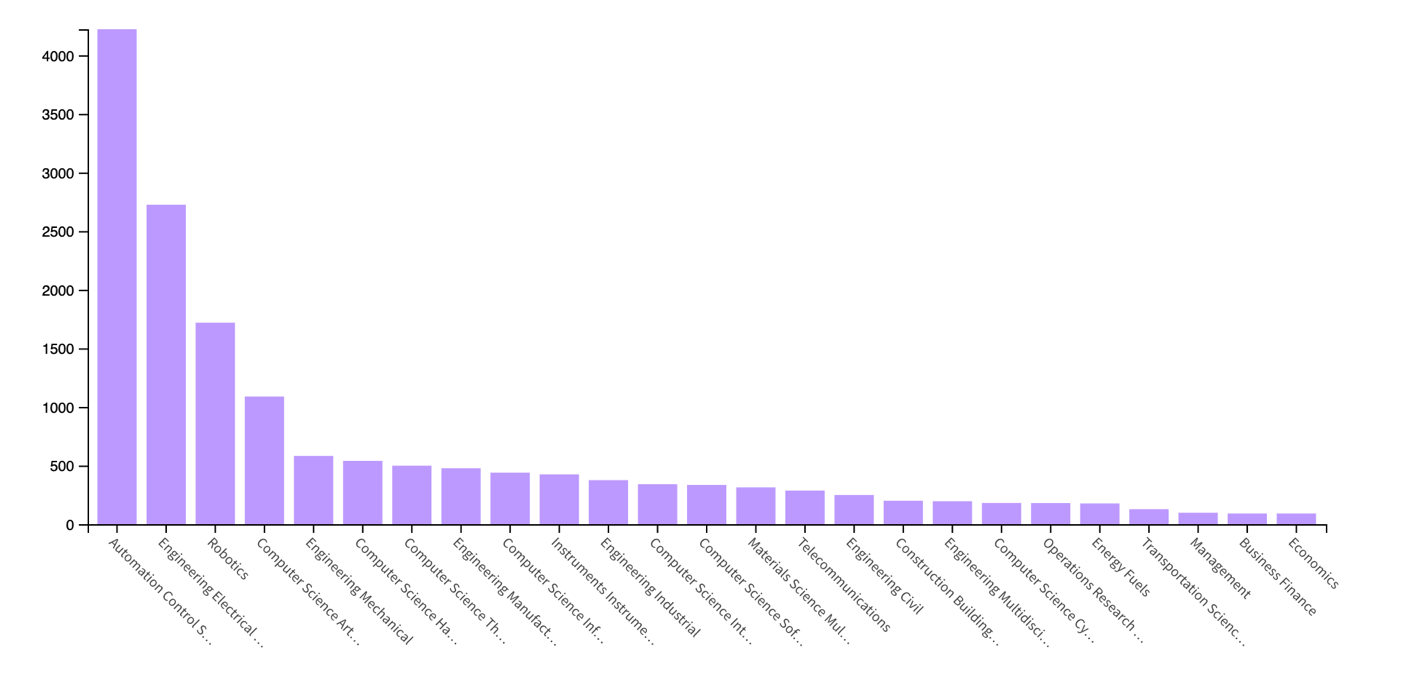

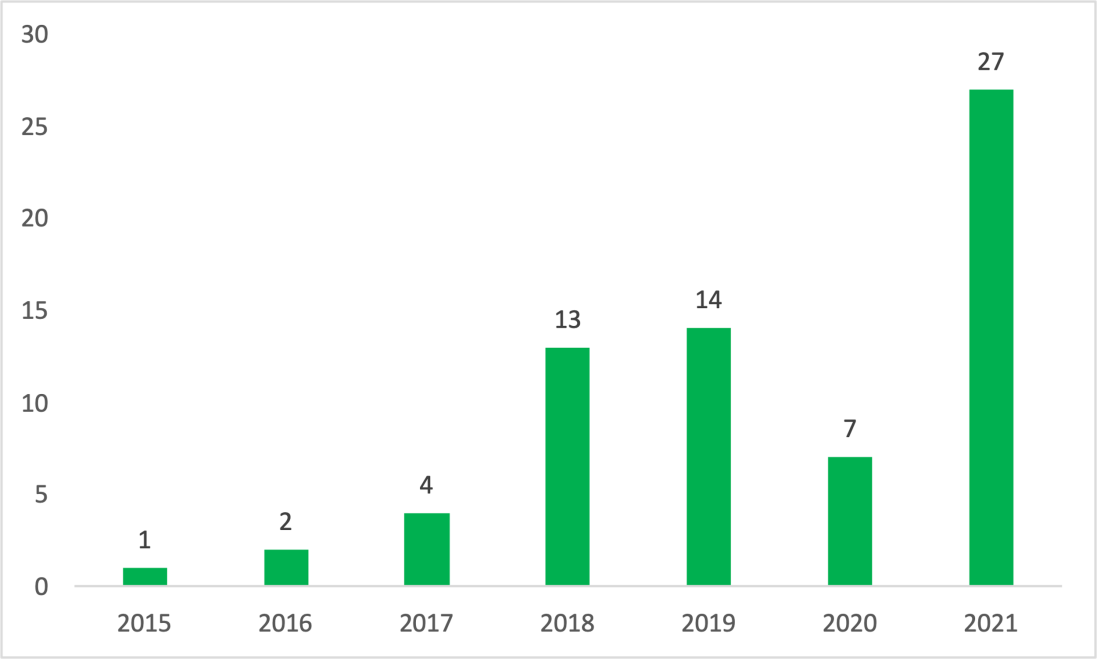

Till today, humanity has not stopped buying or selling essential commodities, although this is the basis of any economy, modern commodity-market relations have changed radically. Cash transactions, bank transfers, cash payments, savings and deposits, digital currencies, and currency conversion transactions: are just a tiny part of what the current stage of the economy is all about. For accountants, this means dealing with a data set that has never existed before. Consequently, relying solely on human labor turns out to be impractical and inefficient. Humans continue to make mistakes even if they are highly skilled experts, whereas a better, more intelligent method of data processing, namely computer automation, is generally free of these errors (Paychex, 2020). Thus, the automation of accounting was a new step in the evolution of the craft, which quite naturally threatened the need for human input. In turn, this has raised academic interest in the issue, which is reflected in the multifold increase in citations of articles on related topics, as shown in Figure 4. This literature review seeks to assess the significance and relevance of this threat in the context of Welsh accounting students, using relevant and credible literature as a basis.

The Primary Reason for Accounting Automation

Business management in today’s legal and economic field requires the entrepreneur to comply with many rules and criteria. Basically, in order to effectively manage production, a business must not only systematically report income through income tax returns and pay taxes faithfully but also keep track of subpoenas. Accounting is a dynamic field, so new regulations, ordinances, and accounting rules appear frequently (Axtell et al., 2017). Given this, today’s entrepreneur works under constant uncertainty and risk, so must make balanced, adequate decisions to keep the business and economic activities of the entire enterprise under control. On the other hand, the possibility of errors made by accountants is never ruled out. These can be data entry errors, incorrect transaction errors, failure to account for commission, errors of principle, or duplication errors (Paychex, 2020). Moreover, miscalculations and assumptions can be made intentionally if the accountant is interested in causing damage to the company for personal or commercial purposes. In this context, it is particularly noted that the threat of such problems is equally severe for small businesses and multinational companies. More specifically, if a small company makes an accounting miscalculation, it can be a fatal mistake: incorrect financial data has often been the cause of forced company closure (Nickolas, 2021). On the other hand, an accountant’s mistake can cost tens of millions of dollars for large companies, as was the case with the prominent British supermarket chain Tesco (Nazir, 2020). Therefore, that means that the estimated damage will not be lower than for a small company. All of this leads to the idea that a person in the role of an accountant is prone to error.

Also noteworthy is the fact that an individual’s work as an accountant is itself imperfect. The individual cannot perform dozens or hundreds of arithmetic operations per minute, and moreover, cannot comprehensively evaluate the whole existing picture. This is shown by statistics evaluating accountants’ reactive rather than proactive nature, as accounted for by 44% of business owners (Djurovic, 2021). At the same time, just like any other person, the accountant requires breaks, days off, and vacations, which affects the operational efficiency of the entire operation. The reduced security should also be noted, as the accountant may not provide encryption of the data used or be an industrial spy from a competitor’s company (Moffitt et al., 2018). Added to this, according to Djurovic (2021), only 25% of small businesses seek the help of a highly qualified accountant, while the remaining percentage either manage the business’s operations themselves or seek help from relatives. To put it another way, there are many problems with a person in the role of an accountant, which is why companies are looking to automate accounting.

The Essence of Accounting Automation

In the era of digital business, the decision to use accounting automation software seems justified and, moreover, necessary. There are several interpretations of accounting automation, looking at the phenomenon from different angles. Kokina & Blanchette (2019) emphasizes the mechanical part of the account, showing that this process is based on previously created scripted rules. Cooper et al. (2019) show that automated processes optimize the accounting approach by reducing the need to perform routine tasks. In Zubrenkova et al. (2021), automated accounting, in general, is seen as a vital direction for a modern company, the absence of which would entail the company’s demise. All of this together allows to interpret accounting as an essential part of the information support system of the work of any enterprise, focused on the use of computer technology. In this definition, it is important to note that the automated approach does not mean a block of economic and financial accounting management isolated from a person but implies a competent symbiosis between a person as an operator and technology as an optimization tool.

In view of this, it is interesting to examine the individual functions of computerized accounting. The central core of the use of computerized technology lies in the smoother achievement of organizational results. Concerning accounting, this means correct business accounting, managing cash flow inside and outside the organization, planning, and adjustments as per the agenda (Axtell et al., 2017; Moffitt et al., 2018). Other accounting functions managed by automated systems include budgeting and cost control, preventing financial errors of any nature, and employee performance evaluations combined with the company’s HR department (Alvehus, 2018). Consequently, the operation of automated accounting management systems is characterized by multitasking and ambiguity of operation, which means that one should expect that the very decision to automate accounting entails many benefits for the company.

The economic, organizational, and social benefits of using automated accounting are unconditional. Most of the studies devoted to this issue focus on the benefits since the solution to this issue are of applied importance for the organization. In general, it should be said that the amount of accumulated scientific work in the field of automation of accounting continues to increase. In addition to Figure 4, attention should be drawn to Figure 5 in this context, which shows that automation research is multifaceted. Independent academics worldwide are exploring the applicability of the concept of accounting automation in areas such as artificial intelligence, civil engineering, transportation systems and telecommunications, robotics, and cybernetics, combined with the apparent industry of operations management. The use of automated accounting provides an opportunity to save accountants’ time by automating repetitive activities (Cooper et al., 2019). According to Djurovic (2021), time savings start at one hour per day, with Whatman (2021) indicating that savings are maximized at the close of the financial reporting period. In his article in Forbes, Gass (2018) comes to similar conclusions, showing that when robotic processes are used in accounting, audit time is reduced from months to weeks. This is not surprising when one considers the number of versatile tasks and the amount of information used that accumulates by the end of a quarter, half-year, or year.

Associated with significant time savings is an increase in another metric, namely labor productivity. Because of optimization, an accountant can perform more tasks in a shorter period. Widell (2021) agrees, pointing out that automated accounting increases production efficiency by up to 44 percent. At the same time, when an employee has more free time, it allows them to take on additional tasks, promoting active career development because of the employee’s professional development and demonstration of excellent results. In addition, accounting automation improves data accuracy by ignoring the human errors studied above.

Two other benefits of automated accounting functionality are increased security and cloud technology, both of which require separate discussion. The criterion of increased security when using automation should be considered from several angles. First, computer calculations, often protected by encryption mechanisms, reduce the likelihood of physical unauthorized access to materials: only a specialist who knows the decryption key can work with the documents. Second, the use of centralized record management systems makes it possible to instantly restrict access or completely block it in case of illegal actions. However, Rîndașu (2017) and Moffitt et al. (2018) emphasize that the decision to use automated accounting generates a cybersecurity threat that exposes data to the risk of theft through fraudsters. This is hard to disagree with, given the multiplicity of ways to steal virtual information, from phishing to social engineering (Paychex, 2020; Moffitt et al., 2018). Consequently, the security of automated accounting is determined by finding an effective balance and certainly using robust encryption algorithms where even stolen data would be uninformative without a decryption key.

Disruptive Technologies

Cloud technology is becoming a severe trend in today’s accounting industry, a functional advantage. On the one hand, companies have access to digital copies of documents from anywhere globally, which significantly simplifies the work. In turn, this creates a tendency for accountants to work remotely, as commercial information is made available even when working from home, subject to all cybersecurity rules. Djurovic (2019), for example, notes that 37% of industry employees find themselves working remotely in 2021, and there is a possibility that this number will grow. This fits perfectly with data from McCabe (2020), who showed that 81% of companies expect the number of remote employees to increase in the coming years. On the other hand, the use of cloud technology solves the problem of optimizing workspace. Under the Welsh government regulation, records related to accounting must be kept for at least three years for private companies and seven years for government agencies (Permanent Secretary, 2019).

These rules will not be revised until 2024, but it is unlikely that these requirements will be changed, given the international bureaucratic experience. Such a solution allows to meet long-term planning goals, preserve potentially valuable documents, and use them as evidence in case of conflicts. However, such a solution requires the company to have an extensive archive, especially if the company is significant. Cloud technology, along with accounting automation, is one of the most apparent manifestations of disruptive technologies. Strictly terminologically, such technologies include any tools, phenomena, or processes that have the potential to change the sustainable functioning of a market or industry (Smith, 2020). In other words, disruptive technologies adjust the organizational vector of enterprise development and catalyze its business evolution. Thus, automation through cloud technology allows avoiding using physical storage and conserve company space. At the same time, it means that any employee with authorized access can access the desired document without searching for the physical original.

Another apparent positive manifestation of automation, made possible only by introducing cloud accounting technologies, is comprehensive integration. When documents are digitized, or initially do not have a physical original due to the electronic workflow, their employees’ access to them is more optimized. For example, a complete report for a fiscal year can be helpful for a manager, a finance department, a marketing department, or employees in analytics: with the proper level of access, each of them can freely access the document without the need to disturb other employees. All of these things combine to create a situation in which automated accounting is beneficial for the successful commercial development of a company. While in practice, the decision to automate accounting is not without its drawbacks and from some angles may cause more problems, in the end, it can significantly increase labor productivity and reduce the time to perform routine tasks.

For breakthrough technologies, however, it is fair to point out their strictly ambiguous impact on enterprises, industry, and the market as a whole. In fact, inventions such as cloud computing and artificial intelligence integration that simplify the way work tasks are performed can have some drawbacks. For example, breakthrough technologies are rarely perfect in the initial launch stages, so that businesses may experience financial and technological difficulties operating them (IET, 2021). In addition, imperfections can cause low productivity, mainly if technical delays result in software outages. It should not be forgotten that the low testability of such developments is often associated with a higher market price for the technology and low reliability (IET, 2021). Finally, it is not unlikely to be a scenario in which investing in a particular disruptive technology ultimately proves strategically unwarranted if the tool does not have sufficient viability and competitive advantage.

Benefits and Weaknesses of Technology/Automation

Against the backdrop of the apparent benefits of automated accounting, a sensitive issue becomes determining the role of the accounting department employees shortly. On the one hand, it is natural for an entrepreneur to optimize the operational structure to show the best results at the lowest cost. From this perspective, the choice of automated accounting seems to be a viable strategy that will achieve the desired commercial results and, according to Kokina & Blanchette (2019), significantly reduces the risk of human error. On the other hand, performing routine tasks on an automated level does not eliminate the need to monitor and proofread them when necessary. An entrepreneur who invests in stand-alone computerized accounting alone will almost certainly ultimately fail due to the impossibility of using automated accounting alone. Thus, the apparent problem is determining the balance between digitalization and employee retention.

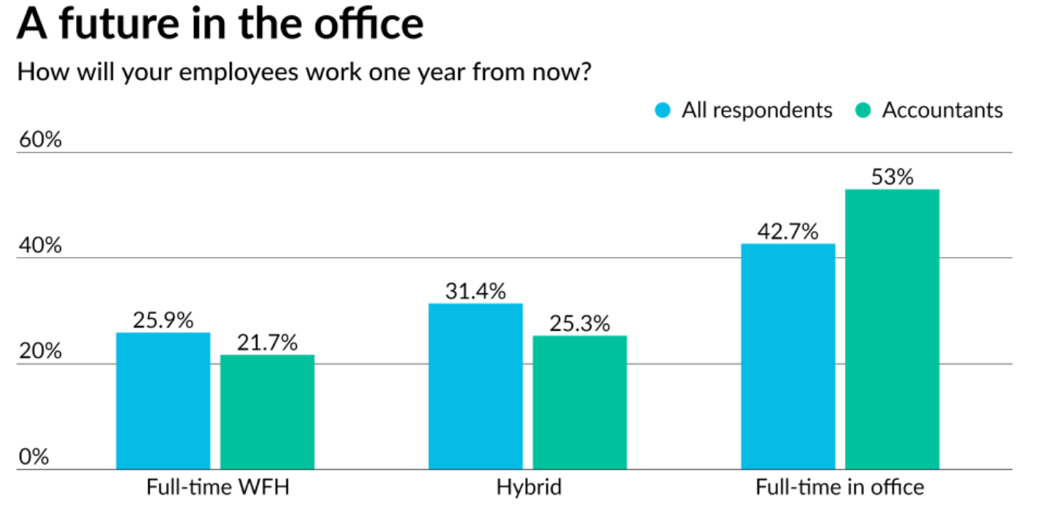

If one pays attention to current market trends, it is clear that automation is already very much integrated. This can be confirmed both by the total market volume and by the constantly emerging and evolving software. For example, Wadhwani & Saha’s (2019) comprehensive report indicates that the automation market will reach $5 billion by 2024. Reportlinker (2021) gives a more accurate estimate, adjusted for changes caused by the COVID-19 pandemic: according to the report, the market will be $3.9 billion by 2026. In this context, it is worth emphasizing that COVID-19 has become a serious challenge to all humanity and continues to act as external solid pressure for most areas. Corporate operations have been particularly affected as people have been forced to work from home due to social constraints (McCabe, 2020; McKibbin & Fernando, 2021). However, British accountants’ work was also affected, and they are not interested in continuing to work from home and generally show a genuine desire to return to their offices once the pandemic is over (Figure 6). This is intriguing given that more than 43% of all accountants in Britain were remote (Oliver, 2019). However, even more exciting information is shown by Arrowsmith (2018), who estimated the market for automated accounting software at $11.8 billion. From all of the above, one can conclude that the growth of the automated accounting market is evident, but it is highly dependent on external pressures, including COVID-19. The closer to the beginning of the pandemic the estimates were made, the smaller the final market size was assumed.

At the same time, there is a clear trend toward expanding the functionality of accounting software. In the UK context, the following software programs should be named that have increased popularity among Welsh firms: Xero, Intuit QuickBooks, Bokio, Wave, and Zoho Books. The five software programs named differ in the breadth of functionality offered, the price, and the history of existence in the local market. To make this comparative analysis easier to understand, all of the academically interesting information is presented in Table 1. The general conclusion that can be drawn from this table is that the modern automated accounting market is quite diverse and differentiated so that every consumer can find a suitable product.

Table 1. Comparative analysis of the five most popular automated accounting applications in Wales and the UK (interpreted from Ashar, 2019).

Against the background of the aspects discussed, it is essential to emphasize that automation is becoming a pressing trend for today’s accounting market. In turn, it is critical to recognize that, as such, it is not a threat to accountants. This may seem very contradictory, and in fact, some authors tend to have an alternative view. For example, Rîndașu (2017) has shown that along with the expanding influence of robotic technology, the work of accountants will disappear. A similar opinion is held by Hao-Yang et al. (2018), who believed that up to 60% of current accountants would be laid off shortly. XLDesafio generally equates accountants with salespeople, consultants, and drivers, indicating that these jobs will soon disappear. However, one need only look at existing examples of professions at risk to see that the thesis of their disappearance is untenable. The current moment has replaced drivers, salespeople, consultants, and even janitors, although their fields have seen the most noticeable automation. Instead of disappearing altogether, partial job cuts may be a temporary effect, there has been a radical transformation in the duties performed. Drivers had to provide and monitor autopilot, consultants had to give computer reports in a human-readable format, salespeople had to set up self-service kiosks, and janitors had to monitor the efficiency of mobile robots. In addition, any of these positions have been expanded to include additional functions. Extrapolating these judgments to the job of an accountant, it is appropriate to predict that this position will remain relevant as well but will undergo significant changes.

Metamorphosis of Accounting

As has already been discovered, the work of accountants in the future will undergo critical metamorphoses in a certain way. It is safe to expect that the future accountant will not resemble the current accountant, nor will the current accountant resemble his predecessor of ten years ago (Fronda, 2021). While the accountant’s central tasks namely, economic, and financial accounting remain unchanged, the profession is gradually being enriched with new functions. First, the traditional approach to accounting is rapidly being replaced by the use of intelligent digital technology. According to Nagarajah (2016), up to 56% of all accounting tasks performed in the future will require automation. Routine tasks, whether manual billing, accounts receivable reconciliation, or document reconciliation, will lose relevance for the employee, freeing up time for more important matters. Second, with technology, the breadth of information obtained increases, and the volume of data is significantly increased. This means that the accountant of the future will be able to quickly get the information he wants without having to wait a long time for an answer.

A significant metamorphosis of automated accounting is the trend toward outsourcing and remote work. Employees no longer need to be physically present in office space and attend meetings in person, as much of the work is done using a computer with the appropriate level of access. Consequently, the future accountant can work from home or even from another country (McCabe, 2020). Fourth, automation will lead to increased transparency of the job duties performed. Tax evasion and number manipulation to cover fraudulent schemes are known as unscrupulous companies’ private practices (Nickolas, 2021). Because of automated accounting, mainly if such programs are centralized, the likelihood of providing incorrect data is reduced. Another important trait of the future accountant is advanced technological skills: this is a forced need, as an employee without computer literacy will hardly be able to give the company the desired benefit. In addition to technological competence, however, Djurovic (2021) discusses several other essential traits of the new accounting employee: effective communication, business counseling, and project management. This data fits perfectly with Outbooks Global (2021) statements stating that 70% of accountants view their advisory roles for small business companies as strategic. As one can see, the accountant’s range of activities is expanding dramatically, and to maintain a competitive edge in the marketplace, employees must keep up with industry trends.

Although the computerization of accounting is progressing rapidly, no technology can replace humans in specific tasks. The professional areas and traits of the human accountant discussed below stem from the notion that even the most sophisticated computer systems with highly intelligent functionality and machine learning skills cannot replace what inherently subjective characteristics are. Specifically, four critical elements experienced accountants tend to possess. First is the sense of professional instinct that develops in a professional with experience. Performing routine tasks combined with solving non-standard problems significantly develops the accountant and gives him or her an instinctive sense of the process. More specifically, such professionals can detect a problem long before it occurs, demonstrating the proactive nature of the work (Tucker, 2017). Such benefits fall into the category of intangible and complexly programmable algorithms since, in this case, it is talking about unconscious processes of human thinking. This is the first of the reasons why a competent accountant may not worry about losing his job.

Practical communication skills, namely trust, determine the second reason. A computer can count taxes flawlessly, but one cannot build a human relationship with it. A computer cannot build favorable relationships with partners, engage in better corporate practices, or convince a manager to change current financial practices. All a computer can do is analyze and produce objective, emotionless reports. Without ignoring the value of such results, it is essential to note that this is not enough for a company to operate effectively. Consequently, building trusting relationships as part of corporate communication is the second reason for keeping jobs in the field.

A third important reason is human subjectivity, expressed in the sense of self-interest and resulting compassion. Accountants often have to make strategic deals and communicate with corporate partners in order to benefit the company. A computer will not determine the best outcome for the company, much less conduct a persuasive negotiation when a competent accountant can manage the task (Tucker, 2017). From this stems the deep sense of compassion a person is capable of building long-term relationships. Thus, it is not uncommon for a company to temporarily concede a portion of a benefit during business meetings with the expectation that it will be compensated many times over in the future. Since automated accounting cannot cover these needs, compassion and a sense of benefit become a third factor in accountants’ peace of mind.

Finally, the fourth reason is a person’s predisposition to take risks. It is a trait of the experienced professional to determine what risks can be justified. A robot will always take the path of least resistance, whereas a human may take seemingly ill-considered actions to expect to benefit later from that risk. Ultimately, this leads to the conclusion that there are still inherent advantages to humans in the role of accountant, which allows him or her to maintain the workplace until computers have improved to the point of blending in with human intelligence.

It is not hard to see how much the functional component of the accounting profession is already progressing. Several respected authors have expressed concerns about this aspect and have sought to theorize about the changing role of the accountant. For example, van Mourik & Wilkin (2019) point to the increased need to develop critical skills in accounting students because as the availability of information evolves, the risks of using unreliable knowledge increase. Nguyen (2018) shows that for the accountant in the era of large-scale digitalization increases the involvement in strategic planning of enterprise management. More specifically, Nguyen points to the increased positive effects for the company from the active involvement and timeliness of the accounting staff. An equally interesting perspective on the role of accountants is presented by West (2018), who notes the difficulty of setting ethical boundaries in today’s company environment. For example, tax evasion issues can take on an unexpectedly profitable context for the entrepreneur, resulting in the accountant being the person involved. Heele (2019) observes that when an automated approach is integrated into business practices, the intimacy between the accountant and the direct client increases; the author also points to the “driving” importance of accountants to companies. As a summary of the above, Rivera (2020) points to the critical need for the growth of relevant skills. Among these, technological awareness and willingness to learn new knowledge, administrative skills, and developed critical thinking, as well as client orientation and teamwork skills, are particularly noteworthy.

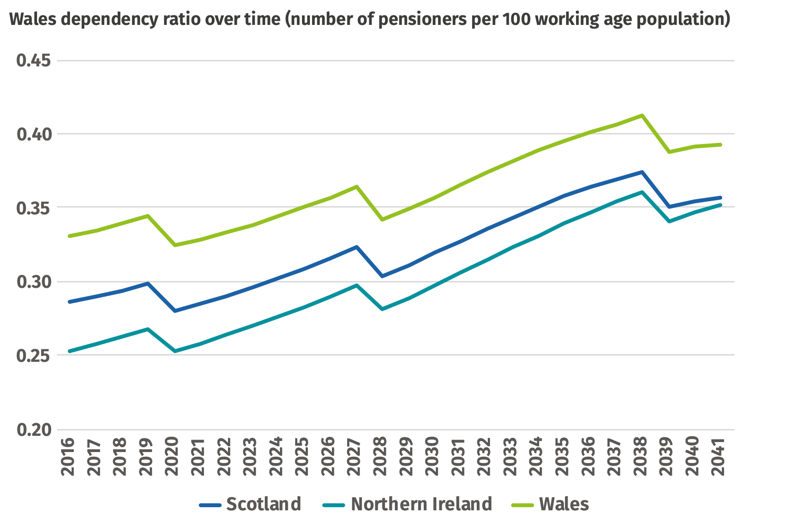

The Context of Wales

Wales is one of the four administrative and legal centers of Great Britain, which has recently gained partial independence from the monarchy. The use of this region in this study is justified from several angles. On the one hand, Wales is a small enough country in which to take measurements comfortably. On the other hand, Wales is a rather old settlement with a rich history, which means that the local population has cultural features and attitudes relevant to sociological research. Additionally, Wales is quite an economically developed country. Although Wales lags behind the UK capital, its GDP is relatively high and was €22,900 per capita by 2019 (European Commission, 2021). Some researchers, such as Donovan (2018), have even described the country as one of the richest and most productive in the world, which, of course, requires separate clarification. However, it was not just economics, history, and culture that was the basis for choosing Wales as a study. This region has eight universities and sixteen colleges, giving the entrant higher, secondary, and further education (Welsh Government, 2021). This offers the student more than ninety-five academic courses related to accounting (Accounting degrees in Wales, 2021). In addition, Wales is a technologically advanced country, which means graduates and adults have access to online courses and schools that will give them the qualifications they need. Finally, statistical projections from Fawcett & Gunson (2019) show that Wales is one of the UK’s most senior centers, which means it is appropriate to expect the average age of accountants to gradually rise: Figure 7. In turn, this creates some challenges for recruiting new workers. Consequently, students in Wales can study accounting without hindrance, and hence the questions of this study apply to them.

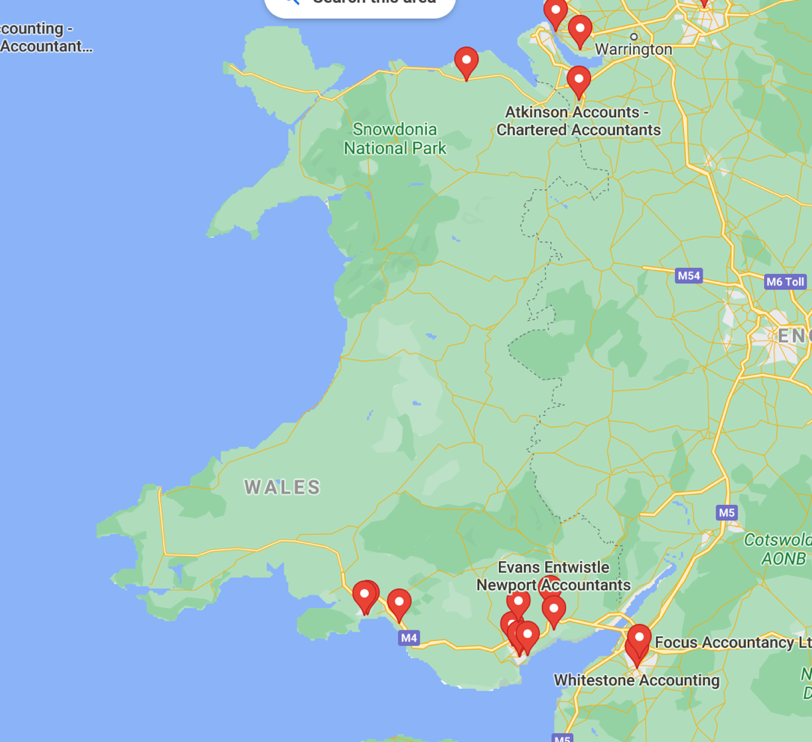

The number of accounting firms in Wales is severely limited because the small population prevents the accounting market from developing effectively. Referring to local firm search services provides conflicting information. For example, British Accounting Firms show that only ten firms in Wales provide certified professionals (Accounting firms in Wales, n.d.). ICAEW (2021), the competent professional body promoting British accounting around the world, indicates that twenty-five private and public companies can accommodate Welsh university and college graduates. A self-reported Google Map search suggests similar figures, showing that most accounting firms are located in the south of the country, near Cardiff’s capital, as shown in Figure 8. At the same time, it should be understood that these extraditions are only valid for companies representing b2b accounting services. That said, there are over 267,000 businesses in Wales, almost every one of which necessarily has at least one accountant employee (Welsh Government, 2019). From this, it is concluded that there are sufficient employment opportunities for local graduates.

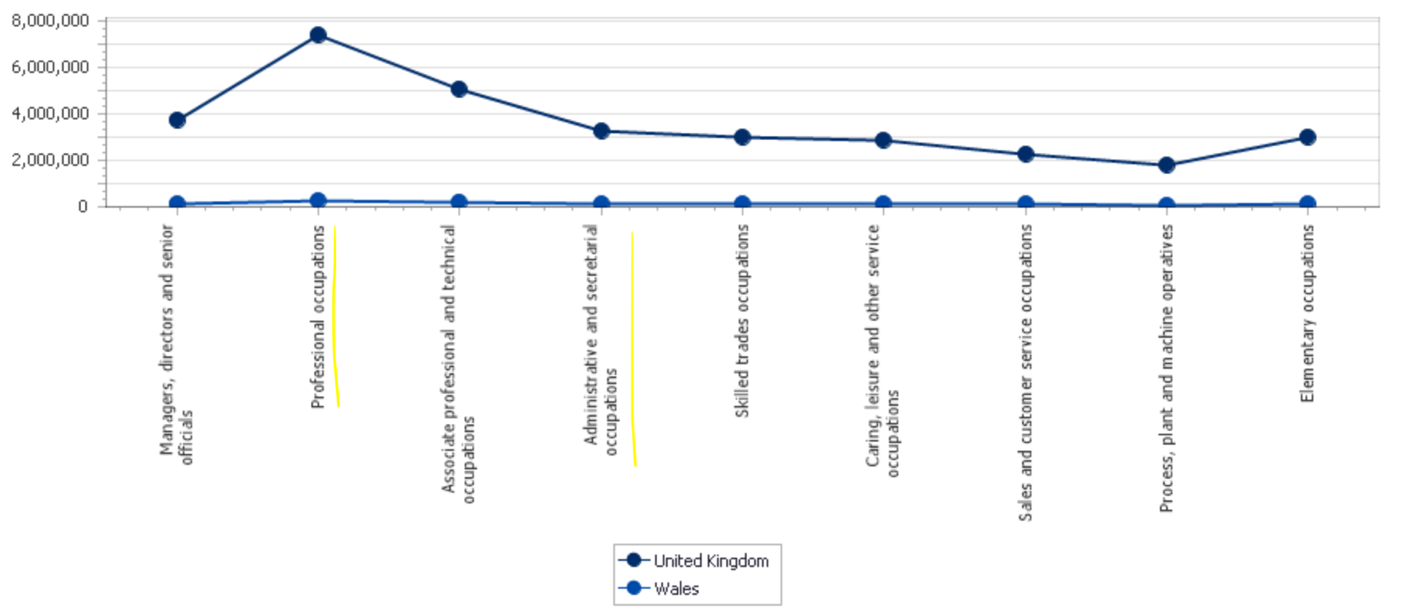

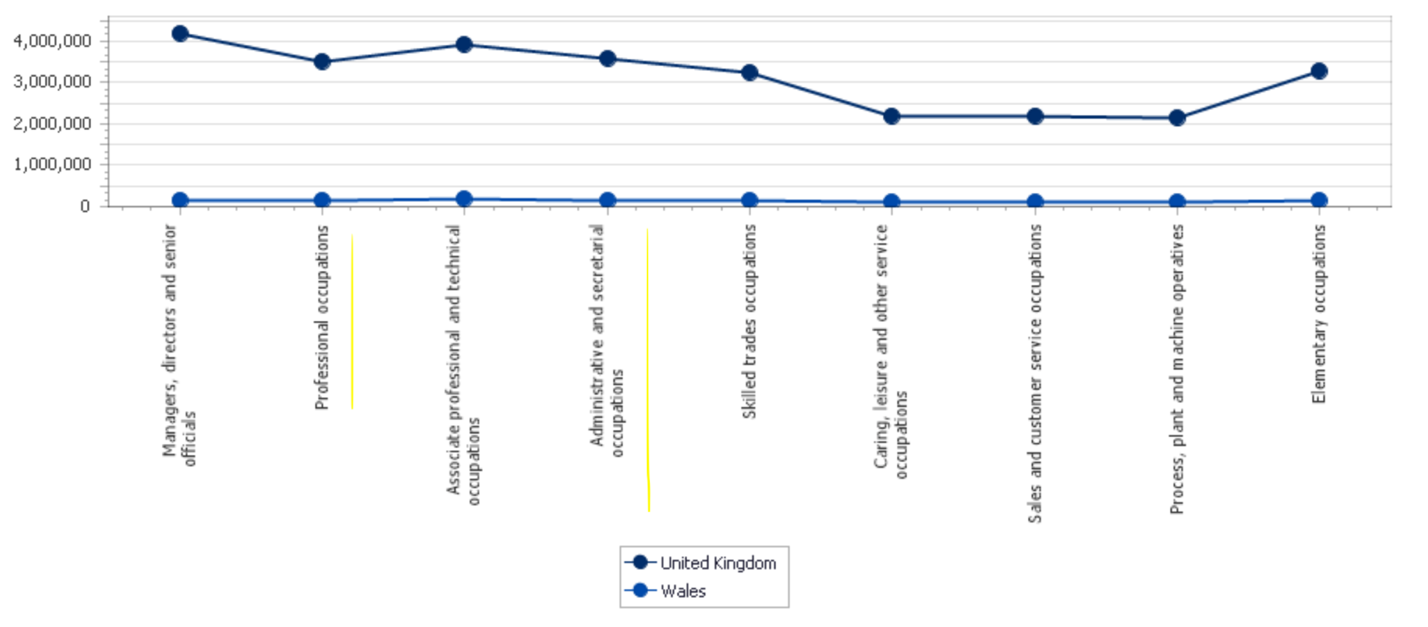

Accounting automation, however, is likely to transform classic Welsh employment. 6.5 percent of local positions have a high predisposition toward automation, which is even higher than in the UK as a whole (Fawcett & Gunson, 2019). Researchers continue to highlight trends and show that women are likely to be the most vulnerable, with 65.1 percent of automation-prone jobs held by women (Fawcett & Gunson, 2019). However, this data does not mean that these employees are at risk of being laid off. Exposure to automation means vulnerability to professional role transformation, as discussed earlier. Notably, detailed statistics reflect an upward trend in employment both in Wales and across the UK. For example, the government statistical agency shows that by 2020, the number of people employed in accounting-associated occupations (“Professional occupations,” “Administrative and secretarial occupations”) was 434500 for Wales and 10668300 for Britain (StatWales, 2021). The exact figures for 2004 were 31% lower for Wales and 33% lower for the UK: the changes are shown in Figures 9 and 10. There is also a noticeable increase in employment among the Welsh population of 8%.

Conclusion

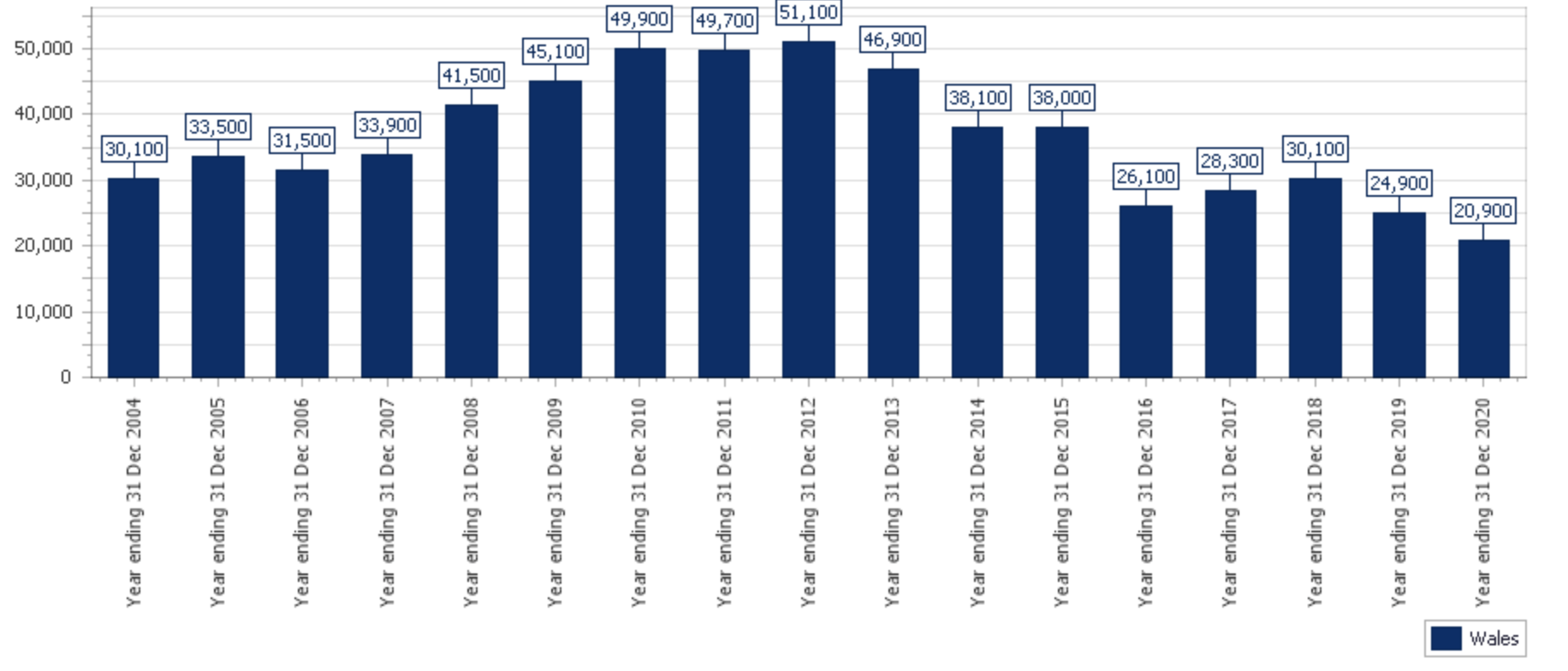

It is of particular interest to trace the unemployment rate among young people aged 16 to 24. Figure 11 shows that this parameter is dynamic but has been trending downward since 2012. It is noteworthy that this year formally ended the effects of the global financial crisis, and the economy began to stabilize (Kilincarslan, 2019). As a result, one can trace a general correlation that unemployment rates in Wales among university graduates have declined rapidly over the past nine years. In other words, more graduates were finding jobs after training, including those related to accounting. Similar data is provided by another source, Vacancysoft (2021), which points to a record increase in the number of employees in the accounting field. This suggests that the employment of Welsh accounting students is not in danger of disappearing.

Methodology

Introduction

For this paper, a secondary research technique was chosen, based on a comprehensive literature review methodology. Thus, most of the materials were collected by other authors, but the objectives of this review were to evaluate and compare them critically. The work touched on social, occupational, and demographic research categories, so the selection of mixed-method studies based on qualitative and quantitative tools was the most effective. A longitudinal time horizon was chosen as optimal because of the interest in the potential employment development pathway of Welsh accounting students rather than fixing the outcome at a point in time (Thomas, 2020). The research selection mechanism was noteworthy: an initial filtering process was conducted to select the papers. Thus, most studies had relevance within five years, were written in English, and had reputable authors or publications. This methodological strategy made it possible to preserve the overall novelty of the work and to operate with reliable data. The total number of papers used was sixty-eight. The fact that web publications and online pages were used to collect and analyze the material was due to the general uniqueness of the information used and the current lack of new statistical results in the works.

Research Philosophy

Central to the research in the development of this dissertation was a commitment to high standards of master’s-level academic quality. The research philosophy is built on the profound principles of pragmatism, in which knowledge is not fixed as the truth but is subjected to permanent questioning in an effort to produce a complete, comprehensive, and critical document. The possibility of replacing human labor with machine processes is not absolute, and no one can have a guarantee of a particular outcome. Instead, information and trends are constantly being modified and adjusted according to internal and external demands (Kennon, 2021). Thus, to accept that the future of Welsh graduates will be unfavorable in terms of employment is to take a single point of view and be biased on the issue. It was necessary to use all the information found, even if it did not fit the vector of a particular topic; in other words, ignoring potentially valuable knowledge in favor of a one-sided presentation was unacceptable. Bias toward particular statements or authors was also unacceptable: instead, the thesis was characterized by objectivity. Such ideas were entirely consistent with the philosophy of realism that formed the basis of this scholarly work.

The choice of specific topics for the entire work was justified by the author’s personal interest in exploring current trends in accounting, especially against the backdrop of the profound digitalization of production. Concerns and interest in the future employment program were the driving forces behind the choice of this topic. In addition, as a researcher, the author of this dissertation is fully convinced of the ethical standards and principles regarding fair use of open sources, plagiarism, and citation without attribution.

Research Approach

The research approach was based on a deductive method to assess the current progress of the accountant’s work within the framework of a rapidly changing agenda. In other words, the context of Welsh students and technological advances were taken as common factors, a deeper examination of which allowed for the identification of patterns and finding points of convergence. At the same time, the study was characterized by a qualitative approach to data collection and evaluation, used in an effort to answer the “what,” “why,” and “how” questions (Chandani, 2021). Thus, the study was characterized by a critical appraisal of the data collected: information from one source was often compared with other available information to present alternative perspectives. This produced extensive and multifaceted but academically sound material. As a rule, the material collected was first subjected to reading, after which a decision was made as to its relevance to the research paper. Direct quotations were not used as document references, although paraphrasing conclusions was an essential tool for analysis. That said, some information, including Figures 1, 2, and 8, was obtained autonomously, without reference to specific papers, so its use did not require in-text citation.

Thus, the overall strategy of the literature review was reduced to a critical appraisal of the available material, selected according to the primary filtering criteria. The credibility of the review is supported by the use of a large number of academic publications and government data. At the same time, criticality is confirmed by considering several points of view and summarizing them. In general, the literature review reflected the general trends within the issue under study and allowed to clarify the scope of the study.

Research Strategy

The two approaches that guided the strategy of the entire study are based on the use of case study principles and grounded theory. From a case study perspective, the thesis conducted an in-depth study of potential futures among Welsh university graduates interested in employment in a learning profession (Chun et al., 2019). From a grounded theory perspective, an attempt was made to generalize existing data without the goal of reconciling with previously known evidence, and while a comparative analysis was conducted, this is not a barrier to strategy (Sibbald et al., 2021). In other words, employment, technological advances, and accounting worked as independent variables to arrive at a generalized view. Thus, the strategy of this study stemmed from the predetermined purpose of the thesis. The analytical part of the thesis was to look for potential causal relationships. The primary sample functioned as academic literature, the reading of which allowed not only the identification of facts of interest but also the establishment of patterns between phenomena and observations. Thus, the critical variables of the analytic strategy were automation, the human resource of accounting, the role of the state, and the nature of employee skills. Possible patterns of integration of these variables were investigated, and conclusions were formed, and mutual influences were determined.

Methods and Procedures

Because the strategic objectives and purpose of the study required the collection and subsequent analysis of qualitative data, it was decided to use readily available materials from other sources. Materials were found using the digital search platforms of Google, Google Scholar (most of the sources were gathered from this platform), ResearchGate, and Microsoft Academic through thematic analysis and content analysis, including the specificity of articles using keywords. Specifically, “accounting,” “accounting automation,” and “accounting trends,” and “AAS” were selected as keywords. The number of sources collected initially was 93, of which only 61% were used in the current thesis. Specific materials were selected according to primary filtering criteria, which included writing in English, the date of the publication since 2015, and the authority of the writers or publication in which the paper is posted (VCU, 2021). Authoritativeness was evaluated by matching the topic of the published work with the author’s scholarly interests (Librarians, 2021). Upon selection, each paper was read with a draft of crucial theses and findings. In addition, there was a cross-research grid of findings presented in the Results section (Table 2), representing the most significant practical value for the entire dissertation. In addition, the official websites of the U.S., Welsh, and British governments were used to gather reliable information.

Conclusion

The choice of a methodological framework for the dissertation was driven primarily by the purpose of the work, namely the attempt to qualitatively answer the question of the changing structure of accounting as a future profession for Welsh students in an era of large-scale digitalization of production. Understanding the comprehensiveness and voluminous nature of the work drove the choice of the literature review as the central tool of the analytical research strategy. Therefore, the entire dissertation is a document that meets the high standards of master’s-level academic writing and is characterized by honesty and open-mindedness.

Findings and Analysis

Introduction

Determining the relationship between accounting automation and employment opportunities for Welsh students was of crucial interest. It was expected that the large-scale robotization of production would decrease job availability because of the greater commercial benefits of computer systems than human beings. However, this claim was not supported by the results found. As findings from the literature review, three critical findings were found to describe the properties of the job market among Welsh university bachelor’s students.

Discussion of Articles Chosen

First, central to the findings of the scholarly articles discussed was the recognition of the unstoppable change in the accounting market at the level of all developed countries, particularly the UK market. The technological changes taking place are significantly altering the structure of accounting. Scientific and technological progress is also characteristic of the Welsh market, which is a critical administrative and economic unit in the United Kingdom. For example, the rapid digitalization, the new automation tools, and the increased competition drive the entrepreneurial choice to invest in computerized accounting. In fact, an equal sign can be put between the automation of accounting and the increased productivity and competitive advantage of the firm. Consequently, by investing in computerized accounting, entrepreneurs focus on the growth of a company’s commercial parameters. In turn, such organizational transformations stimulate the development of the automated software sector, as leaders are interested in using a tool that is unique and has unique professional characteristics. Thus, it is appropriate to note the paradoxical nature of the cause-and-effect relationship between two variables. On the one hand, increasing automation is causing more companies to adopt this approach. On the other hand, the increasing variety of individuals involved in accounting automation increases the variety of commercial products and, consequently, catalyzes the overall progress of automated accounting systems.

Second, this increases the likelihood that automation leads to the erroneous conclusion that it reduces job opportunities for Welsh graduates. Accounting automation, because of the critical benefits that entrepreneurs derive from robotization, may indeed become a choice for software rather than humans. However, such judgments are not supported by practical observations. The number of new accountants in Britain and Wales, in particular, has been found to be on the rise despite the widespread adoption of automation. It is critical for Welsh university students to understand that accounting automation is not a threat to their employment, but it imposes severe demands for the competencies available. Thus, it is unlikely that a graduate with the accounting skills of fifty years ago will be in demand in the job market because there has been a radical qualitative change in the accounting profession over half a century, especially in terms of technological sophistication.

Third, technological awareness is an essential competency for all new accountants. In an era of complete digitalization of production, it is imperative to be able to use computer systems fully and independently perform accountable actions. It is essential for future employees to have computer security skills since an accountant’s job is inextricably linked to interaction with trade secrets of production. Knowledge of the fraudulent schemes used and the basics of data protection from third-party hacking are potentially crucial to employers.

Bar Graph of Article Years

Beliefs Based on the Research Question

There have been fundamental changes in accounting related to work practices. Automation as a phenomenon has changed the very structure of accounting, removing the need for employees to perform routine, monotonous work. Instead, employees in the sector must now learn new skills. This refers to the increased technological awareness, communication, and administrative as well as strategic competencies of the new accountant. Automation itself is a form of disruptive technology that significantly optimizes and simplifies production. However, the innovative nature of such tools often reduces their financial and uninterrupted technical benefit to the enterprise.

Key Findings

A comparative meta-analysis was conducted for the articles that corresponded to one of the critical interests of this dissertation (research question #4), and the results are presented in Table 2 below. More specifically, 31 sources directly or indirectly described changes in professional and personal attributes that accounting professionals are expected to encounter in the near future. From Table 2, we can see that the total number of traits described was equal to nine. However, it is crucial to emphasize that the frequency of occurrence of a particular term in the article is not an absolute value. In other words, with full responsibility, the author of this dissertation rephrased skills such as “communication skills” and “networking skills” into the general term “effective communication” in order to find a common denominator. This applied to some other qualities, the generalization of which did not affect the meaning.

The key results available from the statistical analysis of Table 2 are shown in Figure 13. The histogram shows the frequency of occurrence of specific terms. Thus, it can be seen that the absolute leader among others is technical skills, the possession of which is critical for accounting professionals of the future. In fact, automation cannot be accomplished without workers who have broad competencies in computer literacy. Management skills are the second most crucial factor in the ranking, which is also essential for accountants. This is not surprising, as employees’ routine activities free up their time for more in-depth tasks that involve integration with other departments. Analytical thinking and effective communication are the third and fourth qualities of the accountant of the future, respectively. Analytical thinking is critical in this era of diverse information available: the proliferation of automation will result in an accumulation of tasks and procedures on which it is the accountant’s responsibility to decide. Competent management of these issues, combined with the need to process, interpret, and select information, forms the foundation of the accountant’s analytical competencies. At the same time, effective communication is an equally important skill. The accountant of the future will have to communicate daily with clients and employees in other departments to ensure the integrity and functionality of the enterprise. Without the proper skills to interact, find approaches, and make valuable connections, such tasks will be out of reach. Finally, fifth on the list of most important competencies is professionalism. In fact, despite the expanding role of the accountant, company leaders still want to see an employee primarily as a professional with a high level of theoretical knowledge. It is noteworthy that the strategic influence skill is close to the leadership top five. In fact, combining strategic influence and management strengthens the second factor on the list. An accountant leader must be able to not only inspire and manage but also build a teamwork plan to achieve short- and long-term goals.

Table 2. A comparative meta-analysis giving an idea of the frequency of occurrence of terms in each source.

Summary

The accounting market in Wales is inevitably changing, and because of the development of automated accounting systems, new demands are being made on graduates of local universities. The retention of conservative essential accounting competencies is no longer a market advantage for the applicant, whereas adaptability, learnability, and computer literacy characterize the competitive graduate who has a high chance of employment. Automation as a process does not have a direct impact on job cuts in the local market, but it does change the structure of the professional role of the modern accountant.

Conclusions

Introduction

The accounting program is changing rapidly, and the role of the accountant in these changes requires special attention. Increasingly, companies are adopting an automated approach to accounting, in which the employee’s functional responsibilities are significantly transformed. The accountant is no longer expected to perform routine tasks; instead, he or she is taking on expanded roles as a strategist and administrator of the company’s financial flows. In this regard, it is appropriate to emphasize the changed skill requirements that a certified public accountant must possess. This dissertation was a practical synthesis that combines qualitative and deductive approaches to reach valid conclusions. All of the stated objectives of the study have been fully met, with the identification of the critical skills of the professional of the future and the identification of trends to reduce the employability of Welsh accountants in the coming years being given the most prominent role.

What Has Changed

Accounting has undergone significant structural changes with the advent of technology. The rapid growth of technology-enabled businesses has led to requests for the integration of digital tools to streamline and simplify accounting. This has raised the corresponding question of the potential to replace human resources with machine labor due to the competitively stronger benefits of automation. However, it has been shown that accounting automation is not a threat to the employability of today’s graduates but offers a number of new skill requirements that they must possess. Thus, the modern accountant is not only a person who calculates a company’s financial flows but also an operator among automated processes.

Limitations

This dissertation has several limitations related to the scalability of the results obtained. First, the results collected are valid for the most part for developed countries and, in particular, for the United Kingdom. Second, the literature reviewed was written only in English, so it is likely that potentially useful material not yet translated into English may have been ignored. Third, all of the materials used were not published until 2015, and for this reason, some automation information may have been missed in the analysis. Fourth, the qualitative research model is not statistically representative and is more subjective than the quantitative method. Although an attempt was made to minimize bias by using a large number of sources, it is impossible to eliminate this factor completely. Fifth, the source-collection strategy was not academically conditioned, so the selection of papers was more of a random search than a systematic work with the databases.

Skills Changes

It should be noted that due to large-scale automation, there are increasing demands on the available skills of graduates. More specifically, it has been determined that the critical competencies of today’s accountant are primarily not so much the ability to manage a company’s finances, although this too is of paramount importance, but rather the ability to perform administrative and operational functions in an enterprise and to adapt to a rapidly changing pace. A central result of the dissertation was the identification of five essential skills that are critical to the accountant of the future. More specifically, these are technological literacy, leadership skills, analytical thinking and the ability to communicate effectively, and professional skills. Strategic influence is also an important aspect. In addition, the in-demand accountant of today is characterized by easy learnability and the ability to work in a team, including meeting the requirements of a leader. In this context, it is necessary to note the blurring of ethical boundaries when, on the one hand, following the instructions of an entrepreneur requires violating the ethical code by evading taxes and, on the other hand, refusing to follow these instructions can be grounds for dismissal. All of this demonstrates the greatly expanding role of the accountant in today’s world, the reason for which is the active proliferation of computerized accounting.

Findings and Conclusions

In Wales, as one of the important centers of economic growth in the British market, there has been a dramatic change in the accounting agenda. Automation has ceased to be a future trend and has actively integrated into companies of the present. In this regard, the role of accountants as critical employees of modern enterprise has changed. The requirements for wearable competencies have also changed. For this reason, it is relevant for Welsh students to develop a list of three recommendations. First, it is crucial to invest in professional development in terms of computer awareness. Second, it is advisable to learn the current software programs in use and to be able to use each of them while still in training. Third, it is essential to develop critical thinking and not to let the fear of losing job opportunities get in the way of real career development, especially when Welsh market practice shows wide horizons for doing so.

The results obtained in this dissertation provide a field for further research in the future. More specifically, one potentially exciting avenue is to attempt quantitative validation of the findings obtained here. In addition, it would be a good idea to conduct an interview survey of interested individuals, whether they be undergraduate students, graduate students, inexperienced professionals, and accountants with more experience, in an effort to identify key trends in public opinion on the issue under study. Finally, it would be helpful to broaden the territorial scope of the study to involve more than just Wales in order to determine the big picture. While it seems likely that trends in the accounting automation industry will remain the same, this hypothesis must be backed up. As an outside branch of the thesis, it would be interesting to learn about the technological solutions that have been created to solve practical accounting problems and how these products have changed over time. It is possible that the nature of these changes is related to the expanding role of the accountant in the enterprise.

References

Accounting degrees in Wales. (2021). What Uni? Web.

Accounting firms in Wales. (n.d.). UK Accounting Firms. Web.

Alvehus, J. (2018). Conflicting logics? The role of HRM in a professional service firm. Human Resource Management Journal, 28(1), 31-44. Web.

Arrowsmith, R. (2018). Accounting software market to reach $11.8B by 2026. Accounting Today. Web.

Ashar, J. (2019). Best online accounting software for small businesses in the UK. Accountancy Age. Web.

Axson, D. A. J. (2015). Finance 2020: Death by digital [PDF document]. Web.

Axtell, J., Smith, L. M., & Tervo, W. (2017). The advent of accounting in business governance: from ancient scribes to modern practitioners. International Journal of Business Governance and Ethics, 12(1), 21-46.

Cavalletti, G. (2020). The Use of Epigraphy in Political Sphere: the Case of Res gestae divi Augusti. Nova tellus, 38(1), 123-139. Web.

Chandani. (2021). Qualitative and quantitative data collection methods in M&E. Tola Data. Web.

Chun Tie, Y., Birks, M., & Francis, K. (2019). Grounded theory research: A design framework for novice researchers. SAGE Open Medicine, 7, 1-8.

Cooper, L. A., Holderness Jr, D. K., Sorensen, T. L., & Wood, D. A. (2019). Robotic process automation in public accounting. Accounting Horizons, 33(4), 15-35. Web.

Dancey, K. (2016). Adapting to survive and thrive in a world of change. IFAC. Web.

Djurovic, A. (2021). 37 amazing accounting statistics showing the power of numbers. Go Remotely. Web.

Donovan, O. (2018). How rich is Wales? State of Wales. Web.

European Commission. (2021). Internal market, industry, entrepreneurship and SMEs. European Commission. Web.

Everatt, N. (2018). Will AI help or hinder the future of accountancy? Accountancy Age. Web.

Fawcett, J. & Gunson, R. (2019). A 21st century skills system for Wales [PDF document]. Web.

Flavin, B. (2019). Is an accounting degree worth it or worthless? Rasmussen University. Web.

Fronda, A. (2021). Audit reforms will force rapid adoption of new technology. Accountancy Age. Web.

Gass, J. (2018). AI’s impact on accounting and finance. Forbes. Web.

Gerber, M. E. (2017). Where did all this business come from? INC. Web.

GrantThornton. (2020). Building your ‘new normal’ [PDF document]. Web.

Gulin, D., Hladika, M., & Valenta, I. (2019). Digitalization and the challenges for the accounting profession. Proceedings of the ENTRENOVA-ENTerprise REsearch InNOVAtion Conference, 5(1), 428-437.

Hao-Yang, W. U., Xing-Chen, W. A. N. G., & Yue, L. E. N. G. (2018). Analysis of Reform Thinking and Countermeasure for Higher Education for Accounting in New Normal. DEStech Transactions on Economics, Business and Management, 314-318.

Heele, K. (2019). The changing role of accounting. NSA. Web.

Hood, D. (2021). Accountants more likely to return to offices than others: Study. Accounting Today. Web.

ICAEW. (2021). Find a chartered accountant or firm. ICAEW Find A Chartered Accountant. Web.

IET. (2021). Disruptive technology: Definition, pros vs. cons and examples. Indeed. Web.

Kefron. (2021). 5 facts you need to know about HMRC’s new MTD regulations. Kefron. Web.

Kennon, J. (2021). Why past performance is no guarantee of future results. The Balance. Web.

Kilincarslan, E. (2019). Smoothed or not smoothed: The impact of the 2008 global financial crisis on dividend stability in the UK. Finance Research Letters, 38, 1-14. Web.

Kokina, J., & Blanchette, S. (2019). Early evidence of digital labor in accounting: Innovation with Robotic Process Automation. International Journal of Accounting Information Systems, 35, 1-13. Web.

Librarians, B. (2021). How do I research an author’s credibility? BL. Web.

McCabe, S. (2020). 81% of firms expect more remote work post-pandemic: Survey. Accounting Today. Web.

McKibbin, W., & Fernando, R. (2021). The global macroeconomic impacts of COVID-19: Seven scenarios. Asian Economic Papers, 20(2), 1-30.

Moffitt, K. C., Rozario, A. M., & Vasarhelyi, M. A. (2018). Robotic process automation for auditing. Journal of Emerging Technologies in Accounting, 15(1), 1-10. Web.

Nagarajah, E. (2016). Hi, robot [PDF document]. Web.

Nazir, S. (2020). Watchdog ends five-year investigation into Tesco’s accounting scandal. Retail Gazette. Web.

Nguyen , N. P. (2018). Performance implication of market orientation and use of management accounting systems: The moderating role of accountants’ participation in strategic decision making. Journal of Asian Business and Economic Studies, 25(1), 1-17.

Nickolas, S. (2021). What is accounting fraud? Investopedia. Web.

Oliver, B. (2019). Why remote work is the future of accounting. TX CPA. Web.

Outbooks Global. (2021). How to find a good certified bookkeeper in Ireland? Outbooks. Web.

Paychex. (2020). Common accounting errors and how to prevent them. Paychex WORX. Web.

Permanent Secretary. (2019). Welsh government retention and disposal schedule [PDF document]. Web.

Record, R. A., Silberman, W. R., Santiago, J. E., & Ham, T. (2018). I sought it, I Reddit: Examining health information engagement behaviors among Reddit users. Journal of Health Communication, 23(5), 470-476.

Reportlinker. (2021). Accounts Receivable Automation Market – Growth, Trends, COVID-19 Impact, and Forecasts (2021 – 2026). Intrado. Web.

Rîndașu, S. M. (2017). Emerging information technologies in accounting and related security risks–what is the impact on the Romanian accounting profession. Journal of Accounting and Management Information Systems, 16(4), 581-609. Web.

Rivera, A. (2020). The shifting roles of accountants. CPA. Web.

Sangster, A. (2021). The life and works of Luca Pacioli (1446/7–1517), humanist educator. Abacus, 57(1), 126-152. Web.

Sibbald, S. L., Paciocco, S., Fournie, M., Van Asseldonk, R., & Scurr, T. (2021). Continuing to enhance the quality of case study methodology in health services research [PDF document]. Web.

Smith, A. (2021). Financial history: The evolution of accounting. Investopedia. Web.

Smith, T. (2020). Disruptive technology. Investopedia. Web.

StatWales. (2021). People in employment by area and occupation (SOC 2010). Welsh Government. Web.

Thomas, L. (2020). What is a longitudinal study? Scribbr. Web.

Thomson Reuters. (2021). The power of modernization [PDF document]. Web.

Törnqvist, E., & Forss, L. (2018). Automated accounting in accounting firms: A qualitative study on impacts and attitudes [PDF document]. Web.

Tucker, T. (2017). Robots are not accountants. Accounting Today. Web.

u/Slick_Deacon. (2018). Will accounting become automated? Reddit. Web.

Vacancysoft. (2021). Demand for UK tax accountants highest in over two years, PWC & BDO in fastest growth. Vacancy Soft. Web.

van Mourik, G., & Wilkin, C. L. (2019). Educational implications and the changing role of accountants: a conceptual approach to accounting education. Journal of Vocational Education & Training, 71(2), 312-335.

VCU. (2021). How to conduct a literature review (health sciences and beyond). VCU. Web.

Wadhwani, P., & Saha, P. (2019). Robotic process automation (RPA) Market Size By Service [PDF document]. Web.

Welsh Government. (2019). Size analysis of active businesses in Wales, 2019 [PDF document]. Web.

Welsh Government. (2021). Study at Welsh universities. Wales. Web.

West, A. (2018). Multinational tax avoidance: Virtue ethics and the role of accountants. Journal of Business Ethics, 153(4), 1143-1156.

Whatman, P. (2021). 8 excellent benefits of accounting automation. Spend Journal. Web.

Widell, R. (2021). Finance accounting. Digital Workforce. Web.

XLDesafio. (2018). The future of employment is a labor of love. Tim Leberecht. Web.

Zubrenkova, O. A., Kozlov, S. N., Mishina, Z. A., Sysoeva, Y. Y., & Zubenko, E. N. (2021). Modern and Historical Aspect of Automation of Accounting. In T. Antipova (Ed.), Advances in Digital Science, (pp. 423-432). Springer International Publishing.xf.