Summary

Background to Business Issue

Bank Muscat is a fiscal services company in Oman that offers retail banking, corporate banking, treasury, investment banking, asset management, and private banking. In 2018, it was estimated to have assets worth $ 31.9 billion (Alshubiri, 2022. Despite all this, the company has not been trending in the right direction. The financial reports over the last decade show that the cash dividend payout has increased to an extent considered high based on the industry average. This means that the profitability of the firm continues to drop. Additionally, the balance sheet strength has significantly decreased, which forces them to operate with liabilities.

Research Problem and Questions

The main aim of the research is to identify the benefits and challenges of financial restructuring for the banking sector in Oman. Some of the benefits include the preservation of insolvent lenders as well as avoidance of the bankruptcy process. Another is liberation from strict rules or regulations such as short-term liquidity, maximum credit risk per counterpart, and limitation on the total open forex position of the banks (Alshubiri, 2022). The third benefit is that the nation was able to set the interest rate at any level (CBO, 2021). The fourth benefit is tax allowance, such as release from value-added and income tax installments.

Additionally, eliminating amendments to productive legislation associated with the pledge, guarantee, and mortgage ensures the safety of the pledge right for financial institutions. The fifth advantage is that it results in novel instruments for debt redemption (Alshubiri, 2022). Lastly, there is mandatory arbitration of conflicts emerging during the process of fiscal restructuring. The research questions that will help guide the process include, what is financial restructuring? What is the motive behind financial restructuring? What are the components of financial restructuring? What are the potential benefits and challenges of financial restructuring? By employing the survey method, the study targets to answer all the above questions.

Aims and Objectives

Oman’s banking sector’s financial situation and subsequently, the fiscal companies, have not been great for the past few years. This is understandable considering the pandemic which affected the economy globally (Gąsior, 2021). However, some other countries or economies have already recovered. Business analysts claim that financial restructuring might be needed to save the fiscal system in Oman (Gąsior, 2021). This research aims to understand the definition and meaning of the term. In addition to that, it attempts to explore the motive behind the procedure. In trying to comprehend the process, the study aims to identify various components of financial restructuring, potential benefits, and challenges.

Research Rationale

Looking at the company’s financial reports from 2011 to 2021, it is trending in the wrong direction. For instance, their dividend payout ratio has increased as it was 35% in 2011 and 57% in 2021 (Alshubiri, 2022). This suggests there is less possibility of sustaining such payouts soon as it has been using a smaller portion of the earnings to reinvest in its growth. This means that the profits, productivity, and efficiency will decrease, and the balance sheet strength will decline (Gąsior, 2021). To attempt to increase the business, the value will mean accepting liabilities (Gąsior, 2021). Therefore, this study is significant as it provides reasons for whether or not to consider financial restructuring due to the information concerning benefits and challenges in the situation.

Literature Review

Introduction

Past research shows two components of financial restructuring, including debt restructuring and equity restructuring, that could be beneficial to the situation. However, it is important to understand that despite the benefits of financial restructuring, the decision to adopt it has its challenges. The procedure means company operations are altered to suit the current objectives or goals. This affects some business areas and demands much from employees and management (Abdollahi Poor and Botshekan, 2020). The changes that arise from the process become difficult to embrace, and the leadership encounters resistance.

In addition to that, the banking sector in Oman does not comprise firms that are experienced in that area. An example is Bank Muscat, which performed well until the pandemic (Abdollahi Poor and Botshekan, 2020). Due to a lack of experience in financial restructuring, it becomes hard to develop a plan to handle any risks that may emerge from implementing the procedure. To conduct financial restructuring, it is essential that an organization adopts this framework: assess its current situation, redefine its goals, make operational improvements, increase net asset turnover, and undergo debt and capital restructuring.

Introduction to Debt Restructuring

Debt restructuring refers to rearranging an institution’s entire debt capital. It involves reshuffling items on the balance sheet as it possesses debt obligations (Mayr and Lixl, 2019). It is more commonly utilized as a fiscal tool than contrasted equity restructuring (Maudos and Vives, 2019). This is since a fiscal manager must always monitor the alternatives to reduce the cost of capital and better the organization’s efficiency (Vives, 2019). This, in turn, calls for continuous assessment of the debt part, as suggested by D’Arista (2018). It helps them minimize the cost of borrowing and increase the working capital position.

Introduction to Equity Restructuring

In addition to debt restructuring, equity restructuring refers to rearranging equity capital. It consists of reshuffling the shareholders’ capital and the reserves on the balance sheet (Gandhi, Chhajer, and Mehta, 2018). Restructuring equity and preference capital becomes a difficult procedure involving a process of legislation and is a highly controlled area (Gandhi, Chhajer, and Mehta, 2018). This process is primarily concerned with the notion of capital depreciation. One method of accomplishing this is re-purchasing shares from shareholders for money results in a restructuring of share capital.

Discussion

Debt restructuring can aggravate excessive investment when its amount is significant. In addition, it greatly impacts underinvestment when the bargaining power of the shareholders is greater than that of debtholders (Kalaitzake, 2019). Additionally, one can alter the equity capital to redeemable preference loans or shares. The second method is restructuring equity share capital by noting the share capital by specific proper accounting entries (Kalaitzake, 2019). This assists in reducing the amount owed by the institution to its shareholders without returning equity capital in the form of cash.

Methodology

Introduction

The fundamental point of the research is to identify the benefits and challenges in Bank Muscat. Additionally, it is important to state that the study targets five to seven staff members of the Bank Muscat as participants (Horvat, Krecenbaher, and Bobek, 2019). The organization’s management will be contacted to approve the time of the various activities and the people involved. Additionally, the firm will be requested the contacts of the individuals to avoid limitations (Mostenska et al., 2020). This is feasible since the company has had a great relationship with researchers. The primary methods of data collection include surveys as well as face-to-face interviews.

Research Methodology

The main data collection methods for the research is survey and face-to-face. Five to seven individuals in Bank Muscat of Oman’s staff will be selected. Firstly, questionnaires will be handed to the participants (Duong et al., 2020). Afterward, selected individuals will be interviewed and asked questions concerning the research topic. The conversations will be recorded and stored for analysis (Duong et al., 2020). Lastly, responses from questionnaires will be reviewed for further assessment.

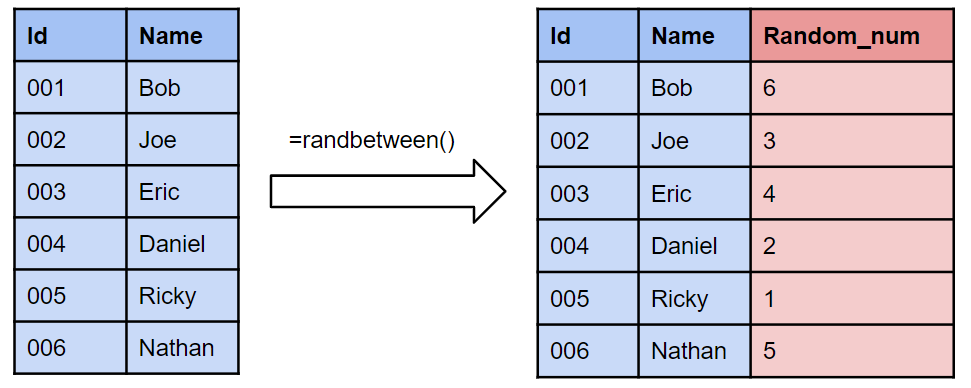

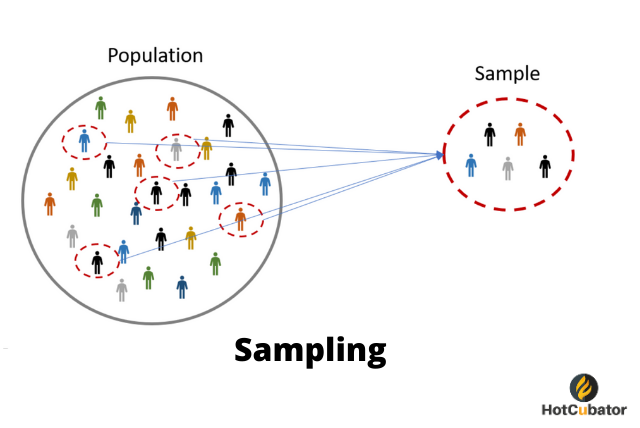

Quantitative Study

To conduct the quantitative study, the survey will employ closed questions. These will require the respondents to answer with either ‘yes’ or ‘no’. By using probability sampling, the researcher will randomly select individuals who will represent information of the entire staff. After that, the research will have to proceed to an interview stage. The participants will be interviewed about financial restructure and how it can impact the institution (Amosova, Larionova, and Rudakova, 2018). Getting responses from most individuals would be helpful for this part of the study.

Qualitative Study

The qualitative part of the study will be conducted differently from the quantitative research. For instance, the surveys will utilize open-ended questions that aim to produce written responses. Non-probability sampling will be used in qualitative research to select individuals according to criteria and convenience to allow better collection of data (Horvat, Krecenbaher, and Bobek, 2019). The face-to-face form of questionnaire and interview will be valuable in this part of the process.

Time Plan

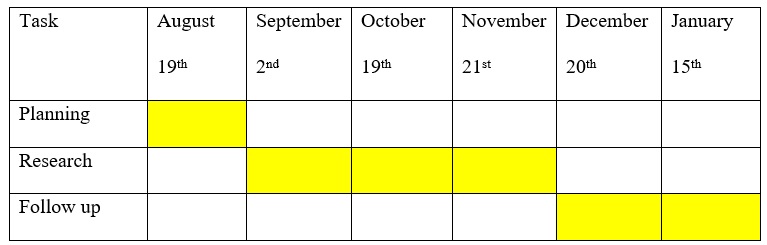

Gantt Chart

Key Milestones

This research has three key milestones: establishing foundations, evidence and data collection, and reflection and assessment. Early in advance, the researcher will be needed to determine the foundation of the study, usually surveying available literature and refining research questions. The last item is learning the usage of important approaches, equipment, and resources. They must develop numerous targets, for example, how much? Where? What? When? Finally, despite the focus being on data collection, analysis is essential. It will enable to draw a conclusion which might be responses to the questions set at the beginning of the research process.

Reference List

Abdollahi Poor, M.S. and Botshekan, M.H. (2020) ‘Solutions for financial restructuring in Iranian banks’, Journal of Asset Management and Financing, 8(4), p. 1-20. Web.

Alshubiri, F. (2022) ‘The financial competition, concentration and structure of financial performance nexus in the financial sector of Oman’, Economic Change and Restructuring, 55(2), p. 681-714. Web.

Amosova, N., Larionova, I. and Rudakova, O. (2018) ‘Trends in the field of financial restructuring of the banking institutions in Russia’, Financial and Economic Tools Used in the World Hospitality Industry, p. 79-84. Web.

CBO. (2021) ‘News’. Web.

CBO. (2022) ‘Financial Stability Report’. Web.

D’Arista, J. (2018) ‘An overview of financial restructuring and its consequences, All Fall Down, p. 43-45. Web.

Duong et al. (2020) ‘The effect of financial restructuring on the overall financial performance of the commercial banks in Vietnam’, The Journal of Asian Finance, Economics and Business, 7(9), p. 75-84. Web.

Gandhi, V., Chhajer, P. and Mehta, V. (2018) ‘Mergers and acquisitions in India: A strategic impact analysis for the corporate restructuring’, Asian Journal of Research in Banking and Finance, 8(3), p. 1-8. Web.

Gąsior, A. (2021) ‘Technological restructuring during COVID-19 pandemic’, European Research Studies, 24(2B), p. 994-1003. Web.

Horvat, T., Krecenbaher, E. and Bobek, V. (2019) ‘Position of a bank within legal framework for financial restructuring of companies in Slovenia, Croatia and Austria’, International Journal of Diplomacy and Economy, 5(2), p. 177-188. Web.

Kalaitzake, M. (2019) ‘Central banking and financial political power: An investigation into the European Central Bank’, Competition & Change, 23(3), p. 221-244. Web.

Luu, H.N., Nguyen, L.Q.T. and Vu, Q.H. (2019) ‘Income diversification and financial performance of commercial banks in Vietnam: Do experience and ownership structure matter?’, Review of Behavioral Finance, 12(3), p. 185-199. Web.

Maudos, J. and Vives, X. (2019) ‘Competition policy in banking in the European Union, Review of industrial organization, 55(1), p. 27-46. Web.

Mayr, S. and Lixl, D. (2019) ‘Restructuring in SMEs–A multiple case study analysis, Journal of Small Business Strategy, 29(1), p. 85-98. Web.

Mostenska et al. (2020) ‘Stages of restructuring of enterprises in Ukraine’, In International Conference on Business and Technology (p. 1153-1167). Springer, Cham. Web.

Mulya, A.P. and Rahadi, R.A. (2021) ‘Analysis of restructuring credit for commercial segment’, International Journal of Accounting, 6(32), p. 36-44. Web.

Vives, X. (2019) ‘Digital disruption in banking, Annual Review of Financial Economics, 11(1), p. 243-272. Web.

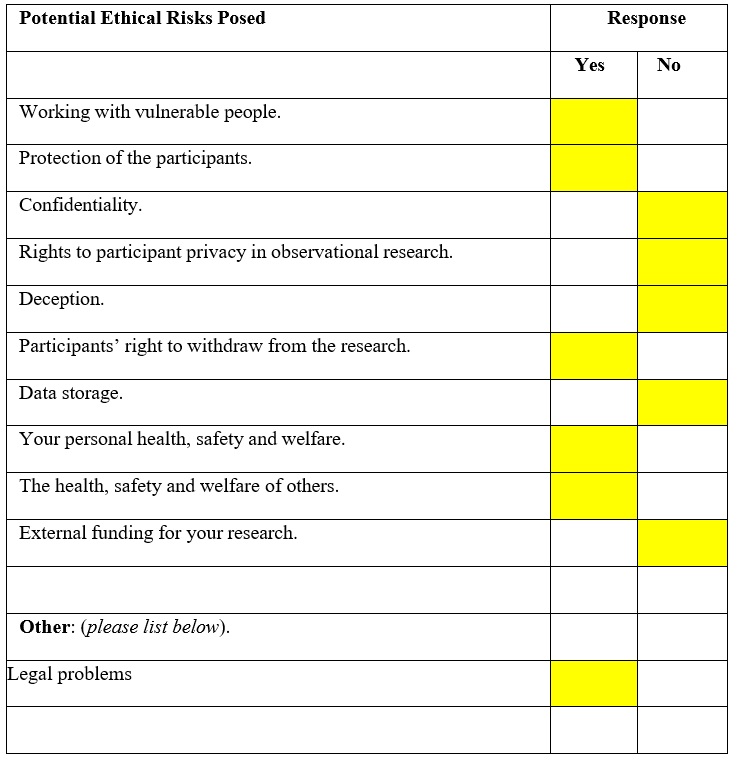

Risk Assessment Form