This Brexit essay deals with the results of Brexit and its impact on the world. Check it out if you’re looking for Brexit essays to take inspiration from.

Introduction

The possibility of the UK leaving the European Union or the so-called Brexit is a key source of concern for the major part of the British business world. It is assumed that the potential changes in the trade relations with the EU, as well as the uncertainty associated with investments, can have a negative impact on the UK economy. World economists and analysts try to carry out predictions regarding the possible consequences of this decision.

In order to analyze the character of the potential outcomes, it is critical to study the way Brexit will affect various economic aspects such as imports, exports, investment sector and others. The paper at hand is aimed at elucidating the advantages and disadvantages of the UK leaving the union from different perspectives.

Background

While analyzing the role of EU for the British economy, it is critical to understand the fact that the former currently regulates almost all the aspects of the British trade.

EU membership and the trade arrangements now affect approximately 60% of the British trade. Experts state that this percentage is likely to grow up to more than 85% in case the EU succeeds in the trade negotiations it is now carrying out (Giles 2016).

It is also important to note that EU members belong to the customs union, which means they are not imposed by the trade tariffs or customs controls on the products moving inside the EU, as well as a common tariff that refers to goods entering the EU from the outside.

In addition, the concept of the EU’s single market is aimed at ensuring the free flow of services, capital and people within the member states. In the meantime, experts point out that in the terms of goods, the single market operates far more effectively than from the services standpoint, as there are still numerous legal, administrative and cultural barriers to the movement of services around the Union (Boulanger & Philippidis 2015).

Moreover, the EU performs a representative function in any trade negotiating process. In other words, it performs decision making on the behalf of all 28 members in the World Trade Organisation (WTO) and manages the free trade agreements (FTAs) under the EU’s Common Commercial Policy.

As a member of the EU, Great Britain is represented in the European Commission, which participates in the final shaping of union’s rules and regulations. As a result, the EU has a powerful regulatory influence on the entire UK economy, including the public and private sectors.

Some analysts assume that the EU’s role in the UK life is excessive – the former does not only regulates national policy making but restricts the democratic capacity of the British electorate (Booth et al. 2016).

Outcomes

Export

First and foremost, it is critical to note that the EU currently regulates almost all the significant parts of the UK economy, including the public sector and other domestic firms which do not carry out any exporting operations (Amlôt 2016). As a result, Brexit is likely to have a serious impact on the UK economy in general. Experts point out, eight key sectors that Brexit is apt to influence:

- Goods: automobiles; medicals and pharmaceuticals; airplanes; capital goods and machinery; food, drinks, tobacco;

- Services: financial; insurance; professional (Booth et al. 2015).

The key concern resides in the fact that the European Union is now the biggest export market for Great Britain. According to official statistics, about 53% of British goods are annually purchased by EU members. In case the UK decides to leave the EU, it will still have a chance to export its goods to such countries as Norway, Iceland and Switzerland.

The main difference resides in the fact that the country will be deprived of the opportunity to participate in the rules setting that is regulated by the EU single market. Therefore, it will have to act in accordance with the rules that are imposed by the EU.

However, an opposite opinion suggests that Brexit can have some positive outcomes for the British economy. Thus, for example, some experts believe that leaving the Union is likely to encourage the local manufacturers to focus on the collaboration with such countries as China, Brazil and India (Giles 2016). In other words, Great Britain will receive a chance to open up new export markets.

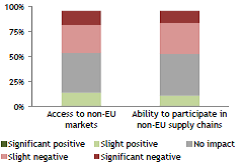

The diagram below represents the prognosis for the market access after Brexit generated by the Global Counsel.

Import

The principle point in the framework of import perspectives resides in the fact that Great Britain currently imports a wide variety of goods from other EU members. According to experts’ estimation, its import significantly dominates over its export.

Thus, the statistic shows that in 2011, the country exported £159bn of goods to the union, whereas the imported goods would make about £202bn. Therefore, an annual trade deficit for the country is now £42bn (Brexit could benefit UK economy, says £8bn fund manager, 2016). Therefore, British analysts have grounds to assume that in the terms of import British membership in the EU is more beneficial for the latter.

However, it is necessary to admit that such large scope of the imported goods is mainly determined not by the regulations imposed by the EU but the social demand for foreign goods, for example, German automobiles and French luxury products. As a result, the main concern of the British is about the possibility of receiving higher tariffs on EU imports in case they decide to leave it.

Growth

The most critical concern is, therefore, to perform an adequate consideration of the possible risks for the Great Britain’s economy in case it chooses to leave the EU. According to the expert’s estimation, the so-called “Brexit” would be less harmful to the Great Britain than for the EU itself.

Thus, the majority of the financial analysts claim that the country is likely to have only insignificant difficulties arranging its free trade contract with the EU as soon as it leaves, as the UK has a considerable trade deficit with other Union members (Wood 2016). As a result, it would be reasonable to assume that the EU is likely to lose more exports profit from Great Britain than vice versa (Center for European Reform, 2014).

From the investment standpoint, the Brexit outcomes are unclear. At the current point, the UK is rather productive at attracting foreign investors. According to the authoritative sources, it is a home to an extended stock of the EU and the US FDI and it is in a more beneficial position than other members of the EU (Petersen, Schoof & Felbermayr 2015).

In fact, it is now of the most preferred investment locations in the modern markets. Statistics shows that the investment from all sources has increased largely throughout the past decades. However, it is critical to note that the rise has occurred due to the EU’s contribution to the largest extent.

The question, consequently, arises whether foreign investors will still be willing to contribute to the UK economy if it is not a part of the EU. Some economists warn that foreign investments are sure to be put off. According to the estimation of the National Institute of Economic and Social Research, for instance, overseas direct investment is likely to fall significantly.

Nevertheless, Capital Economics state that, due to the recent Eurozone crisis, the extent of the foreign investment might grow as the UK will, then, be regarded as a “safe haven” (Chu 2012, para.3).

In the meantime, it is critical to take into account the fact that the UK will be no more restricted by the burdens of the EU regulations. Hence, it will able to develop its trade more efficiently with faster-growing economies – the existing tariffs will be eliminated and the trade agreements signing will be performed without consulting the EU members (Wintour 2016).

Therefore, the principle idea that underpins these reflections is the assumption that the UK currently possesses an economy that is big enough to let the country act as an efficient trade negotiator on its own.

Immigration

The immigration question in the Brexit framework is, likewise, debatable. According to official statistics, approximately 165,000 of EU citizens moved to the UK in 2011. A year earlier, this number comprised 182,000 people (Chu 2012).

On the one hand, the opportunity to stop huge flows of immigrants might improve the general quality of life of the locals. In other words, the strain on public services and infrastructure will be significantly refused.

Specialists claim, for example that the immigration flows need to be cut considerably, and Brexit is the only way to regain control of the borders (Springford & Whyte 2014). Although their proponents do not necessarily insist on reducing immigration, they still firmly believe that the regulation rules should be set by British Government (EU referendum 2016).

Meanwhile, some experts argue that intensive immigration brings considerable economic benefit for Britain as it assists in providing resources for the labour market and increasing the general productivity (Chu 2012). In other words, despite the fact that the flows of immigrants result in some problems with housing and service provision, the general net effect is positive.

Budget

According to experts’ estimations, the economic outcomes of the EU contributing to the UK are mixed. On the one side, in case Great Britain decides to leave the EU, it is likely to save 0.5% of its GDP (Brexit ‘would trigger economic and financial shock’ for UK, 2016).

On the other side, analysts warn that the British government might find it problematic to reduce farm subsidies and development funds outside the EU (A background guide to “Brexit” from the European Union, 2016).

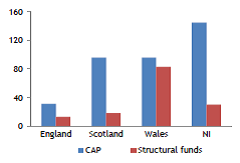

The point is that such regions as Wales and Northern Ireland are currently sustainable beneficiaries of the EU budget – in case the EU cuts its investment, Westminster will have to replace it which will become a significant burden for its economy.

Therefore, the Brexit will be most harmful to particular regions because the EU currently performs the funding of the poorest regions – it contributes to their budget supporting the infrastructure, the education and the training.

From this perspective, leaving the union is definitely unbeneficial for the UK (Campos & Coricelli 2015). In case of the exit, Great Britain is apt to solve the problem of replacing the EU structural funds with national regional development programs.

The diagram below represents the share of the structural funds in internal investments.

Therefore, the outcomes of the British exit for the budget are rather unpredictable. Numerous researchers have made attempts to calculate the financial impact of this decision. Thus, for example, the economists from the Centre for Economic Performance of London School of Economics and Political Science have worked out two scenarios that are most likely to develop in case of Brexit. Their calculations are represented in the table before.

The offered table provides a critical analysis of two perspectives: optimistic and pessimistic. In the first scenario, a total welfare loss is expected to comprise 1.13%, which will be determined by potential changes in non-tariff barriers. The analysts point out the fact that non-tariff barriers play a critical role in regulating trade in such service industries like finance and accounting – these are the sectors where the country proves to be a major exporter.

In the second scenario, the total loss grows up to 3.09%. As it might be seen, the costs of reduced trade are more significant that the potential fiscal savings. According to the experts’ estimations, the loss will make £50 billion in the second scenario and about £18 billion in the first scenario in cash terms (Dhingra, Ottaviano & Sampson 2015).

Security

The security problem is particularly acute as it is vital to assess potential risks of the leaving the EU adequately. One of the wide-spread opinions resides in the assumption that the EU membership endangers the country’s security.

Thus, some experts believe that remaining in EU means providing easy access to the terrorist attacks as the open border does not allow carrying out a consistent control of the arriving people (Buiter, Rahbari & Schulz 2016).

Moreover, there is an assumption that the collaboration between the UK and the EU in the terms of security will continue even if the former chooses to leave. The only difference will reside in the fact that the government will be able to determine the terms of entering, which is critical for the British safety (EU referendum 2016).

An opposite opinion suggests that the Brexit will have a negative outcome for the country’s safety as the latter will be deprived of the security facilities that the EU offers such as NATO and the United Nations (Buiter, Rahbari & Schulz 2016).

In addition, the relevant point of view is supported by the fact that as long as the UK is the EU member it is enabled to exchange important criminal records and collaborate closely with other EU countries (Dabrowski 2016). As soon as it leaves, the collaboration will have to slow down.

Overall Impact

Despite the fact that the impact of Brexit on the British economy is hardly predictable, the analysis of particular economic aspects allows drawing a series of general conclusions:

- Any extreme claims made about the outcomes of Brexit for the national economy is ungrounded – the analysis of every sector shows that leaving the EU has both positive and negative consequences.

- There is a possibility that Brexit will have a negative impact on the job market due to the difficulties it will create for the immigrant flows.

- There is a chance that Brexit will have a positive influence on the regulation of immigrants – the country will be enabled to implement essential restrictions on its own, which is apt to increase the security level.

- There is a large uncertainty in the investment sector – analysts cannot predict how foreign investors will behave in case the country is no more a part of the union.

- There are potential advantages for the British economy in trade terms – the country will receive more freedom in decision making. In the meantime, it will also be deprived of the beneficial terms it now uses for exporting.

- From the budget perspective, Brexit has negative outcomes as Great Britain will stop receiving considerable financial assistance from the EU, which currently goes to poorer regions. In the meantime, the UK will be no more oblige to pay the membership contribution to the union.

The authoritative source, Woodford, has worked out a comparative analysis of the benefits and disadvantages of Brexit. Its results are represented in the table below.

Conclusion

The profound analysis of Brexit’s consequences has shown that the character of the outcomes cannot be referred to utterly negative or fully positive. Thus, every segment of the British economy is likely to experience all kinds of outcomes in case the country decides to leave the EU.

The main benefits that the UK is supposed to receive in case it leaves are connected with the immigration sector and the security assurance. Thus, will receive a chance to implement its own immigration limits and introduce a stricter entering policy in order to improve the national security.

In the meantime, the country is also sure to meet some challenges. Thus, the principal drawback of this decision is connected with the national budget that currently receives sustainable support from the EU, particularly in terms of poor regions. Moreover, the investment future also remains unclear. Specialists do not have a common opinion regarding the potential intensity of foreign investments in case Great Britain is no more the member of the EU.

The most ambiguous aspect is the trade segment. Hence, on the one hand, the country will get free from the single market’s regulations and will a chance to extend its trade to the new markets. On the other hand, there some concerns about the importing sector that might experience the negative impact from the Brexit.

Reference List

A background guide to “Brexit” from the European Union 2016.

Amlôt, M 2016, QNB Research reviews the economic consequences of Brexit.

Booth, S, Howarth, C, Persson, M, Ruparel, R & Swidlicki, P 2015, What if…? The Consequences, challenges & opportunities facing Britain outside EU.

Boulanger, P & Philippidis, G 2015, ‘The End of a Romance? A Note on the Quantitative Impacts of a ‘Brexit’ from the EU’, Journal of Agricultural Economics, vol. 66, no. 3, pp. 832-842.

Brexit could benefit UK economy, says £8bn fund manager 2016.

Brexit ‘would trigger economic and financial shock‘ for UK 2016.

Buiter, W, Rahbari, E & Schulz, C 2016, ‘The implications of Brexit for the rest of the EU‘, VOX.

Campos, N & Coricelli, F 2015, ‘Some unpleasant Brexit econometrics’, VOX.

Capital Economics for Woodford Investment Management 2016, The economic impact of “Brexit”.

Center for European Reform 2014, The economic consequences of leaving the EU.

Chu, B 2012, ‘What if Britain left the EU?’, The Independent.

Dabrowski, M 2016, Brexit and the EU-UK deal: consequences for the EU.

Dhingra, S, Ottaviano, G & Sampson, T 2015, Should We Stay or Should We Go? The economic consequences of leaving the EU 2015.

EU referendum 2016.

Giles, C 2016, What are the economic consequences of Brexit.

Global Counsel 2015, BREXIT: the impact on the UK and the EU.

Petersen, T, Schoof, U & Felbermayr, G 2015, ‘Brexit – a losing deal for everybody’, ESharp.

Springford, J & Whyte, P 2014, The consequences of Brexit for the City of London.

Wintour, P 2016, ‘How will the EU referendum work?’, The Guardian.

Wood, B 2016, ‘Why the markets fear Brexit’, The Economist.